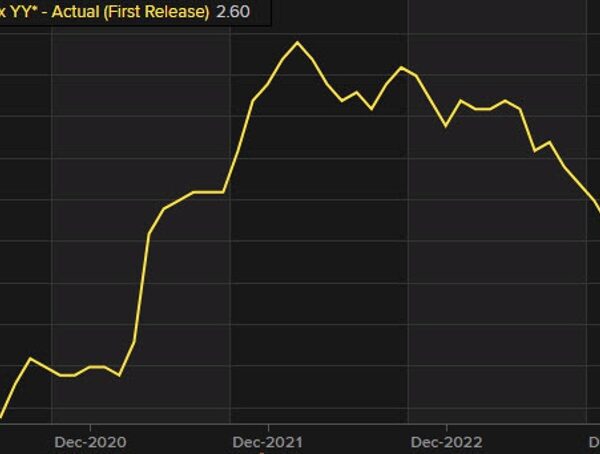

Main currencies are principally little modified as broader markets are taking a little bit of a breather thus far as we speak. The US CPI data yesterday produced a chaotic response because the greenback went up and down, earlier than shifting again up barely once more within the aftermath. That comes as bond yields additionally firmed however equities had different concepts as tech shares rallied laborious.

That’s making it robust to get grasp on issues however the Fed pricing now reveals that odds of a June price reduce are at ~76% with 84 bps price of price cuts priced in for the 12 months. It should now come down as to whether the Fed sees match to information markets in the direction of a transfer in June or preferring to maintain their choices open.

However thus far as we speak, equities are extra muted whereas bonds are additionally not doing a lot. US futures are flat whereas 10-year Treasury yields are down simply 0.6 bps to 4.148%. That is not giving merchants a lot to work with forward of European morning commerce later.

The yen is an early mover with USD/JPY easing to 147.23 earlier than bouncing again to 147.60 now. Japan’s spring wage negotiations will conclude this week and we’re already getting some early headlines here. That may maintain the yen within the highlight till the weekend, with the BOJ developing subsequent week.

As for European buying and selling, there will likely be some gentle information releases to maneuver issues alongside. However the primary focus will keep on broader market sentiment as merchants digest the post-CPI response earlier than one other slew of US information tomorrow.

0700 GMT – UK January month-to-month GDP information

1000 GMT – Eurozone January industrial manufacturing

1100 GMT – US MBA mortgage purposes w.e. 8 March

That is all for the session forward. I want you all one of the best of days to come back and good luck together with your buying and selling! Keep secure on the market.