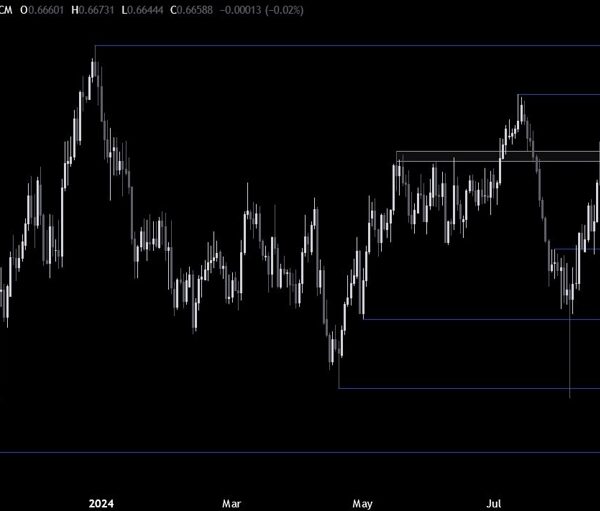

For buyers on the lookout for high-quality revenue with the potential for important complete return, company mortgage-backed securities (MBS) will be the reply. The securitized merchandise are debt obligations issued by businesses reminiscent of Fannie Mae, Freddie Mac and Ginnie Mae whose money flows are tied to the curiosity and cost on a pool of mortgage loans. Company MBS have low credit score danger as a result of they’re backed by the U.S. authorities. On the identical time, present company MBS are yielding about 5.5%, stated Jason Smith, senior portfolio supervisor inside the international securitized merchandise workforce at Neuberger Berman. “They look incredibly compelling,” he stated. There are a selection of things at play. For one, prepayment danger is at an all-time low, Smith stated. Since so many People obtained or refinanced mortgages when rates of interest had been at generational lows, few are inclined to refinance. “You are in an environment now where you are far more certain about the cash flows that you have underlying the security,” Smith stated. The 30-year fixed-mortgage fee hit a 20-year excessive in October, just under 8%, and is presently 6.87%, in line with Mortgage Information Every day . In the meantime, fewer folks may have hassle paying their mortgages due to low unemployment and owners who’re having fun with a rise in dwelling values, which has boosted the fairness of their houses, stated Michael Kessler, senior portfolio supervisor at Albion Monetary Group. The nationwide common loan-to-value ratio — which is the dimensions of the mortgage relative to the property worth — was 42% within the third quarter of 2023, in line with CoreLogic . The typical home-owner with a mortgage has greater than $300,000 in fairness for the reason that buy date, the agency discovered. Due to this fact, even when somebody defaults, the mortgage lender ought to get all of their a reimbursement when the house is offered, Kessler added. “The low default risk because of the combination of low unemployment and strong income — and as a backstop, a huge amount of home equity — that, to us, makes the fundamentals quite attractive,” he stated. On the identical time, present coupon MBS have a median 140 foundation level unfold, Kessler identified. That is as a result of the Federal Reserve is not shopping for mortgages because it shrinks its stability sheet and banks aren’t shopping for as a lot as they used to, he stated. “You have these two holes in the buyer base and that is what has pushed spreads on mortgage-backed securities to wider levels relative to history,” Kessler stated. That every one provides as much as an ideal alternative, specialists stated. Pramod Atluri, fastened revenue portfolio supervisor at Capital Group, believes company MBS might see important complete returns within the mid-7% vary this 12 months. Becoming MBS into your portfolio In truth, Atluri believes company MBS are extra engaging than investment-grade company proper now. As interest-rate volatility comes down and the curve normalizes, company MBS can see 100 or 200 foundation factors of extra returns, he stated. “You get a similar upside with a lot less downside, better liquidity, better rating [and] more resilience,” Atluri stated. His agency’s Bond Fund of America (ABNFX) has 40% in mortgage-backed obligations, in comparison with about 30% in company, as of Dec. 31, in line with the fund’s dwelling web page. As well as, company mortgage-backed securities additionally commerce defensively if the financial outlook had been to worsen, he added. “Therefore you can have this really, really big shift as people sell back the riskier stuff and move up in quality,” he stated. In truth, he anticipates an inflow of retail consumers as cash strikes out of cash market funds and into core bond funds. About 25% of core bond fund holdings are in mortgage-backed securities, in line with Morningstar. “This retail piece could be a big, big, big new buyer here and we will see if banks and foreign investors start coming back to the market as the outlook improves for lower rates,” Atluri stated. BlackRock can also be bullish on MBS, calling them a great diversifier in a portfolio. The agency, which stated it’s being very selective in the place it’s placing cash to work lately, additionally favors the securities over investment-grade company bonds. Each are prime quality and produce revenue for the portfolio, however spreads in funding grade bonds are very tight now. “Mortgage-backed securities didn’t do as well [as investment grade] last year,” stated Wei Li, BlackRock’s international chief funding strategist. “We look at it as overweight of MBS versus the underweight that we currently have in IG, having been overweight IG for a long time.” Albion’s Kessler additionally finds mortgages extra engaging on a relative foundation over corporates, though he has publicity to each. The agency will get diversified publicity to MBS by exchange-traded funds. For Capital group’s Atluri, the “belly” — or center — a part of the 30-year mortgage curve is most engaging. They’re presently barely under par, so if charges fall and extra folks refinance, they will be protected against prepayment danger, he defined. The upper coupons, round 6%, are buying and selling above par and may very well be susceptible to prepayment if charges fall, he stated.

Subscribe to Updates

Get the latest tech, social media, politics, business, sports and many more news directly to your inbox.