Andriy Onufriyenko/Second by way of Getty Photographs

By Michael J. Fleisher

Since early 2022, the Federal Reserve (FED) lifted the federal funds price by 5.25% to curb inflation, triggering hypothesis from pundits over the financial influence and future path of price will increase. Not too long ago, the Fed famous that inflation has been tempered by restrictive financial coverage and signaled the probability of easing financial coverage this yr. Fairness traders applauded this dovish pivot with a reduction rally towards the tip of 2023. Nevertheless, past the market response to early indicators of a possible lower within the federal funds price, we wished to analysis the conduct of equities after the Fed truly lowers charges. Moreover, we wished to see if the lower in charges can be utilized as a sign for future market conduct. On this analysis, we have a look at the trailing 12-month change within the federal funds price going again to the mid-Seventies to investigate market returns after the Fed has commenced easing.

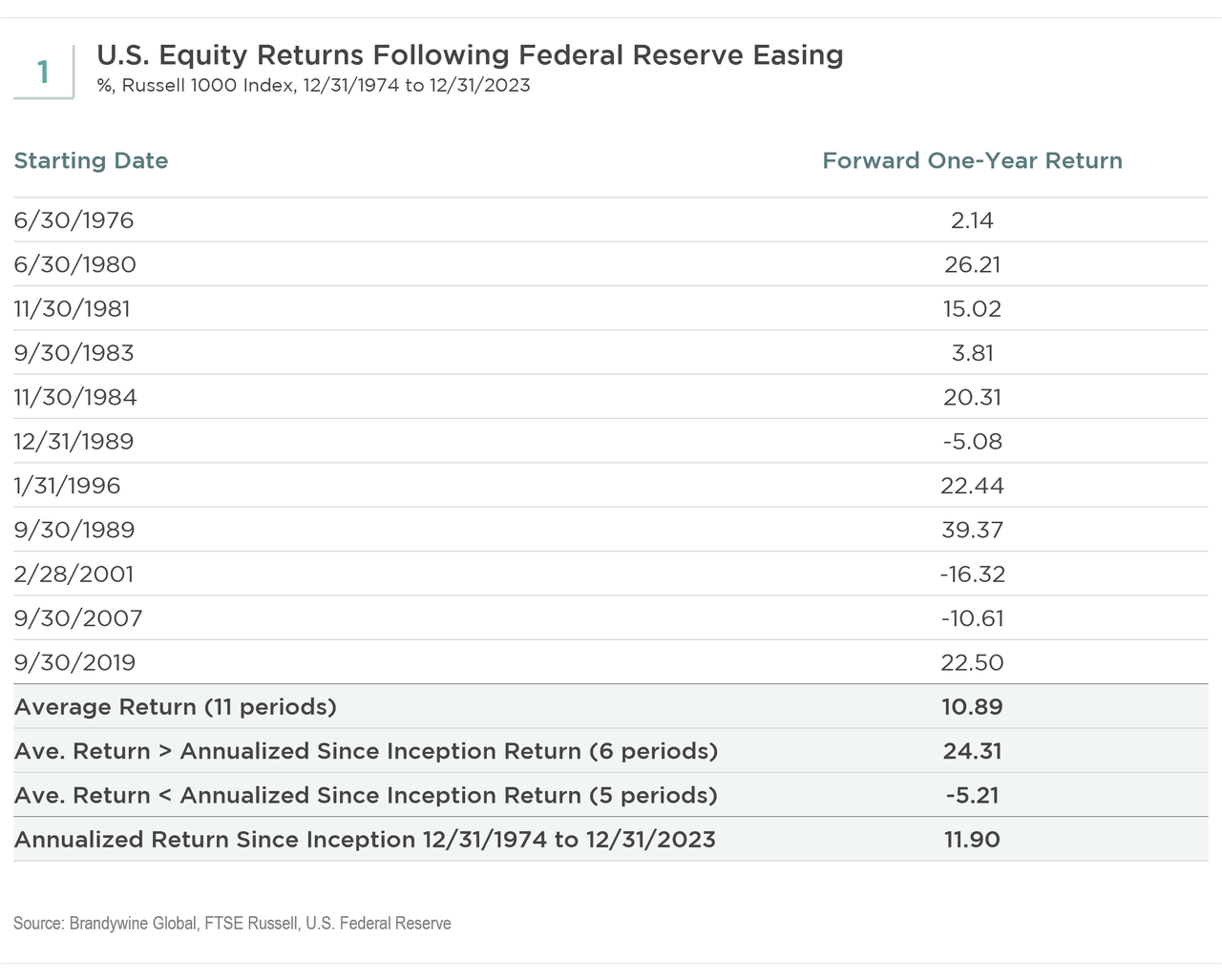

The chart under reveals that the U.S. fairness market, as measured by the Russell 1000 Index from December 31, 1974, to December 31, 2023, on common, data related returns relative to its long-term historical past one yr after the 12-month change in charges turns into damaging (see Exhibit 1). Nevertheless, when taking a look at every particular person interval of reducing charges, the market outperformed its long-term common in 6 out of 11 occurrences with a median 24% return. Intuitively, it is smart that the market would outperform because the Fed lowers charges to stimulate the financial system. When trying on the remaining 5 out of 11 durations throughout which the market underperformed its long-term common, we discover that these subpar occurrences had a median return of -5.21%, and the efficiency for 3 of those 5 underperforming time spans resulted in damaging returns. Additionally, these damaging return durations occurred inside 12 months of an inverted yield curve. As we briefly defined in our last analysis, the yield curve can un-invert because the Fed lowers short-term charges. The inverted yield curve has been a superb predictor of recessions, and when adopted by financial easing, decrease charges could also be a extra coincident indicator of worsening financial knowledge and a struggling financial system.

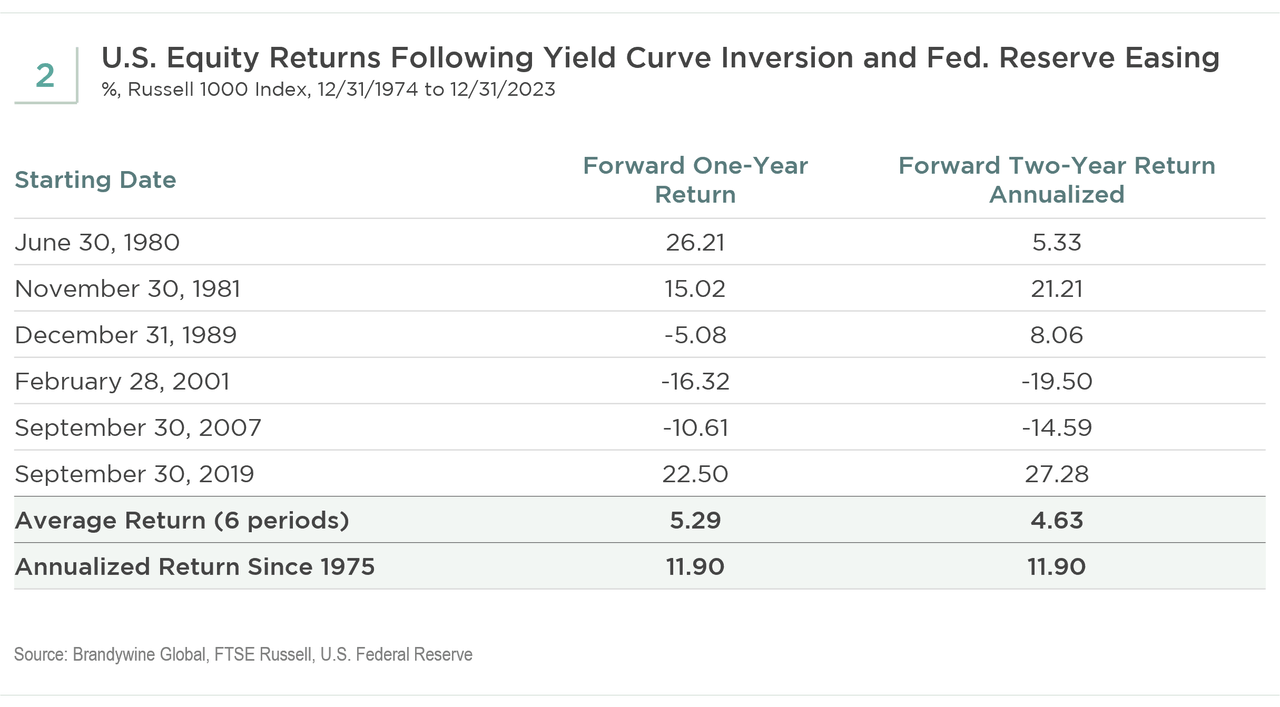

We checked out all durations from 1975 till 2023 during which each the 12-month change within the federal funds price was first damaging and the curve had been inverted inside the prior 12 months. The under chart (see Exhibit 2) reveals that the market, on common, underperformed with a median return of 5.29% versus the long-term common of 11.90%. Moreover, the underperformance persevered on common when taking a look at 2-year annualized returns, with the common return dropping to 4.63%. The market underperformed for twenty-four months out in 4 of the 6 durations when the Fed lowered charges inside 12 months of an inverted yield curve.

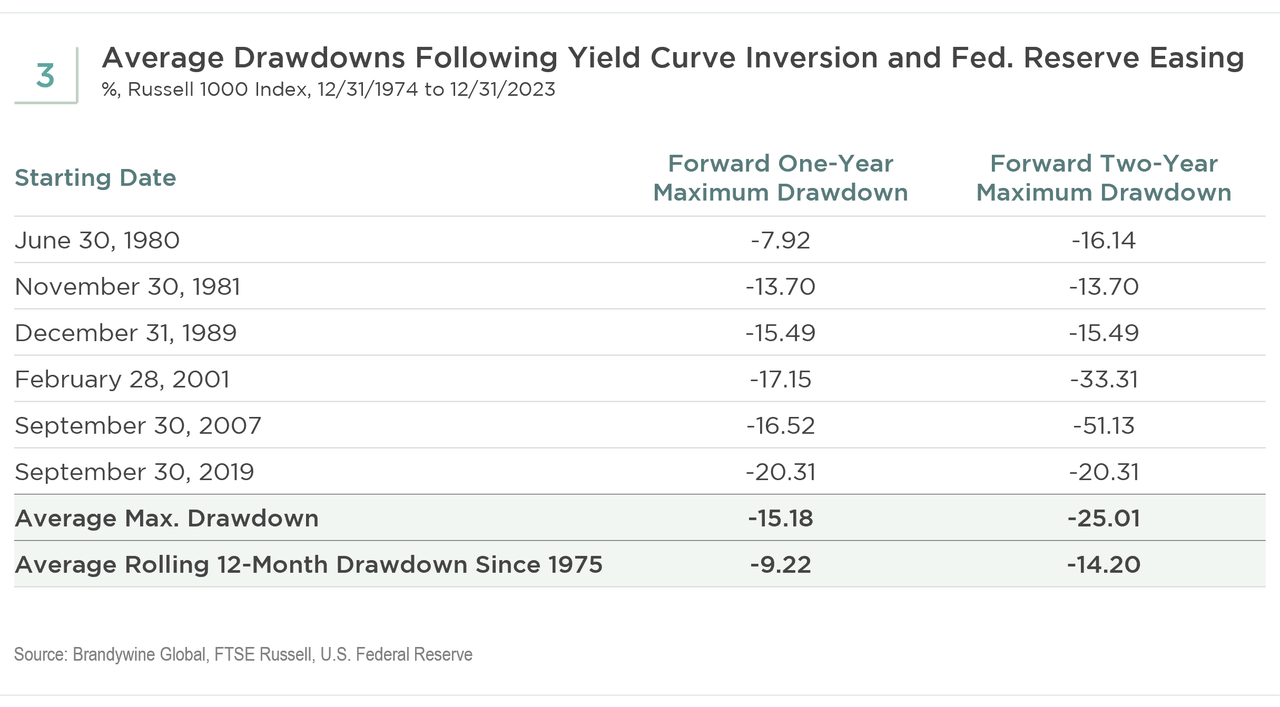

We additionally regarded on the most drawdown throughout every reducing price interval after an inverted curve. As seen in Exhibit 3, the common one-year most drawdown throughout these time durations underperforms the common most one-year drawdown for the total analysis historical past. When taking a look at most two-year drawdowns, the common return is far decrease and underperforms the utmost two-year drawdown in 5 of the six durations. Whatever the full-year returns, the utmost drawdowns assist to quantify the volatility that may happen when the Fed lowers charges near inverted yield curves and/or recessions. For instance, after September 30, 2019, the one-year return of the market was 22.5% (Exhibit 2). Nevertheless, the utmost drawdown that occurred was -20.31% in simply two months on account of the COVID-19 pandemic (see Exhibit 3).

There was a lot dialogue round whether or not the U.S. is headed for a recession. More and more, some traders consider the Fed has been nimble sufficient to orchestrate a delicate touchdown for the financial system. Nevertheless, the yield curve stays inverted, though nicely off-peak inversion ranges, regardless of the Fed signaling its probability to decrease charges this yr. Whereas there are solely 11 knowledge factors of trending declines in rates of interest, we get an understanding that the ends in the fairness markets have been combined when charges have decreased. When trying on the charts, we see that when charges are reducing and there was an inverted yield curve, a bear market – most probably from a recession – could happen. Nevertheless, the lower in charges could also be a lagging indicator of a poor financial system. In the meantime, traders already could have reacted proactively to poor expectations, whether or not it was a weak financial system or greater inflation-delaying price decreases. Whereas we have no idea precisely when the Fed will decrease charges, traditionally, after the curve has been inverted, financial easing coincides with elevated market volatility.

The Russell 1000® Index measures the efficiency of the large-cap phase of the U.S. fairness universe. It’s a subset of the Russell 3000® Index and consists of roughly 1,000 of the most important securities primarily based on a mix of their market cap and present index membership.

Editor’s Observe: The abstract bullets for this text have been chosen by Looking for Alpha editors.