On Monday, Peruvian gold miner Nilam Assets, Inc. (OTC PINK: NILA) has announced its intention to accumulate a staggering 24,800 Bitcoin (BTC). The strategic initiative comes through a Letter of Intent (LOI) with Xyberdata Ltd, setting the stage for the acquisition of 100% of the widespread inventory of MindWave, a particular function entity to be established in Mauritius for holding the digital property.

Following The Saylor Playbook

This important shift in the direction of digital asset funding by Nilam Assets includes the issuance of a newly licensed Most well-liked Class of Sequence C Inventory, provided in change for the Bitcoin at a reduction relative to present market costs. With the transaction, Nilam goals to safe digital property exceeding one billion {dollars} in worth, underpinning a broad strategic milestone for the corporate in its pursuit of diversification and innovation.

Pranjali Extra, CEO of Nilam Assets, Inc., underscored the strategic significance of the transaction, stating, “The Company and team have been working diligently over the last several months to finalize all agreements and due diligence necessary to proceed to a legally binding Letter of Intent (LOI).”

The collaboration with Xyberdata and the institution of MindWave in Mauritius is a part of Nilam’s strategic imaginative and prescient to harness the potential of Bitcoin. These property will serve not solely as a big addition to the corporate’s portfolio but in addition as collateral to lift capital for funding in high-yield producing tasks.

This transfer aligns with NILA’s broader aims of fostering a finance ecosystem that’s inclusive, sustainable, and outlined by transparency, innovation, and sustainability. “We prioritize clear communication, embrace cutting-edge ideas, and invest in projects with enduring social and environmental impact,” added Pranjali Extra.

The acquisition phrases and additional strategic particulars are anticipated to be specified by subsequent definitive agreements. The completion of this acquisition will see MindWave turning into a completely owned subsidiary of Nilam Assets, with MindWave shareholders exchanging their fairness curiosity for the newly issued Most well-liked Inventory (Class C).

This class of inventory will entail conversion rights upon an inventory on NASDAQ or one other nationwide change, amongst different liquidity occasions, signaling a big future milestone for Nilam Assets within the public monetary markets.

Bitcoin Neighborhood Reacts With Doubts

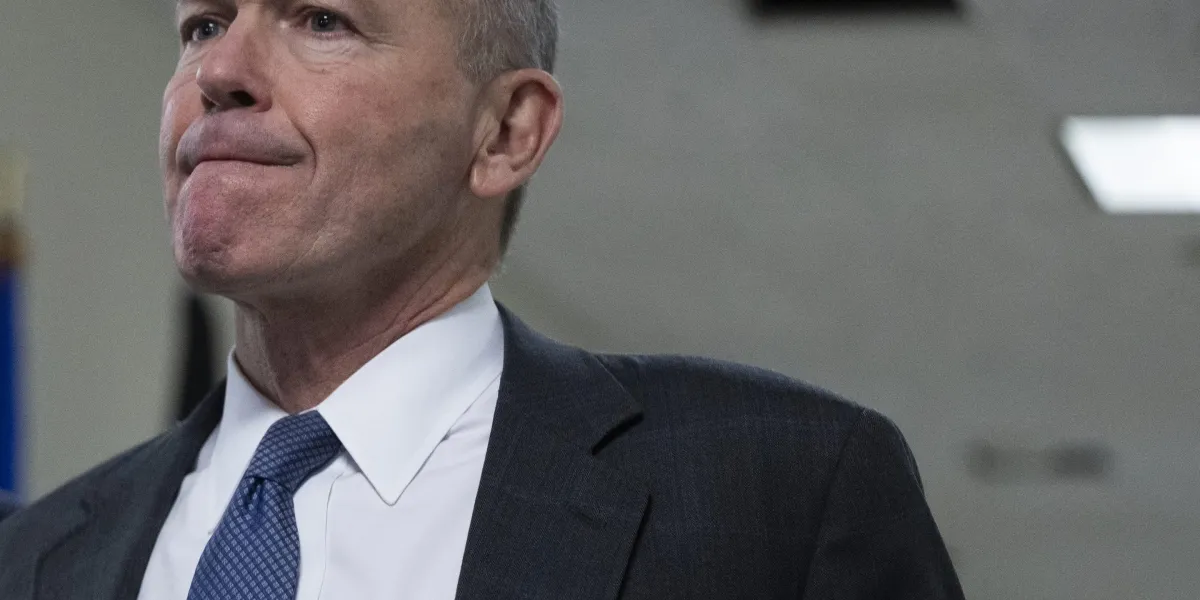

Nonetheless, the announcement has been met with skepticism and warning by a number of notable figures inside the Bitcoin neighborhood. Matthew Sigel, Head of digital property analysis at VanEck, hinted at Nilam’s strategic inspiration, stating, “IN SAYLOR HE TRUSTS –>MOGO, $50M market cap payments company, which owns 13% stake in crypto exchange WonderFi (WNDR CN, mkt cap $180M) announces plans to add Bitcoin to company treasury.”

Tuur Demeester, a revered Bitcoin OG and analyst for Adamant Analysis, expressed his reservations extra bluntly: “I removed my tweet about that gold explorer buying 24k BTC, after a commenter pointed out that it’s indeed a stunt from a dying penny stock (market cap of $5M). Perhaps it’s a harbinger of what will come, but this, indeed, is _not_ huge news.”

This sentiment displays a broader skepticism in regards to the motivations behind Nilam’s pivot to Bitcoin, questioning the solidity of the corporate’s monetary technique.

Criticism additionally got here from @hodlonaut, who voiced issues in regards to the nature of the transaction and the strategies Nilam may make use of to safe the funds for such a big buy, stating, “Not sure what type of fiat abomination NILAM is, or what type of accounting voodoo they intend to deploy to raise the funds, but I do know they want 24,800 btc and that there will never be more than 21M. A storm is brewing.”

Bitcoin analyst Dyan LeClair added that MOGO is a microcap OTC inventory, “so this can only work if there is demand for the equity sale. A letter of intent is one thing, actually executing is another. Likely flops, and is for PR purposes. On the contrary, we live in meme world, who knows what happens.”

At press time, BTC traded at $70,316.

Featured picture created with DALL·E, chart from TradingView.com