JHVEPhoto

Funding Thesis

IBM (NYSE:IBM) is set to announce their earnings report for the primary quarter of this yr, on Wednesday, April twenty fourth, subsequent week, after market hours.

Huge Blue reported a strong full-year FY23 earnings report within the earlier quarter, which confirmed a re-acceleration of their core enterprise segments, Software program and Consulting aided by sturdy development on account of AI. Its Consulting enterprise reported sturdy development as properly, defying the final weak spot that was seen by way of final yr, together with its consulting friends like Accenture (ACN).

Final quarter, administration did properly to revive additional confidence within the power of their enterprise as they invested and launched new merchandise and options, particularly in AI. Subsequent week, I anticipate administration to construct on this momentum for instance the progress of their Software program and Consulting segments, in addition to the income impression from AI.

Over the long run, I imagine it nonetheless gives buyers enticing entry factors at present ranges. I had previously covered IBM, the place I had issued a Purchase ranking, and I’ll proceed to suggest a Purchase for IBM inventory.

Summarizing IBM’s This fall Efficiency and Key Administration Commentary

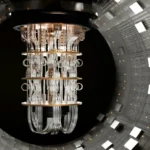

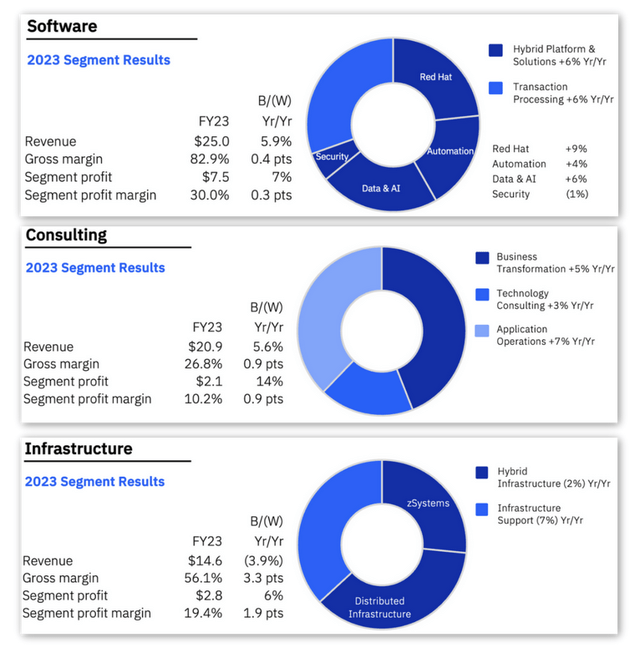

For the total yr FY23, IBM’s revenues grew 3% to $62 billion, as seen within the chart under, led primarily by a 5% improve in Software program income and over 6% in Consulting. As well as, the corporate reported sturdy development in its free money of ~$11 billion by way of FY23, however what baked the cake for the market was administration’s sturdy information on free money of $12 billion projected by the tip of this yr.

IBM’s income and free money tendencies since 2018 together with administration’s personal steering for FY24 (Firm sources)

On the call to debate its stellar This fall earnings, administration pointed to the platform-based method they have been utilizing to drive inter-segment synergies between IBM’s Software program and Consulting segments. IBM’s 2019 acquisition of Crimson Hat continues to drive accretive features for IBM’s software program platform, which is constructed on prime of Crimson Hat infrastructure.

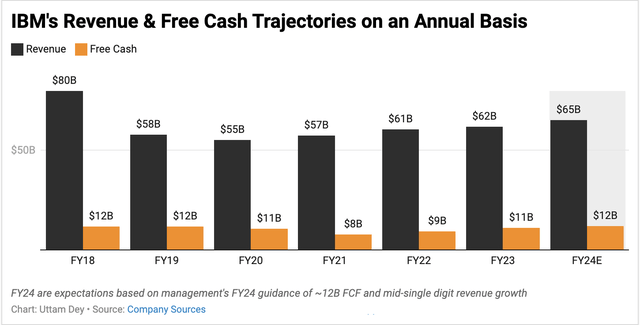

Software program and Consulting segments now account for about 75% of IBM’s complete revenues, up from 73% in FY21, as will be seen under. These two segments mixed have grown at a compounded development charge of 4.7% since FY21, sturdy by IBM’s requirements, in my view, given its historical past of pre-pandemic no-to-low single digit development.

IBM’s reportable income segments from FY20 to FY23 (Firm sources)

In my earlier protection on IBM, I had noticed how AI was now beginning to play a key function because the launch of a number of initiatives final yr, which I’ll briefly summarize right here.

For instance, IBM’s AI-accelerator-based hybrid cloud service, z16, meant for mission-critical workloads, launched two years ago, is lastly beginning to bear fruit for the corporate. I famous how IBM’s Infrastructure enterprise grew revenues by 2% in This fall FY23, aided by sturdy development in z16 on account of AI demand. As well as, IBM additionally launched its watsonx AI & data platform final yr. Administration introduced that their “book of business” on account of generative AI doubled sequentially, which helped spur development in a lot of profitable offers in Software program and Consulting.

I’ve added some commentary from IBM’s administration of their earlier earnings name, which I felt summed up their This fall earnings:

Since 2021, we delivered common income development for IBM and for every section at or above our mannequin. The general tendencies we’re seeing reinforce our views of the longer term. We’re assured in attaining our midterm income mannequin, and the power of our diversified enterprise mannequin permits us to make progress every quarter.

We entered the yr intent on enhancing our Software program portfolio and strengthening our Consulting place. We now have performed each. Mid-last yr, we launched watsonx, our flagship AI and information platform, and we’re excited by the traction we’re seeing. Consulting has delivered sturdy income development by way of the yr regardless of an uneven macro surroundings.

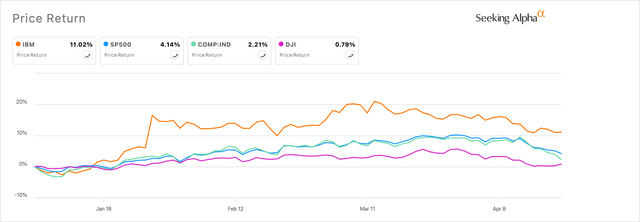

I imagine these outcomes have been sturdy sufficient for IBM to be one of many prime performers, not simply within the Dow 30 index (DJI) but additionally within the S&P 500 index (SPX).

IBM’s inventory efficiency YTD (sa)

Adjustments in Q1 that may impression IBM’s earnings subsequent week

By means of the quarter, IBM has been busy launching merchandise and options throughout its product suite, as famous under. As well as, the corporate additionally introduced some key adjustments of their reporting segments, which is vital to consider as an investor. I’ll begin with the change in reporting segments announcement.

IBM can be barely altering their reporting segments beginning Q1 FY24 (Firm sources)

Beginning within the Q1 FY24 quarter, I’ll anticipate IBM to begin reporting its income break up by enterprise and segments primarily based on the construction I famous earlier. This alteration has no materials impression on IBM, in my view. I see this modification being made to reflect IBM’s divestiture from the Weather Company.

As well as, IBM will now be reporting its Security Services inside its Consulting enterprise below the brand new reorganization. I really imagine this can be helpful to the corporate. I had famous in one of my previous coverages that cybersecurity friends reminiscent of SentinelOne (S) and Palo Alto Networks (PANW) have been additionally seeing elevated ranges of demand for his or her Managed Safety Companies options. I imagine transferring Safety Companies to IBM’s Consulting enterprise can be a long-term benefit for the corporate, given the constructive shifts in demand for IBM’s Consulting companies in addition to the general demand for Managed Safety Companies.

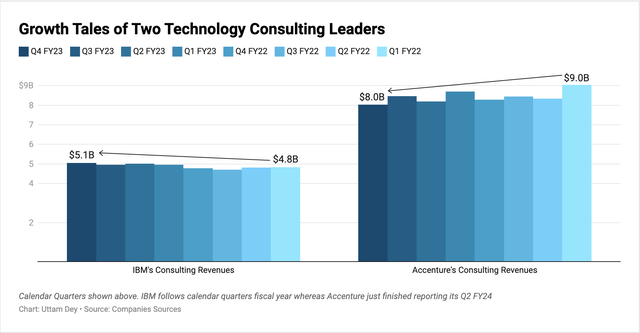

Persevering with the prepare of observations with IBM’s Consulting, I seen some weak spot continues to persist inside the broader Consulting market. Accenture cut its annual revenue forecasts, whereas McKinsey has been slashing jobs as demand wanes for Consulting companies. Nevertheless, as famous within the chart under, I see that IBM defies these tendencies.

IBM continues to defy the chances in of a stoop within the broader market Consulting Revenues (Corporations sources)

By means of my earlier evaluation, I noticed that IBM has been very profitable in transferring into area of interest market segments reminiscent of DevSecOps & AIOps. All these market segments are rising areas for IBM to develop whereas leveraging its AI and Crimson Hat-based software program platform, which additionally feeds into its Consulting enterprise.

On the AI entrance this quarter, I noticed that IBM is widening the scope of its AI options, constructing on product launches final yr. IBM recently announced the availability of Microsoft-backed (MSFT) Mistral AI’s LLM mannequin on their watsonx platform. I see IBM has been persistently ramping up the supply of a number of LLM fashions as a part of their multi-model technique.

For instance, Meta’s (META) Llama2 LLM fashions were already made available on watsonx final yr. I imagine IBM has been transferring the needle by fairly a bit to make the impression, which is able to proceed to supply the noticed tailwinds over the long run for the corporate.

IBM’s Outlook and Valuation

By way of my outlook, I notice that IBM has projected revenues to develop by ~5% y/y to $65 billion, whereas free money is projected to develop by ~7% y/y to ~$12 billion for FY24. I seen that consensus FY24 income projections have barely dipped to $63.6 billion as of writing. I imagine this may be because of the rise within the US greenback (DXY), which has risen ~2.5% since IBM reported its This fall earnings in January.

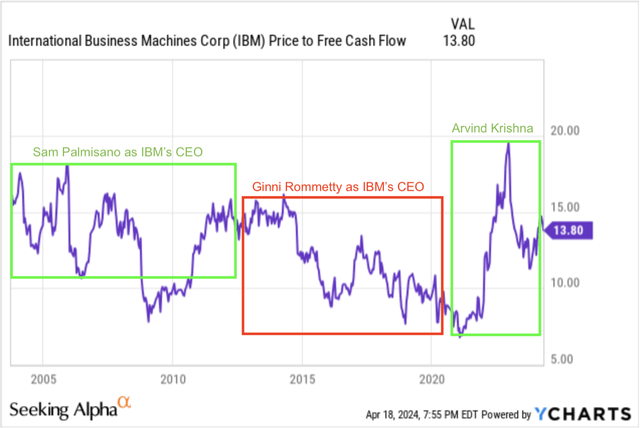

Nevertheless, given IBM’s momentum in product launches and companies that I famous within the earlier part by way of the primary quarter, I imagine the corporate will preserve its projections unchanged. Given these views, I estimated IBM to be buying and selling at 14x ahead free money. I imagine these valuation multiples are nonetheless overlooking the expansion in free money that IBM has demonstrated since 2018, as I famous in a chart in the beginning of this submit. From that chart, I noticed that IBM’s free money has grown by 19% CAGR since 2018, which could be very spectacular in my view. It simply provides room for the ahead free money a number of to develop to a a number of of 15x, as final seen in the course of the instances of Sam Palmisano, a earlier CEO of IBM, as proven under.

IBM’s FCF A number of Historical past Since Two A long time (yCharts)

If I take advantage of reverse DCF to worth IBM, I see that there’s nonetheless super upside. My assumptions listed here are:

-

Low cost charge is 9% increased than market estimates.

-

IBM’s sustained development within the enterprise will stabilize FCF development nearer to its long-term midpoint development mannequin over the long run.

Creator’s Valuation Utilizing reverse DCF (Creator)

Based mostly on my mannequin, I imagine IBM nonetheless has room to develop from its present ranges. Markets are experiencing heightened volatility, which can impression IBM, however I imagine any pullbacks on this inventory will be purchased.

5 Key Components to search for in IBM’s Q1 FY24 earnings report

I needed to emphasise a number of issues that I believe are vital to search for in IBM’s earnings report subsequent week:

-

AI: Now that we’re within the second full yr of AI because the ChatGPT euphoria started, what are the income impacts AI is having on IBM’s prime and backside strains? I anticipate administration so as to add extra colour to bookings and segments or develop extra on their “book of business” feedback made within the earlier earnings name.

-

Consulting Enterprise: Can IBM maintain the momentum it has loved over the previous 8 quarters, as I had famous in an earlier chart? With Accenture and different friends underperforming, what’s administration’s +FY24 outlook on Consulting? Particularly when Gartner projects Consulting/IT Companies to enhance by 290 foundation factors in FY24. I imagine the momentum ought to proceed and IBM needs to be on monitor to information in the direction of the 6-8% development vary for Consulting in FY24.

-

Software program Enterprise: Can IBM maintain the momentum in its Software program section as properly? If IBM’s Crimson Hat division grows in double digits, that will additional increase its outlook. My tackle Software program is gradual to begin in FY24, however performs catch up within the again half to finally develop ~6-7% in FY24.

-

Any additional revisions to the prior FY24 and long-term midpoint development working fashions? Prior FY24 steering was recently reiterated at the TMT Conference final month.

-

Any incremental headwinds seen from the rise within the greenback in Q1 FY24? Or different headwinds?

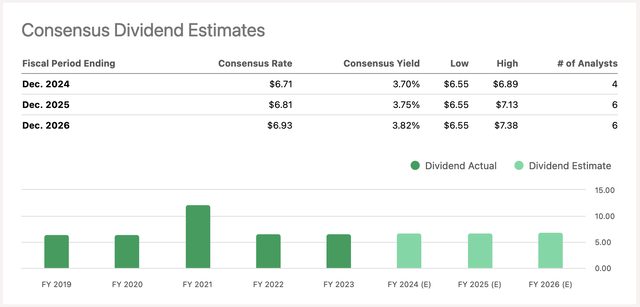

Along with the capital appreciation, many buyers profit from IBM’s dividend yield. Listed below are the consensus estimates to date. Any adjustments in money, free money will have an effect on dividend payouts, however I do not anticipate materials adjustments to dividends right here as properly in Q1.

IBM’s Anticipated Dividends Per Consensus Estimates (SA)

Conclusion

IBM continues to face at a pivotal time in FY24, because it must exhibit to buyers that the Huge Blue can maintain the momentum that it has seen over the previous yr. I’ve said in my protection earlier how I’ve been impressed by IBM’s speedy turnaround in growing & deploying AI merchandise and options, whereas additionally reaching throughout the board and putting key partnerships with friends and important stakeholders within the trade. I imagine the corporate is pulling the proper levers, and this firm positively holds long-term worth for shareholders.

I like to recommend a Purchase ranking on IBM.