Justin Sullivan

Promoting well-run firms with robust manufacturers which have outperformed the marketplace for lengthy durations of time is all the time exhausting. Whereas investing is clearly generally purely a monetary choice, most individuals develop some affinity in direction of their best-performing shares.

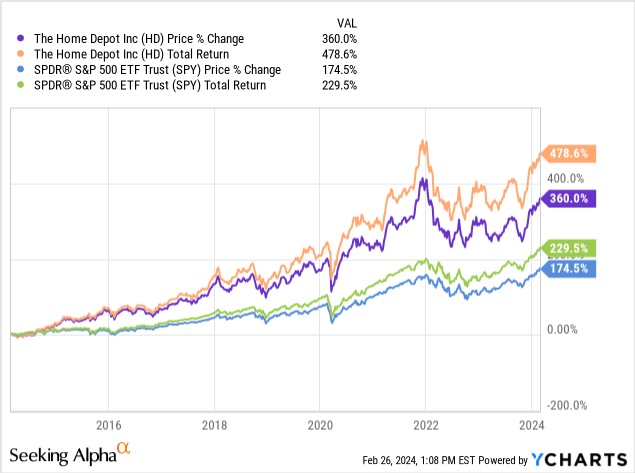

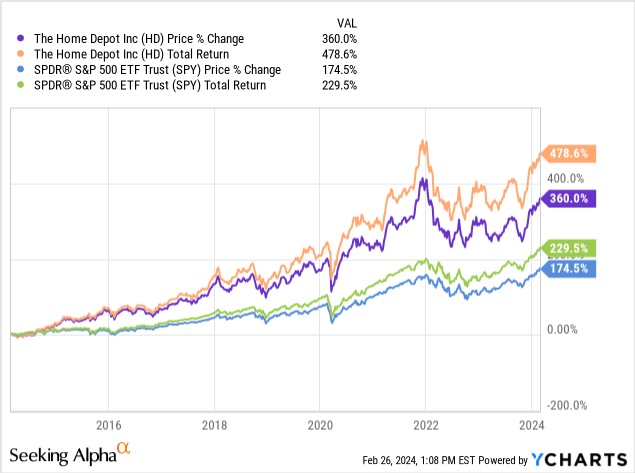

Dwelling Depot (NYSE:HD) had been one of many higher performing investments for a decade available in the market prior the corporate’s current struggles.

The main dwelling retailer was a $81 inventory in early 2024, and the inventory was up almost 500% utilizing whole returns during the last decade. The S&P (SPY) 500 is up almost 230% utilizing whole returns throughout the identical timeframe.

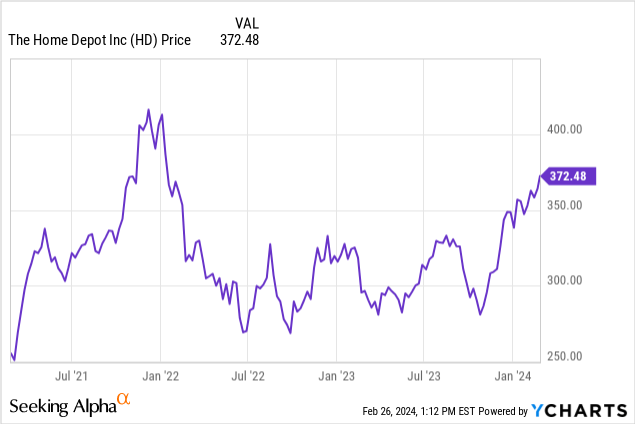

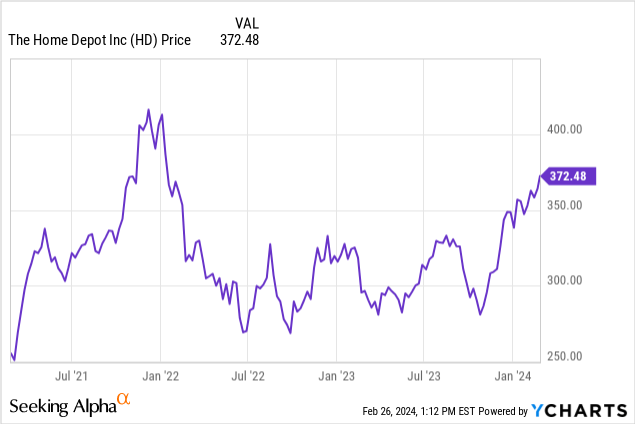

Nonetheless, Dwelling Depot’s inventory has gone nowhere during the last two years.

The main retailer’s inventory peaked in January of 2022, and the inventory has not risen previous these current highest within the final 2 years. The S&P 500 has additionally outperformed Dwelling Depot since early 2022 by almost 10 %.

I wrote about Dwelling Depot in Could of final 12 months. I rated the inventory as a promote primarily due to the weakening housing market, rising prices, and slowing gross sales. I’m altering my score of the corporate right this moment to a robust promote. Dwelling Depot has risen during the last a number of months with the general market, however the firm’s gross sales development continues to sluggish, the housing market is displaying new indicators of weakening, and inflationary dangers are more likely to proceed to place stress on the rates of interest and the general economic system as nicely. Dwelling Depot’s current steerage was disappointing, and the inventory is buying and selling at what ought to grow to be an unrealistic valuation for the reason that present earnings cycle is probably going peaking.

The main housing retailer just lately reported normalized earnings per share of $2.82 and revenues of $34.79 billion, beating analyst expectations by $.02 a share and $111.45 million. Nonetheless, Dwelling Depot’s earnings confirmed some clear weak point within the firm’s core enterprise, and administration’s steerage was regarding as nicely. The retailer reported that same-store gross sales fell by 7.2% on a year-to-year foundation, and the corporate guided to a 1% in same-store gross sales in 2024. The primary causes administration cited for the weak steerage had been inflation and better mortgage charges, each components which have triggered the housing market to decelerate.

The housing market continues to indicate indicators of an additional slowdown as nicely. The Nationwide Affiliate of Realtors just lately reported that housing gross sales had been down 1.7% on a year-to-year foundation, and housing stock was up 3.1% on a year-to-year foundation. Mortgage charges stay at elevated ranges as nicely. The typical 30-year mortgage fee is presently 6.77%, a lot larger than 2 years in the past when the speed was at 3.92%. Costs stay excessive regardless that the speed of inflation has moderated in current months, with January’s inflation fee coming in at 3.09%.

Regardless that Powell just lately talked a couple of seemingly rate of interest lower coming in March, the Fed additionally identified the general value ranges proceed to stay excessive. Mortgage charges aren’t more likely to fall considerably anytime quickly even when the Fed cuts charges subsequent month. Whereas Dwelling Depot clearly advantages considerably from DIY initiatives different spending by current householders, a weakening housing market nonetheless hurts the corporate in a number of methods, since householders are sometimes much less seemingly to enhance a house that’s falling in worth, and a softening housing actual property market additionally means fewer householders. Housing costs are up 46% on common nationally since simply 2019. The corporate has additionally seen a moderation in DIY demand for the reason that pent-up demand popping out of the pandemic with extra folks working at dwelling has slowed.

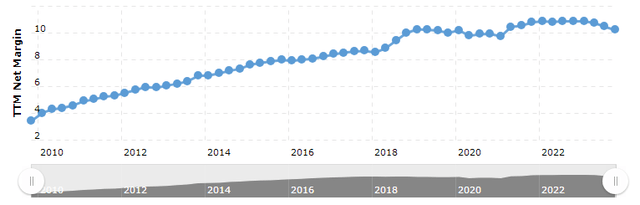

Dwelling Depot’s margins additionally look like peaking, an indication that the corporate’s present earnings cycle is probably going reaching a restrict.

A chart of Dwelling Depot’s Internet Margins (Macrotrends)

Regardless that the retailer’s internet margins stay strong, Dwelling Depot’s internet margins have fallen for 3 consecutive quarters. The corporate decided to increase wages by $1 billion final 12 months, and the retailer has seen prices steadily rise for a while at the same time as gross sales have slowed. The current comments by the corporate’s CEO Ted Decker referring 2023 a 12 months of moderation recommend that the corporate’s present earnings cycle is plateauing as nicely. Recent manufacturing and client spending information have confirmed continued weak point, and whereas the financial consensus is that the US economic system will keep away from a recession in 2024, this 12 months is anticipated to be weak economically nicely. Wages have additionally not stored up with inflation during the last a number of years, and many individuals have now significantly depleted earlier Covid financial savings.

For this reason Dwelling Depot’s inventory seems overvalued at present ranges utilizing a number of metrics. The corporate presently trades at 23.59x anticipated non-GAAP ahead earnings, 2.64x forecasted ahead gross sales, and 16.43x predicted ahead EBITDA. The retailer’s five-year common is 23.59x forecasted non-GAAP ahead earnings, 2.46x predicted ahead gross sales, and 15x anticipated ahead gross sales. Dwelling Depot is buying and selling at a premium to the corporate’s historic valuation ranges regardless that administration just lately reported report earnings and there are persevering with indicators of the retailer’s core enterprise mannequin slowing.

Even nicely run firms with robust manufacturers change into overvalued. Whereas Dwelling Depot has been one of many best-performing shares available in the market for a while, the corporate is going through new and important headwinds that the retailer did not must take care of up to now even whereas the inventory trades at a premium valuation. With prices more likely to proceed to rise even whereas the housing market and total economic system sluggish, Dwelling Depot seems overvalued at present ranges.