Hiroshi Watanabe

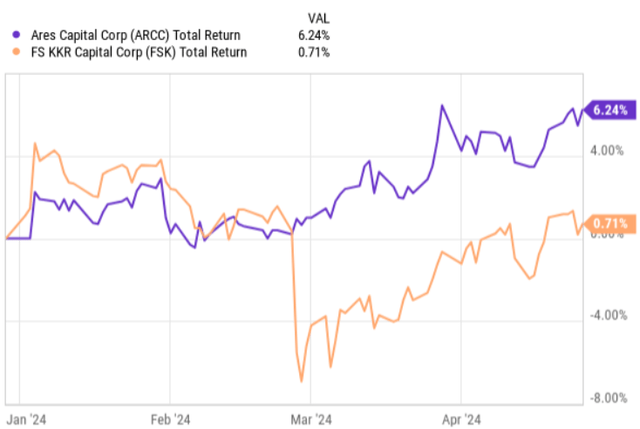

Late December final 12 months, I issued an article evaluating the biggest BDC – Ares Capital (NASDAQ:ARCC) – with the second largest one, FS KKR Capital (FSK). Whereas I used to be bullish on each BDCs, I most well-liked allocating barely extra in FSK because of the following causes:

- FSK traded at a reduction to NAV, whereas ARCC had an embedded premium.

- FSK’s share value had been underneath the stress for fairly a while because of a notable build-up of non-accruals, which in keeping with the Administration was set to vary.

- FSK’s yield was a number of a whole bunch of foundation factors above that of ARCC.

Within the meantime, the truth that ARCC had a premium and thus decrease yield was, in my view, absolutely justified by its sturdy portfolio (consisting of diversified and high-quality names) and fortress stability sheet.

It was simply that on a tactical foundation, it made extra sense to allocate a bit extra in FSK to seize potential returns from the restoration that may materialize because the rates of interest drop (minimizing the chance of non-accruals) and the portfolio improves.

Nonetheless, on a YTD foundation, ARCC has clearly outperformed FSK, principally because of a subpar earnings report by FSK. Within the chart, we will really discover that up till the earnings day, FSK was performing above ARCC.

With that being stated, whereas about two months I issued a follow-up article on FSK arguing how the BDC’s prospects are nonetheless there (and since then, FSK has generated alpha of ~7%), now it appears the proper second to supply a further taste on ARCC and the way I see ARCC performing going ahead.

Earlier than we try this, let me spotlight a very powerful structural components, which have emerged because the publication of my article on ARCC in December 2023:

- The consensus for the variety of rate of interest cuts in 2024 has gone down from 6 to simply 2, and the general state of affairs of upper for longer has clearly strengthened.

- There are some early indicators of a synchronized improve in non-accruals throughout the BDC house.

- The M&A and capital markets exercise has not but picked up and because the rate of interest volatility has elevated, it appears extremely unlikely that 2024 will probably be favorable for the general transaction exercise.

- The BDC index – the VanEck BDC Earnings ETF (NYSEARCA:BIZD) – has continued to go up, registering ~6% in complete returns on a YTD foundation.

So, what these aforementioned dynamics inform is that BDCs have turn into a bit dearer principally because of the strengthening of upper for longer state of affairs, though the chance of non-accrual build-up has additionally ticked larger and there’s no robust tailwinds supporting the expansion in AUM.

Right here, we now have to grasp that rising non-accruals is barely logical as throughout 2023 we had extraordinarily minimal company chapter ranges and the companies, which have began to roll over their beforehand issued mounted charge debt when the rates of interest have been low have been more and more going through challenges on their means to service the ballooning curiosity expense.

Equally, the actual fact the M&A and capital markets are shallow introduces a harder setting for BDCs to not solely develop, but in addition preserve their present AUM. For BDCs, it’s important to search out recent offers as a way to at the very least compensate for the natural paydowns of their investments. In any other case, if the whole asset determine shrinks, the bottom from which BDC can seize spreads between funding yield and the price of capital additionally turns into smaller, thereby placing a downwards stress on the underlying NII technology.

In my view, the dangers which are related to larger non-accruals and slower portfolio progress (and even portfolio lower) are very low for ARCC, which makes the BDC an incredible funding relative to different BDCs on the market.

Listed below are extra particulars why that is the case.

Thesis

In relation to the portfolio high quality and having the protection embedded within the portfolio, ARCC is among the finest within the sport. All of it begins with the diversification. There are three key levers when it comes to the diversification, which we now have to consider that actually distinguishes ARCC from the typical BDC:

- ARCC is well-diversified on the asset allocation stage, the place it’s not restricted to solely credit score house, but in addition has branches in personal fairness, actual belongings and secondaries that collectively represent ~40% of the standard credit score / BDC enterprise measurement.

- On the trade stage can be tremendously diversified and, most significantly, into pockets of financial system, that are inherently much less delicate to the fluctuations within the financial system. For instance, ARCC holds lower than 2-3% of its portfolio in industries, through which usually leveraged mortgage transactions dominate (e.g., lodge and gaming, oil & fuel, and transportation).

- On the firm stage, ARCC carries one of many lowest single firm concentrations within the BDC sector. As of This autumn, 2023, ARCC’s common place measurement in a single firm was 0.2% with the biggest funding consuming solely ~2% of the portfolio.

Furthermore, within the context of ARCC’s defensiveness, buyers have to understand the conservative funding underwriting technique that’s utilized by the Administration (on prime of the diversification side).

The commentary by Kort Schnabel – Co-President – throughout Raymond James forty fifth Annual Institutional Buyers Convention, captures the story nicely:

We’re on the lookout for main market share companies, firms which have dominant market shares and boundaries to these market shares. Good defensible moats round their market share. Excessive free money circulate technology. We’re operating a number of sensitivities on these companies after we underwrite in all totally different charge environments and financial environments, ensuring that the money circulate goes to be there to service our mortgage.

The outcomes of this technique could be properly noticed within the data of the latest earnings report. Despite the fact that the non-accrual place has turn into a problem for increasingly more BDCs, ARCC continues to profit from its conservative underwriting requirements.

As an illustration, the non-accruals at value ended the 12 months at 1.3%, which is under the 1.7% at year-end 2022. That is additionally under ARCC’s 15-year historic common of three% in non-accruals. Particularly, this confirms that ARCC could possibly be simply thought of a BDC, which is extra defensive than the typical BDC on the market.

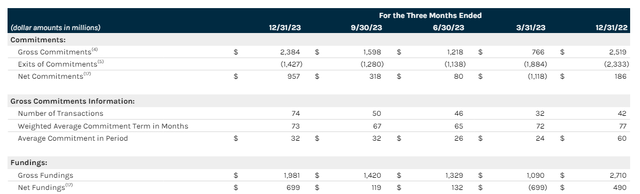

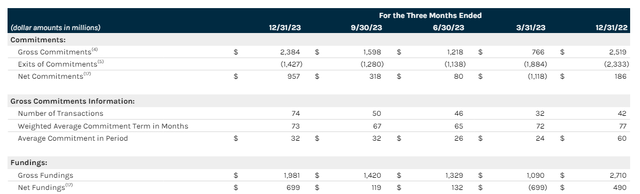

Additionally, if we have a look at how ARCC has carried out on the web funding entrance, we will see that regardless of the actual fact that it’s the largest BDC (which means sizeable chunks of capital being organically paid down every quarter), the Administration has really registered progress in web fundings for already three quarters in a row.

ARCC This autumn-23 Earnings Presentation

All of this has occurred, whereas the M&A and capital markets have remained fairly inactive.

The important thing motive why this has been doable for ARCC lies within the mixture of its measurement and the diversification.

In relation to the dimensions, ARCC has grown so massive that it may well now take part and compete with conventional banks in actually giant ticket measurement transactions. Once more, within the Raymond James forty fifth Annual Institutional Buyers Convention, Kort Schnabel offered an incredible colour on this side:

Additionally permits us, by the way in which, when issues decelerate slightly bit within the M&A setting like we noticed within the final 18 months or so, we will then present capital into that incumbent portfolio. It creates ballast in our origination system. We talked in regards to the scale already. Perhaps not an excessive amount of extra to say there. I suppose simply, the power to decide to giant transactions permits us to have energy within the market over documentation phrases, over pricing, proper? We’re standing up for north of $500 million, typically as much as a billion {dollars} per deal. That offers us a number of energy available in the market, and it provides us entry to the capital markets.

The aforementioned diversification angle stemming from the assorted sectors through which ARCC performs additionally is useful in offering a extra secure demand for ARCC’s capital.

The underside line

Towards the backdrop of upper for longer and on the similar time, growing danger of company misery and a continued inactivity within the M&A and capital markets house, ARCC has turn into a extra engaging funding, particularly in comparison with most different BDCs.

The present premium of ~7% over the underlying NAV appears absolutely justified and doesn’t injury the attractiveness of ARCC. If we assess the core of ARCC, we’ll discover that it has the mandatory traits to soundly climate the prevailing / aforementioned headwinds within the BDC sector.

Given the explanations above and the juicy dividend of 9.2%, I stay bullish on Ares Capital.