The U.S., Japan, South Korea and Taiwan are on a mission to restructure the worldwide chip provide chain. The proposed “Chip 4 Alliance” desires to internalize all components of the semiconductor enterprise—analysis and growth, design, manufacturing, packaging, gross sales and consumption—in-house. This chip clique will solely attain outdoors the circle in strictly managed circumstances.

These 4 economies represent virtually the entire global semiconductor industry, accounting for 82% of the worldwide market share, and 74% of the semiconductor international worth chain with 84% of chip design. They collectively occupy a 77% share available in the market for manufacturing tools and as excessive as 99% for memory chips. Thus, the Alliance is extra than simply cooperation and coordination: What these 4 governments decide will form the worldwide market.

However the Chip 4 Alliance raises a important and complex query: Can nations management manufacturing and handle commerce for a product outlined by innovation and competitors?

If they’ll, we’re one thing very new: an OPEC-style cartel for the digital age.

To the extent that collaborating members within the Chip 4 Alliance promise to manage their respective home semiconductor industries in a coordinated approach, and orient their companies in a sure route, this endeavor might introduce one thing akin to a state-owned enterprise, operated collectively and managed multinationally.

Put bluntly, the 4 Alliance members can lay out, in the long term, which corporations do what, who produces components and supplies, how they’re sourced, and the place chips are distributed and offered. They can even align their R&D, monetary assist, and incentives. The chip sector will function government-arranged monetary assist, on-going governmental affect, public-private joint enterprise planning, and public mandate fulfilment.

That is none aside from a widely known recipe for SOEs, a subject which took heart stage in latest commerce agreements corresponding to the Indo-Pacific Economic Framework (IPEF), the Complete and Progressive Settlement for Trans-Pacific Partnership (CPTPP) or the United States-Mexico-Canada Agreement (USMCA).

Economists have lengthy argued that enterprises beneath the route or oblique management of the federal government sap financial effectivity and hamper market competitors.

It’s thus ironic {that a} new scheme for the worldwide semiconductor business may create a brand new kind of SOE: the “multinational SOE,” distinct from the nationwide SOEs focused by by latest laws and funding agreements.

If key choices of the semiconductor companies of the 4 members are made on the request (if not route) of respective authorities businesses, these companies are presumably set to be a brand new breed of state enterprise for the digital age.

What’s extra, if their enterprise choices are coordinated and orchestrated by the pool of governments—whether or not an alliance, community or every other title—they are going to be just about beneath the collective management of the collaborating governments.

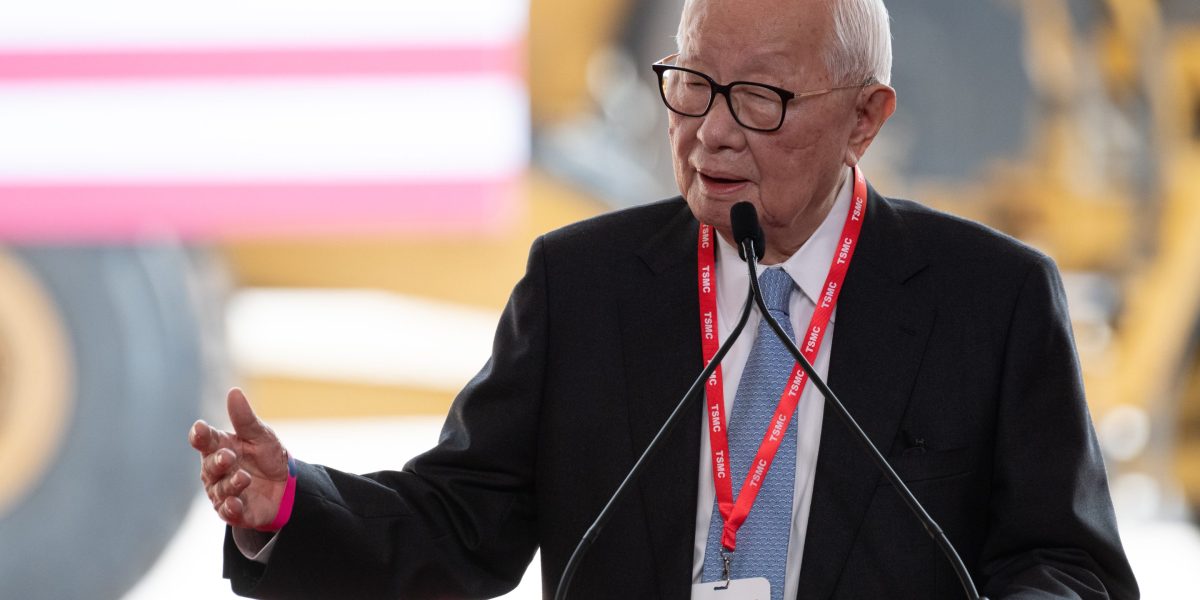

Contemplate, for instance, TSMC’s resolution to construct fabs in Phoenix, Arizona and Kumamoto, Japan, or Samsung’s new fab in Taylor, Texas. These places don’t provide the identical advantages as TSMC’s residence of Taiwan, or Samsung’s residence of Korea: less expertise, higher costs and extra troublesome regulations. Why, then, did these chip giants determine to spend money on the U.S. and Japan? Geopolitics is one apparent risk.

Granted, the Chinese language chip business has additionally acquired a large quantity of economic assist from each central and native governments. Beijing raised a semiconductor fund within the quantity of $19 billion in 2014 and $27 billion in 2019, respectively. It’s now planning to lift a brand new fund of $41 billion. Clearly quite a lot of Chinese language chipmakers could be referred to as SOEs.

But endeavors just like the Chip 4 Alliance danger making a behemoth to struggle a behemoth. One aspect might win in opposition to the opposite—then might wither due to stifled innovation and competitors.

For chip corporations, this complete plan is a Catch-22. In the middle of restructuring the worldwide provide chain, chipmakers are inspired, if not pressured, to debate coordinating enterprise actions with their counterparts. This line of shut session reveals the Achilles’ heel of world firms: the online of competitors guidelines and antitrust sanctions in varied states.

Members of the Chip 4 Alliance would possibly downplay their competitors guidelines, however non-participating governments, just like the European Union, China, or others, would possibly suppose in any other case after they really feel short-changed from a brand new provide chain.

Semiconductors are simply probably the most high-profile space the place nations are utilizing friendshoring to shift away from “countries of concern.” But if these insurance policies develop into the norm, then the worldwide system may find yourself with a lot much less competitors and far much less innovation—dominated by a brand new breed of state-owned enterprise.

Jaemin Lee is at the moment Professor of Legislation at College of Legislation, Seoul Nationwide College in Seoul, South Korea. His main areas of educating and analysis are worldwide financial legislation and worldwide dispute settlement.

The opinions expressed in Fortune.com commentary items are solely the views of their authors and don’t essentially mirror the opinions and beliefs of Fortune.