NeilLockhart

The Q1 Earnings Season for the VanEck Gold Miners ETF (GDX) has lastly begun, and one of many first firms to report its results was Newmont Company (NYSE:NEM). General, the corporate had a good begin to the 12 months with a big enhance in working money circulation and adjusted earnings of $0.55 (Q1 2023: $0.40). Notably, this was regardless of little assist from its main non-managed joint ventures that had a sluggish begin to the 12 months, and Newmont has already said that manufacturing could be back-end weighted with a lot larger manufacturing anticipated from Pueblo Viejo (40%), Nevada Gold Mines (38.5%), Tanami, Brucejack, and Fruta Del Norte because the 12 months progresses. Let’s take a more in-depth have a look at the Q1 outcomes and 2024 outlook beneath:

Newmont Q1 Manufacturing & Gross sales

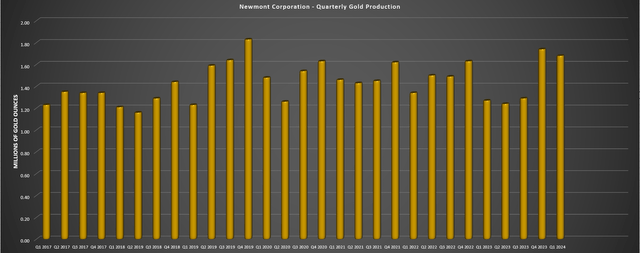

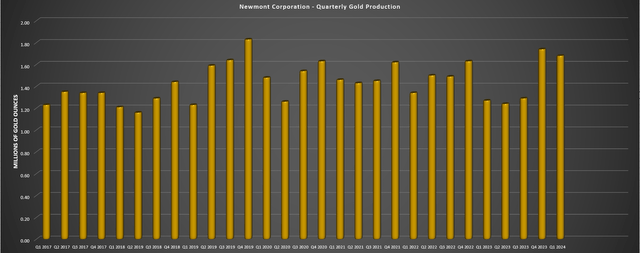

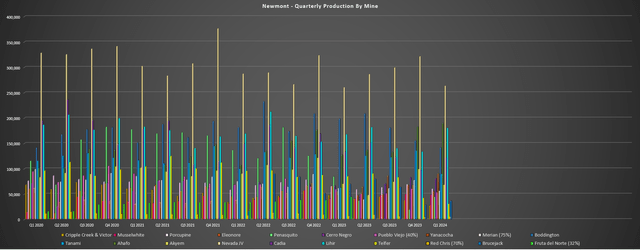

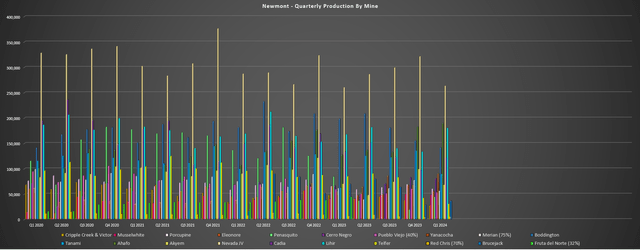

Newmont reported manufacturing of ~1.68 million ounces of gold in Q1 2024, a ~32% enhance from the similar interval final 12 months. The numerous enhance in manufacturing was associated to its large Newcrest acquisition, which added a number of Tier-1 jurisdiction belongings (Cadia, Brucejack, Pink Chris, Telfer) and the huge Lihir Gold Mine in Papua New Guinea which as soon as into higher-grade ore in Section 14A may turn into a ~1.0 million ounce every year producer in peak years at industry-leading AISC. Sadly, Telfer obtained off to a sluggish begin post-acquisition as work continues on its tailings’ storage facility, Brucejack had solely a partial quarter in Q1 with simply ~37,000 ounces produced (12% of annual steering). The decrease manufacturing at Brucejack (a partial quarter impacted by a fatality in December) and Telfer wasn’t helped by a sluggish begin to the 12 months from Nevada Gold Mines and Pueblo Viejo, two non-managed operations which are run by Barrick Gold Corporation (GOLD).

Newmont Quarterly Gold Manufacturing – Firm Filings, Creator’s Chart Newmont Quarterly Manufacturing by Mine – Firm Filings, Creator’s Chart

The excellent news is that Newmont had guided for H2-weighted manufacturing, and the sluggish begin to the 12 months was largely anticipated. Newmont will profit from considerably larger attributable manufacturing from belongings like Fruta Del Norte, Pueblo Viejo and Nevada Gold Mines, particularly with Pueblo Viejo working in the direction of full manufacturing following its 14 million tonne every year growth. Nonetheless, buyers also can look ahead to elevated manufacturing from Brucejack, larger manufacturing from Penasquito (since restarted following a significant strike final 12 months) and better manufacturing from Tanami, which noticed decrease manufacturing after a deliberate mill shutdown and heavy rainfall in Q1. And whereas gold manufacturing was solely up ~30% year-over-year regardless of the main acquisition closing, gold-equivalent ounce [GEOs] manufacturing soared ~70% year-over-year to ~489,000 GEOs at a lot decrease all-in sustaining prices with the addition of Cadia’s copper contribution.

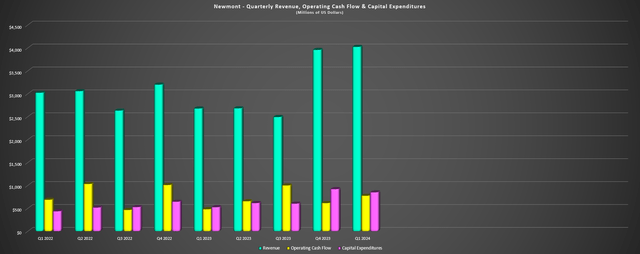

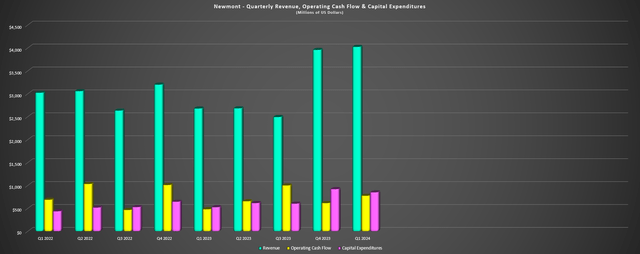

Newmont Quarterly Income, Working Money Circulate & Capex – Firm Filings, Creator’s Chart

As for Newmont’s gross sales efficiency, income got here in at ~$4.02 billion (+50% year-over-year), benefiting from larger metals costs and a big enhance in gold-equivalent ounces offered. In the meantime, working money circulation improved to $776 million (Q1 2023: $481 million) and we noticed a smaller free money outflow of $74 million in what ought to be the weakest quarter of the 12 months from an AISC margin standpoint. Nonetheless, it is vital to notice that free money circulation and working money circulation had been impacted by adverse working capital modifications, together with the Newcrest stamp responsibility cost of $291 million in Q1. And excluding this stamp responsibility cost, we noticed a constructive free money circulation of ~$220 million.

Prices & Margins

Transferring over to prices and margins, Newmont reported Q1 all-in sustaining prices of $1,439/oz, a 5% enhance from the year-ago interval. This was not stunning on condition that the sector has continued to wrestle with a good labor market and inflationary pressures total, and considerably larger prices from its curiosity in Nevada Gold Mines ($1,576/oz vs. $1,405/oz), Eleonore ($1,920/oz vs. $1,420/oz), CC&V ($1,735/oz vs. $1,375/oz), and a shortened quarter from its new Brucejack Mine ($2,580/oz) did not assist. Nonetheless, we should always see considerably improved prices from Brucejack in H2 of this 12 months because it ramps again up in the direction of regular manufacturing ranges (~300,000 ounces every year at sub $1,400/oz AISC) and whereas Nevada Gold Mines noticed larger prices, the Nevada gold portfolio usually sees larger prices in Q1 with upkeep accomplished early within the 12 months. Therefore, whereas prices had been above the full-year steering vary, I might count on them to dip beneath $1,400/oz in H2 2024.

Fortuitously, the upper prices had been greater than offset by the latest gold worth power, and that is regardless that gold did not actually begin making its transfer till late within the first quarter. Nonetheless, even with a mean realized gold worth of $2,090/oz in Q1, Newmont reported AISC margins of $651/oz (Q1 2023: $530/oz) or a 23% enhance year-over-year. And if we look forward to Q2, AISC margins may are available above $870/oz and are lapping simple year-over-year comparisons, setting the corporate up for over 70% AISC margin growth in Q2 2024 vs. Q2 2023 (~$870/oz conservative estimate vs. $493/oz reported in Q2 2023. Plus, as its higher-cost belongings are shed with deliberate divestment, there’s a path to ~$900/oz AISC margins subsequent 12 months if the gold worth (XAUUSD:CUR) continues to cooperate.

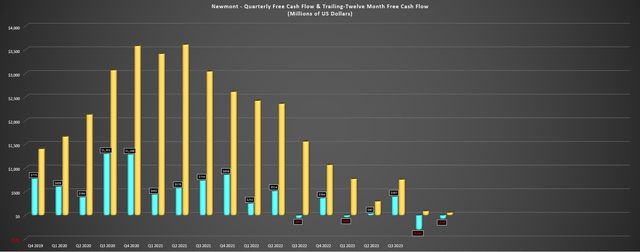

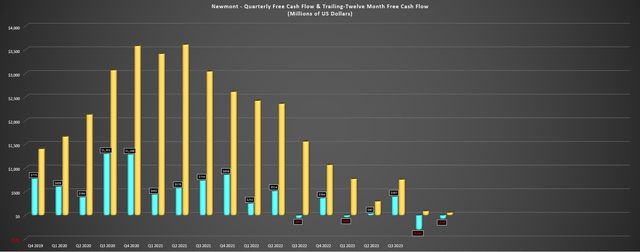

Newmont Quarterly Free Money Circulate & Trailing Twelve Month Free Money Circulate – Firm Filings, Creator’s Chart

Sadly, the improved margins didn’t translate into any vital free money circulation technology in Q1. Nonetheless, it is vital to notice that capital expenditures had been up considerably year-over-year with the addition of the Newcrest portfolio ($850 million vs. $526 million) and vital investments at Tanami 2 Enlargement and Ahafo North, and working money circulation was impacted by a $666 million adverse change in working capital (*) from the Newcrest stamp responsibility cost ($291 million), stock build-up and reclamation spending for its Yanacocha water therapy amenities. Nonetheless, Q2 and the remainder of 2024 ought to look much better, and Newmont ought to generate upwards of $2.0 billion in free money circulation this 12 months.

Newmont’s Q1 2024 working money circulation was $776 million vs. $481 million in Q1 2023, however got here in at ~$1.44 billion in This fall 2024 earlier than working capital modifications (*)

Current Developments

As for latest developments, Newmont offered its Lundin Gold Inc. (OTCQX:LUGDF) stream credit score facility and offtake settlement at Fruta Del Norte and can accumulate $330 million in money by September 2024 whereas sustaining its one-third fairness curiosity in Lundin Gold. It will assist to enhance its web debt place of ~$6.8 billion and is a strong begin in its plan to optimize its portfolio and turn into a leaner and meaner miner with a a lot stronger steadiness sheet.

As for operational developments, the Tanami 2 Enlargement capital has been held at $1.7 billion to $1.8 billion after vital capex blowouts beforehand reported on this undertaking and stays on observe for H2 2027. In the meantime, the extraordinarily excessive margin Ahafo North Venture stays on observe for its first gold pour by mid-2025 with practically half of the spend full. On the adverse facet, Cerro Negro operations are suspended following an investigation after two tragic amenities in early April. Cerro Negro (*) in Argentina is considered one of Newmont’s higher-margin belongings, so this can be a minor drag on total manufacturing and prices this 12 months because it takes time to ramp again as much as full capability following the completion of the investigation.

(*) Newmont’s FY2024 steering for Cerro Negro was ~290,000 ounces at $1,180/oz, nicely beneath its FY2024 AISC steering on a consolidated foundation of ~$1,400/oz (*)

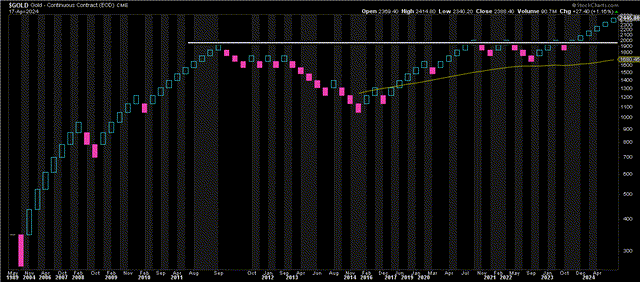

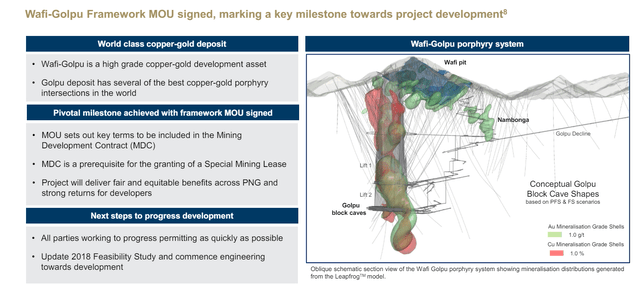

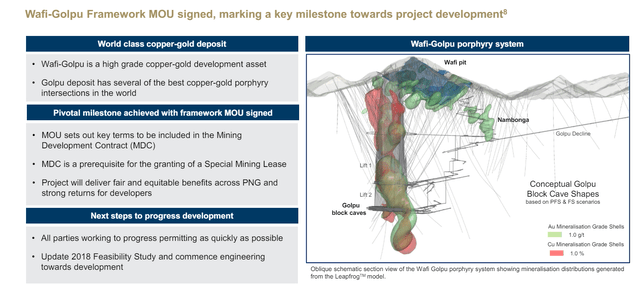

Maybe probably the most vital improvement for Newmont is the latest power in gold and copper costs, with gold plowing by its multi-year resistance with ease and copper persevering with to bang on the door of $2.50/lb. The latest power in gold and copper has offered a big increase to Newmont’s backside line, particularly on condition that it added two vital copper belongings in its Newcrest acquisition with Cadia and Pink Chris in Australia and Canada, respectively. And whereas the huge shared Wafi-Golpu Venture, which is predicted to have adverse all-in sustaining prices after by-product credit, shouldn’t be but permitted and is probably going a post-2030 alternative, the NPV on this asset is wanting much better if gold and copper costs can stay at present ranges. Let’s examine if the latest metals worth power is beginning to get priced into the inventory:

Gold Value Lengthy-Time period Breakout – StockCharts Wafi-Golpu Venture – Newcrest Presentation

Valuation

Based mostly on ~1.16 billion shares and a share worth of $41.00, Newmont trades at a market cap of ~$47.6 billion and an enterprise worth of ~$54.5 billion. This continues to make Newmont the very best market cap title within the sector by a large margin following its Newcrest acquisition, the place it gained a number of giant gold-copper mines/tasks, the high-grade Brucejack Mine in Canada, and the huge Lihir Mine in Papua New Guinea.

Nonetheless, after its sharp rally off its lows since I highlighted the inventory as a Buy at US$31.00, the inventory is now buying and selling at over 14x FY2025 EV/FCF estimates, making it much less of a price play than when it traded at a ~$35 billion market cap simply two brief months in the past. And whereas this does not imply that the inventory cannot go larger, I’m extra impartial short-term on the inventory from the US$41.00 degree with it now again to buying and selling at only a ~2.4% dividend yield and fewer of a reduction vs. what I consider to be a good a number of of 16 – 18x free money circulation for the enterprise.

Newmont February 2024 Replace – Searching for Alpha Premium/PRO

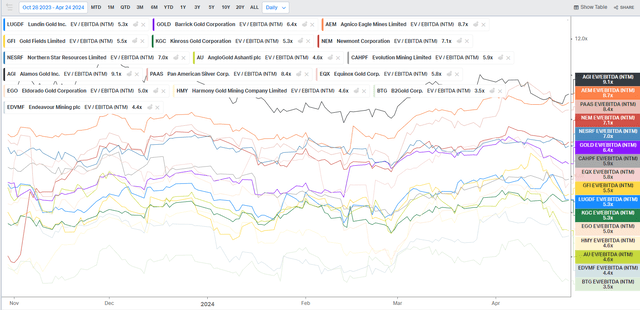

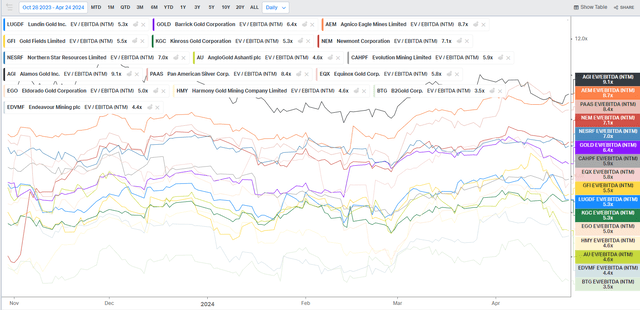

Digging into how Newmont stacks up relative to its friends, we are able to see that Newmont trades at a big low cost to names like Agnico Eagle Mines Restricted (AEM) and Alamos Gold Inc. (AGI), however these are primarily Tier-1 jurisdiction miners with a close to flawless observe document of disciplined capital allocation which have persistently generated larger returns on capital for his or her shareholders with constant per share progress. And whereas it is attainable that Newmont can reverse this development with a better common realized gold worth and a pivot to specializing in margins vs. complete ounces, turning an organization like Newmont round is like turning a supertanker. It could actually take a while, by no means thoughts the truth that it is rather more troublesome to develop when an organization reaches this scale within the gold mining {industry}. Therefore, whereas NEM trades at a really affordable EV/EBITDA a number of and I see an upside from right here, among the simple cash has been made after its ~35% rally off its lows.

Newmont EV/EBITDA A number of vs. Intermediate/Main Gold Friends – Koyfin

That being stated, bullish sentiment for Newmont stays fairly subdued relative to its peer group, and the inventory has a variety of catching as much as do if it could actually execute efficiently. And whereas beating expectations was very troublesome the previous three years in a extremely inflationary setting with the gold worth caught in a spread, the setup is much totally different at present, particularly with Newmont working to let go of its high-cost and non-core belongings to enhance its total enterprise and free money circulation profile. So, with the advantage of a better gold worth that which ought to assist it divest its non-core belongings, a extra sturdy free money circulation profile to scrub up its steadiness sheet and the advantage of bigger Tier-1 scale belongings benefiting from economies of scale post-2025, I believe there’s a excessive chance of a profitable turnaround right here and a return to a sector darling, even when it is going to take time to regain the market’s belief.

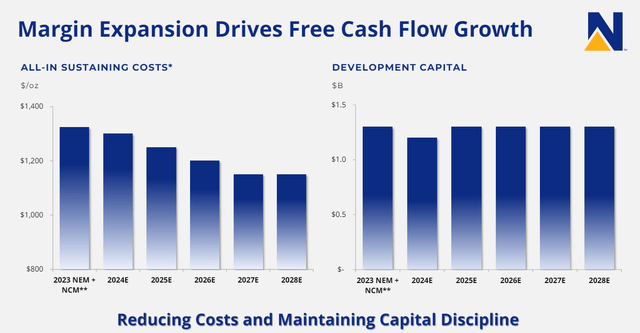

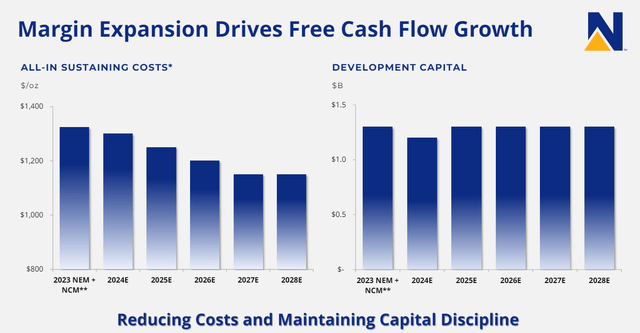

Newmont Lengthy-Time period AISC Outlook – Firm Web site

Lastly, whereas Newmont’s all-in sustaining prices stay elevated at the moment, it is vital to notice that the corporate is assured it could actually obtain a big discount in AISC because it sheds higher-cost belongings and brings on higher-margin belongings later this decade like Ahafo North (~300,000 ounces at $900/oz AISC within the first 5 years) and its Tanami Enlargement (incremental ~175,000 ounces every year within the first 5 years at a lot decrease AISC). As well as, Lihir could also be a comparatively high-cost asset at present, however it is a top-5 gold asset by scale globally in its peak years with the potential for considerably decrease AISC long run. Therefore, with a view that Newmont can be in a a lot stronger place two years from now and a big free money circulation generator even at extra conservative $2,200/oz gold worth assumptions, I might view any sharp pullbacks within the inventory as shopping for alternatives.

Abstract

Newmont Company had a strong begin to 2024 regardless of little assist from its non-managed joint ventures in Nevada and the DRC and appears nicely on observe to ship into its steering of ~4.1 million ounces of gold for its Tier-1 portfolio. In the meantime, the corporate is about to see a big enhance in AISC margins in its Q2 outcomes, with the potential for AISC margins to soar over 30% sequentially to $870/or plus and over 70% year-over-year vs. its simple year-over-year comparisons (Q2 2023: $493/oz). Lastly, we should always see accelerated debt repayments as the corporate works to divest a number of non-core belongings and advantages from a a lot improved free money circulation profile with a lot larger valuable metals costs, and the advantage of a stronger copper worth.

Nonetheless, I choose to purchase at a deep low cost to honest worth when shares are being thrown out and sentiment is within the gutter. Whereas Newmont Company actually has additional upside if gold can stay at present ranges, I’ve no plan so as to add to my place at present ranges with way more enticing bets elsewhere within the sector like B2Gold Corp. (BTG) buying and selling at simply over ~5x FY2025 free money circulation estimates with a ~6.3% dividend yield. Therefore, whereas I might not be stunned in any respect to see Newmont commerce again above US$48.00 within the subsequent twelve months, I might be rather more keen on including to my place on a pullback than chasing the inventory after its 35% plus rally.