A latest report from Bloomberg has shed light on Binance’s newest efforts to refine its consumer base. It enhanced the screening course of for prime brokerage purchasers to exclude US-based traders from its platform.

This transfer comes amidst rising regulatory calls for and the alternate’s endeavors to fortify its compliance framework.

Binance Intensifies Screening To Exclude US Buyers

In keeping with the report, Binance’s initiative to have interaction prime brokers reminiscent of FalconX and Hidden Street on this enhanced screening course of underscores the alternate’s dedication to adhering to regulatory requirements.

The directive to those prime brokers, who predominantly serve institutional traders, consists of rigorous checks on the geographical places of their consumer’s workplaces, founders, and staff.

This method to consumer screening is a part of Binance’s broader technique to make sure that US traders should not served consistent with regulatory expectations.

In the meantime, as Binance navigates the complicated regulatory setting, it has carried out stricter measures past consumer screening. Notably, the alternate has not too long ago launched extra stringent requirements for listing new digital tokens.

As reported, this initiative goals to enhance investor safety in opposition to fraudulent actions, reminiscent of “rug pulls,” and improve oversight of token listings.

These measures embody extending the “cliff period” throughout which tokens can’t be bought, mandating elevated allocation of cash to market makers, and instituting safety deposits.

Navigating International Regulatory Challenges

Whereas Binance’s efforts to strengthen its compliance framework within the US are notable, the alternate additionally faces regulatory headwinds in different jurisdictions.

In Nigeria, for instance, the federal government has raised critical issues, accusing the alternate of facilitating transactions that they allege have negatively impacted the national currency, the naira. This has positioned Binance underneath the highlight, resulting in heightened scrutiny from Nigerian regulators.

The state of affairs escalated, and the Nigerian authorities took decisive motion in opposition to Binance’s operations inside their borders. Two executives from Binance, Tigran Gambaryan and Nadeem Anjarwalla, have been detained in a government facility beginning February 26, intently monitored by the Nigerian Nationwide Safety Company.

This transfer by the Nigerian authorities underscores the rising rigidity between Binance and regulatory our bodies in its working nations, spotlighting the broader challenges crypto exchanges face in sustaining compliance throughout various regulatory environments.

Along with the detention of its executives, the Nigerian authorities has pressed the alternate to provide extensive transactional data on its top 100 users inside the nation.

Regardless of regulatory turbulence, the alternate native token, BNB, has sustained its buying and selling worth above the $500 mark. Regardless of a 6.1% dip in its worth during the last 24 hours, BNB at the moment maintains its place, buying and selling at $516 on the time of writing.

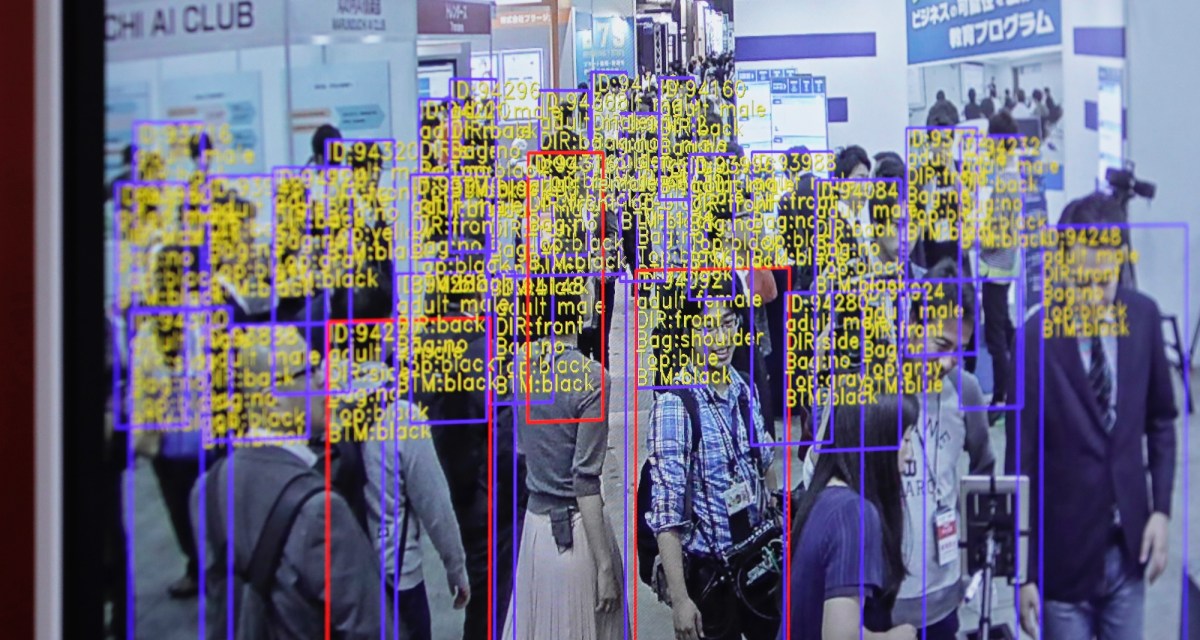

Featured picture from Unsplash, Chart from TradingView