China’s cryptocurrency buying and selling and mining ban hasn’t deterred native traders from flocking to the crypto market. In defiance of the ban, these traders flip to digital property to flee the financial downturn plaguing conventional investments, akin to shares and actual property.

In line with a Reuters report, Chinese language people are discovering “creative” methods to take part within the crypto market, leveraging grey-market sellers, abroad financial institution accounts, and Hong Kong’s endorsement of digital property.

Chinese language Buyers Defy Laws

An ideal instance of the brand new methods Chinese language traders spend money on crypto is Dylan Run, an government within the monetary sector primarily based in Shanghai, who started to diversify his investments into cryptocurrencies firstly of 2023.

Recognizing the declining Chinese language economic system and inventory market, Run perceived the most important cryptocurrency by buying and selling quantity, Bitcoin (BTC), as a secure haven, much like gold.

In line with Reuters, Run now holds roughly 1 million yuan ($140,000) value of cryptocurrencies, accounting for half of his funding portfolio, in comparison with simply 40% in Chinese language equities. Whereas China’s stock market has been sinking for the previous three years, Run’s digital asset investments have surged by 45%.

Though cryptocurrency buying and selling is formally banned in mainland China, traders proceed to commerce tokens akin to Bitcoin on exchanges like OKX and Binance.

Reuters reviews that traders additionally make the most of over-the-counter (OTC) channels and open abroad financial institution accounts to entry the banned digital asset market. Moreover, Chinese language residents leverage their $50,000 annual foreign exchange buy quotas to maneuver cash into accounts in Hong Kong, making the most of the territory’s open endorsement of digital property.

As retail investors rush in direction of cryptocurrencies, China’s brokers and monetary establishments are additionally venturing into the crypto-related enterprise in Hong Kong. With restricted progress alternatives at house, these entities are exploring new avenues to fulfill shareholders and boards amidst a sluggish inventory market and weak demand for preliminary public choices, in keeping with the report.

Nicely-known establishments such because the Financial institution of China, China Asset Administration (ChinaAMC), and Harvest Fund Administration Co are reportedly exploring digital asset companies in Hong Kong.

Casual Peer-To-Peer Crypto Buying and selling Thrives

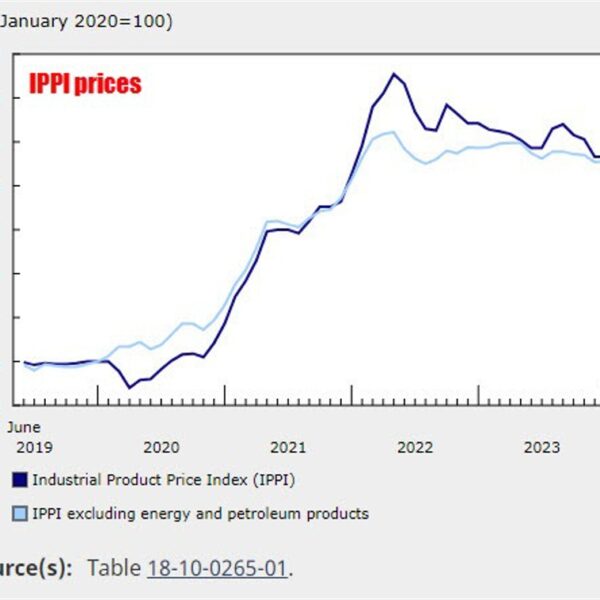

Per the report, the nation’s estimated $86.4 billion in uncooked transaction quantity between July 2022 and June 2023 outperformed Hong Kong’s $64 billion in digital buying and selling. Giant retail transactions starting from $10,000 to $1 million accounted for practically twice the worldwide common.

Knowledge providers supplier platform Chainalysis emphasizes that a lot of China’s digital asset exercise happens by casual, “grey market” peer-to-peer companies or over-the-counter transactions.

In Hong Kong, brick-and-mortar digital trade shops have emerged, providing “lightly regulated” providers. These offline retailers, akin to Crypto HK, permit clients to buy cryptocurrencies with minimal necessities and with out offering identification paperwork.

China’s crackdown on the property sector and a struggling inventory market have eroded confidence in conventional investments. Plummeting house costs and the CSI 300 Index’s 50% decline since early 2021 have pushed traders in direction of different property.

Notably, the report emphasizes Bitcoin’s current 50% surge since mid-October, which has attracted traders searching for alternatives amidst the nation’s financial transition.

General, Chinese language traders, pushed by the financial downturn and searching for refuge from conventional investments, are using inventive strategies to take part within the digital asset market. Regardless of regulatory restrictions, the enchantment of cryptocurrencies persists, and monetary establishments are additionally exploring crypto-related companies.

Featured picture from Shutterstock, chart from TradingView.com