isayildiz/E+ through Getty Photos

Funding Thesis

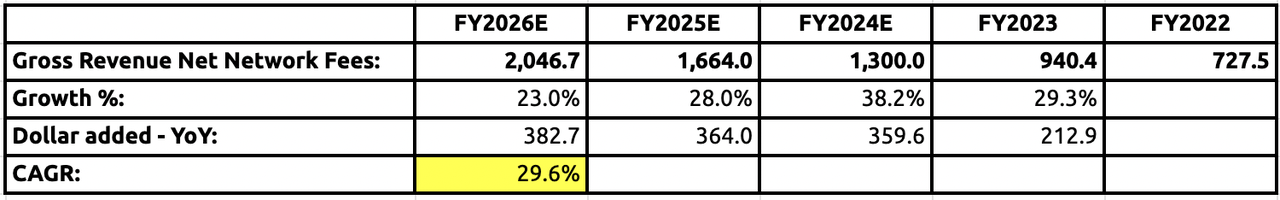

Shift4 (NYSE:FOUR) presents an intriguing funding alternative supported by its sturdy monetary efficiency, modern options, and strategic acquisitions. With a stable observe report of income progress, margin enlargement, and environment friendly value administration, Shift4 is well-positioned for sustained progress of 29.6% within the subsequent 3 years within the dynamic cost processing panorama. I imagine Shift4 is priced at a premium for good causes, and due to this fact, I charge it as a purchase.

About Shift4

Shift4 is a cost software program firm that generates revenues in 2 methods:

-

Facilitates cost for retailers throughout a spread of sectors together with eating places, casinos, and lodges, to sports activities groups. This makes up the majority of its revenues.

-

Fees a month-to-month subscription price to retailers for utilizing Shift4’s POS system

Financials

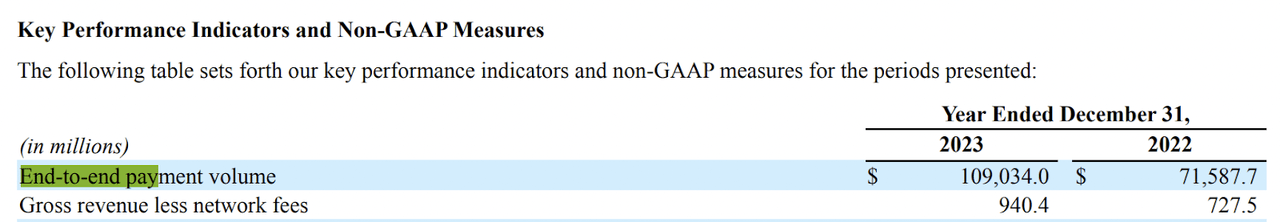

In FY23, Shift4’s end-to-end cost quantity grew 52.3% YoY to $109 billion, highlighting the elevated service provider adoption of its cost processing resolution. Specifically, in the course of the 4Q23 earnings call, administration has reported enterprise wins spanning a number of sectors together with sports activities and leisure, lodge and resort, and in addition to main sports activities group and leisure venues. This helped drive the next quantity of cost processed on Shift’s platform, and because of this, payment-based income grew 28.5% YoY to $2.4 billion.

Furthermore, Shift4’s current acquisitions of Appetize and Finaro have demonstrated profitable integrations and realized synergies. Appetize was strategically acquired by Shift4 to reinforce its presence within the sports activities and leisure business. At present, Shift4 gives cell commerce, point-of-sale (POS), and loyalty options to shoppers on this sector by means of its VenueNext Know-how. The combination of Appetize’s cost software program resolution with VenueNext strengthens Shift4’s foothold within the sports activities and leisure vertical, enabling a wider array of providers and options. Whereas, the acquisition of Finaro aimed to develop Shift4’s presence in European markets.

Alternatively, FY23 subscription income grew 30.9% YoY to $178 million, fueled by the sturdy adoption of its SkyTab POS system, which in accordance with administration, they’ve put in over 25,000 methods in 2023. SkyTab is a next-gen POS system launched in Nov 2022, and by migrating clients over from its legacy POS system, they’re now reporting the next ARPU. Going in the direction of 2024, administration aimed to have 30,000 methods put in within the U.S. alone and 10,000 methods in Europe and Canada.

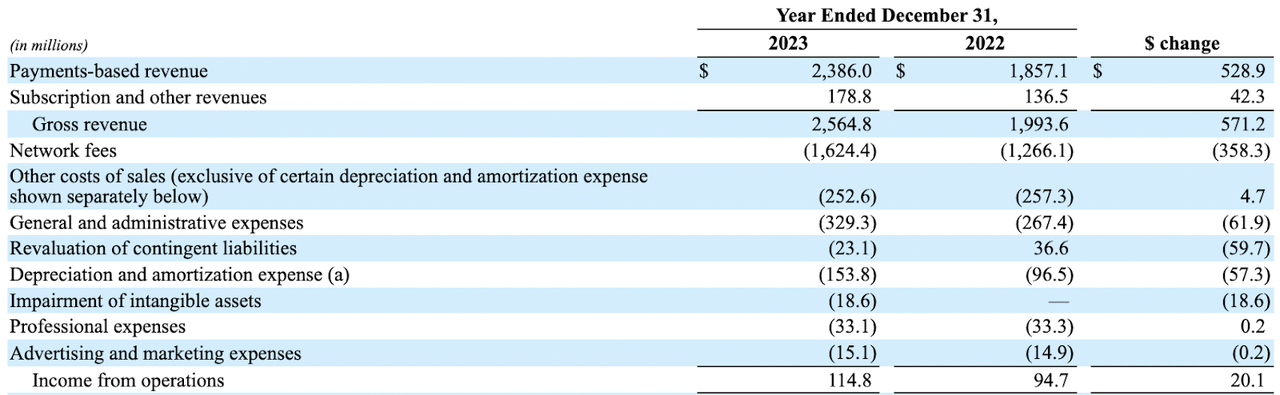

General, Shift4 skilled strong progress, with complete income surging by 28.7% YoY to succeed in $2.6 billion. Extra impressively, gross revenue soared by 46.3% YoY to $687.8 million — outpacing income progress, resulting in a notable enlargement in gross margin from 23.6% in FY22 to 26.8% in FY23. This outstanding achievement underscores Shift4’s distinctive effectivity in managing its prices, in the end strengthening its profitability.

Profitability

FY23’s EBIT grew 21.7% — at a progress charge slower than the income progress. This resulted in EBIT margin falling from 4.75% in FY22 to 4.48% in FY23. Nonetheless, if we exclude the non-recurring impairment of intangible property of $18.6 million that was incurred in 4Q23 because of the stop of sure in–home initiatives, FY23 EBIT would have amounted to $133 million, rising 40% YoY and the margin could be 5.20%. This exhibits that the agency is demonstrating working leverage, leading to margin enlargement.

Additional Growth in ARPU and Expectations of Close to 30% Income Development for the Subsequent 3 Years

Trying forward, the current acquisition of Appetize not solely opens doorways to new market segments for Shift4 but in addition propels ARPU progress by means of elevated upselling and cross-selling alternatives among the many mixed buyer base. The first driver of ARPU enhancement lies within the widespread adoption of Shift4’s cost options. As clients embrace extra of Shift4’s choices, ARPU naturally rises, growing buyer stickiness and higher unit economics total.

Primarily based on administration’s FY24 lower-end steerage of $1.3 billion gross income, Shift4’s present progress trajectory suggests a excessive probability of attaining its focused close to 30% progress over the following 3 years, assuming the annual income increment stays constant. Assuming OpEx stays secure, this progress trajectory signifies potential margin enlargement as we transfer into FY26.

Steadiness Sheet

On its steadiness sheet, as of FY23, Shift4 has $721.8 million in money alongside a long-term debt of $1.7 billion. To gauge its capability to handle this debt, we’ve got to guage its money move assertion. In FY23, Shift4 had recorded a optimistic money move of $388.3 million. Given the numerous money reserves held, this underscores Shift4’s potential to comfortably service its debt obligations whereas concurrently fueling its progress initiatives.

Valuation

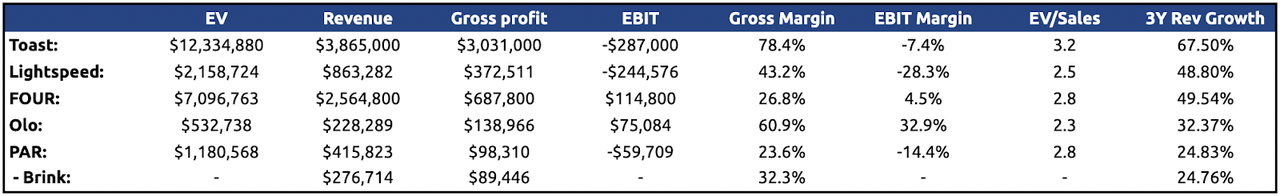

When assessing Shift4’s valuation, using the EV/Gross sales metric gives a extra appropriate comparability, significantly contemplating that a lot of its friends are at the moment unprofitable. Notably, Shift4 instructions a premium in comparison with its friends, besides Toast. Nonetheless, this valuation may very well be justified as Shift4 has demonstrated self-sustainability, the next progress charge, and improved margins. These components underscore the operational effectivity and scalability inherent in Shift4’s enterprise mannequin.

Dangers

Some dangers embody:

-

The extremely aggressive cost processing business might erode Shift4’s potential to compete for market share

-

Macroeconomic components that would influence shopper spending patterns.

-

Challenges in integrating acquired firms, methods, and cultures might disrupt operations and influence monetary efficiency

Conclusion

In conclusion, Shift4 demonstrates a sturdy monetary efficiency, pushed by its modern cost processing options and strategic acquisitions. With important progress in each end-to-end cost quantity and subscription income, the corporate has solidified its place in varied sectors, together with sports activities and leisure, hospitality, and retail. Notably, Shift4’s environment friendly value administration is evidenced by its outstanding enlargement in gross revenue and margin. Trying forward, the corporate’s continued concentrate on margin enchancment, coupled with its sturdy steadiness sheet and optimistic money move, positions it properly for sustained progress of 29.6% within the subsequent 3 years. Lastly, I imagine Shift4’s valuation is justified for above causes, and due to this fact, i charge it a purchase.