Nikada/iStock Unreleased through Getty Pictures

Introduction

In 2024, Apple (NASDAQ:AAPL) misplaced its primary place because the world’s most valuable public company to Microsoft (MSFT). Apple has maintained its standing because the world’s largest public firm for an prolonged interval, and my basic evaluation signifies that this accolade is well-deserved. Reclaiming the highest spot could merely be a matter of time. My optimism concerning Apple stems from its expansive ecosystem, boasting over 1.5 billion customers and unparalleled model loyalty, which offers a stable strategic basis for development. Whereas it’s extremely seemingly that iPhone gross sales development will naturally decelerate attributable to market saturation, Companies emerge as a standout performer with distinctive development prospects. Furthermore, the latest launch of the groundbreaking Imaginative and prescient Professional system has the potential to revolutionize each skilled and leisure domains, harking back to the affect the iPhone had in 2007-2008. Valuation additionally performs a pivotal position in my funding choices, and my evaluation means that AAPL is attractively valued. With these strengths in thoughts, I firmly consider that AAPL deserves a “Strong Buy” score.

Elementary evaluation

Apple is likely one of the world’s largest firms that manufactures and sells smartphones, tablets, PCs, software program, and peripherals the world over. In keeping with Apple’s newest quarterly earnings, the iPhone represented 58% of the corporate’s whole gross sales.

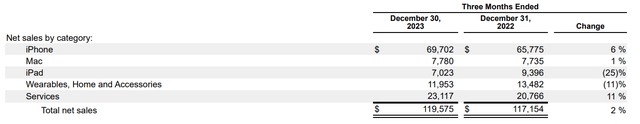

The newest quarterly report was launched on February 1. The December quarter was strong for Apple as the corporate topped consensus estimates and delivered a 2.1% YoY income development and profitability enchancment regardless of the mushy microenvironment, which is evidenced by a disappointing latest Q4 report from Samsung Electronics (OTCPK:SSNLF), considered one of Apple’s greatest rivals.

From the merchandise’ perspective, the iPad and wearables/equipment have been according to the mushy setting, however the energy demonstrated by the iPhone mitigated the dip in different merchandise. After a number of weak quarters, the smartphone market demonstrated a stable 8% rebound in Q4, which was a notable tailwind for Apple. Given the intensive protection of the iPhone throughout the web, I will not delve into exhaustive particulars right here. Nevertheless, it is vital to focus on the numerous rebound within the smartphone market, which marks a notable shift from the detrimental pattern noticed in earlier quarters. With penetration ranges already comparatively excessive, I anticipate regular development to persist for this product. Furthermore, contemplating the substantial portion of income derived from the iPhone, I foresee it sustaining Apple’s exceptional profitability effectively into the foreseeable future.

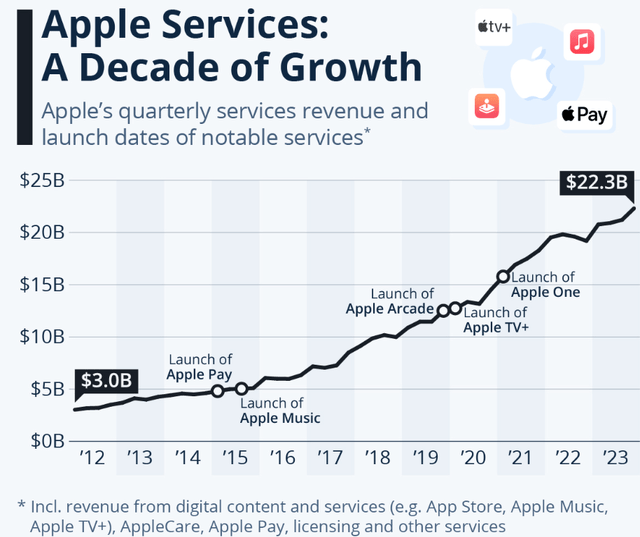

You will need to do not forget that Apple will not be solely about promoting bodily merchandise, however its second-largest income stream is providers, which incorporates revenues from cost providers, subscriptions, and promoting earnings. There are round 1.5 billion lively iPhones on this planet for the time being, so there’s a huge audience for Apple’s “Services” income stream. I believe this line of enterprise will seemingly grow to be the first development catalyst within the foreseeable future. The huge development dynamics again my confidence on this stream in recent times.

The big buyer base for Companies will not be the one issue that may extremely seemingly assist the road of enterprise’ fast enlargement within the subsequent few years. Apple’s model’s energy is unbroken, which we see from data suggesting that Apple’s ecosystem has a staggering 79% buyer loyalty and a buyer retention fee of 90%. Such excessive model loyalty permits Apple to introduce sharp service fee increases, which appear to not have an effect on its model’s energy in any respect. Other than present providers, the quickly increasing adoption of synthetic intelligence (“AI”) capabilities offers extra room for Apple to introduce new choices to clients primarily based on the subscription mannequin.

I’m optimistic about Apple’s potential for vital development in service income, pushed by a number of stable elements. Firstly, the corporate boasts an enormous “cash cow” within the type of the iPhone. Secondly, Apple has a powerful monitor file of innovation and substantial financial resources, enabling heavy funding in inner R&D and strategic acquisitions of modern startups-reportedly acquiring 32 AI startups in 2023 alone. These investments in AI counsel a excessive chance of Apple introducing new, groundbreaking AI-powered options, probably supplied by way of a subscription mannequin. Moreover, with roughly 1.5 billion lively iPhones globally, Apple possesses huge volumes of information, a precious asset for coaching its machine studying (“ML”) algorithms. This knowledge can in the end improve the standard of AI and ML providers supplied by the corporate.

I like to take a look at the corporate’s future prospects by way of the prism of the BCG matrix. As I discussed, the iPhone itself is an obvious money cow due to its excessive market share, excessive profitability, and extremely seemingly decelerating development charges in subsequent years as smartphone penetration ranges enhance. The huge alternative to drive service development because of the iPhone’s intensive adoption brings an enormous synergetic impact, which is able to extremely seemingly make Service the main star of Apple within the subsequent couple of years.

With all due respect, the Mac, iPad, or wearables are unlikely to grow to be the brand new stars as these merchandise didn’t display resilience to cyclicality just like the iPhones and Companies did. However the firm’s model new Imaginative and prescient Professional system, which was officially released just recently, has an opportunity to grow to be a star over the long run. A number of days after its official launch, the Imaginative and prescient Professional is an obvious query mark with all of the preliminary hype brought about primarily by the facility of Apple’s model. The longer term success after the hype cools down will rely on the true worth for patrons from this product. I’m not a digital actuality skilled, nor did I’ve a possibility to check the system on my own, however some reviews look very spectacular and provides the agency feeling that Imaginative and prescient Professional certainly offers an unmatched expertise and is usually a true technological disruptor each for leisure {and professional} settings. Naturally, skepticism surrounds the system’s hefty $3,500 price ticket and considerations about consolation whereas sporting it. Nevertheless, it is value recalling how iconic figures like Steve Ballmer scoffed on the iPhone’s $500 beginning worth and lack of a bodily keyboard again in 2007. The next success of the iPhone speaks volumes, demonstrating the potential for groundbreaking improvements to beat preliminary doubts and reshape complete industries. Due to this fact, I consider that there’s a vital chance that Imaginative and prescient Professional may grow to be a real recreation changer and supercharge Apple’s long-term development prospects just like the iPhone did greater than 15 years in the past.

Valuation evaluation

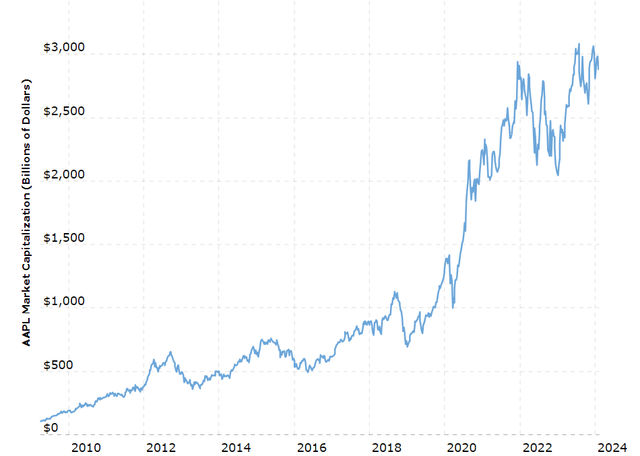

Apple has been the world’s most beneficial firm, with a market cap of round $3 trillion, for a very long time and only recently misplaced its management to Microsoft. The controversy across the “Magnificent 7” overvaluation looks like a scorching subject any time; attempt to sort into your search engine “Magnificent seven bubble,” and you’ll find dozens of recent articles explaining why the U.S. bit tech firms’ valuations are about to burst. I wish to emphasize that there was an article from Clem Chambers calling Apple inventory a bubble in April 2012, virtually twelve years in the past. At the moment, Apple’s market cap was round $500 billion, i.e., the market cap practically sextupled regardless of black swans just like the one-in-a-century pandemic or the largest warfare in the course of Europe since WWII.

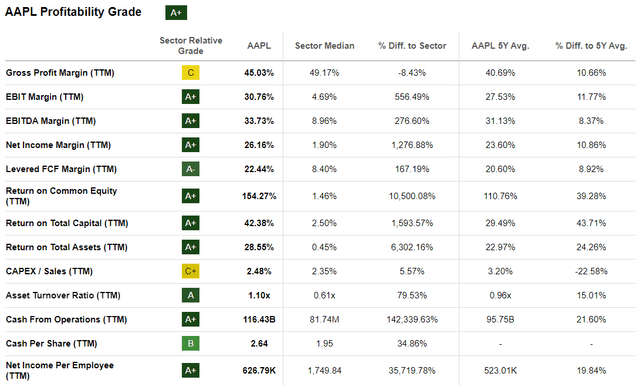

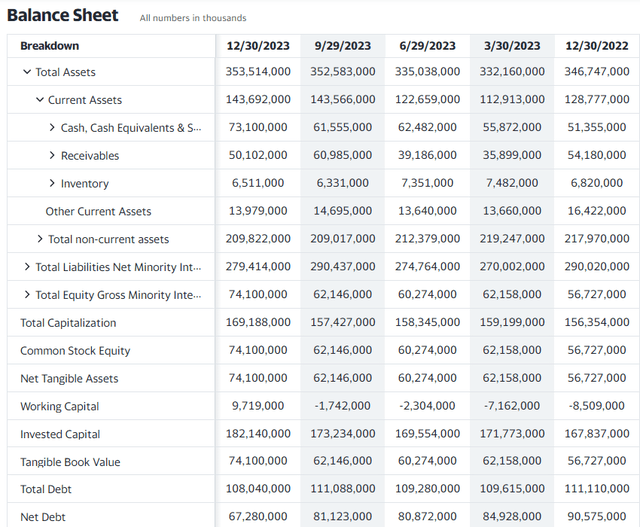

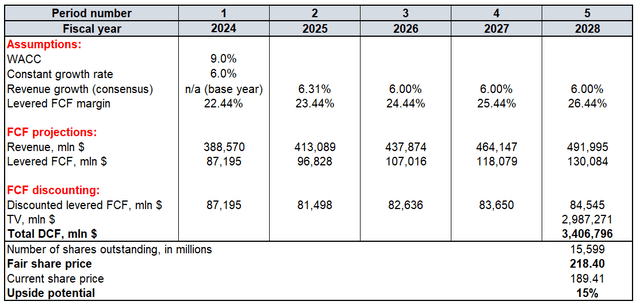

Due to this fact, to find out the attractiveness of Apple’s valuation, I choose to depend on the discounted money circulate (“DCF”) valuation mannequin as a substitute of scorching headlines. I take advantage of a 9% WACC for discounting and a 6% fixed development fee for the terminal worth (“TV”) calculation. The fixed development fee is all the time a controversial metric, and a few readers may name me too optimistic after I give AAPL a 6% fixed development fee. However, over the past 20 years, Apple’s income grew from $8 billion to $383 billion, which equals a 21% CAGR. On this context, a 6% fixed development fee appears conservative and honest. I take advantage of a TTM 22.4% levered free money circulate (“FCF”) margin and forecast a 50 foundation factors annual enlargement. As ordinary, I depend on consensus revenue estimates just for the 2 upcoming fiscal years and forecast a 6% income development fee for years past, which aligns with my fixed development fee assumption. There are presently round 15.6 billion AAPL shares excellent.

Based mostly on my DCF calculations, AAPL’s honest worth is $218, which is 15% increased than the present market worth. Due to this fact, the inventory could be very attractively valued, particularly given the corporate’s unparalleled model and buyer ecosystem loyalty.

Mitigating elements

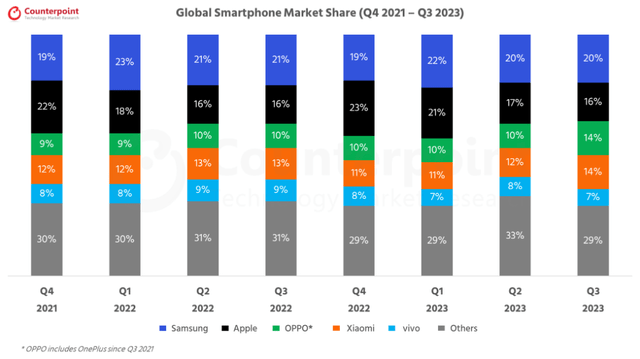

As we’ve got seen within the basic evaluation, having a lot of the income generated from the iPhone is a extremely worthwhile enterprise. That mentioned, this business could be very engaging to different superior client electronics firms and extremely aggressive. Other than Apple, the worldwide smartphone business is crowded with a number of giant Asian producers. Samsung has been persistently main when it comes to market share, however on the chart beneath, we will additionally see that gamers like Xiaomi (OTCPK:XIACF) and Oppo additionally maintain market shares that aren’t thus far beneath Apple. The competitors is intense, and Apple should persistently be on the forefront of innovation to guard its market share.

Samsung’s flagship Galaxy S-series smartphone has been the main direct competitor of the iPhone for a very long time and persistently rolls out new modern options. For instance, the corporate not too long ago launched its Galaxy S24 mannequin, which features generative AI capabilities the iPhone doesn’t have but. With that in thoughts, it is essential to acknowledge that the iPhone is engaged in a steady technological race with its opponents, leaving no margin for error in such a fiercely aggressive panorama. Therefore, I might establish competitors danger as essentially the most vital concern for Apple, significantly given the corporate’s heavy reliance on income from the smartphone phase.

Whereas the latest launch of Apple’s Imaginative and prescient Professional holds promise and, in my opinion, has the potential to revolutionize a complete business, I understand a big danger related to it. I consider this groundbreaking system may render tablets and laptops out of date, thereby cannibalizing Apple’s revenues from the iPad and Mac. Primarily, whereas the corporate could unlock a notable new income stream, it may come on the expense of two present ones, probably offsetting the general affect. Upon reviewing the official description of the brand new product, it seems that its capabilities overlap with these supplied by tablets and laptops. Whereas the spatial computing expertise will definitely provide a recent and modern expertise for customers, it is troublesome to think about the need for a laptop computer or pill when one already owns a tool able to performing comparable duties, however with options emblematic of a completely new digital period.

Conclusion

To me, Apple seems to be an apparent “Strong Buy” attributable to its promising future development and innovation prospects, anticipated to be pushed by its appreciable gathered monetary assets, the continued success of its money cow, the iPhone, and the huge potential of its providers enterprise. Moreover, the inventory is presently buying and selling at a notable low cost, which additional bolsters my optimism as an investor, providing the potential for higher capital appreciation.