grandriver/iStock by way of Getty Photographs

Thesis: After a 2020 change in possession, sturdy operational performances, and at the moment favorable financial situations, Customized Truck One Supply, Inc. (NYSE:CTOS) ought to ship double-digit returns in 2024. I price it a Sturdy Purchase primarily based on anticipated capital positive aspects this yr.

About Customized

The corporate refers to itself as “one source” for specialty vans and tools.

CTOS overview of apparatus (Q3 investor presentation)

It was based in 1996 as Customized Truck & Gear and has been by way of a few possession iterations since. In 2015, a majority curiosity was bought by The Blackstone Group Inc. (BX), which went on to promote it to Nesco Holdings, Inc. (NSCO) for $1.475 billion in December 2020. Nesco was additionally within the enterprise of specialty vans and heavy tools.

The next April (2023), Nesco modified its title and that of the mixed entity to Customized Truck One Supply. On the identical time, it modified the image to CTOS.

The enterprise operates by way of three segments, as outlined within the 10-K for 2022 and with income as acknowledged within the third quarter earnings report:

- Gear Rental Options [ERS]: $118.2 million (27.2% of complete income)

- Truck and Gear Gross sales [TES]: $283.1 million (65.2% of complete income)

- Aftermarket Elements and Providers [APS]: $33.1 million (7.6% of complete income)

Whole income was $434.5 million.

As of Wednesday, January 31, 2024, the inventory worth was $6.54, and it had a market cap of $1.6 billion.

Opponents and aggressive benefits

Not one of the segments above seem to have any vital obstacles to entry, so we must always anticipate every of them to function in extremely aggressive and fragmented markets. Nevertheless, Customized does have some aggressive benefits:

- As a big, publicly traded firm, it probably has higher entry to capital than most of its opponents.

- As an built-in entity, it will probably supply prospects extra environment friendly and cost-effective options than a collection of area of interest companies.

- It claims to have a younger, well-maintained rental fleet; on the finish of 2022, it had a fleet of greater than 10,000 items, with a median age of three.7 years. These tools demographics ought to present greater reliability and decrease prices.

- Due to its dimension and geographical footprint, it is ready to present options for nationwide accounts. That features crews of customer support brokers and technicians.

- It provides direct-to-customer gross sales channels, whereas a lot of its opponents must promote used tools by way of auctions. Getting greater costs for used tools reduces capital expenditures.

To some extent, its margins recommend it has a moat, however solely a slender one. Its gross margin is 24.90%, which is under the Industrials sector median of 30.31%; the EBITDA margin is available in at 12.86%, under the sector median of 13.68%; and the online earnings margin is 3.58%, once more under the trade median of 6.03% (extra on margins under).

Progress

Customized outperforms the sector on progress metrics, although. Income progress [FWD] is 17.89%, properly forward of the sector median of seven.61%. EBITDA progress [FWD] is 62.19%, in comparison with 10.01% for the sector. And EPS [FWD] long-term progress (3 to 5-year CAGR) is a hefty 37.00% whereas the sector median is 11.44%.

Behind that progress is a quickly rising degree of capital expenditures, from $25.9 million in 2018 to $158.7 million in 2023 [TTM]. That is higher than a six-fold enhance in simply 4 and three-quarter years. The corporate doesn’t pay a dividend, so its money move may be devoted primarily to progress.

Over the identical interval, Customized’s complete debt issued has grown from just below $50 million to $190.6 million, a virtually four-fold enhance.

On the finish of the third quarter, it anticipated full-year 2023 income to vary between $1.765 billion and $1.780 billion, in contrast with $ 1.573 billion for 2022.

It anticipated adjusted EBITDA of $425 million to $445 million, which might be a lot greater than 2022’s $181.3 million. Fourth quarter and full-year 2023 outcomes are anticipated on March 12.

Wanting ahead, the analysts who cowl Customized anticipate income to hit $1.81 billion in 2023, $1.91 billion in 2024, and $1.97 billion in 2025.

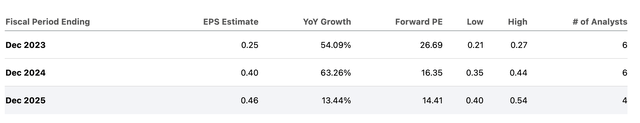

And, they anticipate excessive year-over-year enhancements in earnings per share:

CTOS EPS estimates desk (In search of Alpha)

These are very massive will increase, however given the rising capex, its progress technique, and tailwinds from the Infrastructure Funding and Jobs Act, in addition to decrease rates of interest, they aren’t unreasonable projections.

Margins

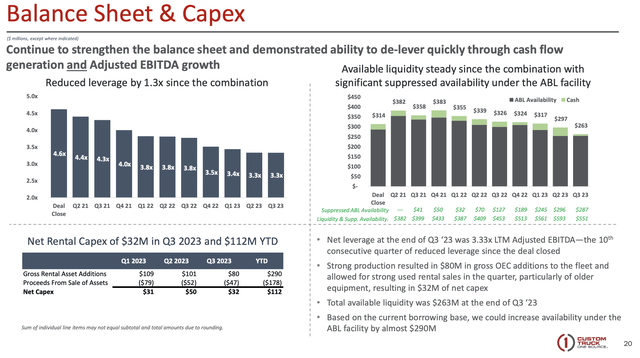

As famous, Customized’s margins lag these of the Industrials sector. And, there’s a massive hole between its EBITDA and internet earnings margins, from 12.86% to three.58%. The largest chunk out of EBITDA comes from curiosity bills; throughout Q3-2023, that quantity to $34.1 million out of EBITDA of $53.0 million. To be truthful, although, it has diminished its leverage for 10 consecutive quarters:

CTOS leverage chart (Q3 investor presentation)

As the corporate notes on the slide, it has a “demonstrated ability to de-lever quickly through cash flow generation and Adjusted EBITDA growth”.

Administration and technique

Chief government officer Ryan McMonagle joined Customized in 2015, because of the funding by The Blackstone Group. Earlier than becoming a member of Customized, he was the CFO of two firms, the place he was answerable for integrating acquisitions. McMonagle began his profession at Bain and Firm.

Fred Ross, who based Customized Truck & Gear in 1996, stays with the corporate within the position of Founder.

Chief Monetary Officer Chris Eperjesy has been with Customized since 2022. Previous to that, he served as CFO at a number of different firms, together with at the least two which have connections with markets the corporate at the moment serves.

Technique: It laid out a five-part progress technique in its 10-Ok: Capitalize on favorable developments throughout a big addressable market; spend money on the rental fleet to fulfill rising demand; develop tools gross sales throughout each present and new prospects, end-markets, and product choices; enhance penetration of aftermarket elements and repair; and proceed to pursue home geographic enlargement.

As famous, the corporate’s progress needs to be aided by the Infrastructure Act, which gives funding for a number of of the top markets it serves.

Because the firm has been in a position to generate vital money flows from its operations (helped partly by debt financing), it has the sources it must implement this technique. It additionally enjoys a number of tailwinds that may assist it keep profitability and money flows.

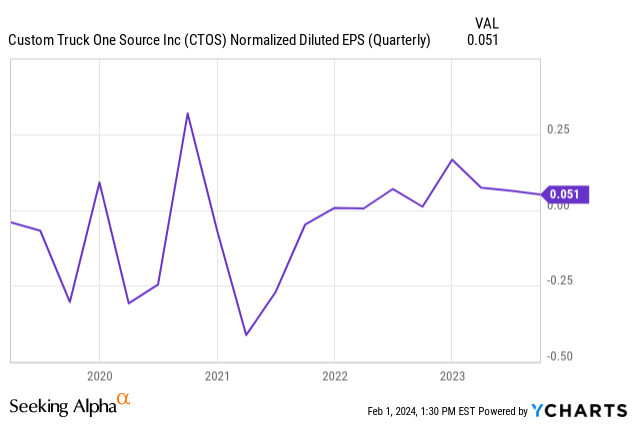

It seems the corporate may additionally profit from being much less seasonal or cyclical than it has been previously. Quickly after the mix with Nesco, its earnings started to degree out:

By changing into extra predictable, which assumes the development will maintain, it ought to develop into extra useful to buyers and assist pull up share costs.

Valuation

As a progress inventory, Customized needs to be assessed by its PEG (price-earnings divided by 5-year EBITDA progress price) ratio relatively than its P/E (worth/earnings) ratio. Particularly, its PEG Non-GAAP ratio [FWD] is 0.66, which signifies it’s undervalued. As well as, it is cheaper than the sector median of 1.76.

It additionally does properly on a number of different valuation metrics. Within the case of EV/EBITDA [FWD], it’s 8.51, properly under the sector median of 11.89. Worth/Gross sales [FWD] is 0.88 versus 1.44 for the sector, and Worth/Guide is 1.76 whereas the sector median is 2.69.

Due to Customized’s debt load, enterprise worth additionally provides an essential perspective. At the moment, the enterprise worth is $3.65 billion, and the enterprise a number of is 8.51, which is properly under the sector median of 11.89. It is also under 10, indicating a wholesome firm, and one that’s undervalued.

And, with 246.5 million shares, the enterprise worth per share works out to $14.81 per share, which is considerably greater than the January 31 closing worth of $6.54. Certainly, the present worth works out to be 44.16% under the enterprise worth per share.

All metrics level in the identical path, telling us that Customized is an undervalued inventory. Based mostly on the enterprise worth per share, that undervaluation is $8.27.

Quants have a Maintain score, whereas Wall Road analysts have issued one Maintain and 5 Sturdy Buys (there have been no different In search of Alpha analyst rankings previously 90 days).

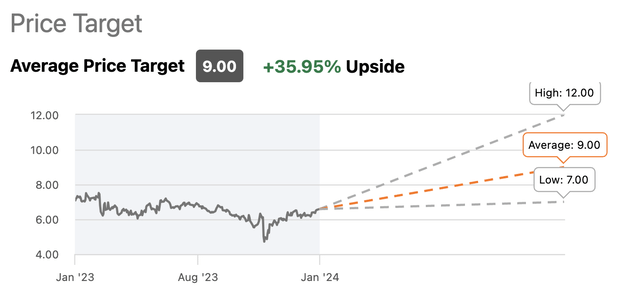

Behind the Wall Road analysts’ bullish rankings is a better common goal worth for the top of the yr: nearly 36%:

CTOS worth targets chart (In search of Alpha)

Dangers

There’s excessive demand and competitors for technicians, and a scarcity of them may drive up Customized’s costs, delay deliveries, and produce other adversarial results.

It relies upon closely on its provide chains, and any disruptions may result in operational challenges. For instance, an auto manufacturing strike that stops or slows the supply of vans.

Of its 246.5 million shares excellent, Platinum Fairness Advisors owns 148.6 million, or 60%, of them. Platinum was a part of the Nesco deal and, with a majority of the frequent shares, could act in methods that aren’t in one of the best pursuits of different shareholders.

Though it has been decreasing its leverage, Customized nonetheless carries a reasonably heavy debt load, and curiosity costs may very well be a good larger drain on profitability.

The corporate experiences within the 10-Ok that it and its service suppliers have skilled cyberattacks, and expects extra of them sooner or later.

Conclusion

Customized Truck One Supply is an undervalued inventory that’s anticipated to show in vital bottom-line progress this yr. There is a good chance that this progress may push up the share worth by nearly 36%, to round $9.00.

That is backed up by greater earnings, rising capital expenditures, progress within the broader financial system, and favorable tailwinds.

Subsequently, I am giving Customized a Sturdy Purchase score.