Founding an organization throughout financial uncertainty and excelling takes greater than only a hungry founder with a good suggestion. It requires a stable basis to face up to the market. Corporations based right this moment should give attention to changing into worthwhile whereas rising, which is just typically a precedence for firms receiving aggressive VC funding. Within the pre-revenue stage, profitability has typically been prime of thoughts, however holding operations environment friendly and targeted is important for maximizing the potential for monetization.

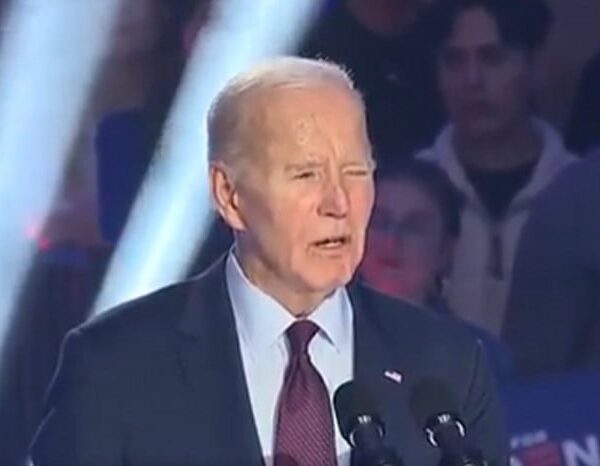

Buyers are participating with fewer pitch decks from founders, in line with DocSend data — investor exercise dropped lower than 2% year-over-year (YoY) from 2022 and 4% from 2021. Nonetheless, traders are nonetheless reviewing pitch decks at a better clip than 2020, proving there’s a marketplace for early-stage offers, though funding was down 27% YoY in Q3.

Each market has its alternatives and challenges. Just some years in the past, a founder’s market led to “zombie” companies elevating cash at unrealistic valuations with a “growth at all costs” mindset, proving there are pitfalls even in a extremely founder-friendly market.

Now that traders have pulled again to level-set, founders have to show their firm is constructed to final with long-term profitability and scalability in thoughts. Traditionally, this follows go well with with Large Tech firms like Google, Microsoft, and Adobe, which had been all at or close to profitability once they went public.

There can be founders who fail in 2023, however there may even be founders who reach ushering within the firms that outline a era.

Instilling stable constructing blocks for the corporate’s basis is much more vital in a tighter financial system and investor’s market. A few of the most modern firms on this planet had been began throughout economically difficult conditions, and people firms had been constructed to face up to the market they had been getting into.

The following era of firms that outline the market will function with the identical integrity. A robust basis helps elevate early-stage capital and can assist the corporate scale when applicable and attain additional levels of its life cycle. Within the days of progress in any respect prices, being worthwhile or maintaining a tally of unit economics had been typically ignored or disdained. That has now clearly modified. For founders now, perfecting the pitch, having an environment friendly gross sales technique, and scoping the product with urgency will create a robust basis for fulfillment that draws traders.