Prykhodov

Amidst a tech sector melt-up, PayPal Holdings, Inc. (NASDAQ:PYPL) has been a lifeless weight. The inventory continues to commerce at discounted valuations despite the corporate’s web money balance sheet and ongoing share repurchase program. I suspect that traders are cautious of the extremely seen aggressive threats going through the corporate’s branded companies, however could also be underestimating the power of the unbranded companies like Braintree.

The digitization of funds remains to be a high-growth story and has sufficient room to assist PYPL maintain progress for years to return. Not even an innovation day held by the brand new CEO Alex Chriss may spark the inventory worth. I reiterate my robust purchase ranking for PayPal Holdings, Inc. shares, as traders ought to be affected person and benefit from the share repurchases as one waits for inevitable a number of growth.

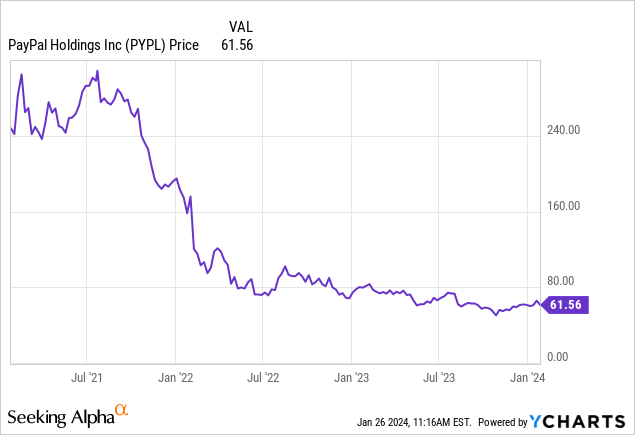

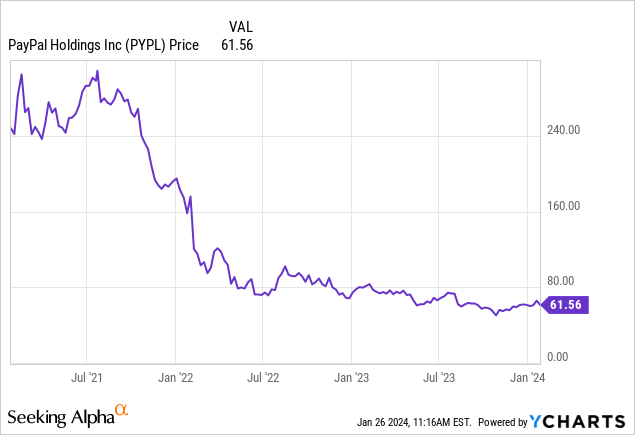

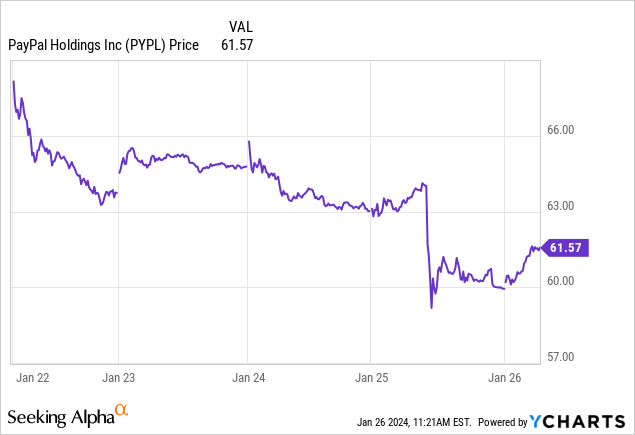

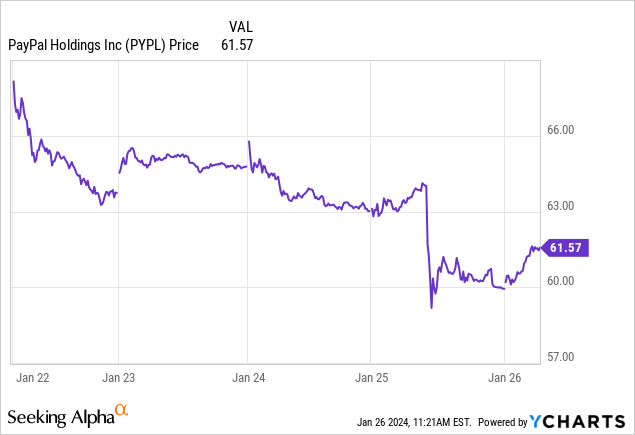

PYPL Inventory Worth

Many tech shares are buying and selling close to 52-week highs. Not PYPL, which is now buying and selling round 2017 ranges.

I last covered PYPL in October, the place I rated the inventory a powerful purchase because of the enticing setup. That setup stays in place at the same time as the corporate encounters some volatility in branded checkout progress. This is not the prettiest story, however valuations are nonetheless extremely compelling.

PYPL Inventory Key Metrics

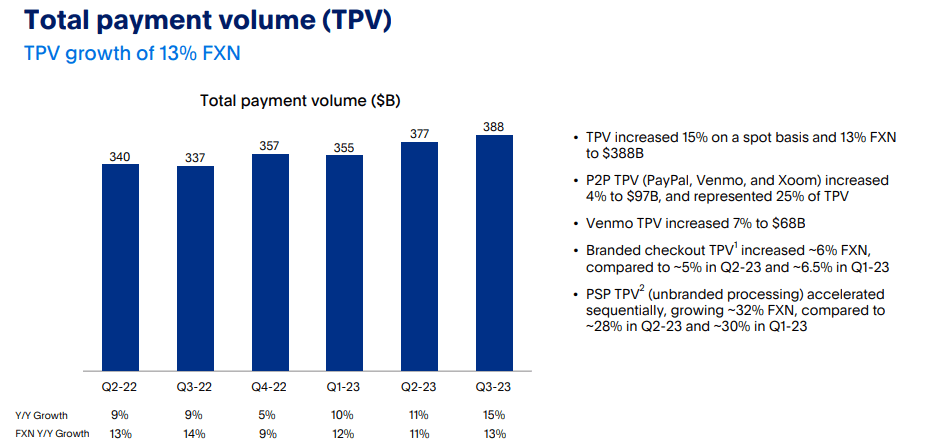

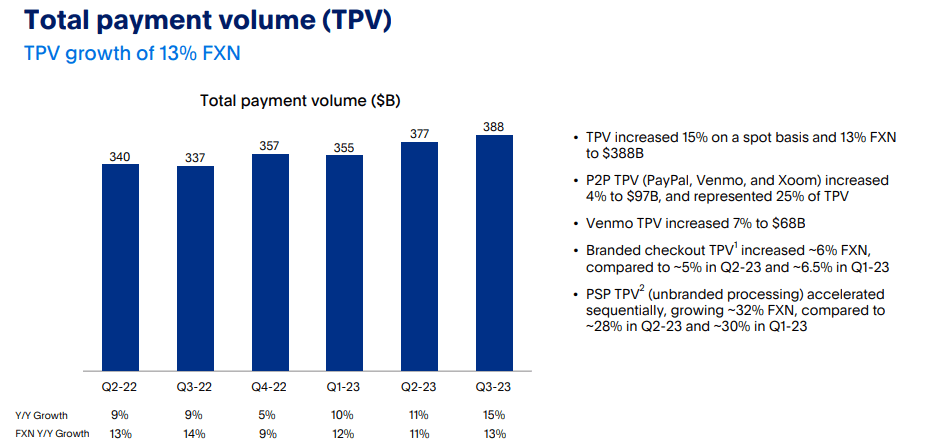

In its most up-to-date quarter, PYPL noticed complete cost quantity (“TPV”) develop 15% YoY (13% fixed foreign money). Whereas PYPL noticed a good 6% YoY progress in branded checkout TPV, it was the unbranded processing volumes that led the best way (primarily made up of Braintree), rising 32% YoY. Over time, I anticipate unbranded processing volumes to make up a increasingly more important proportion of total volumes and thus grow to be a larger contributor to total progress.

2023 Q3 Presentation

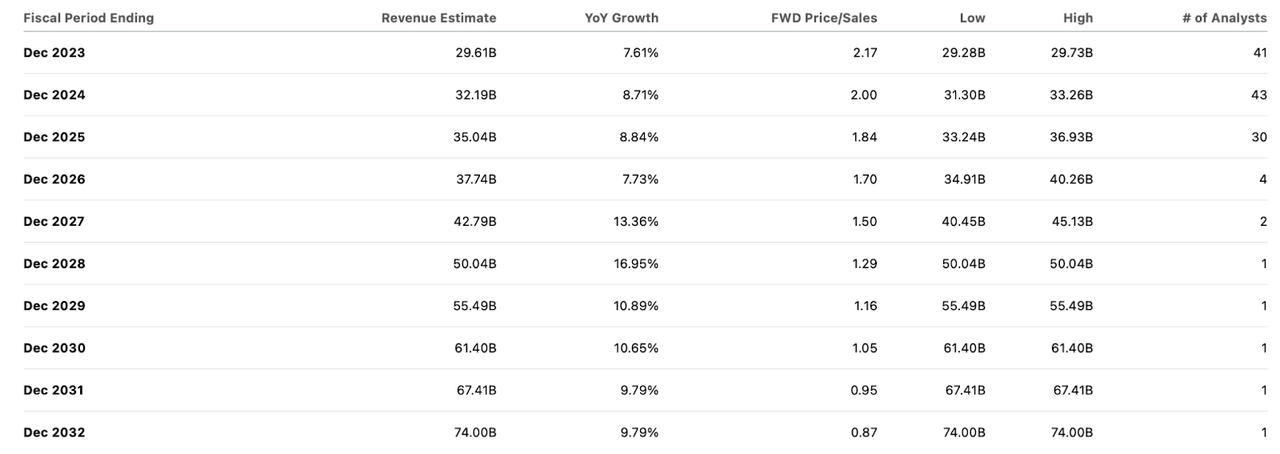

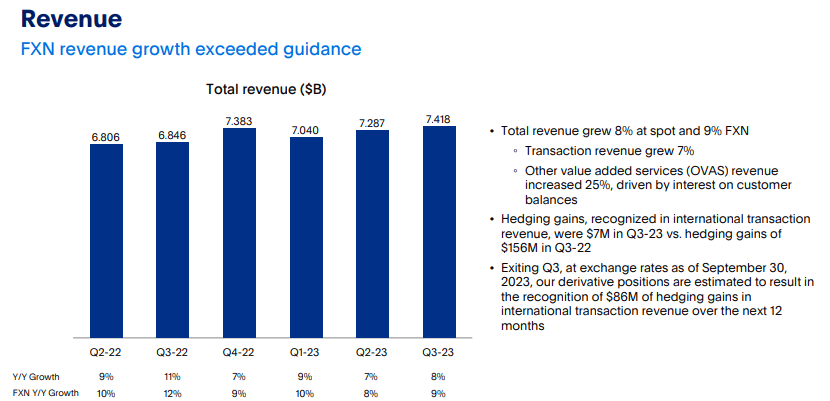

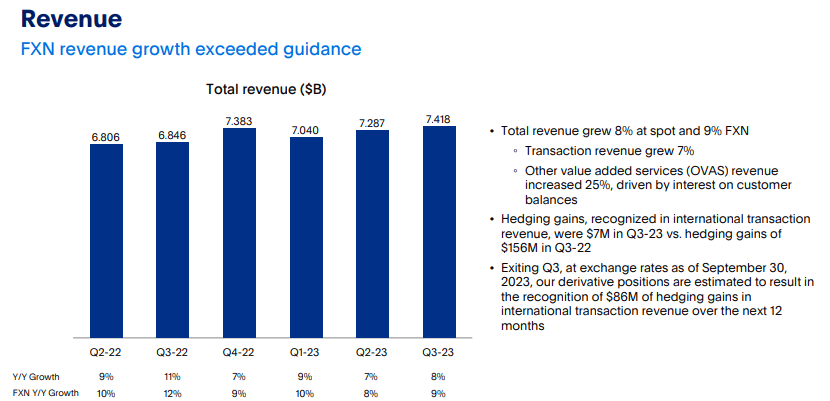

That led to PYPL rising revenues by 8% or 9% on a relentless foreign money foundation, coming in barely forward of steering for 8% fixed foreign money progress.

2023 Q3 Presentation

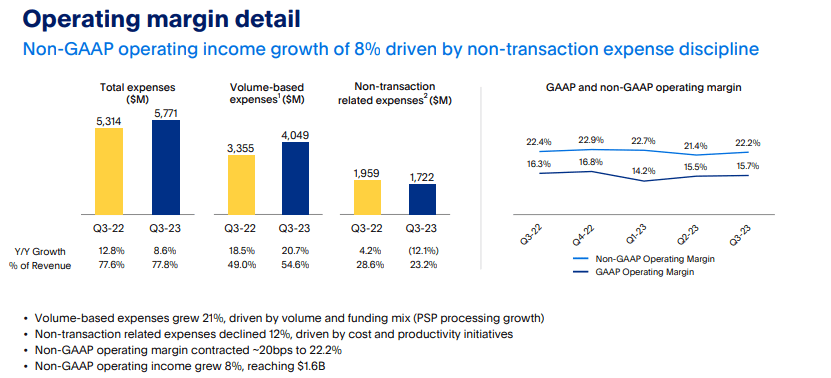

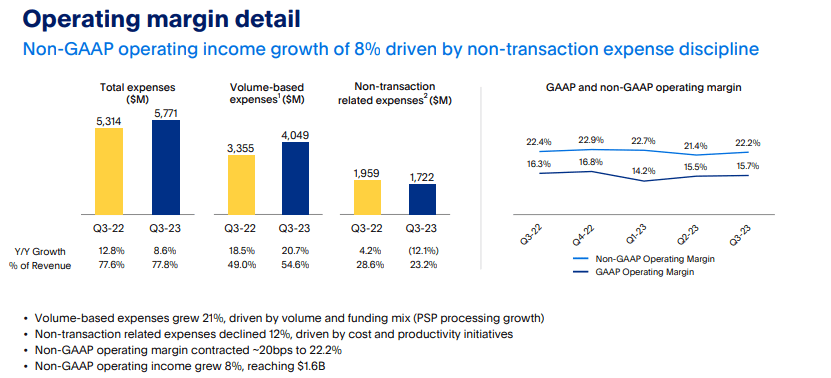

After a number of quarters of margin growth, PYPL noticed some margin contraction on a YoY foundation, with non-GAAP working margin retreating 20 bps. The margin contraction is principally because of unbranded processing having decrease margins – it’s well-known that PYPL has been in search of to take market share in unbranded checkout processing by means of aggressive pricing.

2023 Q3 Presentation

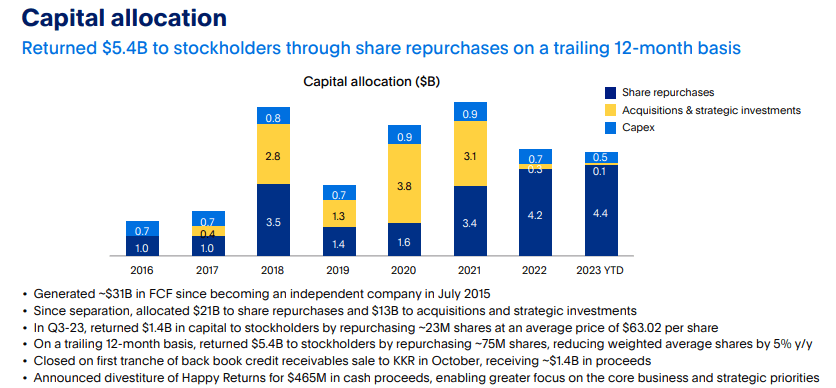

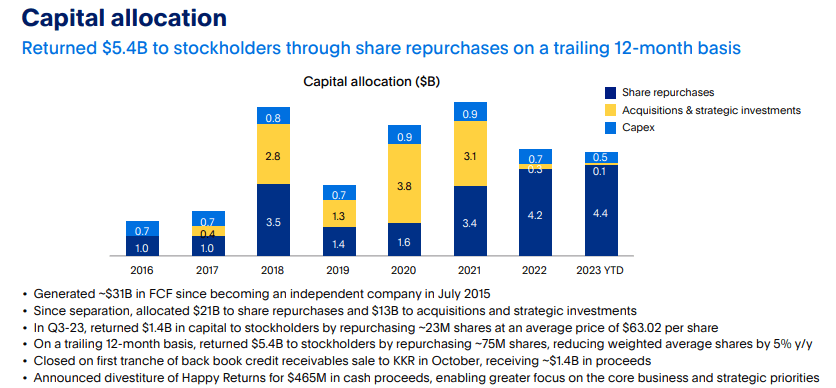

PYPL ended the quarter with $15.4 billion of money versus $10.6 billion of debt, representing a powerful web money stability sheet. PYPL repurchased $1.4 billion of inventory within the quarter as the corporate has basically been returning all free money circulation to shareholders by means of share repurchases.

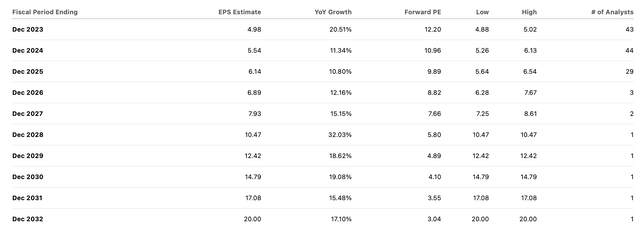

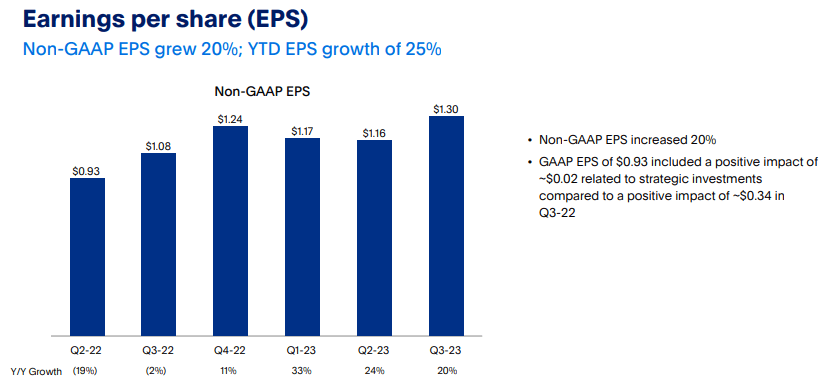

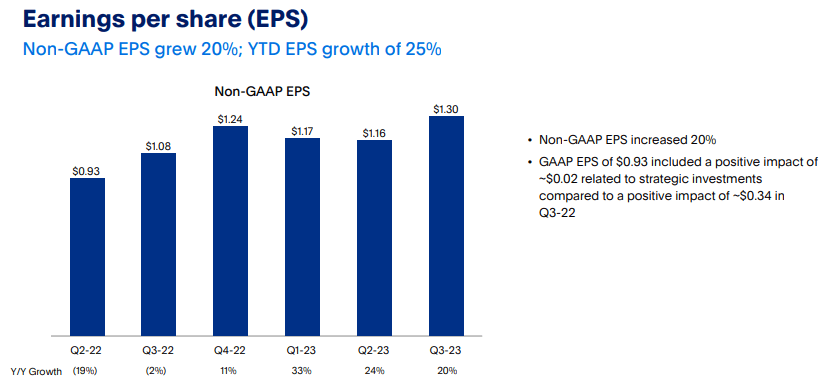

Between the resilient top-line progress and share repurchases, PYPL was capable of develop non-GAAP EPS at an accelerated 20% tempo to $1.30, coming forward of steering for $1.24 in earnings per share.

2023 Q3 Presentation

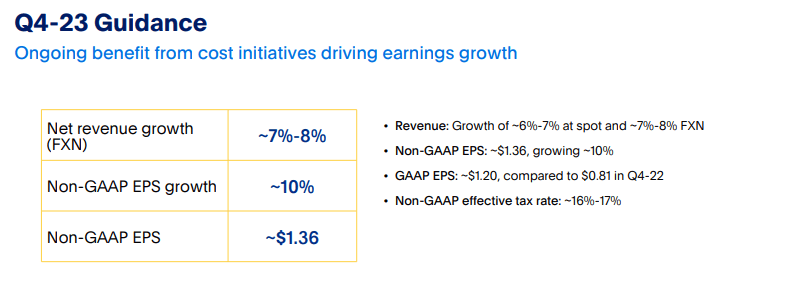

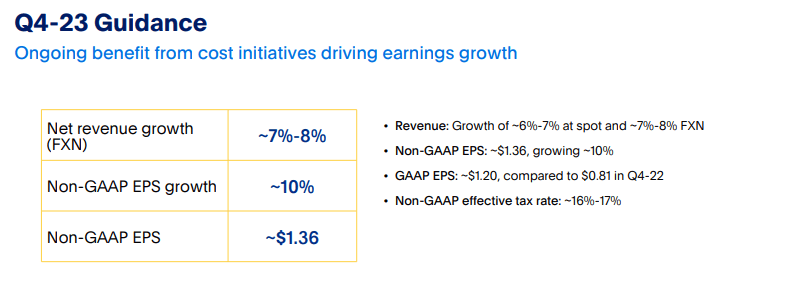

Trying ahead, administration has guided for as much as 8% fixed foreign money income progress and 10% non-GAAP EPS progress within the fourth quarter. Consensus estimates name for the corporate to generate $7.87 billion in income, representing 6.4% progress (in the midst of steering), and $1.36 in non-GAAP EPS.

2023 Q3 Presentation

The conference call was the primary for incoming CEO Alex Chriss. I felt that he did job reiterating the capital allocation priorities that resonate with Wall Avenue, indicating a deal with “high-quality customer growth and profitable revenue growth.” After the 2022 tech crash, Wall Avenue has proven a reluctance to reward aggressive progress methods, and Chriss emphasised that the corporate solely cares about “generating real profit” and that “unprofitable growth is counterproductive to the long-term prospects” of the corporate. These efforts make sense on condition that PYPL has seen top-line progress decelerate meaningfully relative to pre-pandemic years, making it extra prudent to deal with earnings.

Administration gave extra readability concerning their strategy of offloading their buy-now-pay-later (“BNPL”) loans. The corporate had labeled these loans as held-for-sale, which decreased free money circulation by $810 million, however future gross sales of those property will contribute to money from operations. Excluding this classification element, free money circulation would have grown by 21% YoY to $1.9 billion. Administration famous that that they had already obtained $1.4 billion in proceeds from deliberate gross sales simply two weeks previous to the decision and anticipate closing the remainder of their $5 billion in credit score receivables later. I view these monetary transactions to be barely constructive for the corporate because of the decreased credit score danger, although, it doubtless could include complete earnings.

Administration famous that branded processing, after seeing accelerated progress within the second quarter, “moderated” all through the third quarter. Administration nonetheless additionally indicated that within the early weeks of the fourth quarter, “branded trends have stabilized and are tracking in line with the first half of the year.” I anticipate this volatility to persist, given the uneven macro restoration and heightened aggressive threats. The market is clearly pricing the branded processing enterprise at low multiples.

Whereas administration didn’t explicitly state as a lot, it seems that traders ought to anticipate share repurchases to be the primary use of earnings for the foreseeable future. Administration famous that they “have a lot of acquisitions” from prior years which have led to “a lot of duplication.” Administration goals to “build services that can be reused and leveraged across the organization” which sounds to me like there’s nonetheless loads of room for cost-cutting. PYPL had beforehand been extremely acquisitive in previous years, however share repurchases have been the primary use free of charge money circulation over the previous two years.

2023 Q3 Presentation

PayPal January twenty fifth Innovation Day

On Thursday, January twenty fifth, PayPal held an innovation day which was hyped by CEO Chriss to be one which might “shock the world.” It did shock the world, solely negatively.

The “innovations” unleashed within the presentation embody issues like quicker checkout and personalised gives, lots of which really feel extra like regular enhancements and even catch-up. Traders would possibly really feel let down by this presentation in the event that they have been hoping for game-changing innovation, however they might be lacking the purpose.

Is PYPL Inventory A Purchase, Promote, Or Maintain?

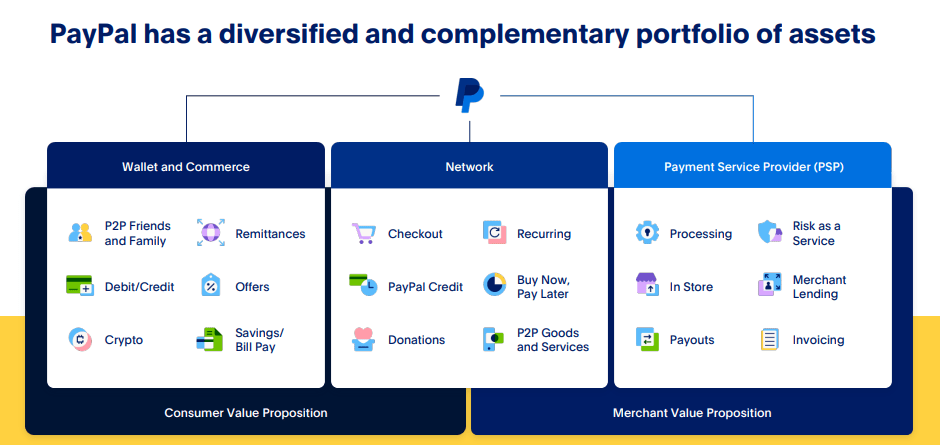

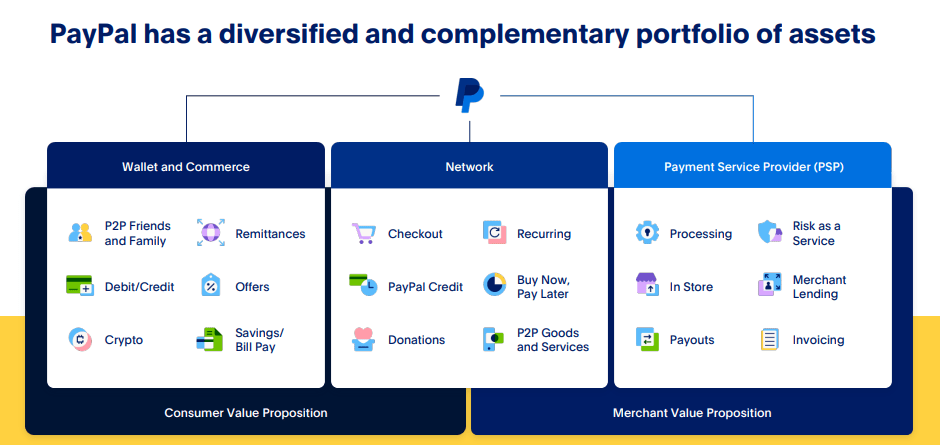

The corporate seems to be doing all the apparent steps (share repurchases, deal with working margins) wanted to earn a better valuation a number of despite a troublesome macro setting. Whereas investor sentiment stays pessimistic, PYPL remains to be a main beneficiary of the shift to cashless transactions because it operates on each the buyer and service provider sides of the worth chain.

2023 Q3 Presentation

The final a number of years have seen PYPL cope with varied headwinds like a post-pandemic slowdown, a deteriorating macro setting, and aggressive threats like Apple Pay (AAPL). The inventory stays 80% decrease than all-time highs and in response, administration has shifted their focus from fast top-line progress in favor of sturdy earnings progress. At current costs, PYPL was buying and selling at simply 12x earnings.

Consensus estimates name for some acceleration in top-line progress, which appears achievable given each the quickly rising unbranded checkout volumes in addition to the potential for an enhancing macro backdrop.

By way of potential catalysts, there sadly don’t seem like any fast fixes right here. I anticipate share repurchases to finally result in materials upside – assuming that the corporate can proceed delivering on earnings progress and stays dedicated to the repurchase program – however it’s anybody’s guess when that upside would happen. Lengthy-term traders may not thoughts ready for this sort of catalyst to happen, however it isn’t clear how the corporate would overcome the competitive-threats-driven valuation overhang in any other case. I’m nonetheless focusing on a good worth a number of of round 15x to 18x earnings, justified by the long-term secular progress and web money stability sheet – and I’m of the view that the corporate can nonetheless ship earnings progress in extra of top-line progress for a few years from price optimization.

What are the important thing dangers? There are clear aggressive dangers that muddy the image right here. Not less than to my untrained eye, it is not clear why PYPL will be capable of keep market share for its branded processing, particularly from the likes of Apple, Shopify (SHOP), or Amazon (AMZN). PYPL has benefitted from a first-mover benefit, however it isn’t clear if it has something greater than that. Maybe the switching prices of re-entering new cost data could assist to retain present customers, however I anticipate the competitors to have higher success in gaining new customers. There could also be one thing that PYPL can do to enhance retention and spark person progress, however it isn’t fully clear precisely what that’s (promotional exercise might be simply replicated by the competitors).

On the flip facet, the corporate’s quickly rising unbranded processing may not see its progress charges final perpetually. The corporate faces stiff competitors from the likes of Adyen (OTCPK:ADYEY) and others, and it’s attainable that the 32% progress seen in unbranded processing this previous quarter finally ends up being a excessive watermark quite than a sustainable quantity. Whereas I’m a long-term-minded investor, I don’t view PYPL to be a high-growth firm anymore, because the thesis as an alternative focuses extra on the earnings energy of the enterprise.

The near-term outlook stays murky for PYPL, as a troublesome macro setting and aggressive pressures could restrict the potential for accelerating income progress. But, with the inventory buying and selling at a low a number of of earnings and the corporate having a dedicated share repurchase program, time could also be all that is vital for eventual upside. I reiterate my robust purchase ranking, as PYPL appears like a high decide in a wealthy market.