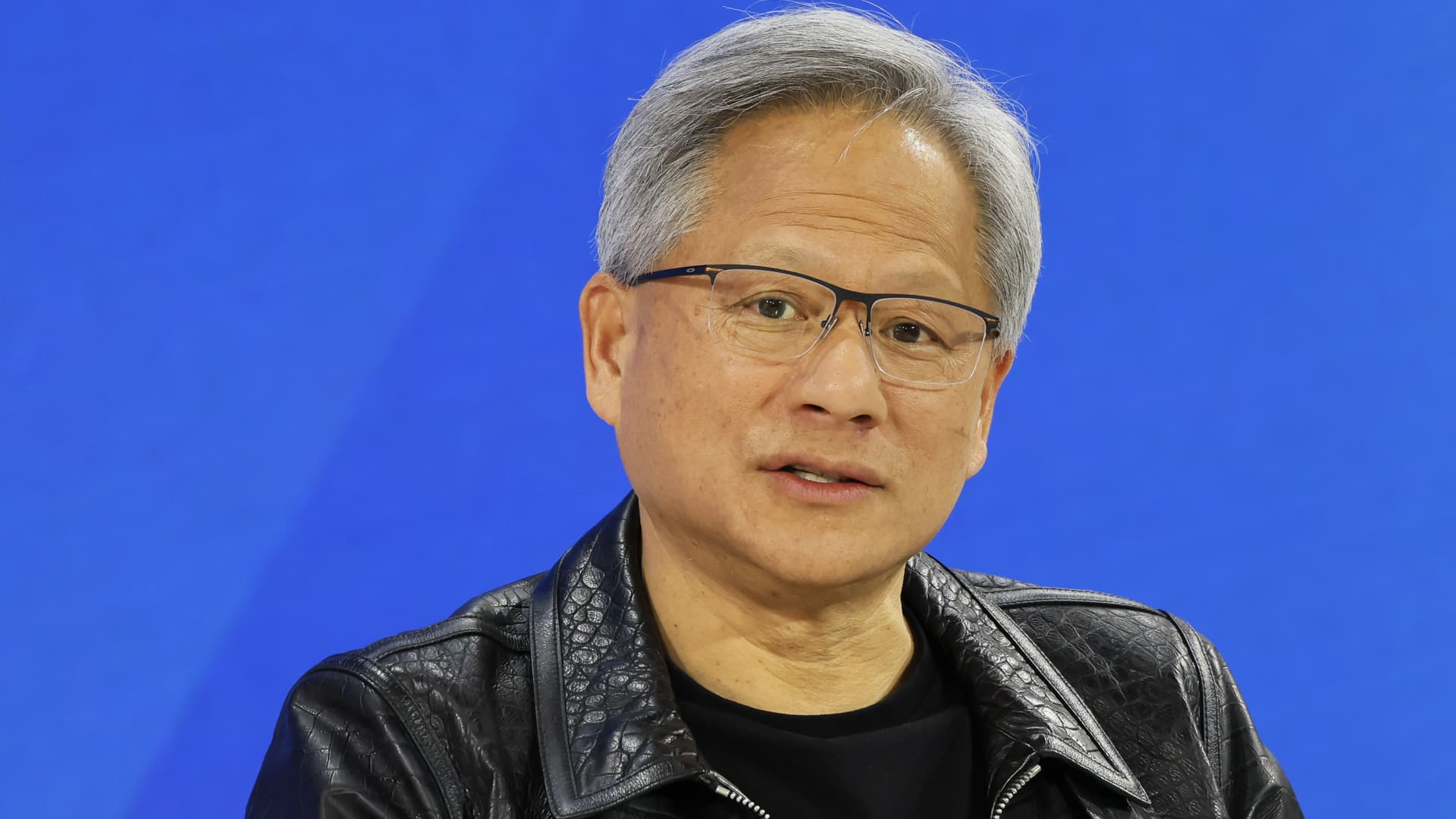

Wall Avenue is deep into the earnings season, however there are nonetheless some main stories on deck. Practically 50 S & P 500 firms are slated to launch their newest quarterly outcomes, together with synthetic intelligence darling Nvidia , Walmart and Residence Depot . Heading into this week, greater than three-quarters of S & P 500 names have posted earnings. Of these, 76% have crushed expectations, FactSet information reveals. Check out CNBC Professional’s breakdown of what is anticipated from a few of this week’s key stories. All occasions are Japanese. Tuesday Walmart is ready to report earnings earlier than the bell. Administration will maintain a name at 8 a.m. Final quarter: WMT shares slid on the again of a cautious client spending outlook . This quarter: Analysts polled by LSEG, previously referred to as Refinitiv, anticipate the retailer to put up slight year-over-year income progress. Nonetheless, earnings per share are anticipated to fall. What CNBC is watching: Walmart shares are off to a powerful begin for 2024, rising 8.1%. Can that momentum proceed at the same time as inflation persists? Guggenheim analyst Robert Drbul thinks so, noting: “Under Doug McMillon’s outstanding leadership and unique vision, Walmart’s business mix continues to change shape and create a better profit mix versus its historical P & L.” Drbul has a purchase score and a value goal of $190, implying upside of 11.5% from Friday’s shut. What historical past reveals: Bespoke Funding Group information reveals Walmart beats earnings expectations 71% of the time. Nonetheless, shares have fallen after the previous two releases. Residence Depot is ready to report earnings within the premarket, adopted by a convention name at 9 a.m. Final quarter: HD shares rallied on better-than-expected earnings regardless of residence enchancment gross sales moderating . This quarter: Residence Depot is predicted to report an earnings decline of greater than 15% from the year-earlier interval, per LSEG. What CNBC is watching: Climate might play a giant position in Residence Depot’s outcomes, famous KeyBanc analyst Bradley Thomas. “We expect 4Q results to be pressured by unfavorable weather conditions, weaker DIY demand and traffic, and the impact of softer inflationary trends on dollar growth,” wrote the analyst, who has a sector weight score on the inventory. What historical past reveals: Residence Depot earnings have not missed expectations since mid-2020, based on Bespoke. That stated, the inventory averages solely a 0.3% achieve on earnings days. Wednesday Nvidia is ready to report earnings after the shut. The corporate can also be slated to carry a name at 5 p.m. Final quarter: NVDA posted a stellar quarter, with income tripling yr over yr . This quarter: Analysts anticipate one other monster quarter for Nvidia. LSEG estimates level to earnings per share and income progress of greater than 400% and over 200%, respectively. What CNBC is watching: Regardless of the inventory’s large outperformance over the previous yr, buyers shall be on the lookout for clues on progress round a China-focused synthetic intelligence chip, which is predicted to launch later this yr . “While a full quarter is not expected to be recognized right away, our estimates see this revenue stream in the region of $12B-$14B in annual revenues and $3-$4 dollars in EPS upside on annual basis,” wrote Piper Sandler analyst Harsh Kumar, who has a value goal of $850 on Nvidia and an obese score. What historical past reveals: Nvidia shares have risen in three of the previous 4 earnings days, Bespoke information reveals. The corporate additionally beats revenue forecasts 84% of the time. Thursday Warner Bros. Discovery is ready to report earnings earlier than the bell. A name between analysts and administration will then happen at 8 a.m. Final quarter: WBD reported a bigger-than-expected loss and a decline in advert income . This quarter: The media big’s income is predicted to have fallen greater than 5%, based on LSEG. What CNBC is watching: It has been a tough begin to 2024 for Warner, with the inventory shedding 13.6% on issues of declining TV advert income and additional disruption from streaming. Nonetheless, Deutsche Financial institution analyst Bryan Kraft, who has a purchase score on the inventory and a value goal of $20, is optimistic in regards to the firm’s future. “We continue to believe in WBD’s ability to succeed in the long-term due to its top-tier content engine and library, sports and news programming, and opportunity to achieve a higher level of operational performance following the merger, especially at its current valuation levels,” he stated in a be aware. What historical past reveals: Warner shares have fallen in three of the previous 5 earnings days, together with two double-digit declines, per Bespoke.

Subscribe to Updates

Get the latest tech, social media, politics, business, sports and many more news directly to your inbox.