valilung/iStock Editorial through Getty Photographs

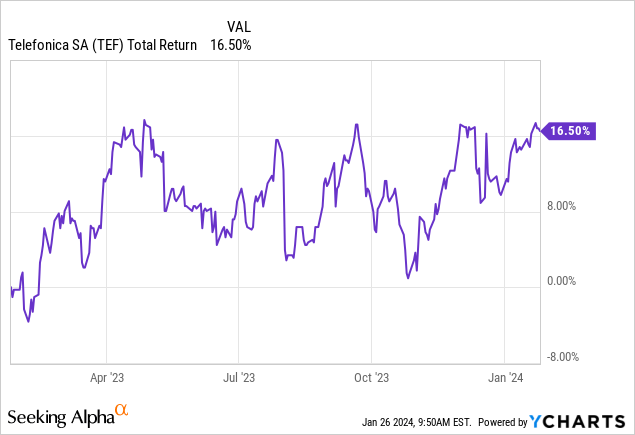

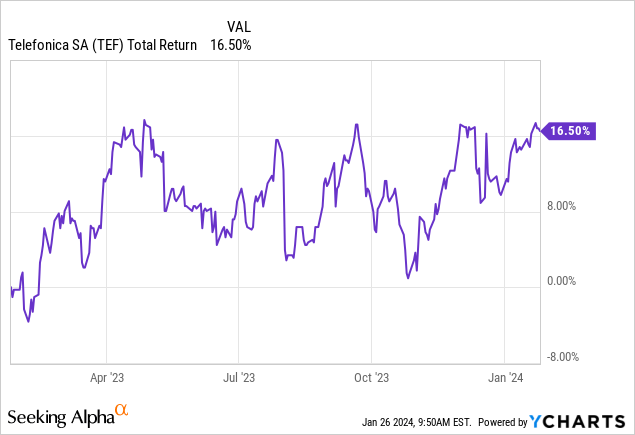

Shares of Spanish telecoms large Telefonica (NYSE:TEF) have had a fairly stable 12 months, returning round 17% (with dividends) in that point amid stabilizing earnings in Spain and recent medium-term monetary targets that look to have been well-received by the market.

I believe it’s honest to say that Telefonica holds a blended bag of belongings total. Its home Spanish enterprise is the decide of the bunch alongside a a lot improved place within the U.Okay., offset by extra so-so operations in Germany, Brazil and varied different LatAm markets. Whereas development prospects are predictably modest right here, these shares do look fairly low-cost on a tough sum-of-the-parts foundation, and I might additionally counsel that the 8%-yielding dividend is sort of a bit safer than the algorithms may suggest. As such, I open on the inventory with a Purchase ranking.

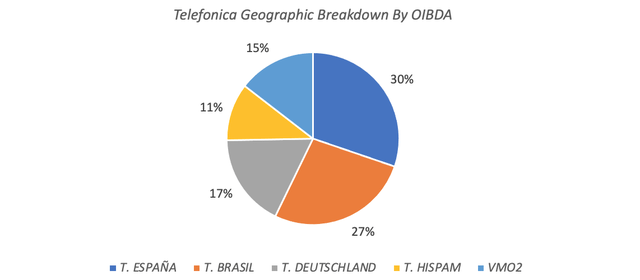

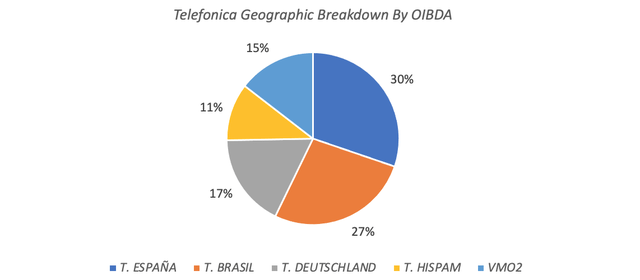

A Blended Bag

Telefonica affords buyers publicity to telecoms markets in Spain, Germany, the UK, Brazil, and a group of different LatAm international locations. Spain accounts for the most important share of group earnings, with 9M2023 working earnings earlier than D&A (“OIBDA”) of €3.4 billion equating to circa 30% of the corporate’s complete. Brazil (~27%), Germany (~17%), its share of the U.Okay. joint-venture (~15%), and Hispanic America (~11%)(“HispAm”) account for the rest.

Information Supply: Telefonica Q3 2023 Supplemental Information Launch

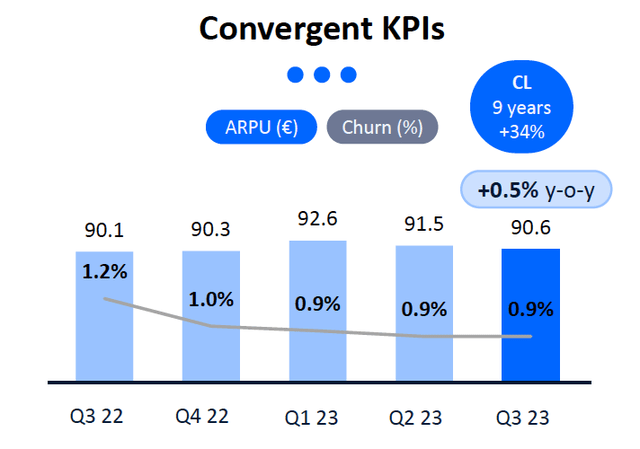

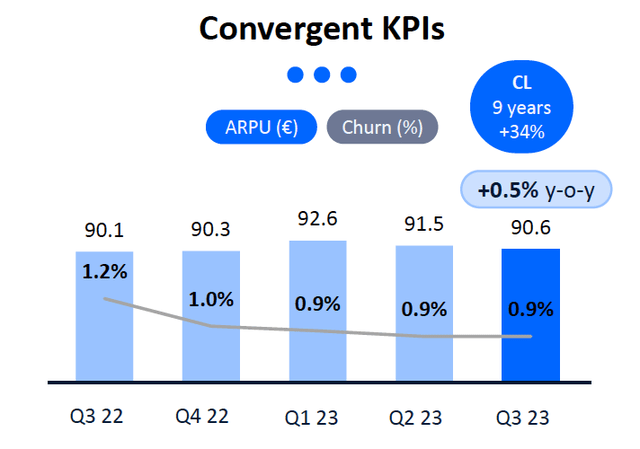

In Spain, Telefonica is the incumbent participant providing each fastened and cell providers, controlling round 35% of the fastened broadband market and 28% of the cell market. It additional studies round 4.5 million converged clients within the nation. Advantages of a converged providing are quite a few, however usually embody decrease churn charges, which in flip lowers buyer acquisition prices as it’s cheaper to maintain maintain of an current buyer than purchase a brand new one.

Telefonica presently generates common income per person of over €90 for converged clients in Spain, which is round 60% greater than the determine reported by Spanish quantity two participant Orange (NYSE:ORAN). Additional, Telefonica will generate round €4.5 billion in OIBDA this yr in Spain, mapping to round €3 billion in working free money circulation at a group-leading 25% margin. That may quantity to round 35% of the group’s complete – the next determine than its EBITDA share, highlighting how comparatively money generative its Spanish enterprise is.

Supply: Telefonica Q3 2023 Outcomes Presentation

Telefonica’s different enticing enterprise is within the U.Okay., the place it holds a 50% share in Virgin Media O2 (“VMO2”) alongside recently-covered Liberty International (LBTYA, LBTYK, LBTYB). Beforehand, Telefonica-owned O2 operated as a cell enterprise solely, with the U.Okay. cell market not being particularly enticing from a aggressive place. Mixed with Virgin Media’s cable community, VMO2 is now a converged fixed-mobile participant, placing it in a a lot stronger place than earlier than. Cable firms have additionally usually benefitted from much less burdensome CapEx necessities in comparison with legacy telecoms suppliers, with the latter having to spend closely to improve legacy copper networks to full fiber. In consequence, I believe this asset ought to command the next a number of than Telefonica’s different telecoms companies, which mainly types the crux of the worth case (extra on that later).

It is rather a lot a blended bag elsewhere. In Brazil, Telefonica owns circa 75% of listed Telefonica Brasil (VIV), and this section is barely a shade smaller than the Spanish enterprise by OIBDA. Whereas a converged operator, the corporate has been grappling with market share losses in broadband, investing closely in full fiber to attempt to stabilize the state of affairs. Capital intensive companies normally characterize a barely larger threat in rising markets given the inflation/foreign money angle, so I am not overly eager on this publicity. Ditto for HispAm, which is why the corporate is exploring strategic choices for the section. A spin-off in all probability represents the trail of least resistance and can be my most well-liked possibility.

Lastly, Telefonica’s German enterprise, Telefonica Deutschland (OTCPK:TELDY)(OTCPK:TELDF), can also be not nice, with the corporate primarily a cell solely participant there. Whereas Telefonica Deutschland does supply fastened providers, it would not personal a set community within the nation, and the economics of renting will in all probability skew closely in favor of the community house owners. As such, Vodafone (VOD) and Deutsche Telekom (OTCPK:DTEGY)(OTCPK:DTEGF) are in all probability a lot better choices for buyers on the lookout for publicity to that house.

Earnings Outlook; Dividend Safe

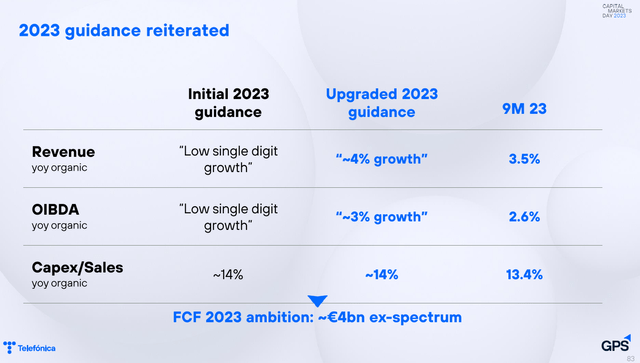

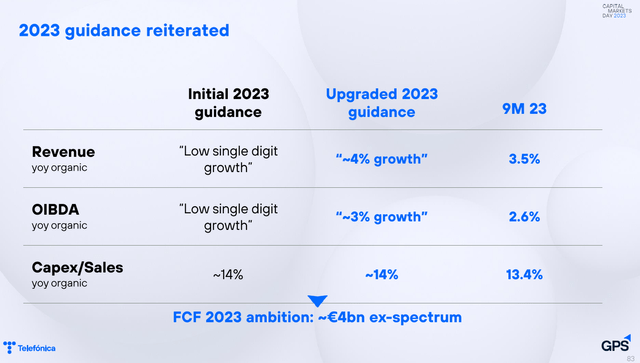

Throughout its This autumn 2023 Capital Markets Day, Telefonica launched a recent set of medium-term monetary objectives. These embody a 1% high line CAGR for the 2023-2026 interval, with EBITDA and working free money circulation (“FCF”) seen rising at greater common annual charges of two% and 5%, respectively, over the identical interval. For 2023, administration targets embody 4% natural income development and three% development in OIBDA.

Supply: Telefonica 2023 Capital Markets Day

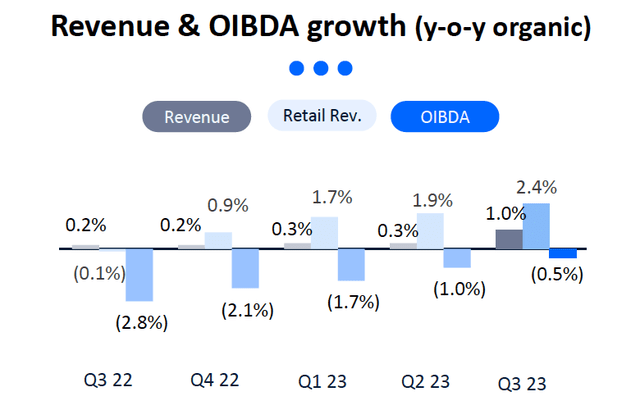

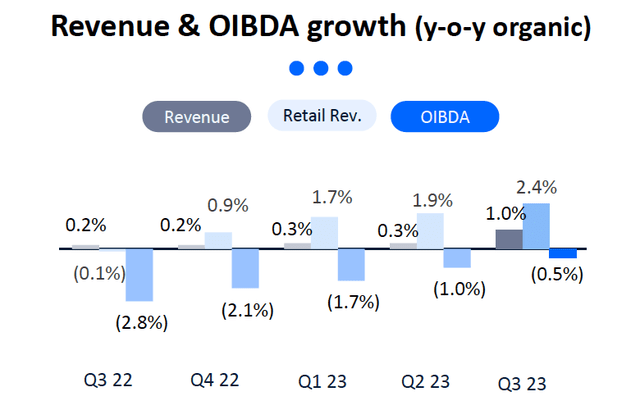

This doesn’t look overly aggressive. Although the perfect a part of Telefonica’s enterprise, Spain has been registering modest declines in OIBDA in current quarters on account of inflationary pressures on the corporate’s price base there. Because the beneath graphic exhibits, the development has been bettering as inflation moderates, and I anticipate that to proceed when the corporate posts full-year leads to late February. That alone ought to put the corporate on observe to satisfy complete company-wide targets.

Supply: Telefonica Q3 2023 Outcomes Presentation

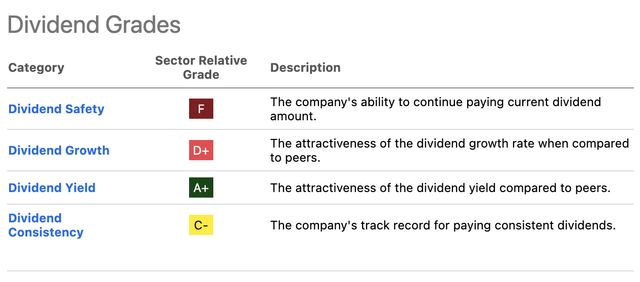

Equally, the corporate’s a lot greater working FCF CAGR goal of 5% is essentially a perform of normalizing CapEx as fiber rollouts cross their peak ranges. This additionally places Telefonica’s dividend on firmer footing than it’d presently seem, with Looking for Alpha’s Dividend Scorecard solely grading TEF a lowly ‘F’ for Dividend Security relative to the sector.

The €0.30 annual payout (~$0.33 per ADS) equates to round €1.7 billion in money phrases, swallowing a lot of the €2 billion in FCF the corporate expects to report for 2023. Because the CapEx/Gross sales ratio declines to round 12% over the subsequent couple of years, that may liberate an additional €800 million or so in annual surplus money circulation earlier than contemplating natural development. Leverage is round 2.5x OIBDA-aL (i.e. after leases), and administration is focusing on modest discount to 2.25-2.5x by 2026. That leaves little room for dividend hikes over the subsequent few years, so whereas the yield appears to be like moderately safe at round 8% proper now, I do not see a lot development on high within the close to time period.

Shares Look Round 25% Undervalued

Telefonica’s ADSs commerce for $4.18 apiece at time of writing, with the Madrid-listed extraordinary shares at €3.82 every. That means an enterprise worth of round €57 billion (~$63 billion) based mostly on circa 5.7 billion shares excellent and round €35 billion in complete web debt (together with lease liabilities).

The best way I see it, that mainly accounts for Telefonica’s consolidated companies, leaving the VMO2 J.V. to drive important upside. Now, Telefonica’s Brazilian and German companies are listed on their respective inventory exchanges, so gauging their worth is comparatively easy because the market has already offered a view. Telefonica Brasil trades for round 4.7x ahead EBITDA as per Looking for Alpha, whereas Telefonica Deutschland trades on a a number of of round 4.2x. This accounts for slightly below 40% of Telefonica’s complete enterprise worth after adjusting for minority stakes. Attaching a 4.7x a number of to the HispAm section, according to Brazil, captures one other ~13%, leaving round 50%, or ~€28 billion, for the Spanish enterprise. That equates to a a number of of round 6x OIBDA, which appears to be like cheap for a market-leading incumbent with stable profitability. The very best incumbent telecoms companies in Europe, KPN (OTCPK:KKPNF)(OTCPK:KKPNY) and Swisscom (OTCPK:SCMWY)(OTCPK:SWZCF), commerce in extra of seven.5x, so 6x for the Spanish enterprise doesn’t look costly.

With the above accounting for Telefonica’s enterprise worth, this leaves VMO2 to drive upside to honest worth. Cable firms usually commerce on greater multiples for the explanation I set out earlier, specifically that they’ve much less onerous CapEx necessities by way of upgrading their networks. VMO2 can also be a converged participant, bringing extra advantages described above. A a number of according to U.S. cable firms like Comcast (CMCSA), Charter (CHTR) and Altice USA (ATUS) wouldn’t be unreasonable, which as per Looking for Alpha commerce within the 7-8x EBITDA area. On the lower-end of that vary and adjusting for web debt and Telefonica’s share of the JV, the fairness can be price an additional ~€0.90 per share (~$1 per ADS) to Telefonica. Including that to the present inventory value will get me to a good worth of simply over €4.70 per share (~$5.15 per ADS), implying round 25% upside to honest worth. In consequence, I connect a Purchase ranking to Telefonica inventory.

Dangers

Telefonica’s enterprise comes with quite a few dangers. Forex is maybe the obvious, with the ADSs priced in {dollars} however the enterprise producing gross sales and earnings in EUR, GBP, BRL and varied different LatAm currencies. Its rising markets operations arguably current further foreign money threat although inflation and foreign money depreciation, and this represents a fabric a part of Telefonica’s total enterprise. Moreover, the telecoms sector is often extremely aggressive and tightly regulated, each of which may materially have an effect on profitability. As telecoms providers are largely commoditized, there could also be little that Telefonica might do to offset strain to its earnings energy ought to it encounter these headwinds.