BING-JHEN HONG

NVIDIA (NVDA) plunged 10% final Friday for its worst session since March 2020. The transfer got here on no main information however regarding earnings studies and outlooks from abroad semiconductor firms comparable to Taiwan Semiconductor (TSM) and ASML Holding (ASML) tempered the once-hot business. Chip shares command a few 10% weight within the S&P 500 because the AI growth presses on. The rally doesn’t come with out its periodic obstacles, in fact, and the previous couple of weeks illustrate that it’s by no means an elevator trip up for buyers.

I’ve a maintain ranking on the YieldMax NVDA Possibility Revenue Technique ETF (NYSEARCA:NVDY). I see the coated name fund as extra enticing right this moment given a lot increased possibility premium, however I see technical issues with NVDA’s share value. I’ll element the place I believe the ETF could be a purchase.

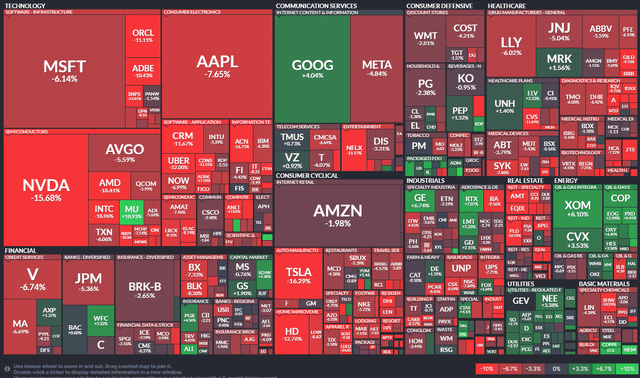

1-Month S&P Efficiency Warmth Map: NVDA Down 16%, Among the many Largest Laggards

In response to Financial institution of America International Analysis, NVIDIA designs and sells graphics and video processing chips for desktop and pocket book gaming PCs, workstations, recreation consoles, and accelerated computing servers and supercomputers.

NVDY, however, is an actively managed exchange-traded fund, or ETF, which seeks to generate month-to-month revenue by writing name choices on NVDA. NVDY pursues a method that goals to reap compelling yields whereas retaining capped participation within the value positive factors of NVDY.

The present distribution price is 135% as of April 19, 2024, and the portfolio pays distributions month-to-month. You possibly can view the distribution schedule here. Searching for Alpha notes that the trailing 12-month dividend yield is 53.2%, in fact the overwhelming majority of that yield comes from promoting choices, so it isn’t like a conventional ETF dividend.

NVDY is a small ETF with simply $375 million in property underneath administration, and it has a excessive 1.01% annual expense ratio. Share-price momentum has been these days, given the steep retreat in NVDA. Additionally it is a risky ETF, however has strong liquidity given common every day quantity of near 600,000 shares over the previous 90 days, although NVDY’s median 30-day bid/ask unfold is considerably huge at 0.17% on common.

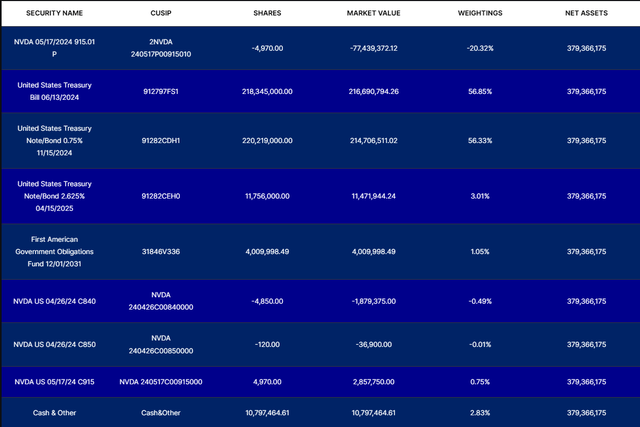

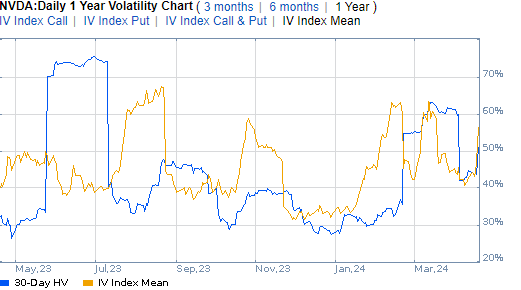

NVDL: Portfolio Holdings

What makes NVDY fascinating right this moment is that NVDA’s implied volatility has surged to above 53%, in response to information from Possibility Analysis & Expertise Companies (ORATS). We usually solely see that proper earlier than an earnings announcement, so buyers could possibly be in retailer for a protracted interval of excessive volatility.

That presents a chance for a fund like NVDY because it sells name choices to generate revenue. Dearer possibility premium means extra revenue collected, all else equal.

NVDA Implied Volatility Rises, Making Name-Promoting Extra Enticing

Constancy Investments

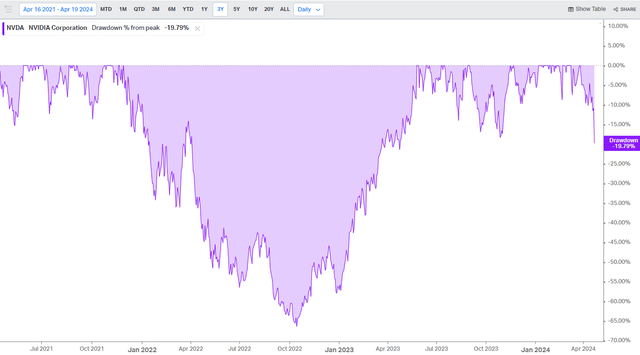

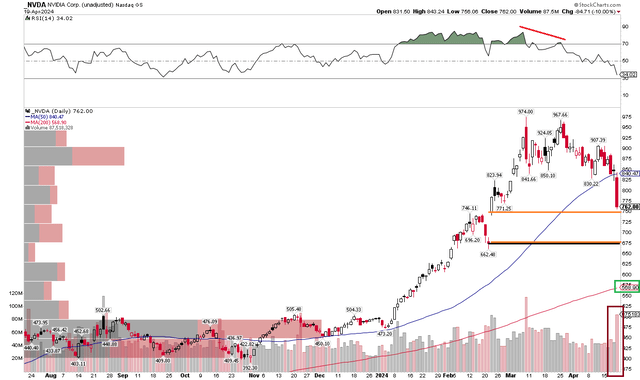

The offset is that lofty volatility has coincided with a steep drop in NVDA’s inventory value. Shares are near technical bear market territory, down virtually 20% from their all-time closing excessive from earlier this 12 months.

NVDA: Shares Down 20% From Their All-Time Excessive, Worst Drawdown Since 2021-2022

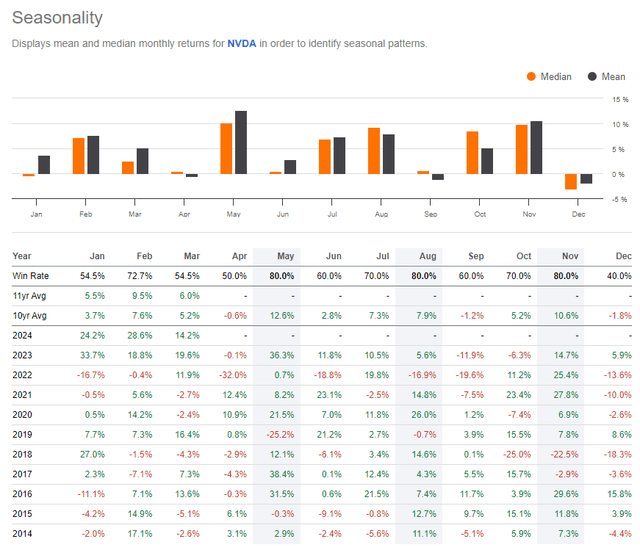

With NVDA promoting for 25 occasions FY 2026 earnings, I observed that Might has traditionally been the chip inventory’s greatest month when analyzing seasonal tendencies over the previous 10 years. The common achieve is greater than 12% with a median return of 10%. So, given the corporate’s valuation right this moment and the inventory’s bullish pattern as soon as April finishes, giving NVDA and NVDY a detailed look is warranted.

NVDA: Bullish Might Historic Developments

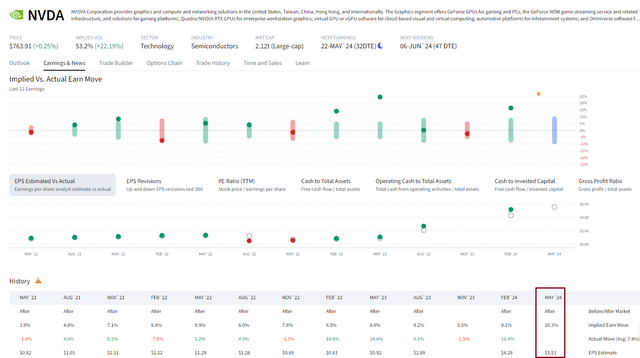

Trying forward for future volatility catalysts on NVDA shares, the corporate is slated to current on the RSA Conference 2024 in San Francisco from Might 6 to 9. Then comes the agency’s Q1 2025 earnings date which is confirmed to happen on Wednesday, Might 22 AMC.

NVDA: Company Occasion Threat Calendar

The choices market has priced in a ten.3% earnings-related inventory value swing when analyzing the at-the-money straddle expiring soonest after the reporting date. That’s the costliest straddle in at the least the final three years, in response to ORATS information, indicating that promoting choices right this moment is extra profitable than earlier than earlier earnings occasions.

NVDA: Implied Volatility Surges Properly in Advance of Might Earnings

The Technical Take

With NVDA priced attractively on earnings contemplating its progress price and as implied volatility runs traditionally excessive, we should gauge NVDA’s chart to get a way of when and the place to probably buy NVDY. Discover within the graph beneath that NVDA has a lingering hole down on the $675 degree. That can be the place the 50% retracement of the October 2023 to March 2024 rally comes into play. Above that, I observed that the 38.2% Fibonacci retracement level is $749 – not removed from the place NVDA settled final week. The query is: Is a low in place?

I don’t assume so, at the least not fairly but. Following a bearish RSI momentum divergence final month and the lack of key help within the $830 to $840 zone, an additional corrective transfer is probably going for my part. That assertion is backed up by a high-volume promoting occasion on Friday, April 19. We have to see indicators that draw back momentum is subsiding earlier than going outright lengthy. For NVDY, I like the truth that volatility has kicked up, however positive factors may be rapidly worn out if NVDA tendencies down. Shopping for NVDA or NVDY when the previous reaches into the $600s seems as a extra prudent strategy.

General, I count on extra draw back with NVDA, which might be bearish for NVDY. However shares aren’t too removed from essential help, and that degree could possibly be reached prematurely of NVIDIA’s late Might Q1 reporting date.

NVDA: Eyeing Draw back Targets, $675 Hole In Play

The Backside Line

I’ve a maintain ranking on NVDY. The short rise in implied volatility ought to put this option-selling ETF on buyers’ radar screens. However with draw back dangers to NVDA, the time will not be fairly proper, for my part, to get lengthy NVDY. Ready till implied volatility rises and NVDA shares attain into the $600s is a greater risk-reward concept.