kodda

I began protection of Hess Midstream (NYSE:HESM) as a “Buy” again in June, saying it provided an intriguing mixture of security and revenue for traders. The inventory has generated a return of practically 35% since then. Extra not too long ago in December, I took the inventory to “Hold” because the inventory neared by worth goal and its guardian introduced it was being acquired. With some latest occasions in addition to the corporate reporting earnings, let’s make amends for the identify.

Firm Profile

As a refresher, HESM is a midstream gathering and processing firm that principally serves the wants of its guardian Hess (HES) within the Bakken and Three Forks shale performs in North Dakota. HESM has distinctive contracts in that in their preliminary part, the contracts have an annual price recalculation to take care of a focused return on capital deployed for HESM. The corporate additionally receives 3-year rolling minimal quantity commitments (“MVCs”) which can be equal to 80% of Hess’ nominations in every growth plan. The fee-based contracts additionally include CPI escalators capped at 3%.

About half of its EBITDA is derived from its three-stream gathering enterprise, whereas roughly 40% of its EBITDA comes from its Processing & Storage section. Its Terminal and Export section, which features a truck and pipeline terminal, a rail terminal, and a header system, accounts for the remainder of its EBITDA.

Sponsor Exercise

One of many huge questions surrounding HESM is what occurs as each of HESM’s sponsors are within the means of being acquired. Oil big Chevron (CVX) is within the means of buying its guardian HES, whereas Blackstone is within the means of acquiring International Infrastructure Companions (GIP).

The corporate was requested about what occurs with the contracts on its Q4 earnings call, with the corporate saying the contracts and acreage will stay in place.

In its 10-K filed in late February, in the meantime, the corporate revealed that it had renewed an extra 10-year time period for crude oil gathering, terminaling, storage, fuel processing, and fuel gathering industrial agreements with HES. These agreements will now span by the top of 2033. This seems to cowl a lot of its system, with HESM having renewal choices for its remaining gathering sub-system for an additional 5 years and on its water service for an additional 10 years at a later date.

The corporate additionally famous that it would not anticipate any change to the funding method for the GIP fund holding HESM.

On that finish, in early February, GIP bought 10 million models by a public secondary providing at $33.10 a unit.

Then in March, it bought $100 million in models again to HESM at $35.50. HESM purchased again $400 million in models from GIP in 4 separate transactions by 2023.

Following the gross sales, HES will personal 37.8% of HESM models and GIP will personal 26.8%.

Turning to its This autumn outcomes reported on the end of January, the corporate noticed its adjusted EBITDA rise 8% to $264.1 million from $245.1 million a 12 months in the past.

This autumn web revenue rose 2% to $152.8 million.

The corporate paid out a 62.43 cent distribution throughout the quarter.

Adjusted free money stream was $146.6 million, because it spent $71.8 million in Capex.

HESM noticed its throughput volumes improve throughout all its merchandise 12 months over 12 months. Gasoline gathering volumes jumped 23% 12 months over 12 months to 403 MCF/d, whereas crude gathering volumes rose 16% to 108 bo/d. Gasoline processing volumes climbed 14%. Crude terminal volumes rose 19% to 120 bo/d, whereas water gathering jumped 47% to 113 bl/d.

The corporate ended the quarter with a leverage of three.2x.

Wanting forward, HESM forecast full-year adjusted EBITDA of between $1.125-1.175 billion, representing 12.5% development on the midpoint. It expects adjusted free money stream of between $685-735 million.

Capex is predicted to be between $250-275 million, with $125-150 million in development capex. The corporate has just a few multiyear tasks within the works, which can add 40 miles of high-pressure fuel gathering pipelines and two new compressor stations. It expects so as to add 85 million cubic ft per day of fuel compression capability subsequent 12 months.

For 2024, HESM expects fuel processing volumes of between $395-405 MMcf/d, oil terminaling volumes of between 120-130 Mbls/d, and water volumes of between 105-115 Mmbl/d.

Wanting additional out, HESM is projecting to develop EBITDA by 10% or extra per 12 months in 2025 and 2026. The corporate expects to extend its distribution by 5% by 2026.

For Q1, the corporate expects volumes to be flat with This autumn because of the influence of utmost chilly climate in January.

HESM turned in a strong quarter, with EBITDA development as soon as once more accelerating. Excessive chilly, which is not unusual within the Bakken within the winter, will influence Q1, however most E&Ps are likely to drill and full wells outdoors of winter, so general its steerage for 2024 was robust.

A lot of HESM’s development is predicted to come back from HES, which is being purchased by CVX. Whereas the contracts will not change and have simply been renewed for ten extra years, the query is that if CVX will proceed with HES’ drilling plans within the basin as soon as the merger is full.

I might guess sure, however CVX did not purchase HES for its Bakken acreage, it purchased it for its Permian acreage and its 30% stake in a prolific offshore oil mission off the coast of South American nation Guyana. So this does add some uncertainty, though the contracts are protected. CVX may additionally look to unload its HESM shares as soon as the deal is full if it doesn’t view it as a core asset.

Valuation

Turning to valuation, HESM inventory trades at 9.7x the 2024 EBITDA consensus of $1.14 billion. Primarily based on the 2025 EBITDA consensus of $1.28 billion, it’s valued at 8.7x.

Observe that HESM’s enterprise worth listed on many web sites is inaccurate by a big quantity as they do not embrace its B share frequent models.

The inventory has a free money stream yield of about 8.9% based mostly on 2024 projections calling for $710 million in FCF. And it pays out a distribution yield of ~7.2%.

The inventory trades at a premium to another mid-sized midstream operators that typically commerce between 8-10x 2024 EBITDA.

Primarily based on an 8-10x a number of on 2025 EBITDA, I might pretty worth HESM between $32-43.

Conclusion

HESM has been performing properly and it has some potential upside, though, after a strong run, it’s in direction of the excessive finish of valuation the place midstream corporations are buying and selling. That mixed with the uncertainty surrounding the upcoming change in its guardian retains me at “Hold.”

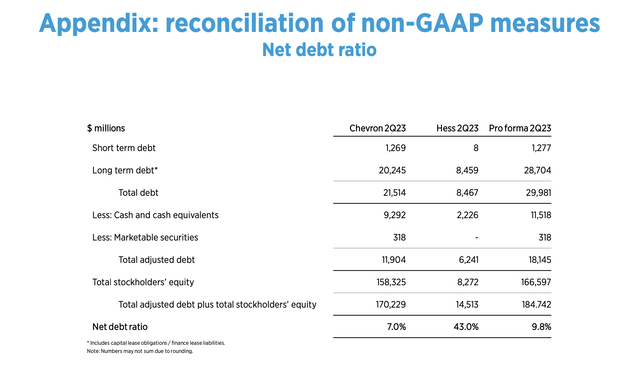

CVX additionally may very properly look to promote its stake, because it may wish to look to pay down some debt after the deal. Debt is not an enormous challenge, however HES comes with a a lot greater web debt ratio in comparison with CVX and CVX hasn’t even talked about HESM when it has mentioned the deal. Thus, CVX would not seem to contemplate HESM as a core asset. CVX owns some midstream belongings within the U.S., however it’s a really small a part of its enterprise.

Nonetheless, if CVX decides to promote its HESM stake it may be a lift to models if HESM seems to promote itself within the deal. Western Midstream (WES) has seen its inventory carry out properly after it was reported that its guardian Occidental Petroleum (OXY) was seeking to promote its stake within the agency, regardless of saying it was not shopping itself.

Following Vitality Switch’s (ET) deal to accumulate Crestwood, including HESM would make sense to mix their Bakken techniques. Given the massive positions in HESM that CVX and Blackstone will purchase in their very own offers, they appear like they could possibly be keen sellers. GIP has already been persistently promoting down its HESM stake over the previous 12 months (together with after the Blackstone deal was introduced), so a whole sale would assist quicken this course of. Thus, it looks as if a logical match.

If a deal have been to be consummated, I might anticipate a modest premium given HES’ present valuation. As such, I’ll elevate my goal to $37 from $33, whereas sustaining my present ranking. $37 is the center of my honest valuation vary listed above.