Edwin Tan/E+ by way of Getty Photos

The next section was excerpted from this fund letter.

INTERNATIONAL WORKPLACE GROUP (OTCPK:IWGFF)

In the course of the fourth quarter, we made one materials new funding in London-listed IWG, an organization that manages shared workspaces. IWG operates 19 completely different manufacturers, the most well-known of which is Regus, that characterize over 3,400 places unfold throughout 120 completely different nations serving 8 million prospects starting from freelancers searching for a desk exterior of the house all the way in which as much as multi-national firms.

Most conversations about IWG start with: how is IWG completely different from WeWork (OTC:WEWKQ), which is in chapter? Effectively, in contrast to WeWork, IWG didn’t interact in a growth-at-all-costs marketing campaign. Not like WeWork, nearly all IWG leases will be terminated by the corporate with minimal breakage prices.

Not like WeWork, IWG’s administration has earned traders’ belief. To return to the Struggle Membership metaphor, IWG’s administration is fairly completely different from that of WeWork, which was initially run by a CEO who appeared to front-run his shareholders by personally shopping for buildings after which promoting them to WeWork for a revenue. The identical “enterprising” CEO additionally personally licensed the title “We” and charged the corporate hundreds of thousands of {dollars} per 12 months for its use. In sharp distinction, IWG is run by its founder Mark Dixon, who nonetheless owns 28% of the corporate and has a really cheap compensation bundle.

IWG has extra scale with greater than six occasions the variety of places as WeWork. That is essential as a result of it permits for extra environment friendly buyer acquisition and retention, and higher property stage monetization. Not like smaller friends who generate most of their income from short-term leases, round one-quarter of IWG’s location-level income comes from ancillary services and products.

IWG additionally has rather more suburban publicity, which strains up nicely each for firms which might be requiring staff to return to the central workplace a few days per week (since they’ll present a workspace nearer to the staff’ houses for the opposite days) and to faucet the huge array of firms not positioned in main cities. A last distinction is profitability. Not like WeWork, IWG has survived the Nice Recession and Covid and has a 30-plus-year monitor file of profitability. In abstract, IWG has higher lease buildings, higher administration, higher places, and higher earnings.

Simply being completely different from WeWork can be a horrible funding thesis. Thankfully, we imagine that the corporate’s enhancing enterprise mannequin provides IWG the chance to considerably develop earnings and see its a number of increase from right this moment’s depressed stage. It’s unlikely that we might have invested in the event that they have been simply sticking with their historic enterprise of signing long run leases with landlords, enhancing the areas, after which renting the area to people or small companies on a short-term foundation. The unique versatile workspace mannequin is each cyclical and capital intensive.

To handle the cyclicality, IWG has taken a number of essential steps past ring-fencing places, which makes it simpler to stroll away. Particularly, the corporate began tying landlord funds to location revenues. This modification has been occurring for fairly a while. In the present day, roughly 40% of lease expense is variable in nature. Nevertheless, these variable lease places nonetheless require vital upfront capital outlay by the corporate.

Extra lately, the corporate has launched a brand new asset-light “partnership” mannequin, which eliminates each cyclicality AND capital depth. On this mannequin, IWG asks landlords to place up all capital investments and decide up all working prices of a location. In return for managing these places, IWG takes a administration payment, approximating 15% of revenues.

IWG’s enterprise mannequin transition is feasible, partially, due to the headwinds going through the company actual property market. With vacancies persevering with to rise, landlords are being compelled to be extra versatile and discover new methods to fill their buildings. Whereas a landlord’s first alternative could also be signing a credit-worthy tenant to a 20-year lease with phrases very favorable to stated landlord, these offers are tougher and tougher to search out today. Within the face of the waning demand for workplace area, IWG is presenting landlords with an answer that helps them fill and monetize area that may in any other case sit empty. For its 15% payment, IWG oversees the build-out, advertising, and consumer onboarding, and makes use of its know-how programs and networks of distributors to handle the area every day. By partnering, a landlord will get a turnkey answer to a revenue-generating shared workspace of their constructing and IWG will get paid for his or her companies, and upside if the property performs.

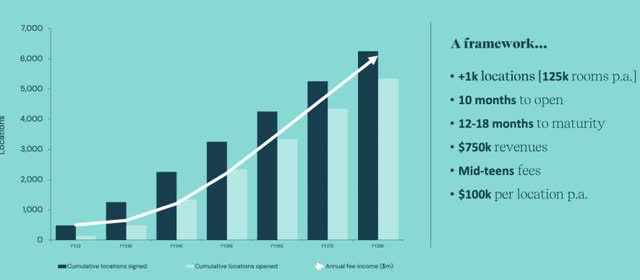

In easy phrases, IWG places out no money and incurs no liabilities. The asset gentle and threat gentle partnerships mannequin drastically adjustments the corporate’s economics of progress away from its historic constraints. In 2018, the corporate laid out over $400M in progress capex so as to add 299 places. In 2024, progress capex is projected to be simply $60M (15% of the previous) to finance the opening of extra websites. The first constraint to progress now’s signing up companions, not capital. Beneath is a chart from their investor day, taking a look at simply their largest market, america. It is a completely different enterprise going ahead.

In 2022, IWG signed up roughly 462 places for his or her partnership mannequin; the variety of new contracts doubtless exceeded 800 in 2023 and in 2024 needs to be in extra of 1,000 places.

Partnering with IWG makes the method of turning vacant area into versatile workspace a lot simpler for a landlord than doing it on their very own. IWG has all the distributors and programs in place to handle the transition to and operation of the property as versatile area, the owner doesn’t need to recreate the wheel. IWG has the advertising and gross sales groups in place, in addition to the billing, staffing, and programs for issues similar to reserving a convention room. As well as, IWG can also be set as much as monetize ancillary choices similar to printing, copying, web, parking, and low from day one. IWG has scale that particular person landlords shouldn’t have. Landlords who work with IWG see a path to greater revenues and decrease prices with much less “brain damage.” Much like Hilton Resorts’ worth proposition to property house owners, a landlord working with IWG ought to earn more money, even after paying IWG charges and income sharing, than in the event that they managed the property on their very own.

So, for each IWG and landlords, there are clear advantages. How in regards to the prospects? Sure, it’s extremely doubtless that the times of all people working 5 days per week from an workplace are over, however most employers additionally don’t need a totally distant workforce. For employers, utilizing shared workspace permits for as much as 50% decrease working prices and 0 capital expenditures; it retains long-term leases off an organization’s steadiness sheets, supplies flexibility, and retains staff by permitting them to work nearer to residence.

IWG advantages from the next 5 attributes:

Community Results – As the biggest operator of versatile workplace area, they’ve the very best geographic footprint. Signing a lease with IWG can present entry to areas while you journey or enable the pliability of entry to a desk each when in your nearest metropolis and when nearer to residence.

Scaled Economies Shared – A time period coined by coined by Nick Sleep and Qais Zakaria of Nomad Companions, scaled economies shared is a technique the place an organization that advantages from economies of scale shares these advantages with its prospects, sometimes by providing decrease costs, to achieve long-term market share. Because the scaled operator of versatile workplace area, IWG passes on many of the financial savings to their tenants and landlord companions. It’s inexpensive to companion with IWG than to be impartial of them.

Improved Aggressive Panorama – IWG’s largest competitor is in chapter. Gone are the times of WeWork rising in any respect prices, signing leases that didn’t make sense, and subsidizing their prospects. A rational aggressive setting favors the rational – on this case, IWG.

Secular Tailwind – In accordance with the HR Report, 90% of staff need flexibility in the place they work, and 89% of employers report higher retention due to versatile work choices. It’s extremely doubtless that firms will proceed to supply staff locations to work exterior of however close to residence. Versatile workplace area is roughly 2% of the company actual property market right this moment and certain going far greater with IWG because the scaled chief.

Confirmed Monitor Document of Success – landlords usually are not accustomed to those managed partnership offers. For a lot of, it’s their first time ever contemplating going this route with a few of their area. IWG’s scale and length of getting a worthwhile monitor file makes them the most secure route for landlords as they decide who to companion with.

The inspiration of our funding in IWG is their partnership enterprise. In spherical numbers, every partnership, when open and scaled, will generate $100K per 12 months in contribution. So, the 1,000+ signups projected for this 12 months ought to develop contribution by $100M each year on a go-forward foundation. Now, there may be nothing magical about including 1,000 places per 12 months. On condition that they require no capital from IWG, it might open as many partnership places as there may be demand. It took IWG 34 years to get to three,000+ places underneath their outdated mannequin. Capital was one of many greatest constraints to progress. With their partnership mannequin, IWG is on monitor so as to add greater than 1,000 places in a single 12 months with just about no incremental capital.

Because the partnerships are simply ramping up, the enterprise transition’s influence on the monetary statements has been restricted up to now, however the wave is coming. Partnership places take 10 months to open and 12-18 months to succeed in maturity. As proven within the chart under, all the partnership signing exercise so far has but to essentially circulate by means of the monetary statements. However it is going to! With every day, we’re at some point nearer. The wave is constructing.

Along with the core enterprise of managing shared workspaces, IWG has their Worka division, the biggest flex workspace market, which connects companies and their staff to 40K+ flex areas throughout 170 nations and 5,500 cities. Worka additionally has an actual property consulting enterprise that assists corporates of their evaluation of and transition to versatile workspaces. Worka (previously Prompt Group) is a enterprise that has been constructed by means of acquisitions and is within the midst of integrating the acquired firms. For example of how far they’re from totally integrating, the Worka.com web site, which is able to combine all the disparate items, remains to be being constructed out.

Worka could possibly be an impartial firm, and there was discuss of spinning it off/promoting it. There are advantages to having market and consulting firms being impartial, not owned by the biggest provider within the business. For now, Worka is financially a totally owned subsidiary of IWG, however in apply is operated as a stand-alone firm with its personal administration workforce and impartial board. The division generated roughly $450M in income and $150M in EBITDA in 2023. During the last decade, Worka’s income grew at a 20%+ CAGR on a mixed foundation. The corporate expects this progress charge to proceed over time. Worthwhile market companies with 20%+ progress charges needs to be value 10X EBITDA in my ebook. If the expansion and profitability maintain, it isn’t onerous to see Worka commanding a valuation in extra of $2B.

Earlier than we ascribe a excessive a number of to the fast-growing-no-capital-required Worka, let’s have a look at the general firm. On the time of our purchases, in spherical numbers, IWG had a market capitalization of slightly below $2B USD and internet debt of one other $750M. There are three divisions. The vast majority of revenues and earnings at present come from the “company-owned” places, that are anticipated to contribute $700M. Worka is the second largest contributor at $200M, and the rapidly rising partnership enterprise is but to be materials at $50M. Company actions partially offset the $950M in contributions outlined above. All of this yields a 2023 EBITDA of roughly $400M, projected to develop double digits in 2024 and attain $1B within the medium time period. In the event you imagine the steering, we’re paying lower than 3X the medium-term EBITDA.

Might multiples compress on IWG? In a deep recession, they definitely may, but when they maintain regular, EBITDA/earnings/money circulate ought to all develop considerably. It’s also fairly doubtless that, as an increasing number of of the revenues and earnings come from the partnership enterprise, the next a number of is ascribed to the enterprise. In 2027, greater than half of the EBITDA ought to come from charges, which is a extra secure asset-light enterprise that traders typically ascribe greater multiples to. I see a transparent path to the share value tripling over time from the mix of income progress, earnings progress and a number of growth.

Attempting to elucidate share value and the actions in share value generally is a idiot’s errand, however within the case of IWG, there are not less than three components that will partially clarify a mispricing of shares:

The Stench of “Office” – whereas a weak workplace market is driving the partnership enterprise for IWG, many traders is not going to have a look at something office-related. Massive Shareholder Liquidating – two of the corporate’s largest exterior shareholders have been compelled sellers in 2022: one is within the strategy of liquidating and the opposite was promoting to satisfy redemptions. Partnerships Not Exhibiting Up within the Financials – As beforehand mentioned, between the time to renovate the area and the time to fill the area, it takes nearly two years from signing for a partnership location to mature. The financial advantages of the scaling partnership enterprise usually are not but evident within the monetary statements.

Investing in something to do with the much-maligned workplace actual property market is an act of braveness and took some handholding. Yaron Naymark of 1 Predominant Capital was useful in laying out the enterprise mannequin transition, belongings, and potential long-term economics of this funding, so thanks, Yaron.

|

Disclaimer: This doc, which is being offered on a confidential foundation, shall not represent a suggestion to promote or the solicitation of any provide to purchase which can solely be made on the time a professional offeree receives a confidential personal placement memorandum (“PPM”), which comprises essential info (together with funding goal, insurance policies, threat components, charges, tax implications, and related {qualifications}), and solely in these jurisdictions the place permitted by legislation. Within the case of any inconsistency between the descriptions or phrases on this doc and the PPM, the PPM shall management. These securities shall not be provided or bought in any jurisdiction during which such provide, solicitation or sale can be illegal till the necessities of the legal guidelines of such jurisdiction have been happy. This doc is just not supposed for public use or distribution. Whereas all the knowledge ready on this doc is believed to be correct, MVM Funds LLC (“MVM”), Greenhaven Street Capital Companions Fund GP LLC (“Partners GP”), and Greenhaven Street Particular Alternatives GP LLC (“Opportunities GP”) (every a “relevant GP” and collectively, the “GPs”) make no categorical guarantee as to the completeness or accuracy, nor can it settle for accountability for errors, showing within the doc. An funding within the Fund/Partnership is speculative and includes a excessive diploma of threat. Alternatives for withdrawal/redemption and transferability of pursuits are restricted, so traders could not have entry to capital when it’s wanted. There isn’t any secondary marketplace for the pursuits, and none is predicted to develop. The portfolio is underneath the only real funding authority of the final companion/funding supervisor. A portion of the underlying trades executed could happen on non-U.S. exchanges. Leverage could also be employed within the portfolio, which might make funding efficiency unstable. An investor shouldn’t make an funding until they’re ready to lose all or a considerable portion of their funding. The charges and bills charged in reference to this funding could also be greater than the charges and bills of different funding options and will offset earnings. There isn’t any assure that the funding goal can be achieved. Furthermore, the previous efficiency of the funding workforce shouldn’t be construed as an indicator of future efficiency. Any projections, market outlooks or estimates on this doc are forward-looking statements and are based mostly upon sure assumptions. Different occasions which weren’t taken into consideration could happen and will considerably have an effect on the returns or efficiency of the Fund/Partnership. Any projections, outlooks or assumptions shouldn’t be construed to be indicative of the particular occasions which is able to happen. The enclosed materials is confidential and to not be reproduced or redistributed in entire or partially with out the prior written consent of the related GP. The data on this materials is simply present as of the date indicated, and could also be outdated by subsequent market occasions or for different causes. Statements regarding monetary market traits are based mostly on present market circumstances, which is able to fluctuate. Any statements of opinion represent solely present opinions of the GPs, that are topic to alter and which the GPs don’t undertake to replace. As a result of, amongst different issues, the unstable nature of the markets, and an funding within the Fund/Partnership could solely be appropriate for sure traders. Events ought to independently examine any funding technique or supervisor, and may seek the advice of with certified funding, authorized, and tax professionals earlier than making any funding. The Fund/Partnership usually are not registered underneath the Funding Firm Act of 1940, as amended, in reliance on exemption(s) thereunder. Pursuits in every Fund/Partnership haven’t been registered underneath the U.S. Securities Act of 1933, as amended, or the securities legal guidelines of any state, and are being provided and bought in reliance on exemptions from the registration necessities of stated Act and legal guidelines. The references to our largest positions and any positions listed within the Appendix usually are not based mostly on efficiency. All of our positions can be accessible upon an affordable request. All hyperlinks contained herein usually are not endorsements and we aren’t liable for such hyperlinks or the content material therein. |

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.