Wirestock

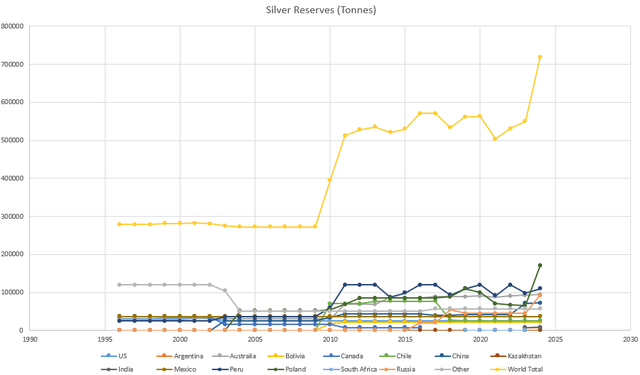

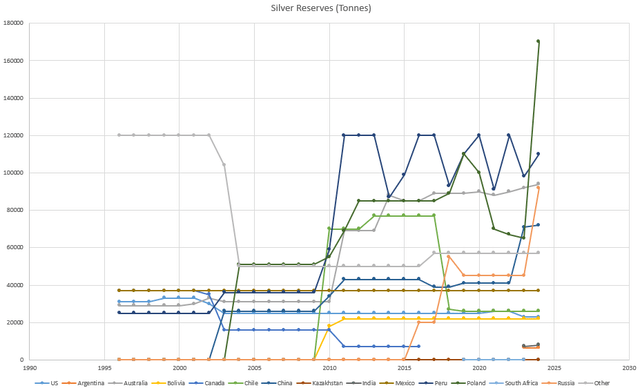

Annually, the U.S. Geological Survey publishes a report on world mine manufacturing and reserves. As valuable metals buyers, we’re particularly within the silver section of this report which provides us extraordinarily worthwhile info on the provision facet of the silver market. There was numerous discuss amongst buyers a couple of looming deficit within the silver market. Nonetheless, this newest knowledge from the USGS debunks the parable that silver is in essential scarcity. In reality, silver reserves have simply hit all-time highs.

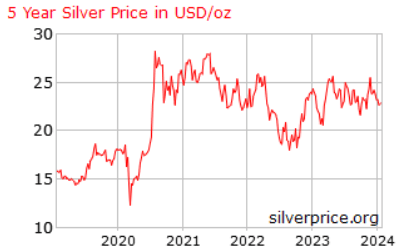

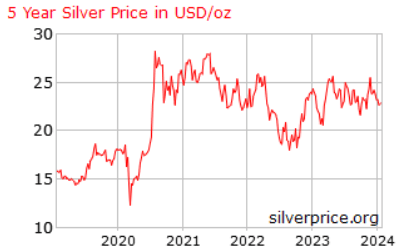

Silverprice.org

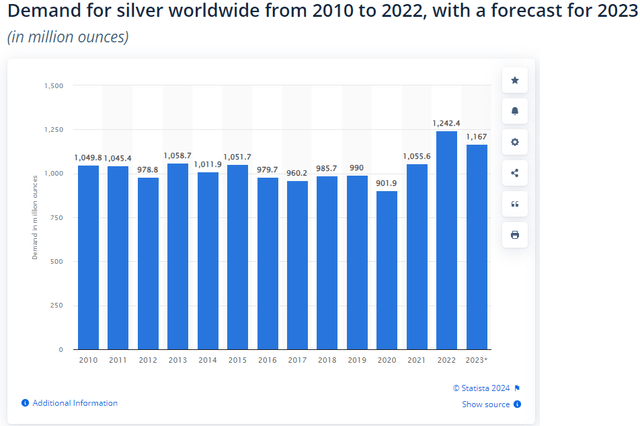

The silver value has been flat throughout 2023 as weak funding demand and robust industrial demand balanced one another out. In accordance with Statista, silver demand for 2023 was estimated at 1.167 billion ounces, down from final 12 months.

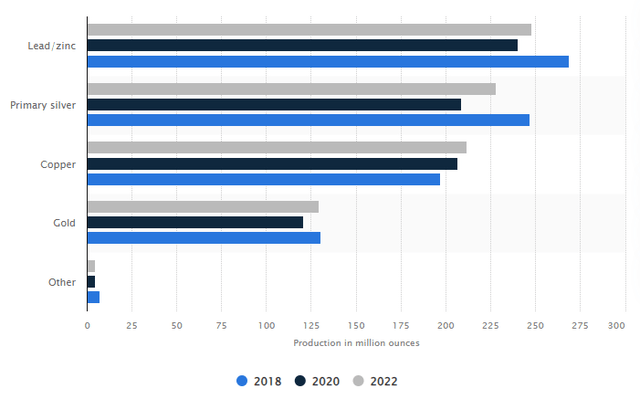

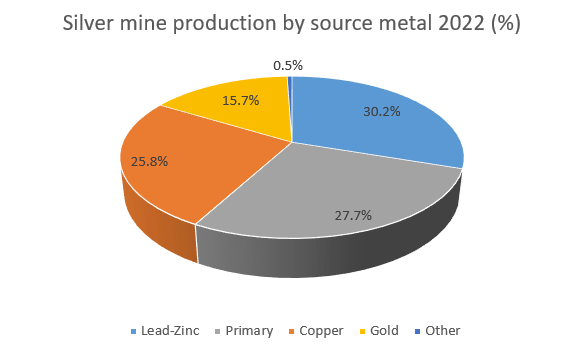

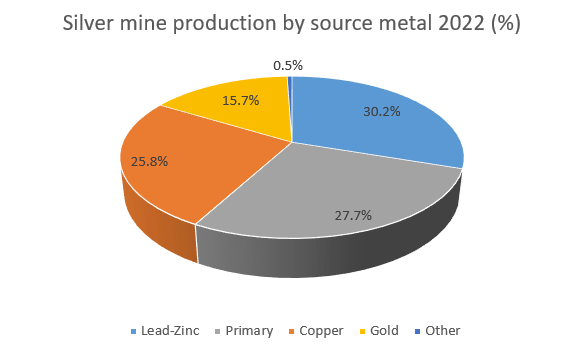

Once we have a look at the provision facet of the silver market, we observe that the majority of the silver provide is produced as a by-product from base metallic mining. It’s anticipated that silver provide from base metallic by-product silver manufacturing will improve within the coming years. 30.2% of silver manufacturing comes as a by-product of zinc and lead mine provide, whereas 25.8% comes as a by-product of copper manufacturing. Thus, 56% of worldwide silver manufacturing is a results of copper, zinc, and lead manufacturing (see determine under from Statista).

Statista

Statista reported that silver manufacturing rebounded in 2022. Regardless of falling silver grades, main silver miners managed to extend manufacturing in 2022.

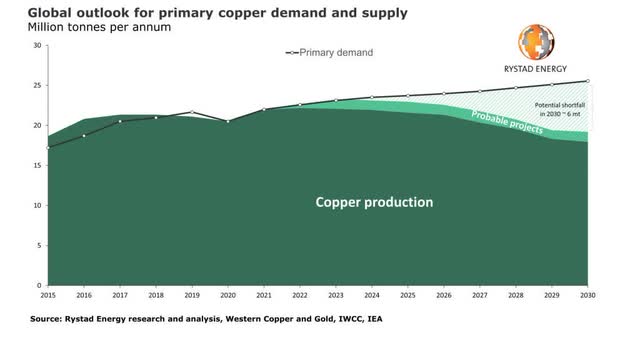

Though demand for base metals is bettering, I do not anticipate that provide for base metals will rise that quick as a result of it is extremely tough to deliver these mines into manufacturing as these are very giant tasks. The grades of those mines are additionally reducing going ahead. For instance, copper provide (and silver by-product provide) is most definitely to develop slowly within the coming years (see figure under of Rystad Vitality). Consequently, the silver by-product provide coming from copper mines will not be rising as a lot.

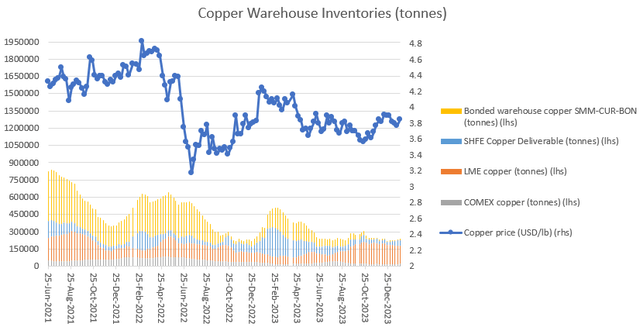

The quantity of copper in warehouses has declined sharply, which is proof that there’s not sufficient copper being equipped to fulfill demand. Chinese language copper inventories specifically are at essential ranges (see the chart under from my private website Correlationeconomics the place I revealed this on LME, COMEX, SHFE, and Shanghai bonded copper knowledge).

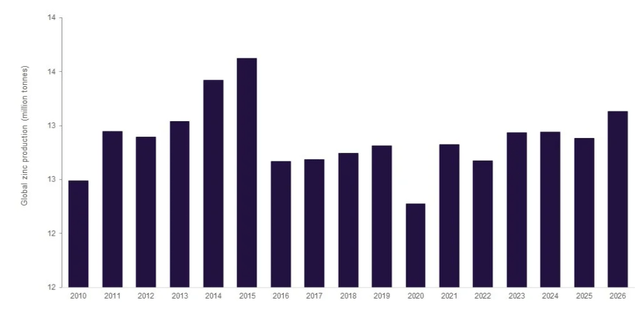

In accordance with GlobalData, international zinc manufacturing will rise, which can improve silver by-product provide.

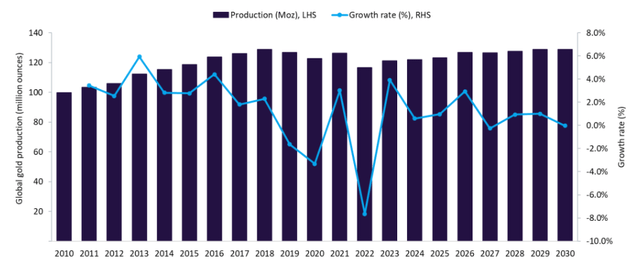

GlobalData stories that the gold provide (and silver by-product provide) shall be near flat.

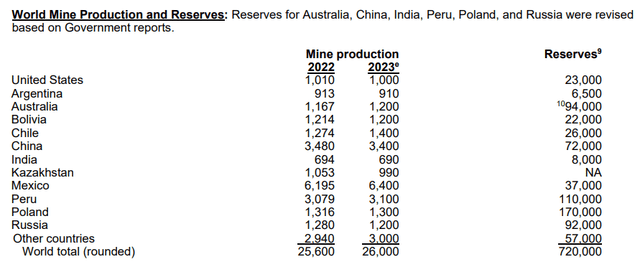

The 2023 USGS report reveals rising silver manufacturing and silver reserves (see charts under from USGS). Mexico, China, and Peru are nonetheless the most important silver producers on this planet. Poland has trumped Peru at 170,0000 tonnes of silver reserves, reworking into the nation with the world’s largest silver reserves. Additionally notable is that Russia’s silver reserves doubled to 92,000 tonnes. Complete silver reserves elevated 30% to 717,500 tonnes, which is very large. Complete silver manufacturing elevated from 25,600 tonnes/12 months (2022) to 26,000 tonnes/12 months (2023). Once we extrapolate the charts we are able to estimate that silver shall be depleted in about 27 years, which debunks the parable that there’s a silver scarcity.

Let’s take a more in-depth have a look at the three largest silver producers: Peru, Mexico, and China.

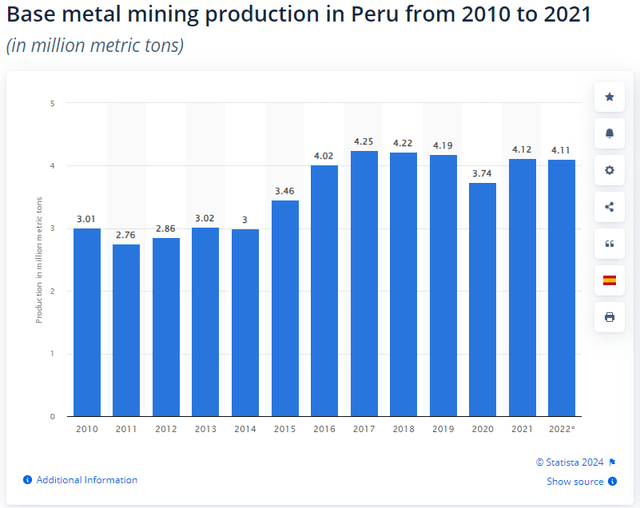

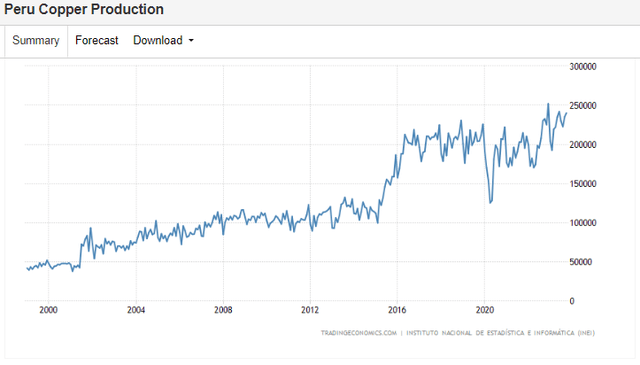

Throughout 2022, we noticed that Peru’s silver reserves have elevated 10% 12 months over 12 months to 110,000 tonnes. On the bottom metallic manufacturing facet, Peru recorded flat base metallic mining manufacturing of 4.11 million metric tonnes in 2022 (see chart under from Statista). Peru’s silver manufacturing was secure at 3,100 tonnes per 12 months in 2023. Peru’s copper production rose to 240,096 tonnes in October 2023.

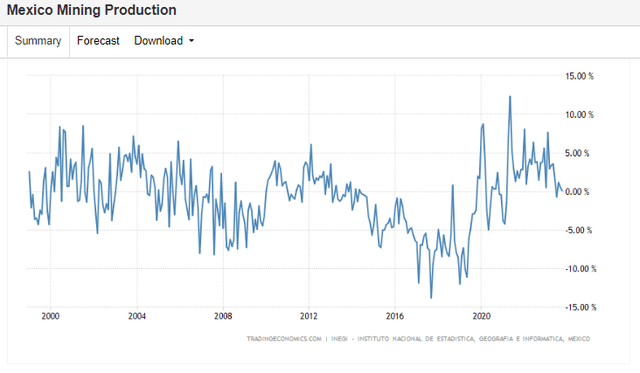

Now let’s check out Mexico. Silver manufacturing elevated 3% 12 months over 12 months to six,400 tonnes per 12 months in 2023. The chart under from Trading Economics reveals how Mexico’s total mining manufacturing declined in 2023. Silver reserves had been unchanged at 37,000 tonnes.

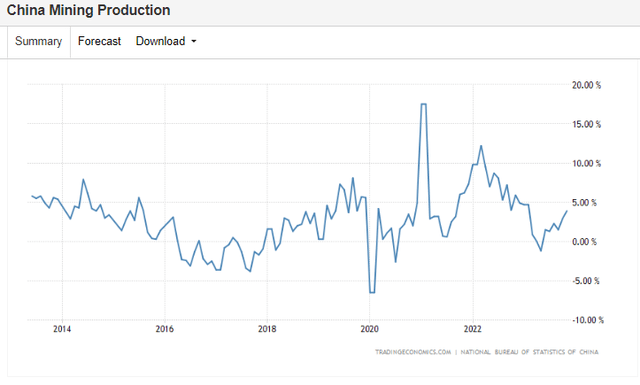

Silver manufacturing in China comes primarily from by-products of lead and zinc (95%), so we have to take a more in-depth have a look at base metallic mining. Mining manufacturing in China elevated 3.9% in November of 2023 over the identical month within the earlier 12 months (see chart under from Trading Economics). Silver manufacturing for 2023 was down barely 12 months over 12 months at 3400 tonnes per 12 months. Silver reserves had been up barely at 72,000 tonnes.

these numbers, base metallic mining has been doing very effectively and a superb quantity of silver is coming from there as a by-product. The general development is pointing to more and more plentiful silver reserves and rising silver manufacturing. This could put a lid on the silver value going ahead, until silver demand outpaces provide. I do not see any silver scarcity in any respect, it’s only a fable. The important thing takeaway for buyers is to not anticipate a surge within the silver value. As a substitute, give attention to firms that mine silver profitably on the present silver value. I anticipate that the silver value will transfer larger however keep in a variety between $20-$25 this 12 months, shifting in lockstep with a rising gold value.