Justin Sullivan

Nvidia Company (NASDAQ:NVDA) nearly closed above a $2 trillion market cap for the primary time as the corporate has often touched above it. The corporate is at present the 4th largest publicly traded firm on the planet, spitting distance away from Saudi Aramco. We stay in a world the place Nvidia, as soon as recognized primarily as a maker of gaming GPUs, and an organization that did not exist 30 years in the past, is quickly to be bigger than Saudi Arabia’s state oil firm.

Regardless of its huge dimension, the corporate’s inventory has grown greater than 60% YTD. A part of that was earnings, however a considerable half is just pleasure. As we’ll see all through this text, the corporate’s earnings present its momentum is finished.

Nvidia 2024 Earnings Outcomes

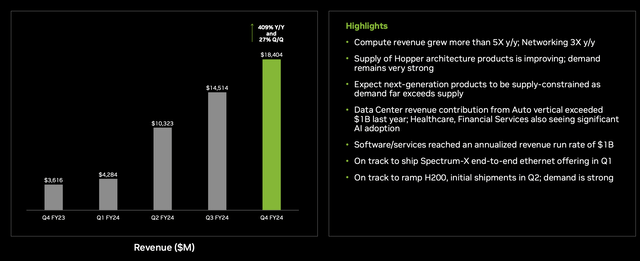

The corporate had affordable earnings results, nonetheless, it is clear that the expansion is slowing down.

The corporate’s margin development declined to 1.7%, and it appears to have roughly capped out at present ranges primarily based on the company’s guidance, which we’ll talk about beneath. As competitors will increase, and the businesses that want GPUs as quickly as doable in any respect prices get them, we count on margins to even decline within the subsequent 1-2 12 months time interval.

The corporate’s income development has additionally slowed down at $4 billion QoQ versus nearly $5 billion for the prior quarter, and greater than $6 billion for the quarter earlier than. These are the 2 items (margins and income) to see the place the corporate peaks from a revenue perspective. Present annualized revenue of $50 billion from the final quarter is a P/E of 40.

The thesis right here facilities across the firm’s income peaking and finally declining together with margins.

Nvidia Phase Efficiency

The corporate’s section efficiency exhibits that your complete firm depends on one factor. Information heart.

These chips make up greater than 80% of the corporate’s income and made up ~100% of the corporate’s QoQ income development. The corporate is working to enhance provide and expects the following technology to be provide constrained which is sensible, so long as it really works to ramp up manufacturing. Nonetheless, as competitors will increase, we count on the corporate to resolve silicon shortages.

That can put stress on margins.

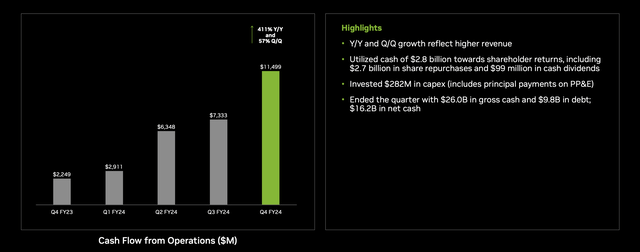

Extra importantly, the corporate’s income is not sufficient to justify its valuation. It must generate huge income as a now $2 trillion firm. The corporate’s CFFO was $11.5 billion on this quarter and shareholder returns had been $2.8 billion. The corporate has $16.2 billion in web money, lower than 1% of its present market cap.

The corporate has ~2% in annual free money circulation (“FCF”), and even when it makes use of nearly all of that into shareholder returns, it may possibly’t justify its present valuation. Actually, to justify long-term returns, its income would wish to develop to roughly 5x its present stage, a large quantity.

Nvidia Steerage

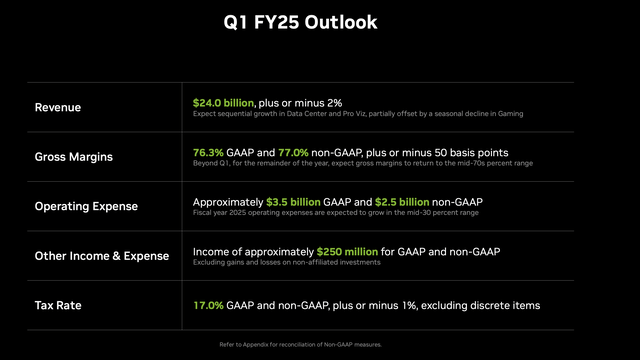

Nvidia’s steering highlights some considerations.

The corporate’s steering is for $24 billion in income, single-digit QoQ development, and the largest weak spot since giant language fashions, or LLMs, got here out. The corporate’s gross margin steering is roughly fixed QoQ with the vary for ~0.3% development. The corporate expects $3.5 billion in working bills, with development in working bills within the mid-30% vary.

Consequently, the corporate expects gross margins to truly go down for the rest of the 12 months into the mid-70s% vary. The truth that margins have peaked so quickly and can decline signifies that this side of the corporate’s revenue development has peaked. All revenue development will come from income now. For a corporation buying and selling at >20x gross sales, that is a troublesome spot.

The corporate nonetheless wants substantial long-term revenue development to justify its valuation. We count on that, as income development peaks, traders will change their valuation on the corporate.

Nvidia Competitors

In our view, Nvidia’s largest problem is that it wants continued development and money circulation. And the corporate’s prospects are successfully huge.

Nvidia’s H200, high-end A.I. Chip Will increase its Dominance

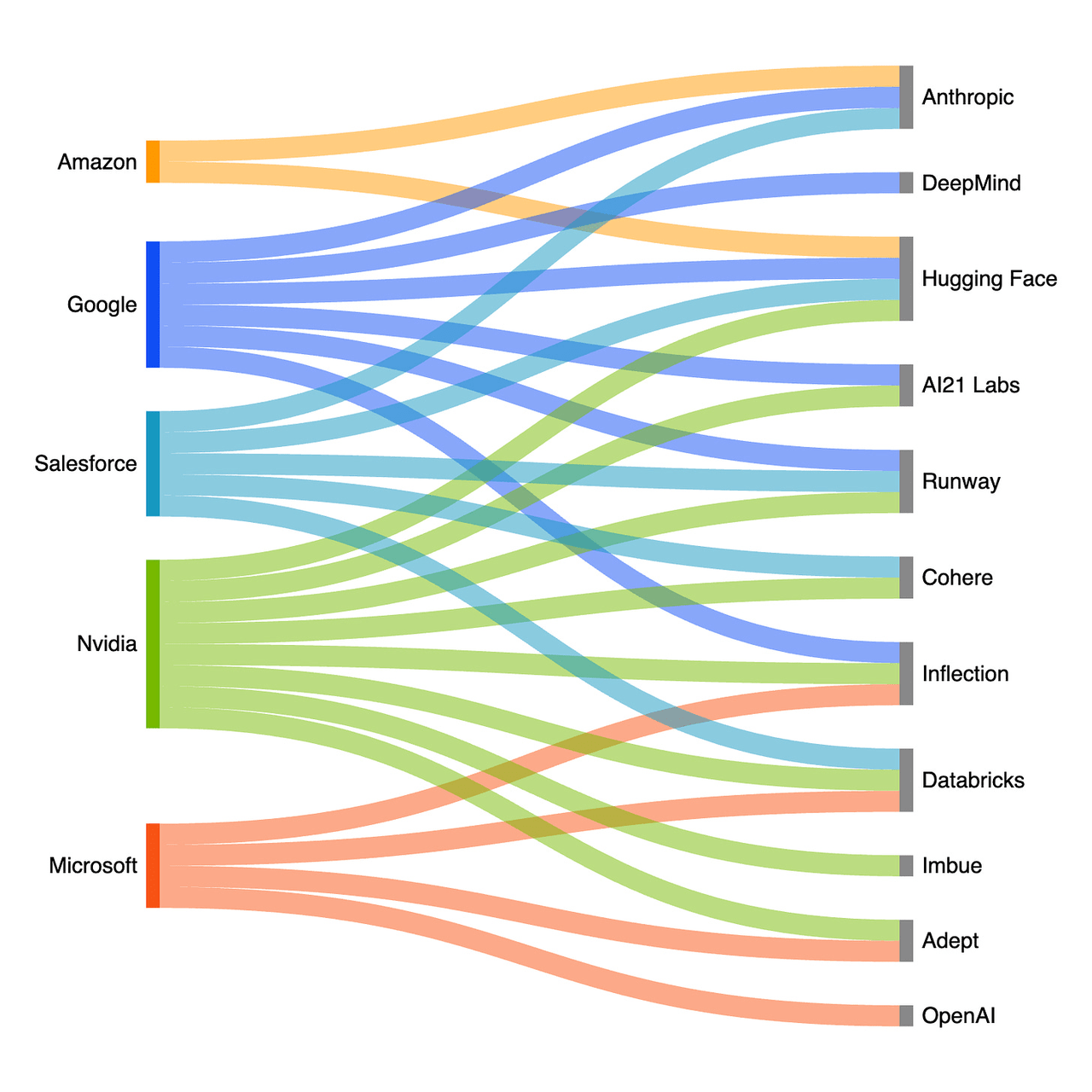

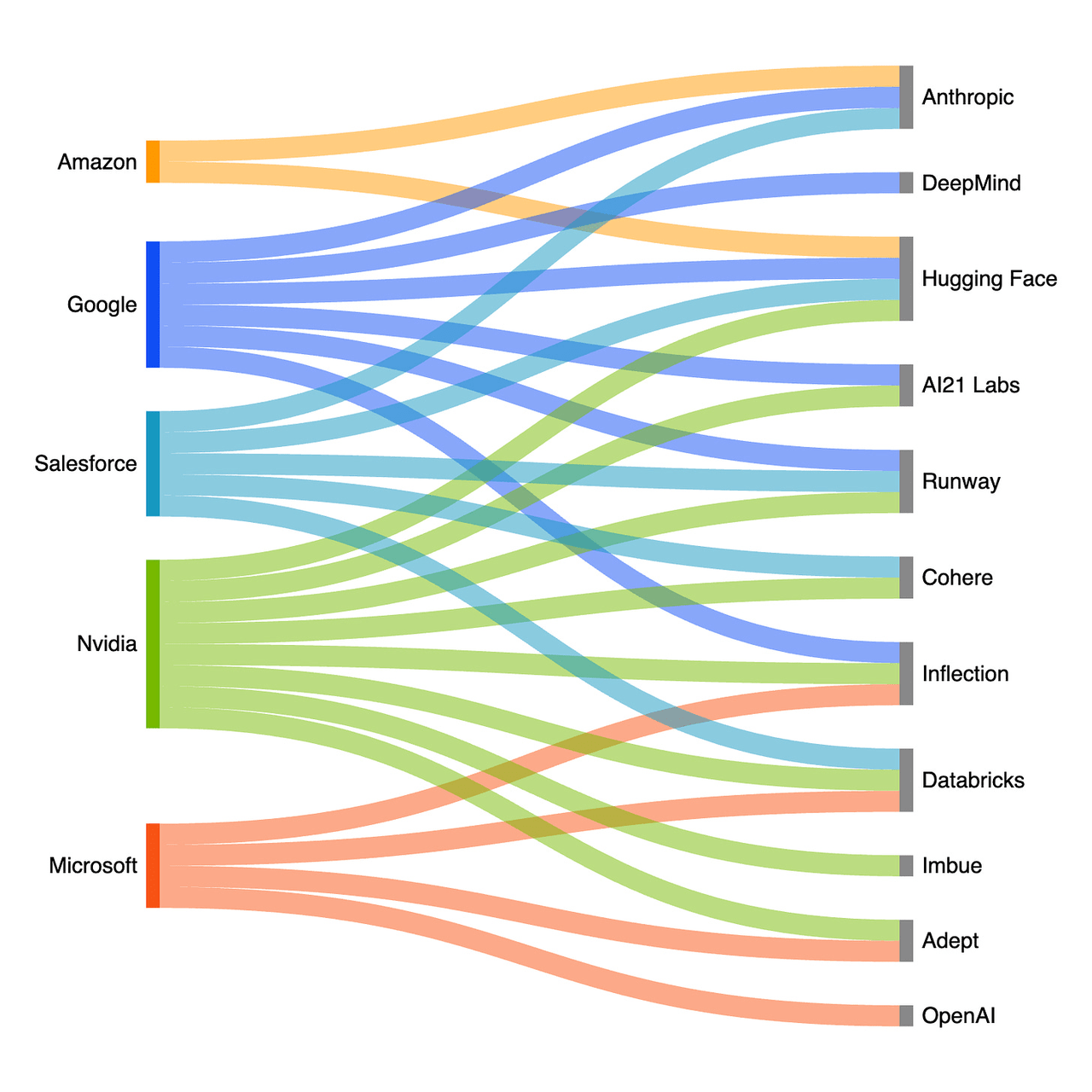

The above exhibits a wide range of main AI start-ups and their traders. Exterior of Nvidia, the corporate’s traders are nearly fully a couple of giant tech corporations. These corporations are engaged on the identical issues: LLMs. Many of those corporations are utilizing infrastructure (similar to Azure or AWS) from their traders.

Estimates are that it took 3 months with 25k Nvidia GPUs to train the latest OpenAI model. Meta Platforms (META) has introduced it’s planning to purchase 350k H100 GPUs. That is a price of ~$14 billion before any discounts. Besides Meta hasn’t introduced any purchases after that. What number of giant corporations will construct what number of giant LLMs?

It is robust to inform, nonetheless. When the capital bills for a longtime tech firm are that prime, the list of potential customers is small. With lead instances continuing to decrease, we do not suppose demand is over, however we view 2024 as the height 12 months for the corporate. The corporate’s rivals, each AMD, and the GPU suppliers themselves, are constructing aggressive GPUs.

AMD’s newest GPUs are roughly as fast as the MI300x. They’re launched at an opportune time. As availability will increase, margins will lower. A drop in margins will considerably damage Nvidia’s potential to generate future returns when it wants development.

Funding Advice

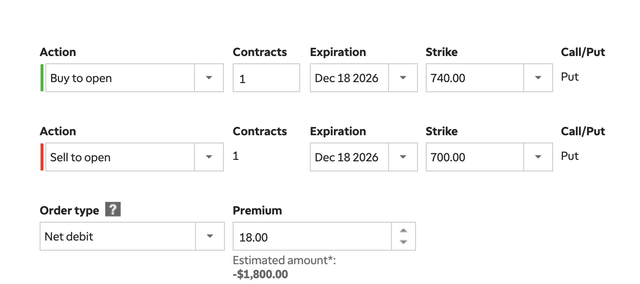

For these trying to wager in opposition to the inventory, we suggest utilizing a vertical PUT unfold. After all, please totally perceive the risks of trading options earlier than putting any trades.

That is a lot decrease danger than a brief for a quickly rising inventory, however the draw back is shedding 100% of your capital. We suggest buying a single PUT choice at $740 / share and promoting one at $700 / share. The midpoint of the premium is roughly $18 / share. The perfect-case state of affairs is the share value on Dec 2026 is <$700 / share, implying a 13% share value drop.

Your revenue in that case is $22 / share, or a 130% return in your cash. The worst-case state of affairs is the share value is >$740 / share, the place you lose your complete funding. We suggest solely doing this with a really small a part of your portfolio given the capital loss % however suppose it is extremely seemingly the corporate’s share value finishes Dec. 2026 beneath $700 / share

Thesis Danger

The biggest danger to our thesis is momentum. Nvidia is at present a momentum inventory, as seen with its YTD efficiency. There is a well-known saying that the market can stay irrational longer that you could stay solvent, and that is a danger right here. Our choice funding has a set expiration, and if the thesis doesn’t pan out, you then lose your whole capital. That is value paying shut consideration to.

Conclusion

Nvidia has had an unbelievable 12 months. The corporate continues to see its share value enhance because the market struggles to search for thrilling various investments. The corporate now has a market cap of ~$2 trillion, making it the 4th largest publicly traded firm on the planet, on par with Saudi Aramco. And the market can stay irrational longer than you possibly can stay liquid.

On the finish of the day, the hen comes residence to roost. Nvidia Company is seeing competitors enhance quickly, which is threatening margins. Lead instances are reducing as prospects are capable of get the GPUs they want. We suggest shorting the inventory via a vertical PUT unfold, which caps losses at 100%, and might greater than double your cash if the inventory drops 12%.

We count on this to be worthwhile. Tell us your ideas within the feedback beneath!