scalatore1959/iStock by way of Getty Pictures

Overview

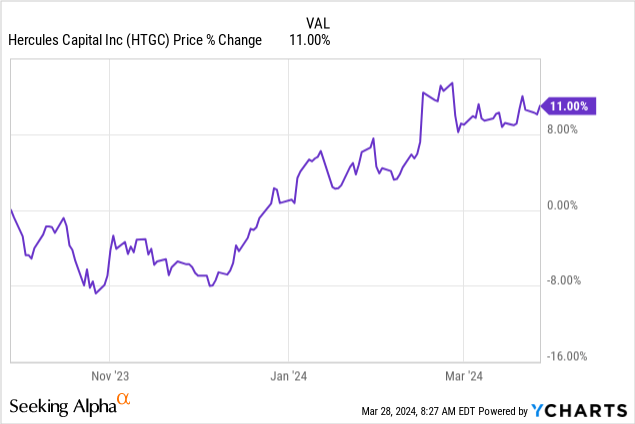

I previously covered Hercules Capital (NYSE:HTGC) again in August of 2023. Since then, HTGC has delivered a complete return of over 13% as a result of constant NII (internet funding earnings) development and excessive dividend distributions. The value has run up over the past 6 months and now the dividend yield sits round 8.7%. Though the value has run up, I’m upgrading my score to a Purchase at these ranges. The value trades at a big premium to NAV (internet asset worth) for the time being however I plan to proceed rising my place to snowball my dividend earnings.

I’ve coated a ton of BDCs (enterprise growth corporations) this month however I can simply say that HTGC stands out from the gang. Their portfolio and technique have confirmed efficient and administration continues to drive outcomes. The indications of portfolio development have been nice and elevated ranges of profitability have resulted in a number of supplemental dividend funds.

The fed are anticipated to start out slicing charges within the second half of 2024. Though I personally imagine we’ll see very gentle cuts, I imagine that HTGC is properly suited to thrive no matter any rate of interest cuts. Historical past has proven us that they’ve thrived in a close to zero charge atmosphere and for my part, their robust portfolio and funding technique will proceed to help and drive development transferring ahead. Due to this fact, I’m upgrading my score to a Purchase, at the same time as the value is nearing all time highs.

Portfolio

HTGC’s portfolio is generally comprised of debt investments and a warrant portfolio. Most of you’re aware of debt investments because the loans or debt that Hercules offers to their portfolio corporations. They gather curiosity on this debt which go in direction of the overall NII obtained. Their debt investments include 125 portfolio corporations with funding sizes ranging wherever between $5M to $200M with a complete value foundation of $3.06B. The efficient yield of their debt funding portfolio is 15.3%.

Alternatively, warrants are notes that give the holder the correct to purchase an actual variety of shares of an organization’s inventory at an agreed upon value. This portion of HTGC’s portfolio is far smaller with a good worth of $186M however I really feel that it is worthy of mentioning as a result of administration appears to be attempting to develop this space of the portfolio. It appears as if the warrants have been issued alongside the debt funding portfolio to function a further supply of return that may contribute to the overall funding earnings. The warrant portfolio comprises 103 corporations and fairness holdings inside 74 corporations.

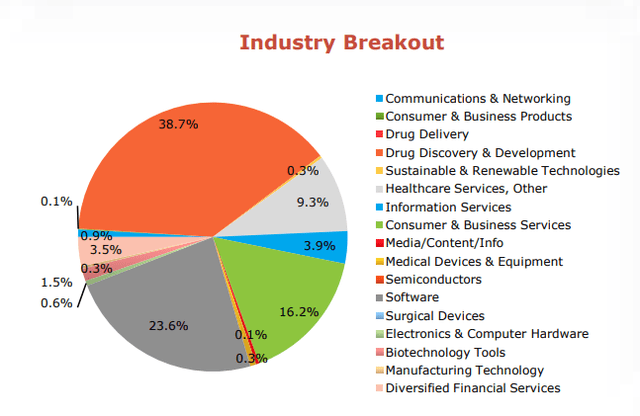

I additionally like that the portfolio is various in business with a significant focus in healthcare & pharma in addition to IT companies, software program, and tools. Not solely is the portfolio various in business however they’re additionally various in area. Nearly all of the portfolio corporations are primarily based inside the western area of the USA, making up 47% of the publicity. They’ve a 27% publicity to the northeast area of the US in addition to worldwide publicity making up 11%.

About 84% of the portfolio is classed as senior secured 1st lien debt and eight.4% of the portfolio is taken into account senior secured 2nd lien debt. Fairness investments make up about 5% of the portfolio whereas the beforehand talked about warrant positions are solely a small 1% of the overall portfolio make-up.

Technique & Curiosity Charges

Funding returns might be maximized right here as a result of HTGC is internally managed. Which means HTGC solely pays its precise working prices and nothing else, versus externally managed BDCs that should dish out price bills to a separate funding advisor. This idea might sound easy however it could possibly severely affect the BDC’s efficiency. For instance, check out Prospect Capital (PSEC) which is externally managed and a inventory I recently covered. Which means HTGC isn’t incentivized to develop charges as the overall quantity of belongings below administration grows.

Hercules focuses on pre-IPO and M&A (merger & acquisition) enterprise capital backed corporations which have demonstrated excessive ranges of development. Roughly 96% of their debt funding portfolio is comprised of floating charge loans. Extra importantly, these floating charge loans have rate of interest flooring which implies that there’s a restrict in place on how low these charges can go. This affords nice draw back safety towards the sensitivity to rate of interest cuts.

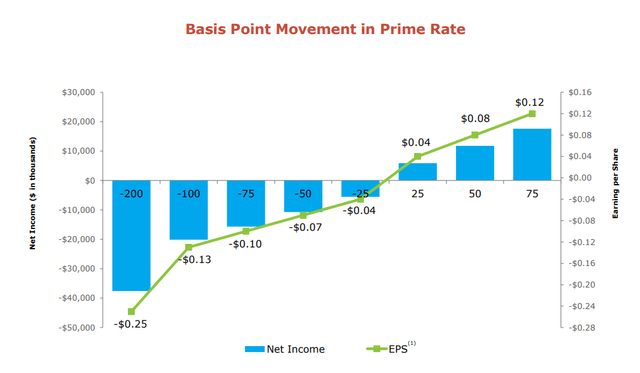

We will see a visible of how rates of interest might affect internet earnings and EPS. Nobody is aware of how a lot the Fed will decrease rates of interest nevertheless it look like they’re staying cautious to see how the labor and employment market performs out. They’re now anticipated to have fewer charge cuts. Due to this fact, I feel average charge cuts round -50 foundation factors is a good ball park space to count on. A -50bps drop would lead to an estimated drop in EPS/NII by -$0.07 per share.

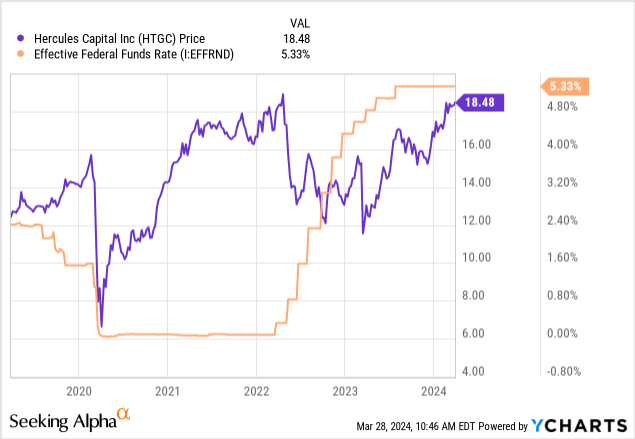

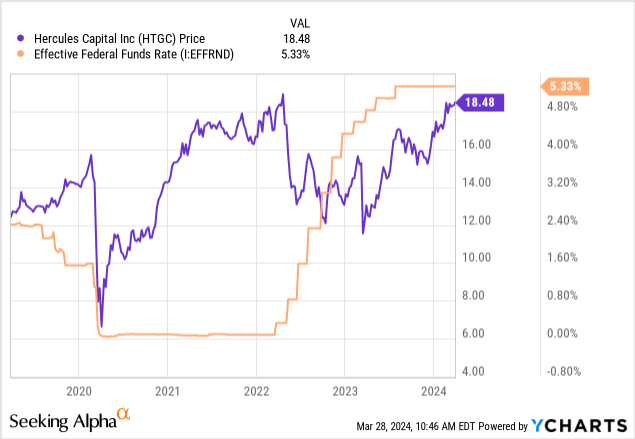

Nevertheless, I need to level out that all through a time interval the place charges have been close to zero, HTGC nonetheless managed to thrive. We will see the inverse relationship between value and the federal funds charge. As charges have been reduce close to zero, the value of HTGC took off. Whilst charges began to rise, the value got here down a bit earlier than accelerating again up once more as a result of elevated ranges of NII.

Financials

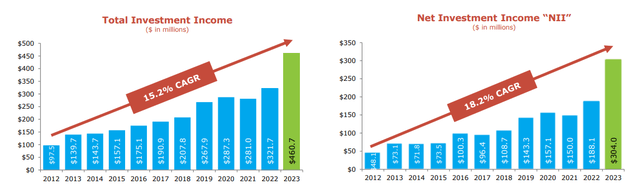

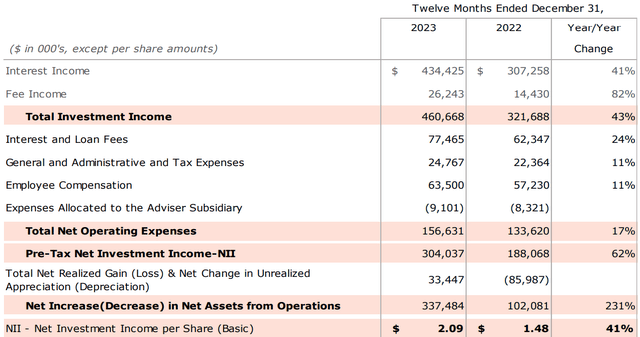

Crucial metric right here is the NII (internet funding earnings) reported. Throughout the newest Q4 earnings report, NII was reported at $0.56 per share. This closed off their fiscal yr 2023 with a complete internet funding earnings of $304M. This represents a powerful development of 61.7% yr over yr! HTGC has actually capitalized off the upper rate of interest atmosphere and have discovered a method to reward shareholders handsomely.

Trying on the complete funding earnings over the past decade, we will see that complete earnings has grown at a CAGR (compound annual development charge) of 15.2%. As well as, the overall NII has grown at a CAGR of 18.2% over the identical time interval. This development has helped administration obtain a liquidity degree of $744M out there to speculate.

We will additionally see how there’s a complete yr over yr development of NII per share of 41%. For comparability, listed here are among the NII development metrics of related peer BDCs:

- Trinity Capital (TRIN): 25.6% YoY enhance in NII.

- Ares Capital (ARCC): $707M complete funding earnings & 10.5% YoY growth.

- Predominant Road Capital (MAIN): 13.5% YoY complete funding earnings growth.

Commitments have grown persistently greater yr over yr. For the shut of fiscal yr 2023, the overall mortgage commitments was about $17.3B compared to the prior years $15.7B. It is value highlighting that since inception in 2005, there hasn’t been a single yr the place commitments have decreased decrease than the prior yr. Simply so as to add context, new commitments are nice as a result of they imply {that a} regular earnings stream can go in direction of financing HTGC’s debt funding portfolio corporations. As well as, it could possibly assist propel development inside the portfolio and additional enhance the degrees of earnings produced inside.

Danger Profile

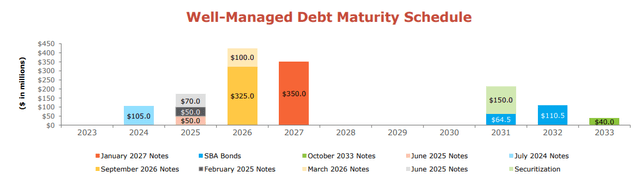

Their debt investments have a brief time period maturity horizon that sometimes sits between 36 – 48 months. As well as, there debt maturity schedule does have a sizeable quantity of notes due in September of 2026 and January of 2027. Nevertheless, that is far out and administration has loads of time to develop their portfolio with further mortgage commitments. As beforehand talked about, they’ve $744M in liquidity as a cushion.

As well as, HTGC at present has stable funding grade rankings from Fitch and Moody’s.

- Fitch: BBB-

- Moody’s: Baa3

I count on rate of interest cuts to be gentle and inside the vary of -50bps. If this occurs, HTGC is properly suited to proceed delivering robust NII outcomes on this atmosphere. Nevertheless, I could also be incorrect and charge cuts might occur extra aggressively than I anticipate. If that is so, NII could also be affecting extra unfavorable than anticipated and affect NII. Because of this, the supplemental dividends are more likely to decelerate or cease altogether. Up to now although, there aren’t any indications of slowing NII development and the money readily available is a lot at hand any future money owed due.

Dividend & Valuation

As of the most recent declared quarterly dividend of $0.40 per share, the present dividend yield is 8.7%. NII was reported at $0.56 per share which implies that the dividend protection right here is roughly 140%. This can be a large margin of security and the additional money circulation is among the causes that the fund has been capable of challenge a number of supplemental dividends. The most recent supplemental dividend was within the quantity of $0.08 per share and was issued at first of March. This follows a previous supplemental dividend declared again in October of 2023 and a previous raise of two.6% in August of 2023.

The dividend development has been spectacular for an already excessive yielding asset. During the last 5 yr interval, the dividend has grown at a CAGR of 5.10%. Zooming out to an extended time horizon of 10 years, the dividend has nonetheless grown at a CAGR of three.36%. That is completely acceptable for a BDC that has a 4 yr common dividend yield of 12.84%. The rise in share value considerably lowered the yield however there was as soon as a time is current historical past the place you might’ve snagged shared with a yield above 15%.

Hercules trades at the next premium to NAV than traditional. Because of this, many are opting to remain on the sidelines for higher entry and I do not blame them! Nevertheless, I imagine that it’s important to pay for high quality. The value at present trades at a premium to NAV over 60%. For reference, the average 3 yr premium is 43.22%. We noticed the premium attain as excessive as 75% on the peak of 2022 and as little as a reduction of -34% within the crash of 2020.

Though I don’t imagine we’ll see shares of HTGC commerce at a reduction once more anytime quickly, I do assume we may even see a slight value lower when charges are lowered. Nevertheless, HTGC’s portfolio is properly suited to maneuver these charge modifications as beforehand talked about, so I’m not involved. As well as, if we stay in an atmosphere the place the common rate of interest is greater, this could be an ideal factor for BDCs like HTGC as a complete. A better rate of interest interprets to greater profitability metrics from the debt investments for the reason that portfolio is generally comprised of floating charges.

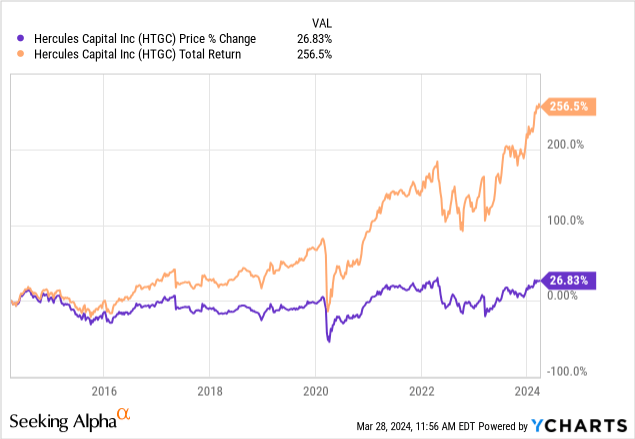

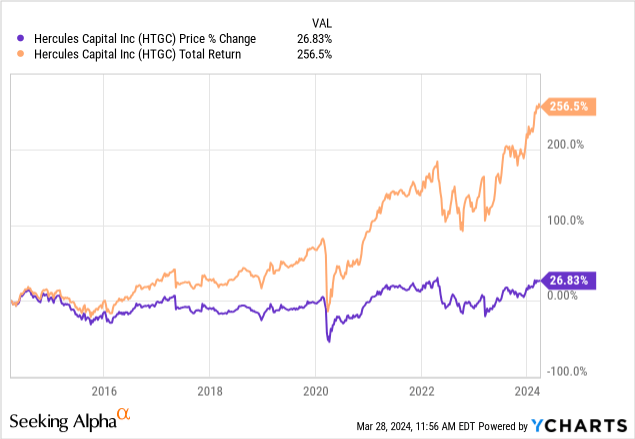

The value motion right here issues a bit much less to me as HTGC can proceed to ship constant excessive yielding dividend earnings. During the last decade, the value has solely appreciated by 27% whereas the overall return is above 256%. That is as a result of continued excessive distributions and I think about that the majority traders that proceed to carry HTGC additionally prioritize constant earnings over value appreciation. Because of this I’m upgrading my score to a Purchase and plan to proceed constructing my place and amassing regular dividend funds.

Takeaway

Hercules Capital stays a high tier BDC that continues to develop internet funding earnings over time whereas delivering a excessive degree of dividend earnings. The value has run up lately and the present premium to NAV sits above 60%. Nevertheless, after taking one other have a look at their development, portfolio, and mortgage commitments, HTGC stays a high choose to experience out the longer term rate of interest modifications. Their portfolio is various throughout totally different areas and industries and subsequently mitigates any kind of focus danger.

The whole return of HTGC has been stellar regardless of the mediocre value enhance. Nevertheless, traders do not sometimes add BDCs to their portfolio for value development. As a substitute, we deal with the earnings that HTGC can proceed offering us. I improve my score to a purchase due to this continued NII development and the power to mitigate rate of interest sensitivity with the well-crafted debt portfolio investments. As well as, new commitments to develop the portfolio have persistently will increase yr over yr with out ever slowing down.