Jonathan Kitchen

What’s the BlackRock Science and Expertise Time period Belief?

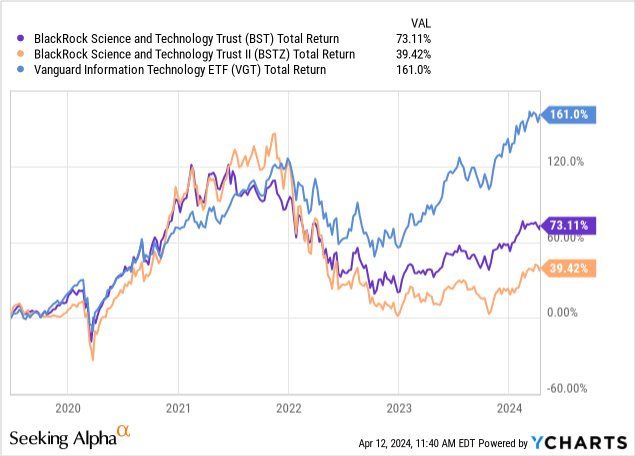

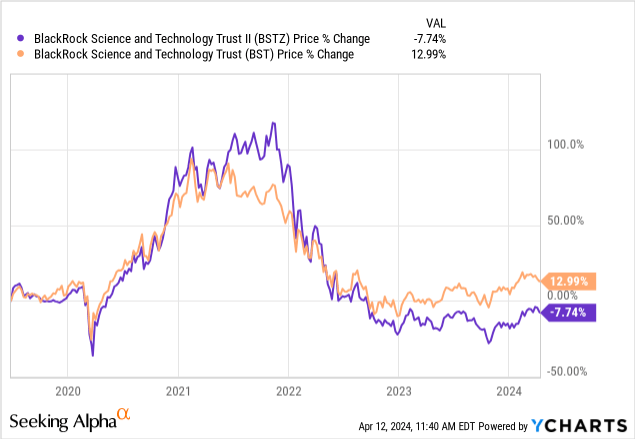

The BlackRock Science and Expertise Time period Belief (NYSE:BSTZ) is an fairness closed finish fund that invests within the expertise sector. The fund was launched throughout the summer season of 2019 as a comply with as much as the terribly profitable BlackRock Science and Expertise Belief (BST), which we recently covered. Managed by BlackRock (BLK), the world’s largest asset manager by AUM, BSTZ has been a high performer within the expertise closed finish fund sector alongside BST. Since inception, BSTZ has notably trailed BST and the broader expertise sector regardless of comparable sector focus.

The satan lies within the particulars for BSTZ. Merely put, the fund launched throughout an exuberant interval when demand for technology-oriented investments together with semiconductors and software program peaked. The slowdown impacted BSTZ extra considerably than sister fund BST or listed expertise funds such because the Vanguard Info Expertise Index Fund ETF (VGT). Because the IPO markets begins to defrost and personal fairness exercise ramps up, BSTZ has begun to outperform.

Nearly three years ago, we discussed BSTZ in depth. The fund has been reshaped since our earlier protection together with adjustments to the portfolio and a restructure of the month-to-month distribution. At this time, we’re going to revisit the fund and discover the turnaround that’s starting to take form.

The Fund

BSTZ invests within the largest and most profitable firms throughout the expertise sector. BSTZ enhances portfolio returns with a yield producing covered call strategy. Lined calls are a conservative by-product technique designed to generate further earnings. This technique is most profitable throughout flat markets and will underperform throughout vital market runs. For shareholders of BSTZ, the choices technique supplies further earnings to assist the fund’s month-to-month distribution.

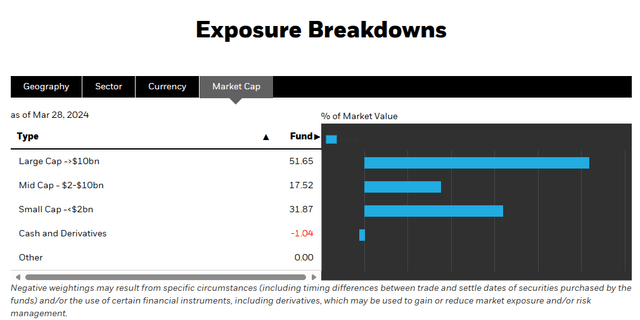

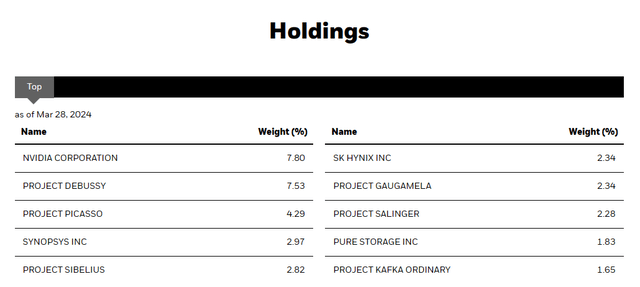

Wanting within the portfolio, the biggest holding is Nvidia Company (NVDA) at almost 8% which continues to steer the expertise sector with AI innovation. NVDA alone has powered a good portion of return throughout indices together with the S&P 500. Many of the portfolio is invested in massive capitalization firms.

The rest of the portfolio is a important differentiator between BSTZ and different expertise oriented funds together with BST. Most closed finish funds and index funds put money into publicly traded equities. Because of this, their portfolios are usually just like massive funds together with VGT or the Invesco QQQ Belief ETF (QQQ). A good portion of BSTZ’s portfolio is invested in personal, enterprise funded investments. Throughout the high ten holdings, we’ll observe that a lot of the investments are privately funded together with Undertaking Debussy (7.53%), Undertaking Picasso (4.29%), and Undertaking Sibelius (2.82%). We are going to discover this facet of the portfolio in depth.

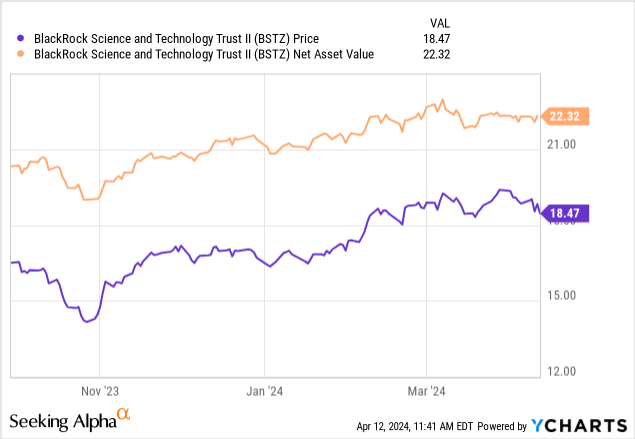

BSTZ is at present buying and selling in a sexy valuation. Following adjustments to the distribution coverage and a stabilizing market, BSTZ has begun rebuilding internet asset worth or NAV. Even nonetheless, the fund continues to commerce at a significant low cost to NAV of over 16%.

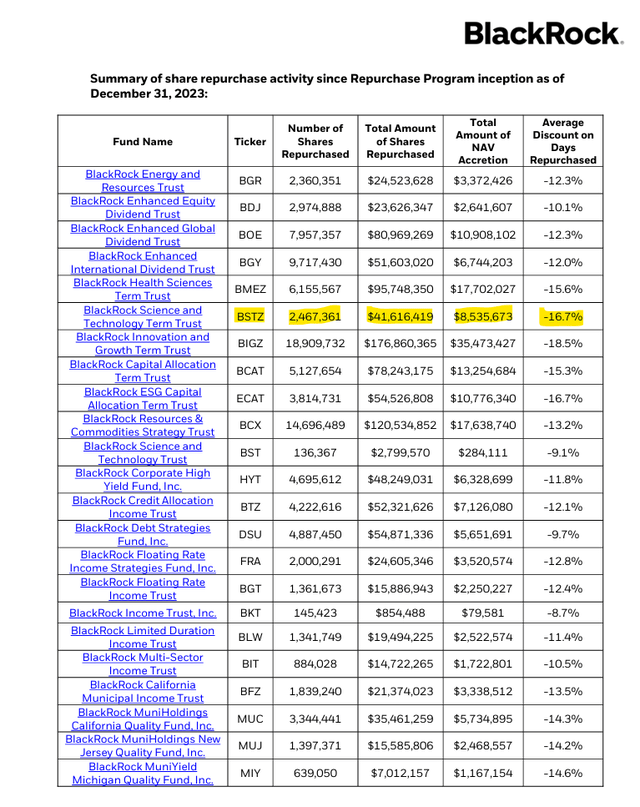

Nonetheless, the low cost is much more priceless to BSTZ. Closed finish funds have a wide range of monetary maneuvers to generate worth for his or her traders. One such mechanism is a share repurchase program. Over the previous two years, BLK has initiated vital share repurchase applications for his or her closed finish funds, specializing in these buying and selling at vital reductions to internet asset worth. BSTZ is one such fund, repurchasing a complete of two,467,361 shares as of yr finish. The affect of those repurchases have been vital. The typical low cost to NAV on days repurchased has been (16.7%) comparable to $8,535,673 in internet asset worth accretion.

BSTZ can also be a fairly priced fund. The fund doesn’t use any type of leverage, so inside bills are restricted predominately to the administration payment charged by BLK. The gross expense ratio on internet property is 1.35% composed of a administration payment of 1.25% and administrative charges totaling 0.09%. This administration payment is affordable, particularly for a fund working within the personal house. The fund doesn’t cost an incentive payment like many personal fairness funds.

Dividend

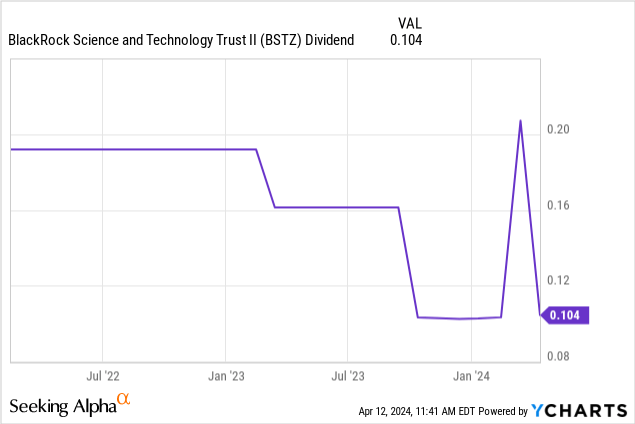

BSTZ launched previous to the pandemic, when the expertise sector was scorching. The fast success propelled BSTZ’s share value and distribution, growing dramatically. For early adopters of BSTZ, the fund’s success was extraordinary, primarily main the closed finish fund universe when it comes to efficiency. Nonetheless, the success was quick lived. BSTZ shortly fell into the chaos of the rising rate of interest period. Throughout 2022, the fund underperformed competitor BST considerably, predominantly as a result of allocation to personal investments which suffered from illiquidity and valuation compression.

BSTZ bumped into hassle shortly and the fund’s mounted distribution started to shortly erode internet asset worth. The cycle was visibly unsustainable and BSTZ’s administration group determined to chop the dividend in March 2023.

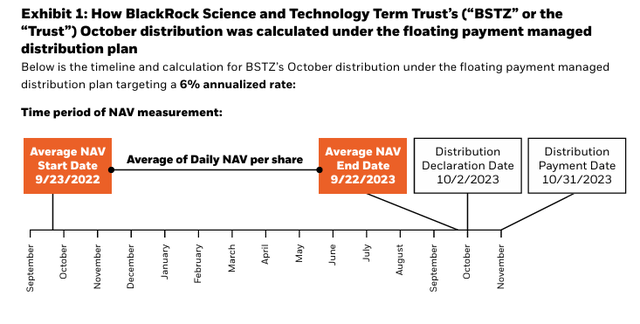

Nonetheless, even the distribution reduce was inadequate to alleviate the stress of a tightening market. BSTZ continued to erode with detrimental whole returns regardless of a double digit distribution. At this level, administration determined to behave decisively. BSTZ and BST each initially launched with managed distribution insurance policies that means a flat month-to-month dividend supported by a yr finish complement, if crucial. In October 2023, BSTZ announced the implementation of a floating cost managed distribution plan. The dividend is now calculated as 6% of the fund’s trailing internet asset worth over the earlier 12 month interval.

The distribution coverage replace resulted in a big reduce to the dividend within the close to time period. Nonetheless, the coverage is just not unusual and is extra aligned with the long run well being of the fund. The distribution coverage is just like that of the Liberty All-Star Fairness fund (USA). BSTZ’s internet asset worth declines during times of market stress. Contemplating the fund’s illiquid holdings, the discount in distribution throughout these durations is welcome and preserves the fund’s property. In distinction, valuations increase and NAV appreciates throughout robust durations permitting the fund to pay out the next portion as a dividend to BSTZ shareholders. The up to date coverage has already corresponded to a restoration in BSTZ’s internet asset worth.

Non-public Investments

BSTZ’s construction as a closed finish fund is an acceptable setup for a fund that invests within the enterprise capital house. A main space of concern is the opacity of BSTZ’s personal holdings. The personal portion of the portfolio is both a key level of attraction for bullish traders or a disqualifier for skeptics who worth transparency above all else. Each events can agree that BSTZ’s worth proposition is uncommon with few different funds working in an analogous house.

Some diligence and digging as traders can yield useful details about BSTZ’s investments. For instance, Undertaking Debussy is an funding in a software program firm referred to as Databricks. Databricks is an emergent software program agency based over a decade in the past. The corporate describes itself as a worldwide analytics and synthetic intelligence firm. Databricks pioneered their “Lakehouse” platform, a cloud information platform that permits for summary querying towards massive information units. That’s the restrict of my experience into the software program house, however the agency supplies additional color on their enterprise:

At this time, greater than 9,000 organizations worldwide — together with ABN AMRO, Condé Nast, Regeneron and Shell — depend on Databricks to allow massive-scale information engineering, collaborative information science, full-lifecycle machine studying and enterprise analytics.

Headquartered in San Francisco, with workplaces around the globe and lots of of world companions, together with Microsoft, Amazon, Tableau, Informatica, Capgemini and Booz Allen Hamilton, Databricks is on a mission to simplify and democratize information and AI, serving to information groups clear up the world’s hardest issues.

One other massive personal funding in BSTZ’s portfolio is Undertaking Picasso, often known as PsiQuantum Corp. PsiQuantum is working to construct a subsequent technology computing platform based mostly on processing monumental and summary information units. Their web site describes their mission in better element:

PsiQuantum’s mission is to construct and deploy the world’s first helpful quantum pc. The corporate was based on the premise that commercially priceless quantum computing would require error correction, and due to this fact very large-scale methods. We consider that we have now a quick and possible path to large-scale fault-tolerant methods, based mostly largely on leverage of current expertise – together with high-volume semiconductor manufacturing, packaging, and high-power cryogenic methods.

Our superior society – and by extension a big fraction of trade – is constructed on a basis of chemistry, physics, and knowledge. Quantum computing has the potential to categorically advance our mastery of the bodily world and of knowledge, with widespread affect throughout science and expertise. We’re engaged with prospects and companions to guage and optimize purposes spanning local weather, healthcare, finance, vitality, agriculture, transportation, communications, and past. We’re constructing a method to unravel inconceivable issues and are engaged in partnerships and licensing of our expertise by PsiQuantum licensing companies.

Undertaking Debussy and Undertaking Picasso are the fund’s two largest personal holdings. These investments are in refined expertise corporations who’re main the event of emergent applied sciences. For the fund, these positons are main drivers of efficiency, regardless of their illiquidity. In the annual report, BLK notes that each of those investments had been main detractors of fund stage efficiency.

Additional on, a personal off-benchmark place in Databricks additionally detracted from relative returns. After a further funding spherical was raised in September, Databricks agreed to amass Arcion, an enterprise information firm, in October 20233. Because of this, the valuation elevated however underperformed expertise equities within the benchmark.

A personal off-benchmark place in PsiQuantum additionally dragged on relative efficiency. The quantum pc developer underperformed tech shares over the quarter as a result of lengthy period nature of the agency’s endeavor.

The detrimental efficiency of the fund’s personal investments relative to the broader success within the expertise sector is no surprise. Success within the publicly traded portion of the sector has been evident in gamers like NVDA. Nonetheless, enterprise capital funded firms stay locked up as elevated rates of interest proceed to suppress the personal markets. Funding stays materially costlier for these small gamers and lack of M&A exercise has weighed on valuations.

Nonetheless, there are indicators that the worst could also be behind us. The outlook is brightening as encouraging indicators from throughout the market level in the direction of a brighter future.

Outlook

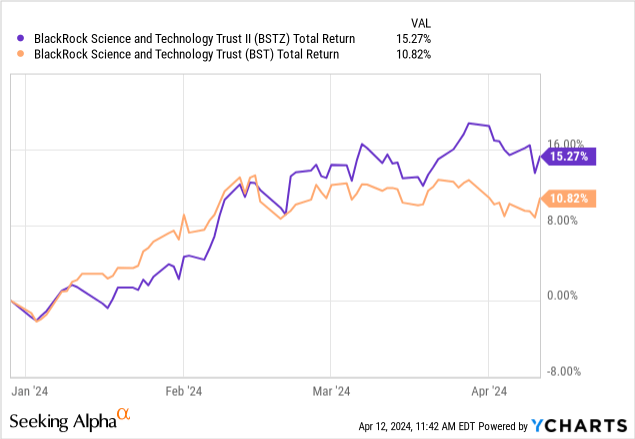

The personal fairness markets have slowed considerably over the previous two years. Deal stream stays restricted relative to the post-pandemic period of low-cost capital. For a fund with main personal holdings, this meant trailing efficiency relative to friends. Nonetheless, BSTZ has outperformed BST yr to this point, with the foremost differentiator being the burden of the personal holdings.

As rates of interest seem to stage and the economic system stays heated, there’s a wholesome momentum constructing throughout the personal markets and IPOs. PWC just lately put out a report discussing the well being of personal fairness.

In 2023, personal fairness (PE) exercise remained sharply down from its pandemic peak, reflecting stubbornly excessive inflation and correspondingly elevated rates of interest and capital prices. Regardless of sitting on unprecedented capital, traders remained cautious, awaiting reductions in asset valuations to mirror cooler demand and tighter financing. Distributors, for his or her half, are prepared to attend for the appropriate suitor, extending maintain durations to maximise exit worth.

This yr is taking form otherwise. 12 months to this point, there have been noteworthy IPO filings of enormous gamers within the expertise sector together with Reddit (RDDT). Moreover, acquisition exercise is starting to ramp up throughout different sectors with Blackstone (BX) displaying curiosity throughout sectors. BX just lately introduced they’re nearing the buyout of L’Occitane Worldwide SA (OTCPK:LCCTF). Moreover, BX just lately returned to an acquisitive place in the true property sector with the acquisition of Condo Revenue REIT (AIRC).

As personal gamers start placing capital to make use of, the winds are starting to vary for BSTZ. Valuation of the personal holdings have stabilized and their liquidity could enhance as extra traders return to the house.

Conclusion

Because the IPO market continues to defrost, BSTZ’s redesigned distribution has resulted in appreciating internet asset worth providing worth to shareholders. The fund’s administration prudently reduce the distribution throughout a tumultuous interval when the fund’s holdings had been undervalued. Because the panorama begins to enhance, BSTZ is outperforming friends and publicly traded opponents. The outperformance is prone to proceed ought to the economic system stay robust. A fee reduce would function an much more vital catalyst for close to time period efficiency.

BSTZ is a novel fund providing vital worth for shareholders. The chance to carry personal, illiquid investments in a publicly traded automobile is important. Because of this, BSTZ presents a significant complement to massive index funds together with QQQ that are expertise oriented. BSTZ presents diversification and extra tax environment friendly yield as a result of closed finish fund construction. The fund is a powerful purchase because it demonstrated the flexibility to climate a big interval of disruption and capitalize by a share repurchase program and strong dividend design.