Lock Inventory

Thesis

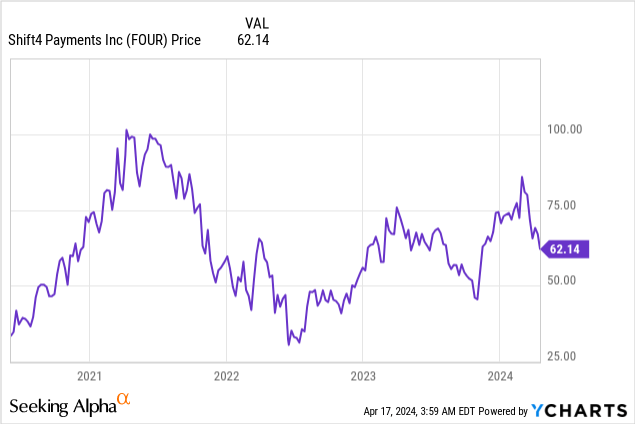

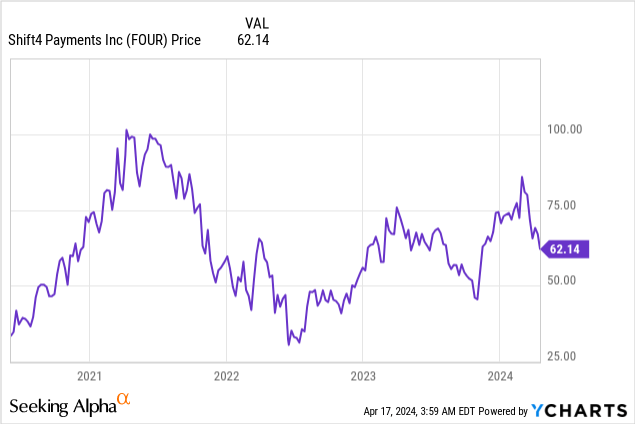

Shift4 Funds’ (NYSE:FOUR) inventory noticed an enormous spike after reporting This fall earnings. This was probably as a result of mixture of an excellent earnings report/steerage and M&A hypothesis. No M&A exercise ended up happening, and since then the inventory has declined precipitously. We consider the current selloff is overdone and that long-term traders can purchase shares at a lovely valuation.

The Fundamentals

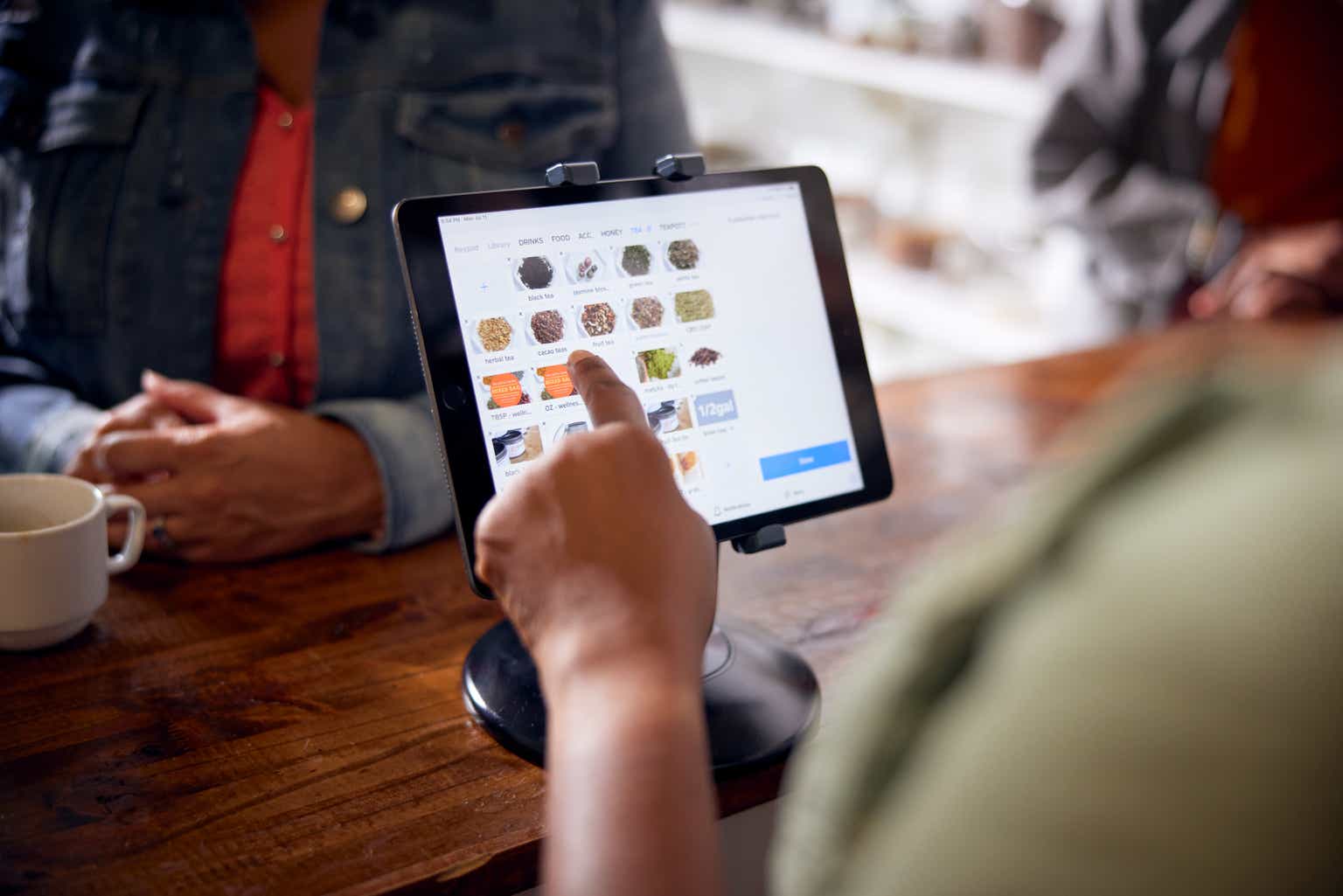

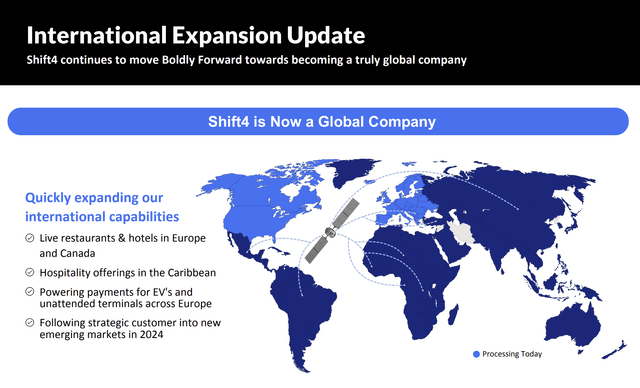

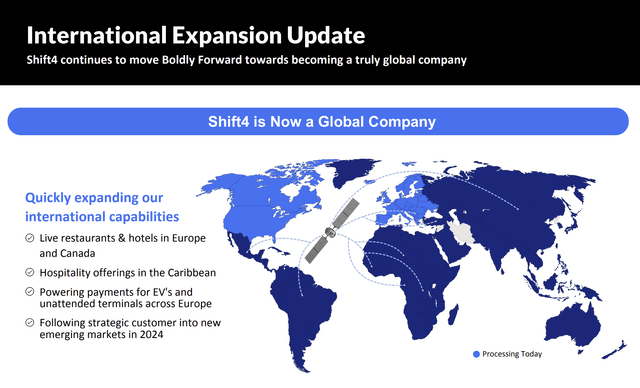

Shift4 is a funds processor, although they do have some software program/web site choices by means of their SkyTab platform. Their major markets are positioned in the USA, Canada, and Europe. They need to proceed increasing their worldwide footprint, and traders ought to monitor how this enlargement is progressing over the approaching quarters.

Shift4’s This fall 2023 Shareholder Letter

Shift4’s major working segments are SkyTab (eating places), Hospitality, Specialty Retail, and Sports activities & Leisure. The corporate is in search of to develop its presence in non-profit providers as properly as gaming (playing), that are comparatively new markets for them.

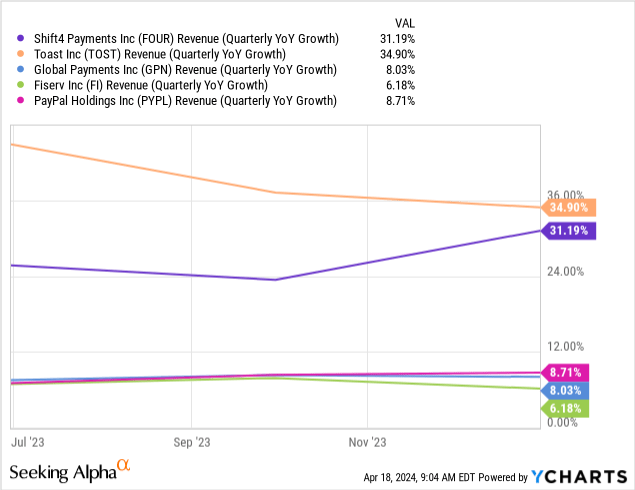

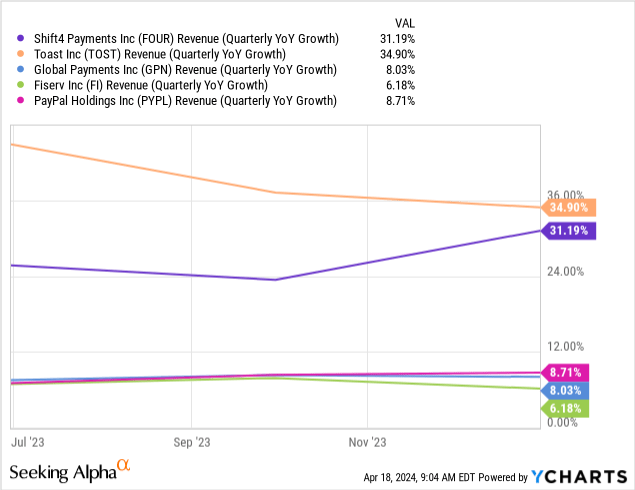

The robust monetary efficiency and steerage is what attracts us to the corporate. Of their most up-to-date quarter Shift4 reported gross income much less community charges of $269.3 million, which was up 35% yr over yr. In addition they reported adjusted EBITDA of $136.1 million, which was up 44% yr over yr. These are wholesome progress metrics when in comparison with different corporations of their trade.

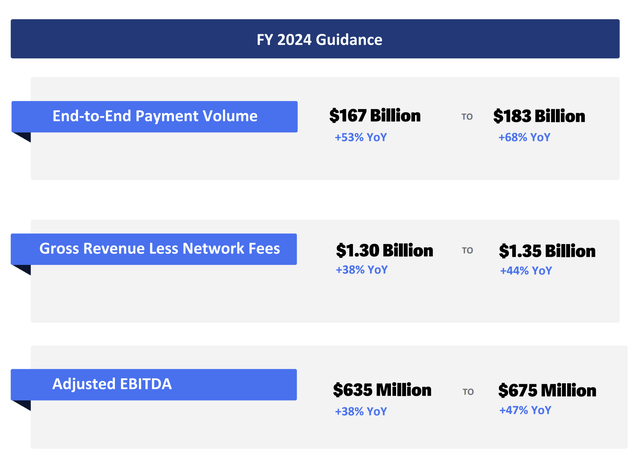

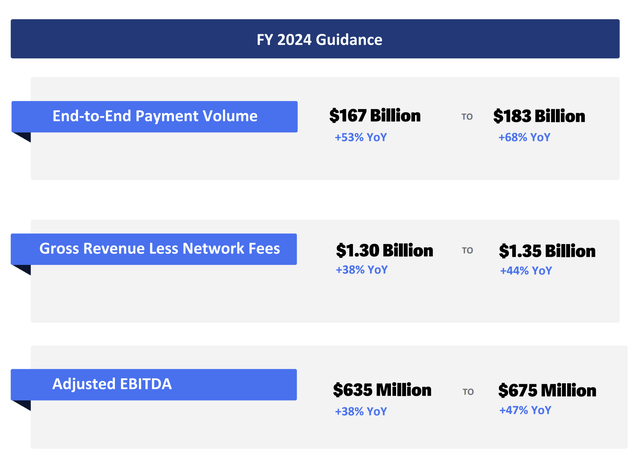

Shift4 offered robust 2024 steerage, which could be seen under. A midpoint of 41% progress in gross income much less community charges means that progress is accelerating from the year-over-year progress reported in This fall. This top-line progress is predicted to gas comparable ranges of progress for 2024 adjusted EBITDA.

2024 Steering (Shift4’s This fall 2023 Shareholder Letter)

Some extra elements to concentrate on:

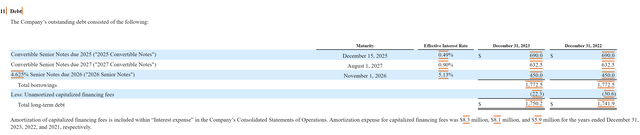

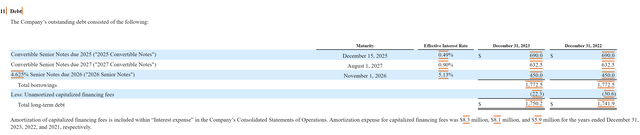

Shift4 has roughly $1.75 billion in debt, and this debt is a mixture of convertible and non-convertible. A few of this debt will probably have to be refinanced at larger charges. We do not see this as being a significant concern over the long-term, as the corporate will both concern new convertibles or will concern new mounted fee debt. The corporate will be capable of simply take up larger curiosity prices because of their profitability, though it could be a drag on earnings over the brief time period.

Debt Abstract (Shift4’s 2023 10-Ok)

Shift4 has a founder CEO (Jared Isaacman). Having a founder CEO is usually considered as a constructive due to the alignment of curiosity with shareholders in addition to their substantial quantity of pores and skin within the recreation, each mentally and monetarily. It does, nevertheless, introduce the chance of the inventory doubtlessly having a unfavourable response if the founder leaves.

M&A Hypothesis

There was M&A hypothesis relating to Shift4 for a few months now. On February 28, there was news of an obvious bidding struggle for the corporate. The mixture of this information and the robust earnings report probably contributed to the robust surge of their inventory over the next two days. This M&A premium rapidly started to deflate when Amadeus stated they weren’t occupied with a deal. Over the March 16-17 weekend, the Shift4 CEO sent out a memo to workers stating that the corporate had rejected all potential bids, and that they obtained a number of bids over the inventory worth (on the time). Since then, the inventory has been on a relentless decline, and is now buying and selling properly under the place it was earlier than reporting This fall earnings.

We consider that a lot of the risky worth motion this yr has been influenced by M&A speculators, and that the corporate’s rejection of all provides has led to many of those speculators dumping their place. The buyout rejection and share worth decline might have additionally spooked some purchase and maintain traders, leading to extra promoting strain on the inventory.

Necessary to notice is that funds firm Nuvei was just lately taken private at an EV/EBIDTA premium to the place Shift4 is presently valued. Given Shift4’s larger progress charges, this appears to bode properly for the worth of Shift4 if it did find yourself getting acquired.

On the finish of the day the M&A dialogue is simply noise. Lengthy-term traders can use moments of uncertainty similar to these as a time to select up discounted shares in good corporations.

We do consider that M&A stays potential over the following 24 months. Nevertheless, it isn’t core to our funding thesis.

Value Motion and Valuation

Shift4’s inventory has been trending sideways over the previous couple of years, and stays properly under the all-time excessive reached in 2021. The inventory is down 16.4% yr up to now and is down 32.6% from its 52-week-high.

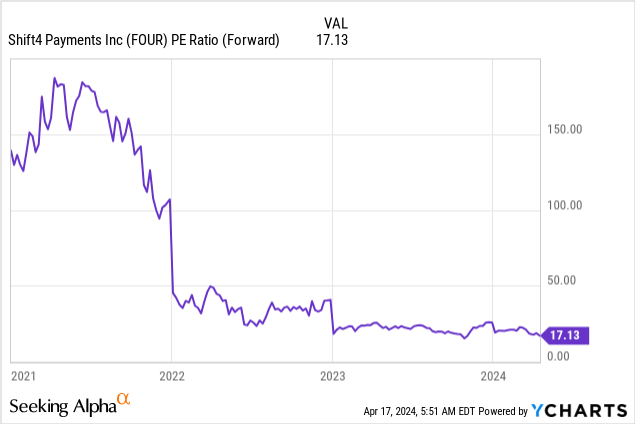

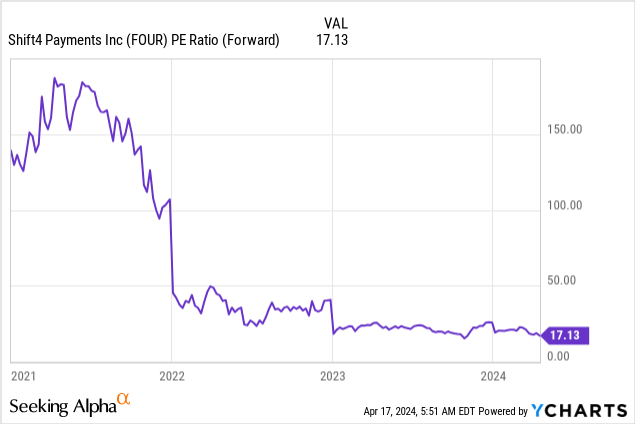

Whereas we usually persist with GAAP web revenue, on this case, we view adjusted EBITDA as being an affordable metric to make use of. It is because the corporate has a considerable quantity of non-cash prices similar to depreciation/amortization and impairments. For these solely occupied with GAAP metrics, Shift4 trades at a ahead PE ratio of 17.13, which seems to be greater than cheap contemplating the expectation for high and bottom-line progress to exceed 40% over the following 12 months.

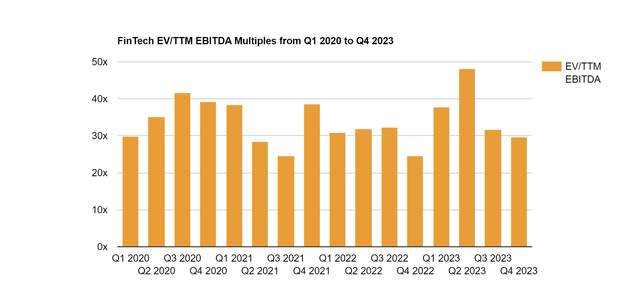

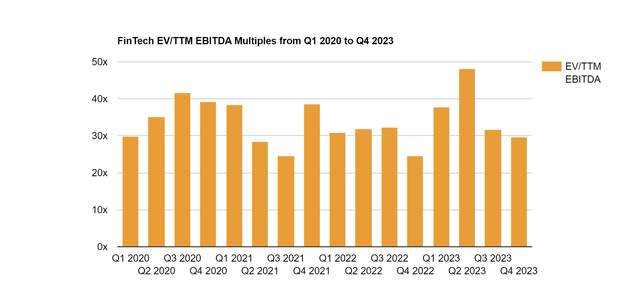

So far as adjusted EBITDA is worried, the corporate presently trades at a trailing EV/EBITDA valuation of 14.4, and a ahead EV/EBITDA valuation of 10.1. This seems to be low-cost when in comparison with the trade common a number of of round 30x trailing EV/EBITDA.

Fintech Business EV/EBITDA Multiples (Software program Fairness Group)

This valuation low cost to their sector seems unwarranted, given the corporate is anticipating to develop their high and backside line by 40%+ over the following yr. For reference, Fiserv (FI) trades at a ahead EV/EBITDA of 12.7 whereas forecasting topline progress of 15-17%. PayPal (PYPL) trades at a ahead EV/EBITDA of 9 with income progress steerage of 6.5-7%.

We consider that Shift4’s inventory ought to commerce at a ahead EV/EBITDA a number of of 15 instances given their anticipated progress fee. This is able to equate to a share worth of round $93 on the midpoint of EBITDA steerage. We’d contemplate promoting our place at that degree if progress expectations stay the identical.

Danger Components

A danger to our bullish thesis is the aggressive nature of the funds trade. It is potential that Shift4 is unable to realize their formidable progress targets. Competitors may additionally strain their margins going ahead.

One other danger is the chance for the CEO to take the corporate non-public in a transaction that advantages himself greater than it advantages shareholders. This appears unlikely to us but it surely’s by no means utterly off the desk.

We view the general danger/reward as being favorable.

Key Takeaway

Shift4 Funds has been concerned in M&A hypothesis which in the end by no means materialized, and the inventory has since bought off. The basics of the corporate stay intact and we view this sell-off as a shopping for alternative.