Michael M. Santiago/Getty Photographs Information

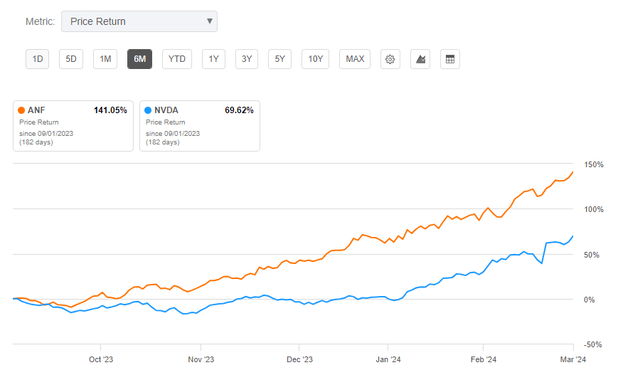

On the subject of meteoric inventory beneficial properties, Abercrombie & Fitch (NYSE:ANF) is probably going not the primary identify that might come to thoughts; many extra would seemingly take into consideration an AI-themed inventory, akin to Nvidia (NVDA) earlier than even contemplating the unconventional prospects of an attire retailer.

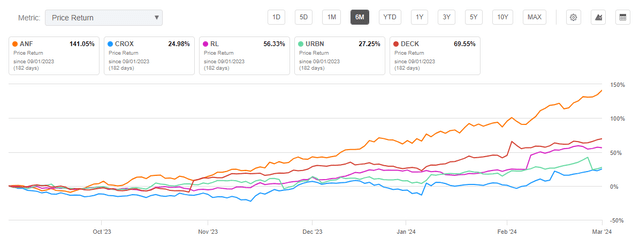

As it could occur, momentum in ANF inventory seems unstoppable. It’s up over 140% within the final six months, double that of market favourite NVDA.

Looking for Alpha – 6M Share Value Efficiency Of ANF In contrast To NVDA

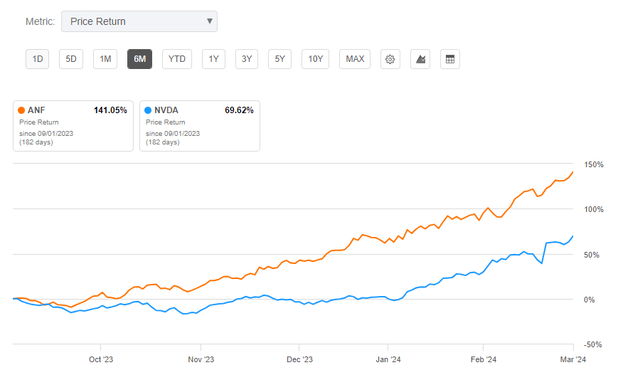

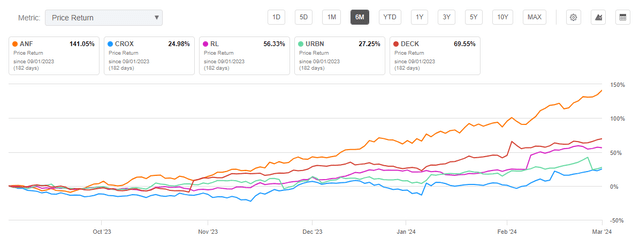

Granted, ANF isn’t the one attire retailer to put up a powerful share value output over the past six months. Crocs, Inc. (CROX) is up 25%, whereas HOKA proprietor, Deckers (DECK) is up about 70%. Nonetheless, these returns pale compared to ANF.

Looking for Alpha – 6M Share Value Efficiency Of ANF In contrast To Retail Friends

I first initiated coverage on ANF after it hit its first 52-week excessive of $50/share, a pricing milestone it reached for the primary time since 2011. In that article, I considered shares as finest left on maintain due primarily to valuation metrics. The inventory went on to achieve 160% since that replace.

I once more covered the inventory in late December and acknowledged that shares have been price continued consideration. Nonetheless, I kept away from expressing overly bullish sentiment on additional momentum. The decision once more proved ill-timed as traders noticed one other 50% achieve since that replace.

With This fall outcomes on deck to be launched on Wednesday, I keep that shares are finest left on maintain for current shareholders. I’d additionally view it as prudent for brand spanking new traders to keep away from new positioning within the inventory at present buying and selling ranges. Right here’s what else to know earlier than ANF studies outcomes.

Why Are ANF Shares Persevering with To Outperform?

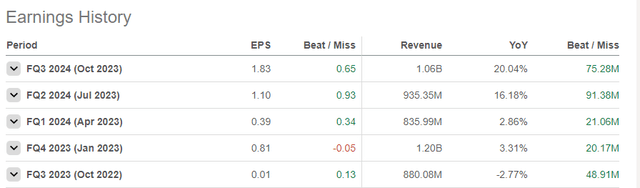

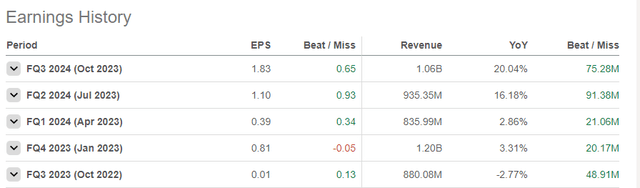

ANF’s outperformance hasn’t been with out advantage. The retailer has topped income expectations for 5 straight quarters. It has additionally beat on earnings in 4 of the final 5 quarters.

Looking for Alpha – Earnings/Income Historical past Of ANF By Quarter

Most lately, the corporate reported 20% YOY consolidated gross sales development with an working margin fee of 13.1%, a whopping 1,100 foundation level enchancment over the identical interval in 2022. Driving the bottom-line margins was a 570 foundation level growth in gross revenue margins.

Supporting gross sales is ANF’s namesake unit, which delivered their 11th consecutive quarter of gross sales development in Q3. Moreover, the unit’s gross sales grew 30% in Q3 as the corporate noticed consensus power throughout genders and in channel combine. The Abercrombie manufacturers have been additionally supported by development in reinvigorated Hollister, which grew 11% in the course of the quarter.

Can Abercrombie & Fitch’s Outperformance Proceed?

Buyers are clearly cheering the sturdy gross sales development, in addition to working effectivity, which has led to a big growth in ANF’s margin profile.

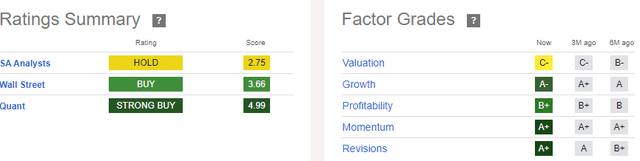

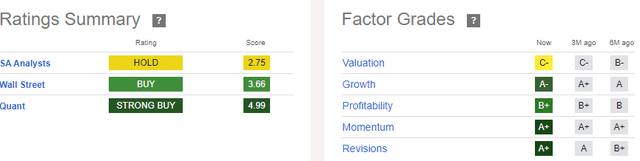

Analysts seem satisfied that the great instances can proceed. Within the final three months, consensus EPS estimates have been raised 9 instances. This has contributed to a near-perfect rating from Looking for Alpha’s (“SA”) quant system. The inventory additionally grades favorably elsewhere. This has stored shares in “strong buy” territory from the quant scores.

Looking for Alpha – Rankings Abstract Of ANF

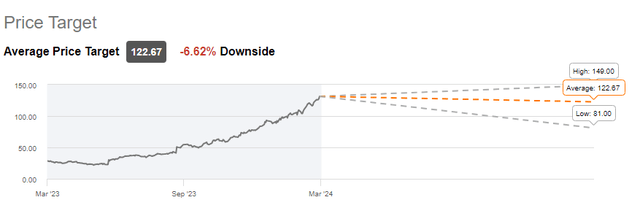

Wall Road is similarly bullish on an total foundation. Nonetheless, most analysts view shares as fairly valued within the $120/share value vary, suggesting mid-single-digit proportion draw back threat.

Looking for Alpha – Common Wall Road Value Goal Of ANF

The general SA group, too, is extra impartial. Latest commentary additionally negatively opines on the inventory’s present share value.

Abercrombie & Fitch This fall Steerage And Outlook

Whether or not ANF can continue to shine will rely on the way it meets its more and more high expectations. In Q3, better-than-expected outcomes enabled the administration workforce to boost their gross sales and working margin expectations for 2023.

Expectations for the ultimate quarter of the yr have been additionally propped up by the robust begin seen on the date of the Q3 outcomes. With a lot of the quantity from the vacation season but to have come, administration appeared more and more optimistic that ANF would flip in a powerful end to 2023.

General, internet This fall gross sales are anticipated to extend within the low-double-digit vary. And working margins are anticipated to land at a midpoint of 13%. That may be in comparison with margins of seven.7% in the identical interval final yr.

The lofty expectations might come as a shock, given present discretionary spending patterns. However ANF’s YTD gross sales efficiency suggests ANF has clearly recognized a strategy to join with their goal inhabitants. Even when ANF have been to overlook its expectations, outcomes would nonetheless seemingly land properly above final yr’s benchmark.

Is ANF Inventory A Purchase, Promote, Or Maintain?

ANF’s share value efficiency has continued to defy my prior expectations. Whereas the working outcomes do help the outperformance, I imagine a pause in additional share value appreciation is probably going sooner somewhat than later.

At current, shares are commanding valuation metrics which can be properly above historic averages. ANF is at present buying and selling at 1.75x value/gross sales. That compares to a mean of 0.40x within the final 5 years. Equally, it trades at an EV/EBIT a number of of 20x. A 12x valuation could be extra acceptable based mostly on its historic report.

Can the inventory keep a better a number of based mostly on its present and future anticipated efficiency? Maybe. However in my opinion, the brand new fiscal yr will carry forth a way more troublesome comparable surroundings on the topline after ANF’s banner 2023. Moreover, margins have considerably expanded due partly to freight tailwinds that may seemingly reverse course within the coming months.

Declining inflation and the potential of decrease rates of interest may additional help income development. And this might present the momentum for continued outperformance. However I’d be hesitant to provoke bullish protection on a inventory that has gained 350% within the final yr.

For traders in search of positioning, I keep the view {that a} “hold” place stays most prudent upfront of ANF’s earnings launch this week, a launch the place expectations will seemingly be working increased than in previous studies.