BeritK/iStock through Getty Pictures

Introduction

I’ve been trying ahead to sharing my up to date ideas on Hims & Hers Well being (NYSE:HIMS). I took every week to digest the earnings name in an effort to make certain I put collectively a considerate piece. I’ve printed eleven articles on Hims going again to November 2021. To place this in perspective, I’ve solely printed 50 different inventory articles within the six years that I’ve been a author on Looking for Alpha.

To be a profitable investor is to be a disciplined investor. For each one inventory I spend money on, there are a whole bunch I discard. I don’t spend money on or write on shares I haven’t psychotically analyzed from each angle nor do I write articles for the cash. I write as a result of it’s a ardour. Looking for Alpha may pay me free.99 for this text and I’d nonetheless write it (Richard: don’t get any concepts). And talking of cash, I disclosed my original Hims purchase of about 50,000 shares at a value foundation of $5.50.

You are able to do the mathematics.

Disclosure

In late 2023, I opened my very own registered funding advisory agency, DocShah Monetary. I received’t bore you with the small print, however we’ve had unimaginable development and formally crossed $1,000,000 in property beneath administration on March 4, 2024. Integrity is on the core of every little thing I do, and as such, please be sure to learn my disclosure on the backside.

Benefit from the piece.

“Who The Heck is Hims?”

This was truly a pal’s response after I mentioned, “I own Hims.”

Happily for us all, Hims is a ‘what,’ not a ‘who.’

Hims and Hers Well being is a telehealth firm that primarily targets Millennials and Gen Z, providing them well being options in 5 broad classes:

- Sexual Wellness (ooh la la)

- Hair Regrowth

- Dermatology

- Psychological Well being

- Weight Loss

As soon as once more, I may bore you with the small print of how large the TAM is for every class, however I already did that here. This text goes to be completely different.

The second you perceive {that a} inventory’s success is twice the byproduct of human psychology as it’s fundamentals, the higher investor you’ll be going ahead.

Millennials and Gen Z are completely different from different generations; for higher or for worse (if we’re worse, I apologize). Most of us grew up remoted. Discover, I didn’t use the phrase, ‘alone.’ We weren’t alone – we had been linked to individuals 24/7/365… simply, you already know… by means of a tool.

We had been remoted.

We didn’t want to satisfy in individual as a result of we may meet by means of a display.

What’s the results of this?

As a colleague of mine emailed me:

The result’s, you get a bunch of anxious/nervous individuals who nonetheless want healthcare, however, if given the selection, would 100% select to do it by means of a display than in individual.

And that is precisely what the market didn’t perceive about Hims;

That Hims was an organization born out of necessity. Not of selection.

And this exactly what I understood at $5 per share;

At $4 per share;

And, as I stood remoted, at $3 per share.

Valuation

We are going to worth Hims through FCF and EPS.

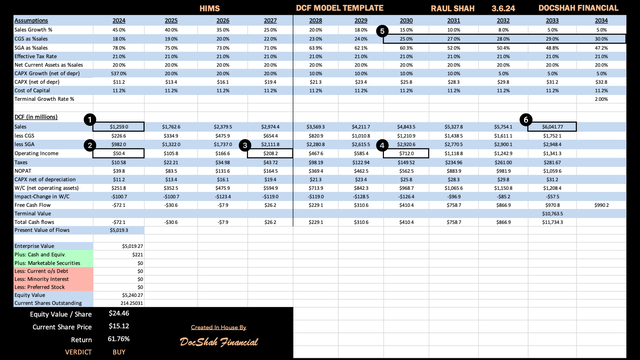

DocShah Monetary’s DCF

DSF HIMS DCF (DocShah Monetary )

I’ve six key checkpoints marked on my DCF in an effort to maintain us in line as we make our method by means of the subsequent ten years collectively. These six key areas are a mixture of steerage from each CFO Yemi Okupe and CEO Andrew Dudum throughout the latest earnings call and my very own forecasts.

Checkpoint 1: 2024 Gross sales

Yemi Okupe’s Steerage:

For the full-year, we’re anticipating income of between $1.17 billion to $1.2 billion.

For my part, Yemi’s steerage seems overly conservative. To achieve $1.2 billion in gross sales for 2024, a CAGR of simply 8.3% per quarter could be required. To place this in perspective, Hims averaged quarterly development charges of 10% final yr:

- Q1: 14.1%

- Q2: 9.0%

- Q3: 9.0%

- This fall: 8.8%

The primary quarter tends to have stronger tailwinds and as such, I’d anticipate Hims to put up strong earnings development. I feel 12.0% is a smart estimate and if we get something close to that quantity, then we may coast the remaining quarters with 6% CAGR development and nonetheless attain gross sales of $1.2 billion.

My forecast is:

- Q1: $276 million (12% sequential improve)

- Q2: $301 million (9% sequential improve)

- Q3: $328 million (9% sequential improve)

- This fall: $354 million (8% sequential improve)

Whole 2024 gross sales: $1.26 billion

Checkpoint 2: 2024 EBITDA

Yemi Okupe’s Steerage:

It’s our expectation that 2024 adjusted EBITDA shall be between $100 million and $120 million.

I calculated EBIT (working earnings) of $50 million for this yr, which roughly equates to $110 million in adjusted EBITDA.

In case you are confused, take the second to learn this, in any other case maintain it transferring:

EBITDA excludes depreciation and amortization. Adjusted EBITDA excludes each of these I simply talked about AND consists of stock-based compensation. So, in an effort to reconcile an adjusted EBITDA forecast with an EBIT forecast (working earnings), it’s a must to reverse all these transactions above. Which means to go from adjusted EBITDA to EBIT, you add again depreciation/amortization and subtract out stock-based compensation. That is why EBIT is loads decrease.

Checkpoint 3: 2027 EBITDA Margin

Yemi Okupe’s Steerage:

Our expectation is that we are going to obtain adjusted EBITDA margins of at the least low to mid-teens by 2027.

I feel that is affordable and so I forecasted the midpoint of steerage with an anticipated EBIT margin of seven%, which is just about in keeping with a mid-teen adjusted EBITDA margin.

Checkpoint 4: 2030 EBITDA Margin

Yemi Okupe’s Steerage:

Our long-term adjusted EBITDA margin objectives are 20% to 30%… our expectation is that advertising as a proportion of income shall be within the mid-30s to low-40s by 2030.

I’ve EBIT in 2030 to be $712 million, which equates to a 15% EBIT margin, which can fall someplace in Yemi’s goal vary for adjusted EBITDA margin.

I feel Hims may have decrease gross margins sooner or later, which might put extra strain on them to chop again on promoting. Proper now, this isn’t mandatory as a result of there aren’t sufficient official rivals to power Hims to be extra aggressive on pricing. As that adjustments, I feel Hims could possibly be pressured to scale back promoting spend to conjure up a revenue, which in flip, may stifle their future gross sales development.

So, I did two issues:

- I lowered SGA expense to firm steerage.

- I slowed gross sales development barely extra aggressively, beginning in 2028.

Vertical Line

You will observe a vertical line marking the division between the years after 2027. From 2028 to 2030, I maintained the identical base charge enchancment in SGA. Nonetheless, I then utilized a multiplier of 0.9x to account for a ten% discount in advertising as a proportion of income. Subsequently, throughout the interval from 2030 to 2033, I utilized a extra aggressive method, utilizing a multiplier of 0.8x to replicate Yemi’s steerage that advertising as a proportion of income will finally fall within the mid 30% vary.

Checkpoint 5: Gross margins

Yemi Okupe’s Steerage:

Over time, we view gross margins going to extra of the mid to high-70s… the trail to sort of the mid-70s that we have guided to is certainly going to be most likely extra of a multiyear journey like that is not going to occur over the course of like a few quarters.

Yemi’s optimism could also be overlooking some potential challenges. Whereas it is tempting to imagine that the corporate’s favorable circumstances will persist into the longer term as Hims at present outpaces rivals within the telehealth sector by varied key measures, it could be unrealistic to anticipate such excessive margins indefinitely.

An business during which an organization is producing 82% gross margins is more likely to appeal to many different suppliers, thus driving down worth. As competitors within the telehealth market intensifies, I anticipate that corporations inside this house will start providing related merchandise, with service high quality turning into the first differentiating issue. Nonetheless, enhancing service usually entails higher prices in comparison with product differentiation.

Merely warning traders of a decline from 82% to 75% in revenue margins might not suffice. Given the potential for additional erosion, traders may anticipate extra substantial margin decreases. To undertake a extra conservative method, I’ve created a glide path right down to 70%, somewhat than stopping at 75% as in Yemi’s steerage.

Checkpoint 6: 2033 Gross sales

Andrew Dudum’s Guidance:

We predict we’re constructing a $10-20 billion firm.

Whereas Hims’ administration has not set any expectations for gross sales in 2033, CEO Andrew Dudum has explicitly acknowledged he sees Hims as a $20 billion firm.

If Hims generates $6 billion in gross sales in 2033, as in my forecast, it will necessitate a P/S ratio of about 3.3x to be a $20 billion firm. All of those numbers are affordable.

Honest Share Worth

Factoring in administration’s full steerage, my very own forecasts, and a few conservatism, Hims’ justifiable share worth is $24.46. This represents potential upside of 62% from right this moment’s present degree of $15.12 per share.

Zooming Out

In any discounted money movement evaluation, the final step entails zooming out to view the large image.

To handle the query of whether or not projecting gross sales to be $6 billion is overly bold or not, I can basically reframe it as, ‘Will Hims develop into a 7x bigger firm in 10 years?’

Nicely, to place this in perspective, gross sales must develop at a CAGR of 24% for Hims to be a 7x greater firm in 2033. I feel most would agree that is properly inside the realm of risk.

So, sure, my DCF is affordable within the huge image.

A Lesson in Zoology with DocShah

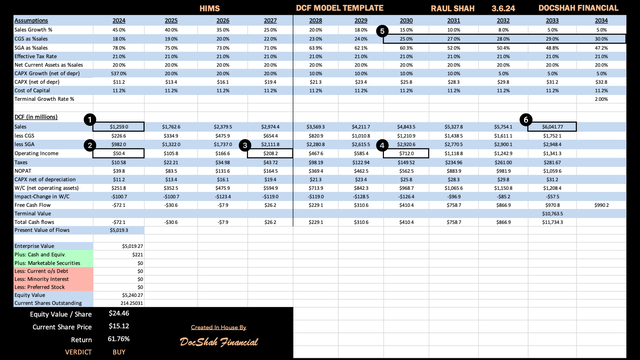

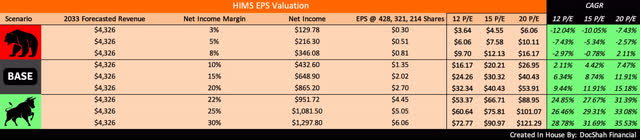

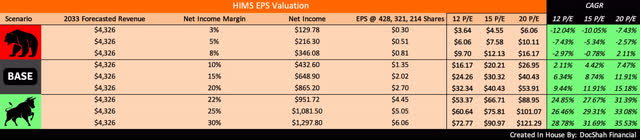

DSF HIMS EPS Desk (DocShah Monetary)

We are able to additionally worth corporations utilizing EPS as a substitute of FCF. Within the above chart, we’ve a bear case, base case, and bull case. I made a number of assumptions:

Bear Case: Share depend will increase by 2x to 428 million

Base Case: Share depend will increase by 1.5x to 321 million

Bull Case: Share depend stays the identical at 214 million.

The handy factor about the best way I constructed this desk is it permits you, the reader, to shortly decide all of your assumptions and provide you with your personal justifiable share worth.

For instance, let’s say you’re impartial on the corporate and consider:

- Internet earnings margins shall be 15%

- Shares excellent are 321 million

- Market assigns a 15 P/E

Then, the inventory could be value $30.32, which represents a CAGR of 8.74% per yr from present ranges.

I’d like to know which end result you forecast so let me know within the feedback beneath. Additionally, please perceive these forecasts are normal ranges.

Potential Catalysts

These are not at all sidenotes, however this text is already fairly lengthy. MedMatch, which is Hims’ AI software program that makes use of machine studying and leverages knowledge factors from its sufferers, and the brand new Hers Weight Loss class may each present immense worth to the corporate’s market cap. Nonetheless, as of proper now, I’d say each are at present of their infancy levels, which makes it tough for me to precisely put a price on them. So, within the spirit of prudence, it’s greatest I wait a little bit little bit of time to quantify their influence till they endure extra develop. Nonetheless, I needed to at the least acknowledge these catalysts and can start factoring them into forecasts as they each mature. I do assume each MedMatch and Hers are “waiting in the wings” and am excited to see them mature.

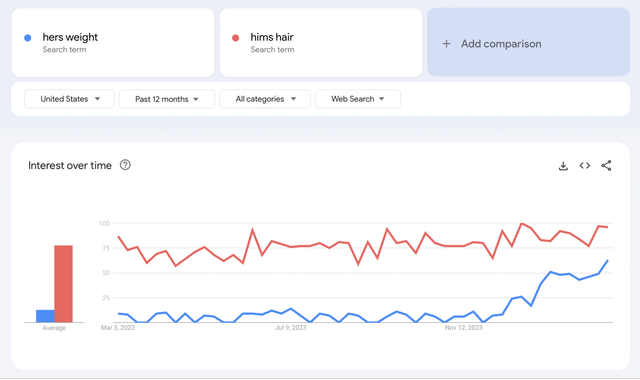

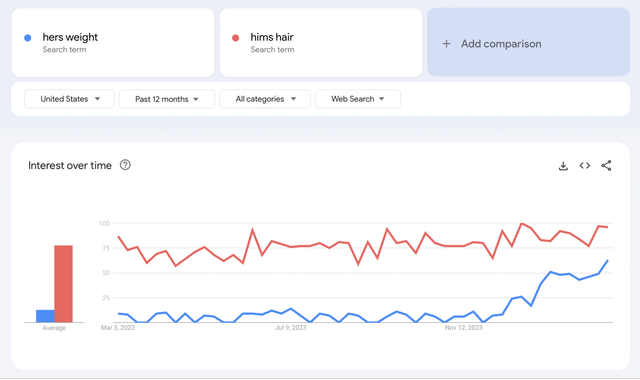

Hers Weight Google Traits

Google Traits Comparability: Hers Weight vs. Hims Hair (Google)

As a fast illustration of my level that Hers is a sleeping big, have a look above on the Google Traits from the previous yr. ‘Hers weight’ may be very shortly approaching the identical search curiosity as ‘Hims hair,’ one of many corporations hottest classes.

Get Off My Garden

I’m going to handle some frequent arguments about Hims individuals are likely to yell in fury to see if any maintain validity.

Hims has no moat…

Those that declare Hims has no moat couldn’t be additional mistaken. To begin with, the worth proposition supersedes the moat. Buyers who fixate on the latter are “putting the cart before the horse.” It’s akin to complaining about outcomes with out specializing in the method. That is one thing that will get ingrained in you from a younger age whenever you’re an athlete, which by the best way, I am a professional baseball player too.

Second, you may declare any firm doesn’t have a moat of their first few years. What moat did Netflix have when it began?

What made Netflix particular was its worth proposition. Particularly, Netflix’s worth proposition was that it was:

- Simpler to make use of

- Extra handy

- Earlier to market (maybe extra a aggressive benefit, however why cut up hairs)

- Less expensive

- Had higher branding

- Had customer-friendly insurance policies.

Over time, the corporate expanded upon its worth proposition by including streaming, unique content material, video games, and so forth. It’s precisely this worth enlargement that’s what traders unknowingly confer with as a moat.

By the best way, if the checklist above sounds acquainted, that’s as a result of it ought to. All of these worth propositions could be utilized to Hims.

Particularly, Hims’ worth proposition is that it supplies a 24/7, digital well being and wellness service for nervous/anxious individuals who desperately want these companies, however want to, by nature, keep away from assembly in individual for stigmatized healthcare considerations. The customized formularies, vertical integration, unimaginable branding, ease of use, comfort, and ease, all present the mandatory basis for an ideal person expertise.

Over time, the corporate’s worth proposition will create a recognizable moat. Then, if one other firm needs to compete for market share, it should high Hims’ worth proposition, not cross its moat.

CAC this, CAC that…

I feel we have to put buyer acquisition value in perspective. Hims is an organization that has:

- 65% YoY income development

- 82% gross margins

- $221 million in money

- $0 in debt

- 14% inside possession

- Founder led

- Large, as in extraordinarily large, TAM

- Tens of millions of followers throughout socials

- Retired 237,000 shares for $2 million at $8.42 common worth per share.

But, some traders select to fixate on buyer acquisition value as if it negates the entire above. If the corporate’s development was destructive, then I’d say excessive buyer acquisition prices flip from benign to malignant.

I can have a look at any firm on the earth, discover one explicit destructive, fixate after which write a PhD dissertation on it. This might be a mistake, as, going again to my earlier level, investing is primarily psychological not logical. There’s a important change going down in society on how youthful generations desire to entry healthcare. A excessive buyer acquisition value in a sea of nice fundamentals isn’t going to halt that dynamic from progressing.

Pondering a excessive CAC will blockade this tsunami of a societal shift going down in healthcare is like worrying {that a} pebble will block a river from reaching the ocean.

The very fact is that Millennials and Gen Z have radically completely different psyches that no telehealth firm has recognized and focused the best way Hims has completed. Additionally, anybody who is aware of promoting will inform you that adverts develop into exponentially costlier the extra focused they’re, so it is sensible that Hims’ extremely focused campaigns are certainly, costly. If this pursuit of the proper buyer, costly as it’s, brings in sticky sufferers who pay month after month, then the juice is well worth the squeeze.

90% + of income is recurring income…

Talking of consumers who pay month after month, Hims doesn’t have me satisfied on their reported recurring income proportion. The one purpose I’m a little bit suspicious is in the event you have a look at the iOS App retailer (or the web), there are a number of 1 star buyer evaluations claiming that the corporate both received’t cancel their subscriptions or that the subscription exhibits cancelled, however nonetheless fees them month after month.

Are these gross sales in error categorized as recurring income? If I make and cancel a subscription in January, however then get billed in error one time in my lifecycle in February and/or March, have I became a recurring buyer? I’m undecided.

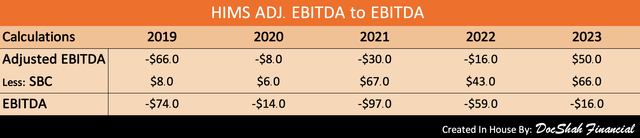

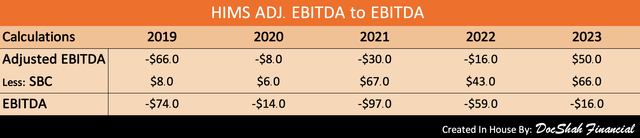

Adjusted EBIDTA… *sigh

HIMS Adj. EBITDA vs. EBITDA (DocShah Monetary )

One of many huge issues with adjusted EBITDA is that it consists of stock-based compensation. Due to this fact, the upper SBC is, the upper adjusted EBITDA is, and alas the issue begins to develop into apparent: the extra you improve SBC, the extra profitability you painting.

Does this dynamic precisely illustrate a enterprise’ profitability? If we settle for that SBC is an expense to shareholders (which it’s), then how does one logically reconcile rising a value (SBC) will increase your revenue (adjusted EBITDA)?

One can’t as a result of it is not sensible.

So, we’ve to take away SBC in an effort to convert from adjusted EBITDA to EBITDA. So far as the shareholders are involved, it is evident that Hims remains to be producing destructive EBITDA, as these earnings are offset by administration’s ever rising compensation.

By the best way, in case you’re questioning, adjusted EBITDA primarily serves as an analysis metric in non-public fairness, somewhat than for public shareholders searching for to precisely assess future money flows. Whereas Hims is perhaps extra accustomed to that realm, I consider emphasizing free money movement as a substitute of adjusted EBITDA of their earnings calls could be extra helpful.

Dangers

Please perceive there are important dangers to investing in Hims and Hers Well being. The corporate has nonetheless not confirmed one full yr of profitability and there’s no assure it’s going to. Buyers have to be ready for the worst-case situation and miscellaneous dangers. I’ll contact on a number of vital ones beneath.

Low Barrier to Entry

The telehealth house is a aggressive surroundings and as such, first to market benefit might not maintain a lot significance. Many traders talk about the specter of Amazon stealing market share away from Hims. Whereas Amazon will surely be a competitor, the longer Hims continues to ship excellent buyer worth, the extra doubtless that risk turns into alleviated.

Enjoyable truth – my first ever article for Seeking Alpha was for Dick’s Sporting Items (DKS). It was additionally my largest ever place on the time ($25,000) and I keep in mind my dad pondering I used to be loopy, however I had completed the analysis and knew the inventory’s intrinsic worth. Again then, the inventory was hammered right down to $23 per share on fears Amazon was going to place them out of enterprise. It was absurd – you had an organization with 70 years of operations, constant EPS development, founder led (son led at that time), $164 million in money, and no debt – you may see where the stock price is now. Spoiler: it is nearly develop into a 10-bagger. The purpose of this anecdote is that Amazon doesn’t crush each enterprise it competes with simply because it is Amazon.

Regulation

Authorities regulation runs rampant within the healthcare business and can doubtless unfold to the telehealth business, which may considerably disrupt HIMS’ enterprise operations.

Inventory Based mostly Compensation

Extreme stock-based compensation dilutes shareholders from materializing future income after they [the shareholders] have made such important investments of time and capital.

Fad Picture

The corporate’s vibrant and cheerful branding might not translate properly in sustaining its effectiveness because it expands into completely different markets and demographics. In its current state, some might argue that its branding could possibly be perceived as overly informal for severe well being points.

Lawsuit

Hims may get sued in some unspecified time in the future, maybe for a psychological well being associated misdiagnosis. Relying on the small print of the case, it could possibly be expensive for shareholders. Hims distributes so many psychological well being prescriptions, it runs the danger of doubtless prescribing somebody or one thing in error.

10-Okay

For the corporate’s set of dangers, please click here.

Takeaway

Hims and Hers Well being is on the forefront of a major societal change going down. Up to now, the corporate has recognized, capitalized, and executed on this pattern and I anticipate that to proceed.

You have heard sufficient in regards to the financials and fundamentals. It is time to really be an astute investor and give attention to the underlying psychology of the issue Hims is fixing.

Millennials and Gen Z want healthcare, however not if it entails assembly one other human being in individual. This won’t change anytime quickly and up to now, Hims solves this dilemma higher than any competitor.

What’s essentially the most Millennial/Gen Z method I can finish this piece?

One thing one thing one thing *insert rocket emoji and shifty eyes emoji right here.