primeimages

Funding Thesis

Euroseas’ (NASDAQ:ESEA) inventory value is up 94 % within the final yr (as of March 18, 2024) and it just lately posted This autumn 2023 outcomes. Revenues have been $49.1 million, down 3 % from Q3 however up 14 % from This autumn 2022. EPS (diluted) was $3.56, down 23 % from the previous quarter – however up 24 % from This autumn 2022. The corporate reported a mean TCE of $29,266/day.

It declared a $0.60 dividend, which interprets to an annualized yield of seven.1 %, based mostly on its Feb 21 closing value of $33.59. ESEA has paid out dividends in seven of the final eight quarters, with a payout ratio within the 11-17 % vary. The This autumn dividend was 20 % increased than the earlier quarter.

The corporate has launched into a newbuild program, aiming to extend its TEU capability by almost 30 % throughout 2024. It would do that by buying seven newbuilds for its fleet this yr, one among which was the two,800 TEU Tender Soul. It was delivered and went straight into an 8-10 month TC at $17,000/d. The subsequent in line for supply—the equal-sized Leonidas Z—is already contracted by means of March 2026 at a day charge of $20,000.

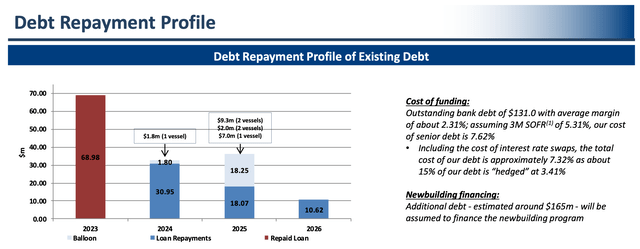

Nevertheless, to finance these newbuilds, ESEA expects to tackle a further $165 million in debt—greater than double its present debt.

When in comparison with its friends alongside elementary indicators, ESEA performs nicely.

Firm Overview

Euroseas, Ltd., is a NASDAQ-listed container shipper registered within the Republic of the Marshall Islands, with operational workplaces in Greece. Integrated in 2005, it owns 20 small containerships (13 feeders and 7 intermediate, with a mean TEU capability of about 3,000). Its most up-to-date fleet addition is the MV Tender Soul. ESEA took supply of this vessel on February 6, 2024, and it instantly commenced an 8-10 month constitution at $17,000/day (see earnings report, p. 1). Six extra feeder ships are on order; supply is predicted in 2024.

The Pittas household is ESEA’s main shareholder. By means of numerous funding automobiles, it wholly or partially controls at the least 58 % of the corporate’s shares (see its 2022 20-F submitting, pp. 76-77). Institutional traders are notably absent from the listing of main shareholders. Given its important possession stake within the firm, investing in ESEA can be a wager on the Pittas household’s motivations and incentives for warning.

Earnings Visibility

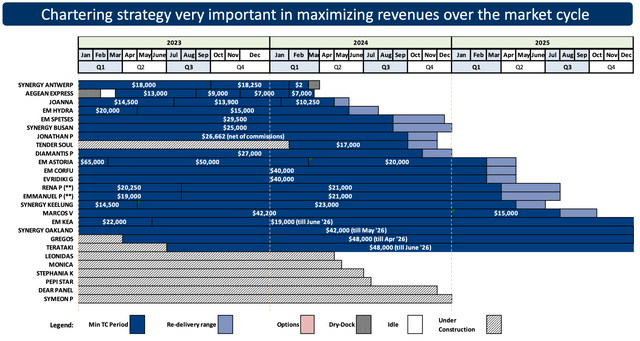

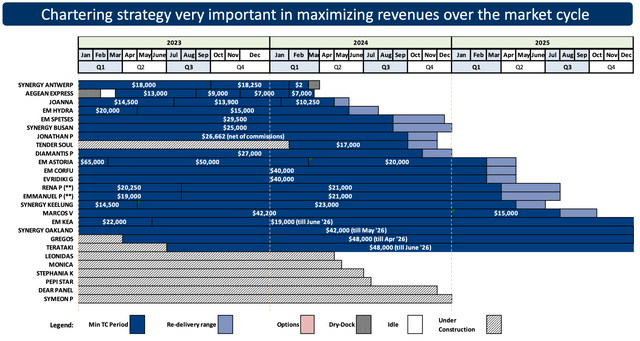

As of Feb 21, ESEA reported 71 % constitution protection for 2024:

Contract backlog as of Feb 21, 2024 (p. 7, This autumn 2023 presentation)

Moreover, ESEA announced on Feb 28 that its newbuild, the two,800 TEU Leonidas Z, will begin a 2-year constitution at $20,000/day upon supply.

The corporate was beforehand capable of repair a number of of its ships on extra prolonged contracts at fascinating charges. Take the Gregos, a 2,800 TEU feeder crusing at $48,000/day till 2026. The day charge growth of some of its different vessels illustrates market tendencies:

- The 1,732 TEU Joanna is all the way down to $10,250/d, in comparison with $14,500/d in early 2023.

- The two,788 TEU EM Astoria sailed at $65,000/d in early 2023, $50,000/d by means of 2023, and since March 2024, simply $20,000/d.

- The two,800 TEU Tender Soul, a brand-new vessel delivered in Feb 2024, was contracted at $17,000/d.

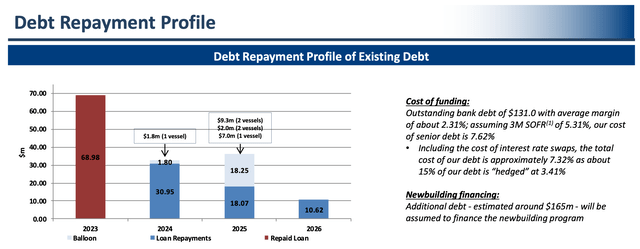

Debt Compensation Profile

p. 19 in ESEA’s newest presentation supplies an summary:

Debt compensation profile (This autumn 2023 presentation)

After repaying almost $69 million in 2023, ESEA is because of repay $33 million this yr. The essential half to notice is the “newbuilding financing” paragraph. ESEA carries $131 million in debt at present however assumes it’s going to draw one other $165 million – a 125 % enhance – as a part of its newbuilding program.

Fifteen % of its debt is hedged – at 3.41 % – leaving it uncovered to rate of interest fluctuations.

Dividend Coverage and Share Repurchase Program

As talked about above, ESEA has paid dividends in seven of the final eight quarters:

DPS and payout ratio, Q1 22 – This autumn 23 (In search of Alpha)

Earlier than this, the final time it paid dividends was in 2013.

The corporate initiated a $20 million share repurchase program in 2022. By February 21, 2024, it had expensed $8.2 million of these funds. Mentioned CEO Aristides Pittas, “We will continue to ensure that we properly reward our shareholders via dividends and share repurchases (..).”

(A notice on the damaged dividend streak: In search of Alpha and Euroseas personal “Dividend History” web page exhibits no dividend for Q2 2023. Nevertheless, the Q2 2023 press release on Euroseas’ web site refers to a dividend of $0.50 for the second quarter. I’ve chosen to stay conservative and current the seven clear dividends.)

Fleet Evaluate

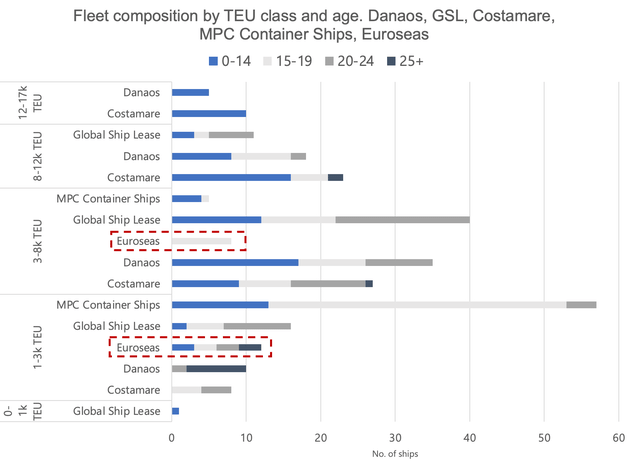

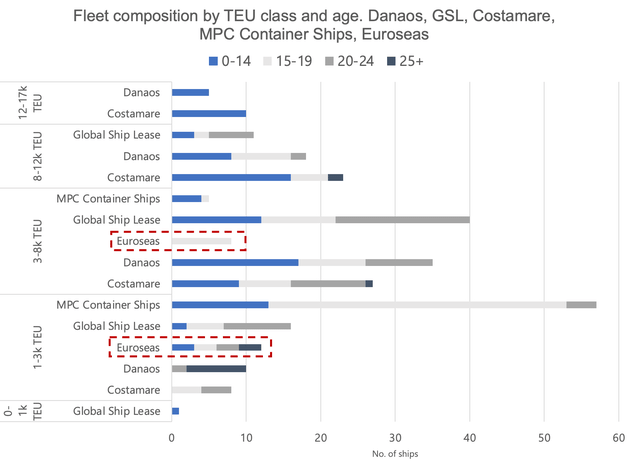

ESEA will probably be in comparison with its closest listed friends. Their fleets are a mixture of the smaller and bigger segments, however all have a presence within the feeder and intermediate segments.

- Danaos Corp. (DAC), which controls 68 container ships (and 7 bulkers)

- Costamare, Inc. (CMRE), which additionally controls 68 container ships (however 21 bulkers)

- World Ship Lease (GSL), which additionally(!) controls 68 container ships (however no bulkers)

- MPC Container Ships ASA (OTCPK:MPZZF), which controls 62 container ships.

Concerning ESEA’s fleet composition, it controls vessels in all age teams and, because the illustration under exhibits, focuses on the smaller segments.

Drawing a bell curve across the horizontal bars is sort of attainable, however MPZZF’s virtually singular focus will break the curve on the under 3,000 TEU class.

Fleet composition in comparison with closest listed friends (Creator’s calculations based mostly on fleet information pulled from firm web sites, as of March 17, 2024)

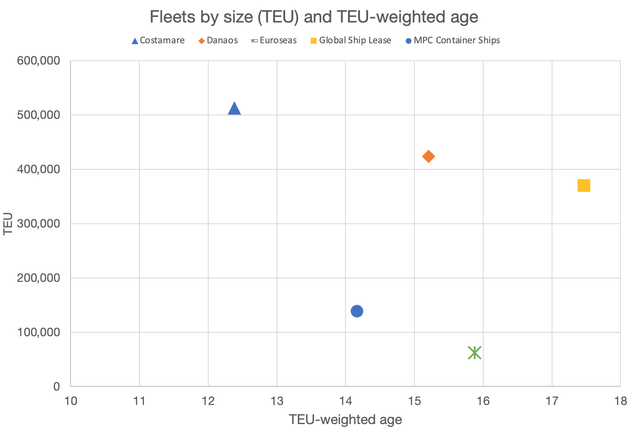

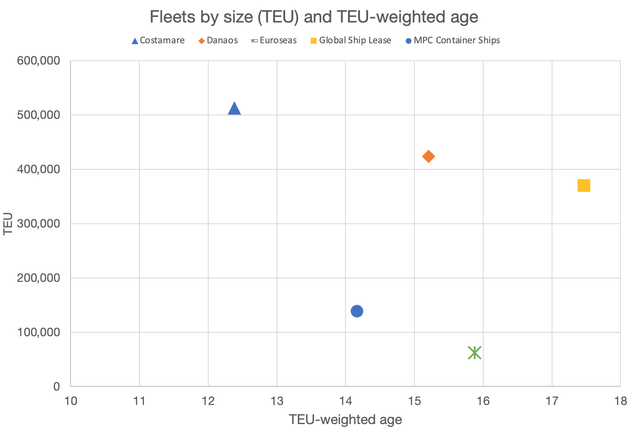

ESEA’s age profile is in the course of the pack. It’s a lot smaller than its friends (about one-ninth of Costamare’s). Evaluating ESEA’s fleet to its friends on a TEU-weighted foundation, the next picture seems:

Fleets by TEU and TEU-weighted age. Euroseas and closest friends. (Creator’s calculations based mostly on fleet information pulled from firm web sites as of March 17, 2024)

A fast simulation of the impact of introducing a further six feeder newbuilds exhibits that the TEU-weighted age of the fleet will go all the way down to 13.7 years by the top of 2024:

| TEU-weighted age on March 17, 2024 | TEU-weighted age on December 31, 2024 | |

| 20 vessel fleet: six extra newbuilds on order | 15.8 years | – |

| 26 vessels: all newbuilds delivered | – | 13.7 years |

This simplified evaluation assumes that every ship on the prevailing fleet on water was delivered in the course of the yr (June 15), newbuilds delivered in the course of the quarter of its introduced supply, and ESEA doesn’t promote any vessels throughout the yr.

Fundamentals

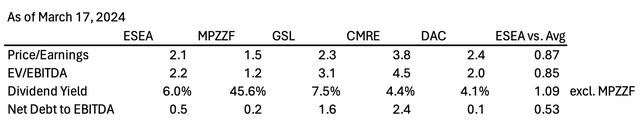

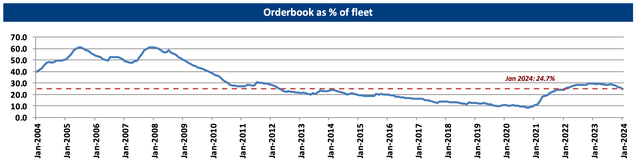

This part will examine Euroseas in opposition to its closest listed friends throughout the next metrics:

- Value/Earnings. An preliminary impression of its pricing in comparison with its friends

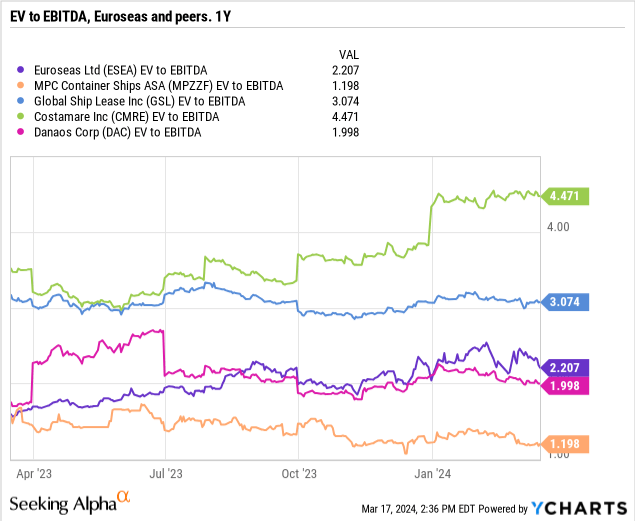

- EV/EBITDA. One other view of its pricing is evaluating its EBITDA to its enterprise worth.

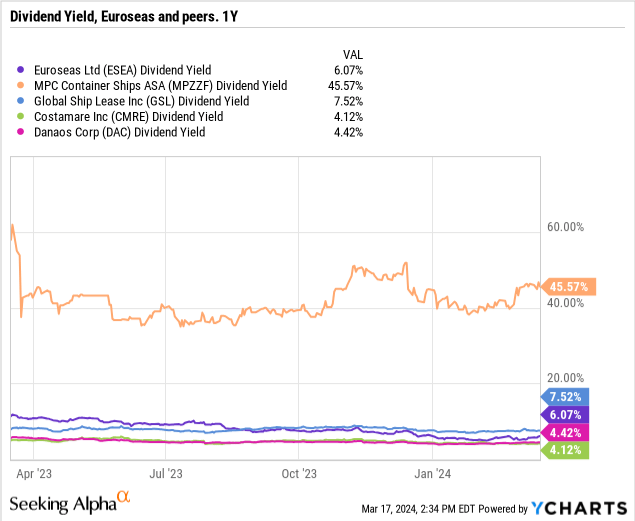

- Dividend Yield. Does it yield roughly than its friends?

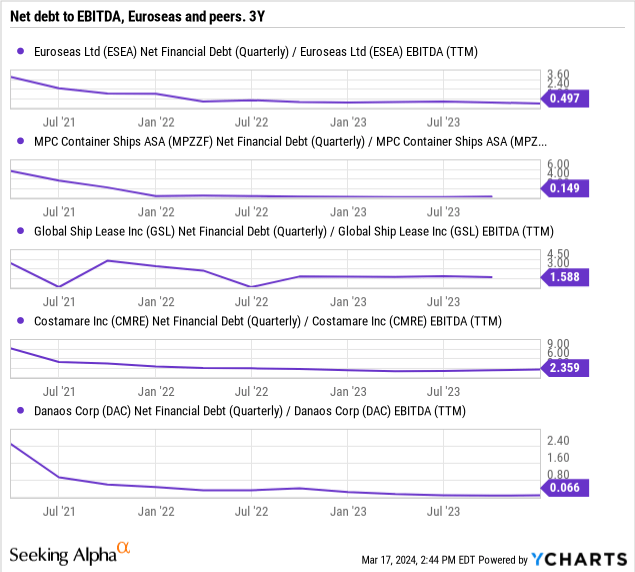

- Web debt to EBITDA (ttm). How is its debt load in comparison with its friends? How susceptible is the corporate to decrease charges?

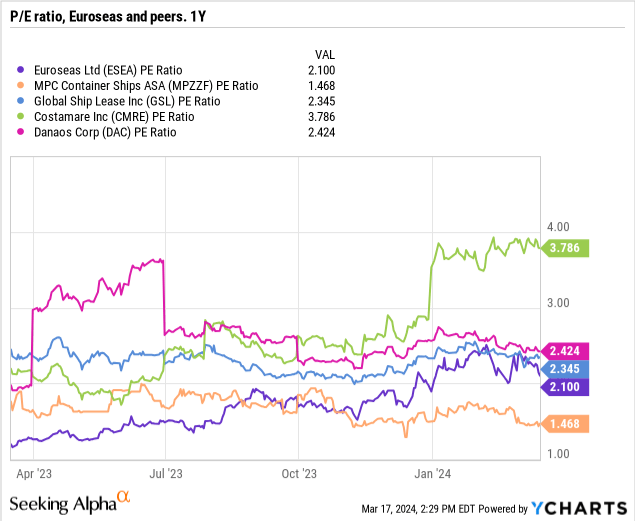

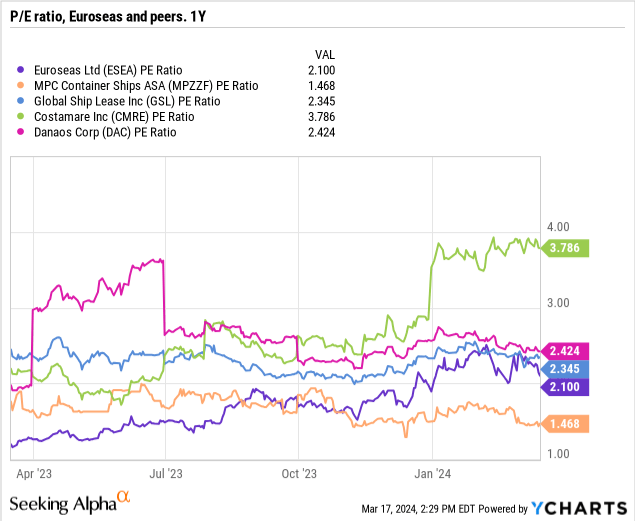

Value/Earnings

Euroseas has traded at a P/E near its friends for the previous yr. On this group, the exception is Costamare, which just lately went from lower than 3 to shut to 4 P/E. Costamare’s container fleet is principally on prolonged charters. Nonetheless, it additionally has a big publicity to the dry bulk market. Thus, one clarification might be the Baltic Dry Index’s rise from a trough of about 1,300 in mid-January to m 2,300 in mid-March.

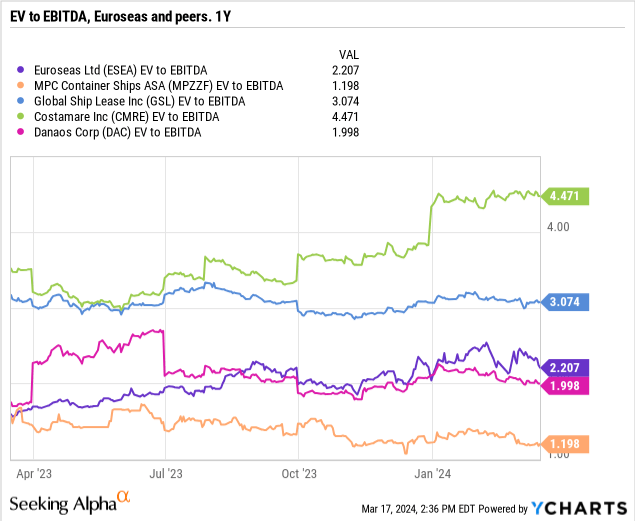

EV/EBITDA

Once more Euroseas is in the course of the pack. Concerning Costamare, the impact of dry bulk charges can be related right here.

Dividend Yield

Euroseas and its friends have yielded between 4 and eight % for the previous yr. The exception is MPZZF, which has been working very excessive dividend yields for a while.

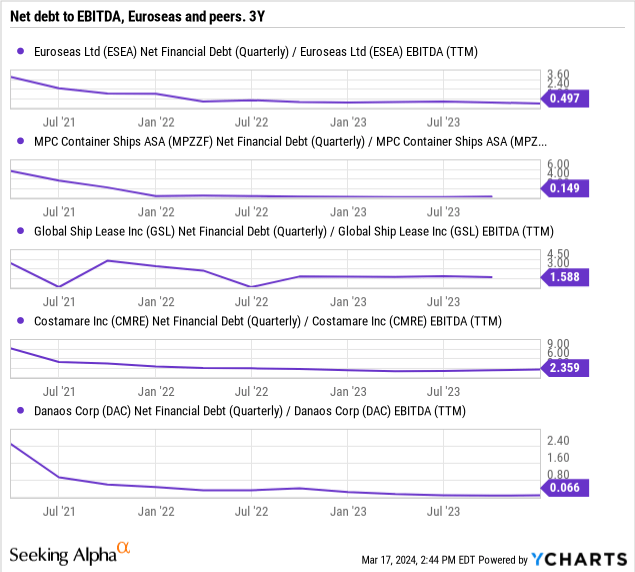

Web Debt to EBITDA

All 4 firms have adopted the acquainted deleveraging journey many if not most, firms inside delivery have been on throughout the previous few years. It is unprecedented to be web money in a capital-intensive business, which is the case for Danaos Corp. It has virtually no debt.

Euroseas is just a bit behind compared utilizing this metric, having traded at lower than 1x EBITDA for the higher a part of a yr.

Even Costamare, at a comparatively excessive ratio of two.4 on this peer group, is presently at low ranges traditionally.

The desk under summarizes these figures. ESEA is barely cheaper than the common of this peer group as measured by P/E and EV/EBITDA.

Abstract of valuation indicators (Creator’s work based mostly on YCharts graphs proven above)

Its dividend yield is barely above common (MPZZF has been excluded as its dividend yield has been very excessive. For my part, it’s not consultant and sustainable). Lastly, its web debt load is decrease than common.

In conclusion, this elementary evaluation exhibits that Euroseas performs nicely when in comparison with its friends.

Market Outlook

On January 18, ESEA presented at New York-based Capital Hyperlink’s “Corporate Presentation Series,” the place it mentioned the market outlook extensively. It famous that whereas TC charges for its related segments (1,700-4,400 TEU) have come down since their pandemic peaks, charges are nonetheless above 2019 ranges. The pandemic charges allowed shippers to enter lengthy TC contracts, guaranteeing wholesome money flows into 2025. Nevertheless, the worldwide order e book ballooned concurrently regardless of uncertainties concerning future propulsion programs.

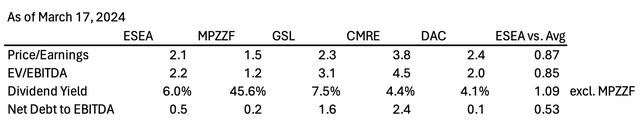

Order E book: The Worst in Years

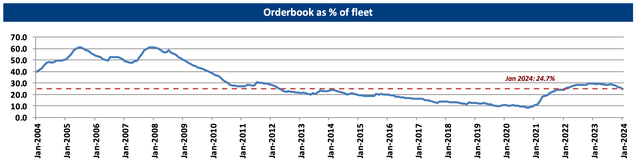

This dynamic has precipitated the worldwide order e book (all ship sizes) to rise to just about 30 % of the fleet. It has since come down to only below 25 %. A degree not seen in about ten years:

World order e book as a share of fleet, 2004-2024 (ESEA Capital Hyperlink presentation (utilizing Clarkson’s Analysis as their supply))

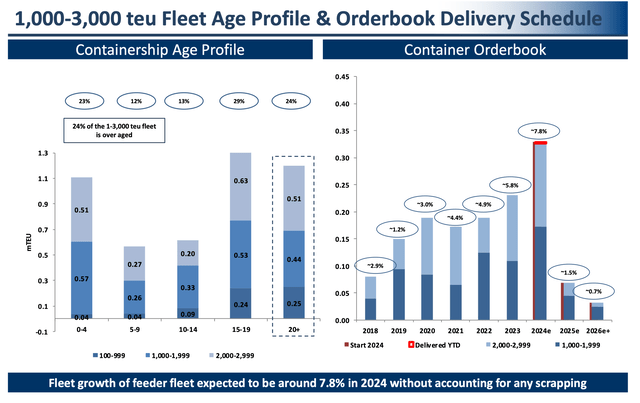

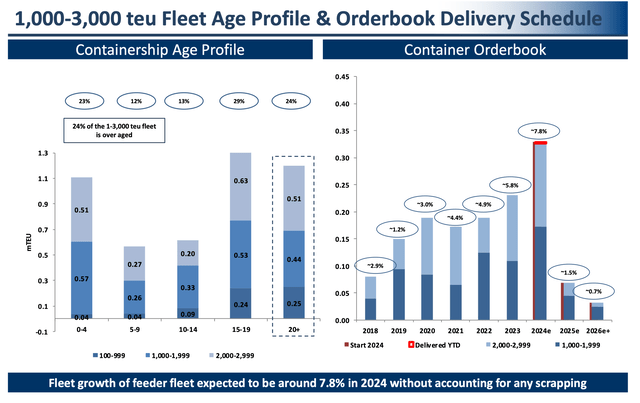

ESEA’s core feeder phase seems to be considerably higher however remains to be its worst in years, as measured by the brand new provide approaching water. With none scrapping, the feeder fleet will develop by almost 8 % this yr:

Feeder age profile and order e book supply schedule (ESEA Capital Hyperlink presentation (utilizing Clarkson’s Analysis as their supply))

The truth that many feeder ships are previous (one in 4 ships are 20 years or older) could assist, however uncertainties concerning future propulsion programs stop house owners from ordering as many ships as they in any other case would have. Additionally, simply because a ship is 20 years or older doesn’t routinely imply scrapping.

The market provide as a complete additionally needs to be taken under consideration. In response to the identical presentation, TEU provide throughout all containership lessons will develop by greater than 11 % this yr, a lot increased than in 2023 (8 %), which was nonetheless excessive. Particular person segments don’t exist in isolation: Whereas a mega ship of, say, 14,000 TEU serves a unique objective than an intra-regional feeder of 1,000 TEU, the identical clear distinction can’t essentially be made between a 2,800 feeder and a 4,000 TEU intermediate ship. It is in the end all related. However, the feeder phase seems to be extra promising than the remaining.

Commerce Progress: Not Sufficient to Soak up Added Provide By Itself

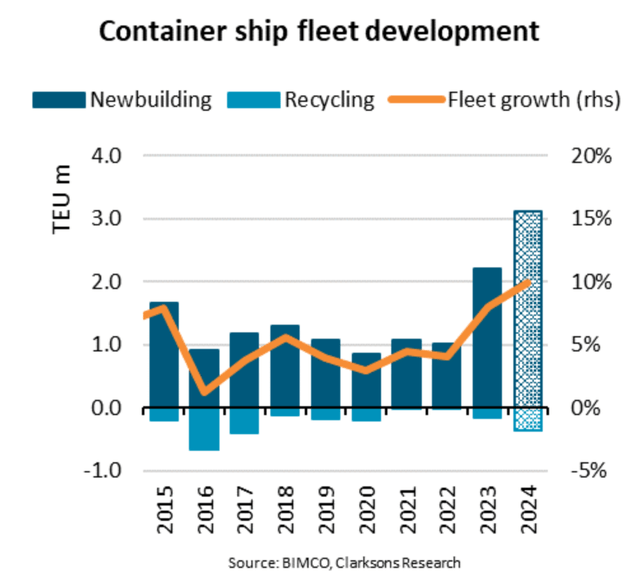

BIMCO reported soberingly on January 10, 2024, that – throughout all segments –

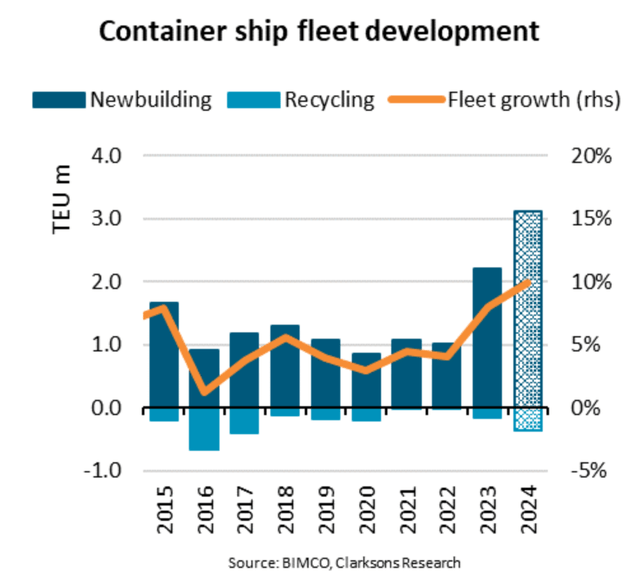

As soon as all of the ships have been delivered [this year], the container fleet capability can have grown by 10%. Nevertheless, the container trades are anticipated to develop considerably slower. We forecast that the rise in container volumes will enhance the demand for ship capability by 3-4% in 2024.

The anticipated enhance in container volumes this yr aligns with ESEA’s message in its presentation (see p. 11). There, it reported an anticipated commerce progress and GDP progress of 3-4 % in 2024 and 2025.

Recycling exercise was very low in 2021-2023 and isn’t anticipated to select up a lot this yr:

BIMCO fleet growth forecast 2024 (BIMCO, Clarksons Analysis, cited in Container Information [March 17, 2024])

Is the World De-Globalizing?

The Russian invasion of Ukraine and the Houthi’s assaults on delivery within the Bab al-Mandab, thereby stopping using the Suez Canal, are two main world occasions which have altered delivery routes.

Nevertheless, trends in worldwide commerce are additionally an element.

Mainlane East-West commerce volumes, largely pushed by “western” economies, are anticipated to be 1.6 million TEU decrease in 2023 than in 2019; although the eastbound Transpacific has gained 2.3 million TEU, solely 100,000 TEU has been added to the westbound Asia-Europe commerce, while Transatlantic, and backhaul volumes from North America and Europe to Asia, have shrunk. Quantity progress has been focussed on commerce involving creating economies.”

In different phrases, much less world commerce is transferring East to West than earlier than. U.S. imports from Asia over the Pacific are growing, nevertheless it’s sending little again on the return. At a fundamental degree, this development implies that provide chains will probably be extra dispersed: Extra international locations and ports will probably be concerned, thus requiring smaller ships. This might imply that intermediate and feeder ships will play a extra crucial position as we advance.

Conclusion

This text has supplied an in-depth overview of Euroseas, Ltd. It has thought-about its possession construction, debt compensation profile, and fleet. It has additionally been in comparison with its closest listed friends utilizing commonplace valuation metrics for dividend shares. This has revealed an organization that performs nicely in comparison with its friends and has been capable of pay constant dividends for 2 years. Lastly, the market outlook was mentioned. Whereas there are constructive indicators available in the market, the excessive degree of uncertainty and sizeable world order e book weighs on the business’s prospects. Finally, this resulted in a Maintain suggestion.