Johan Holmdahl

I’ve been sounding the alarms in regards to the dangers of Novavax (NASDAQ:NVAX) since 11/2016’s “Novavax: The Little Engine That Couldn’t“. My most up-to-date Novavax article was 11/2023’s “Novavax: Much less Is Much less – Shrinking COVID Market Takes Its Toll (Ranking Downgrade)”.

The present article critiques its funding deserves following anxious buying and selling after its This autumn, 2023 earnings launch (the “Release“), presentation (the Presentation“), 10-K (the “10-K“) and conference call (the “Call“).

Novavax’s disappointing earnings were greeted with a thud by the market.

Novavax’s reported its Q4, 2023 earnings prior to market open on 02/28/2024. Its GAAP EPS of -$1.44 missed analysts’ expectations by $0.99; its revenue of $291 million missed expectations by $30.97 million.

Novavax stock closed on 02/27/2024 at $6.02. It opened after the release of its earnings at $4.64; it traded down to $4.23 closing the day at $4.41, down >25% from the previous day’s close. Not atypically shares have since recovered as the market digested the situation. As I write they closed on March 1, 2024 at $5.39.

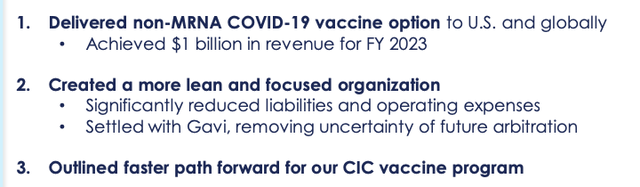

The Call reported Novavax’s progress during 2023 in meeting its three priority focus areas as:

- delivery of its updated vaccine for the fall season;

- taking control of its finances by reducing its rate of spend, managing its cash flow, and evolving its scale and structure;

- leveraging its technology platform, capabilities and assets, to drive additional value beyond its one approved vaccine Nuvaxovid alone

The following excerpt from its Presentation slide 4 summarizes its progress on these priorities:

Its progress on item one is pretty cut and dried. Items 2 and 3 are more subject to interpretation. Unfortunately, as Novavax rushed in its all out response to the pandemic, it became so bloated that a “vital” reduction in liabilities and operating expenses may fall far short of being sufficient. The jury is still out on that.

As for its Gavi settlement, in simple terms, it references an arbitration by the Vaccine Alliance [GAVI]. In the arbitration, GAVI is seeking to recover $700 million in unused advanced purchase agreements [APA] for COVID vaccines.

During the Call CFO Kelly fleshed out his analysis of the situation and its impact for Novavax; addressing the current liability portion of its balance sheet he noted:

…approximately $700 million related to Gavi… over $500 million of that will move to long-term liabilities as we continue to move forward.

In other words the attraction of the settlement is not so much any absolute discount on Novavax’s liability, but rather the payout term. The five year payout moves the obligation from a current to a long term liability. CEO Jacobs had described the financial impact as:

…allowing us to better manage cash flows and make appropriate investments to grow our business. When assessed on a present value and cost of capital basis, we estimate that the cost of the settlement to be in the range of $300 million to $400 million.

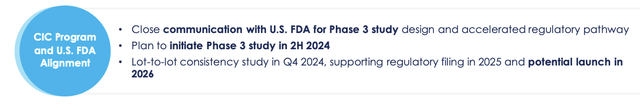

As for priority 3 CIC references Novavax’s COVID-19-Influenza Combination. I regard this vaccine as Novavax’s one viable path to relevance and potential financial health. In this regard I note the confluence of two cultural memes which point to its importance as follows:

- expectation of and adherence to annual flu shots;

- weariness with and increasing resistance to periodic COVID shots;

- despite 2 above COVID remains an ongoing chronic health threat.

If Novavax could develop a competitive CIC, it would permit patients to kill two birds with one stone. How is this progressing timewise for Novavax? The following extract from Presentation slide 12 provides a partial answer to that key question:

There are two known factors which mitigate against getting one’s hopes up on this potential including:

- Novavax’s record of flopping when it comes to timely developing vaccines, in this regard I cite not only that it dropped to third place in developing its standalone COVID vaccine but also its failure to develop an approved RSV vaccine after years of effort and its abandonment of its NanoFlu vaccine when it was on the cusp of filing it BLA;

- Moderna (MRNA) is forward in its growth of a mix vaccine having already dosed its first part 3 research participant[

- Pfizer (PFE) and BioNTech (BNTX) are in the hunt with a mix candidate.

With its dicey past and no clear path forward I continue to rate Novavax a “Promote”.

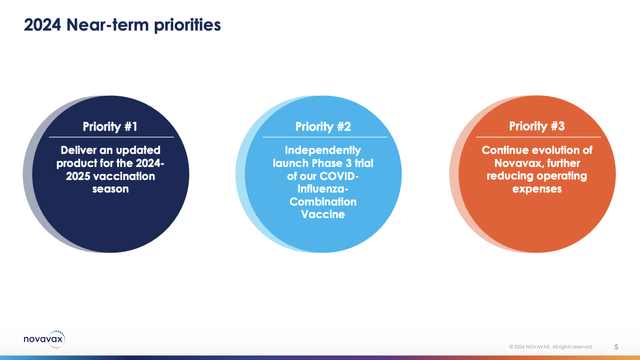

Novavax’s Presentation included slide 5 setting out its priorities for 2024. They are not exactly the same as those for 2023, but as the saying goes, they certainly rhyme:

I have no further observations on 2024 priorities 2 & 3 beyond discussion above. As for priority 1, this is an important one to achieve critical revenues. I consider this as an existential requirement. During the Call CCO Trizzino established a target date for investors to include in their Novavax calendar.

He advised:

For 2024, we are focused on being in market in early September, which we anticipate as the start of the vaccination season. We also intend to offer our vaccination in a prefilled syringe and if approved, under full BLA licensure. We know that in the first post-pandemic season, COVID vaccinations overwhelmingly took place in pharmacies, so we have recalibrated and streamlined our customer engagement teams to focus on this channel.

Accordingly full satisfaction of priority 1 includes an entire wish list of items to achieve by early September, 2024. As I write in early March 2024 this only leaves a scant six months. Is that even possible? Surely it must be but how?

During the Call TD Cowen analyst Smith was thinking along the same lines. He asked what steps were necessary between now achieving full approval. CEO Jacobs passed the question on to CCO Trizzino urging him to speak to difference in 2024 plans compared to 2023. Trizzino responded:

…three critical elements here for success in 2024 is early September on time availability of product in front of the vaccination season. BLA, which is in process right now through rolling submission and prefilled syringe making it easy and convenient use for the pharmacists. We believe that these will make dramatic difference in what we see as our performance in 2024.

An in process rolling submission BLA does not reveal very much. In evaluating this September date and the BLA and the prefilled syringe consider the order of events. The prefilled syringe is a medical device with its own approval standards. The syringe content also requires approval. The product approval should be in hand before filling the syringe.

Is all this approval and processing practically achievable in six month? Surely it must be. Can Novavax do it in six months? Shareholders better hope it can. That is one of several reasons an investor might reasonably elect to sell any interest in Novavax.

The 10-K’s “Going Concern” advice is concerning.

The 10-K includes a typical laundry list of risks to its business. Without minimizing any of the other listed risks, I found the following 2 at the bottom of this list on page 4 to be particularly concerning:

- Given our current cash position and cash flow forecast, and significant uncertainties related to 2024 revenue, substantial doubt exists regarding our ability to continue as a going concern through one year from the date that the financial statements included in this Annual Report were issued.

- Servicing our 5.00% convertible senior unsecured notes due 2027 (the “Notes”) requires a significant amount of cash, and we may not have sufficient cash flow resources to pay our debt.

Later in the 10-K (82) it fleshed out the first issue of concern as follows:

- Novavax’s current cash flow forecast estimates that it has sufficient capital available to fund operations for a year;

- the forecast is subject to significant uncertainties relating to revenue;

- it is further subject its ability to execute on its cost reduction initiatives.

I have previously discussed the issues on its revenues which are subject to regulatory issues beyond its control. As for realizing on its cost reduction initiatives this is always a question for a company that is recognized as having financial challenges.

It comes down to how can a company effectively minimize costs while still achieving essential operational needs?

Conclusion

Novavax is a true battleground stock. Bullish gamblers are bewitched by its huge runups during the pandemic. They are willing to accept losses as the price of admission to be eligible for a repeat of such runups. To these persons I would suggest that the pandemic is over.

True COVID is not. However the white hot fever that generated OWS and like governmental largess is over, done, finished, caput. We cannot be 100% sure of anything. I submit that the odds are unattractively long for a repeat of the frenzy that propelled Novavax to such heights during the pandemic.

Novavax has a whopping collected deficit of $4.8 billion. Its web losses for the final three fiscal years have been $0.5 billion in 2023, $0.7 billion in 2022, and $1.7 billion in 2021. Within the Name it guided for 2024 revenues of $0.8 – $1.0 billion. Its 2023 bills aggregated ~$1.55 billion down from ~$2.63 for 2022.