Justin Sullivan/Getty Pictures Information

My final swing name on Tesla, Inc. (NASDAQ:TSLA) inventory was a Promote score at $290 in July here. Since then, TSLA inventory is down about -20%. I nonetheless consider quotes round $300 are too excessive for 2024. We’re all conscious of mushrooming electrical car, or EV, competitors hurting Tesla margins (suppose value cuts for EVs), whereas slowing auto deliveries and main auto recollects within the U.S. and China are hitting operations. CEO Elon Musk continues to be within the headlines in a negative way. And, a recession is more and more possible within the months forward in my opinion (based mostly on the nonetheless inverted Treasury yield curve, 2023 contraction in complete banking credit score, and rotten main financial indicators since September).

For this text, I wish to give attention to the possible valuation results of a recession situation on Tesla, the place working outcomes disappoint and Wall Road rerates the inventory on declining progress prospects.

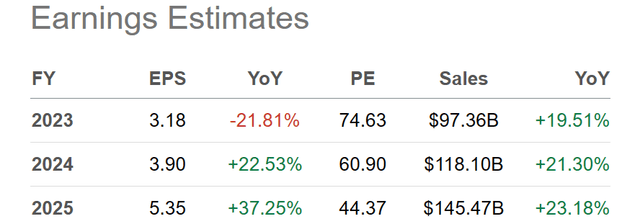

At $240 a share in early January 2024, Tesla stays overvalued, pure and easy. Nevertheless, I can see myself turning extra bullish on a bigger value drawdown throughout a recession. The excellent news is that long-term progress charges on the firm will virtually absolutely keep above common vs. the U.S. blue-chip universe. With present forecasts of 20%-30% will increase in earnings and revenues for each this yr (2024) and subsequent (2025), a large growth-multiple does make rational sense. Nevertheless, the difficulty is what ought to the valuation be on far slower progress than years previous?

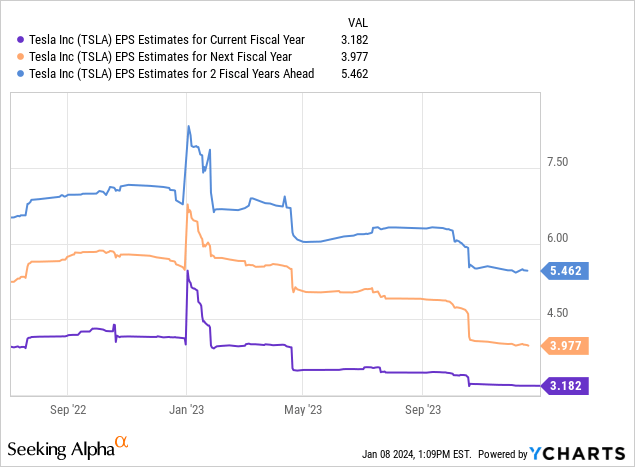

In search of Alpha Desk – Tesla, Analyst Estimates for 2023-25, Made January seventh, 2024

Usually, a P/E ratio of 30x to 40x ahead 12-month forecasts is taken into account about proper for a revolutionary-product firm, already very massive in measurement, increasing yearly at charges below 25%, with prevailing inflation and Treasury safety charges (US10Y) within the 4% to five% space. So, if a recession hits quickly, I absolutely count on Wall Road to push the inventory quote below $200, maybe all the best way again to $150. I do know bulls don’t wish to hear one other bearish projection for value, however that’s the most rational course, assuming historic comparisons nonetheless rely for the corporate. Many perma-bull buyers argue Tesla would not observe the old-school guidelines of valuation. However, this bubble-based view has price them dearly because the 2021 peak above $400 per share (break up adjusted).

Prolonged Valuation

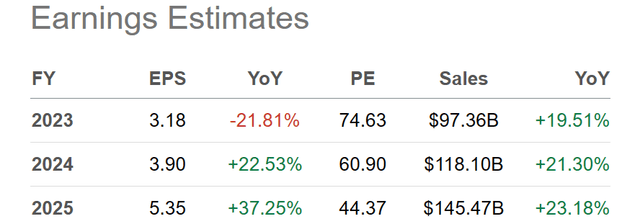

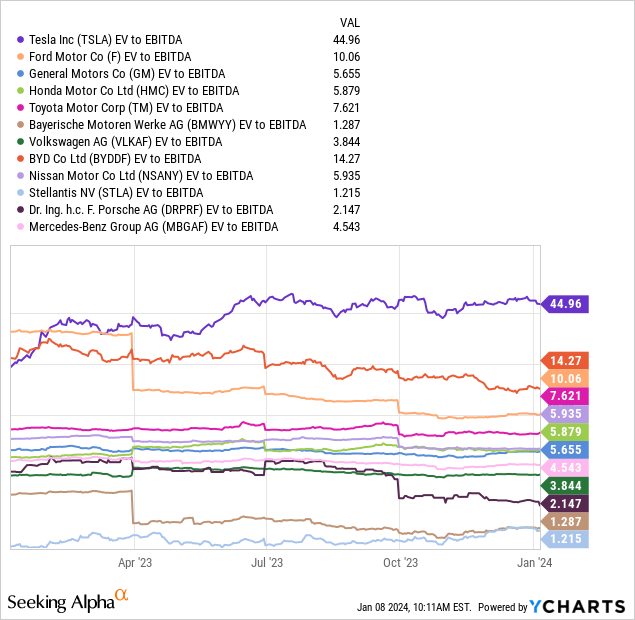

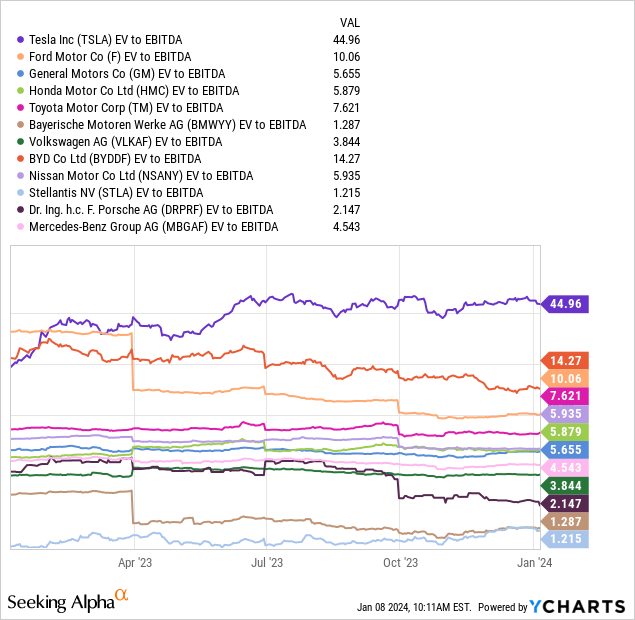

The overwhelming damaging for Tesla buyers stays a valuation a lot increased than related companies. For example, we are able to take the fairness market capitalization + complete debt – money readily available to create the enterprise worth calculation, then evaluate/distinction Tesla with the main auto names worldwide for complete price. On core money EBITDA (trailing), Tesla is promoting for a whopping enterprise worth a number of of 45x vs. a median group common below 6x!

YCharts – Tesla vs. Main World Automakers, Enterprise Worth to EBITDA, 1 12 months

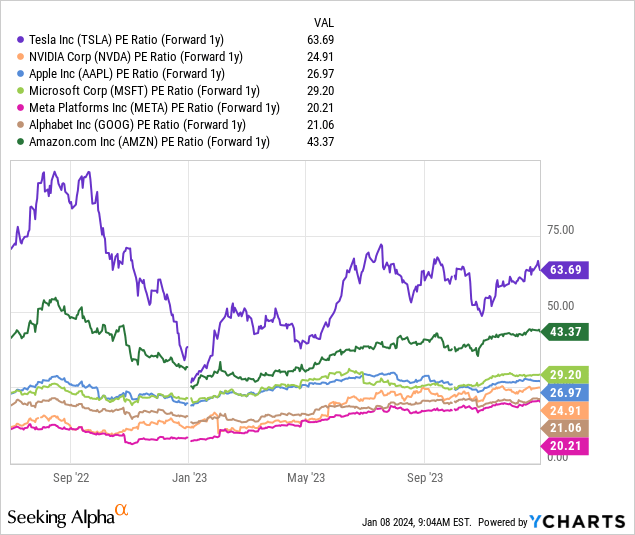

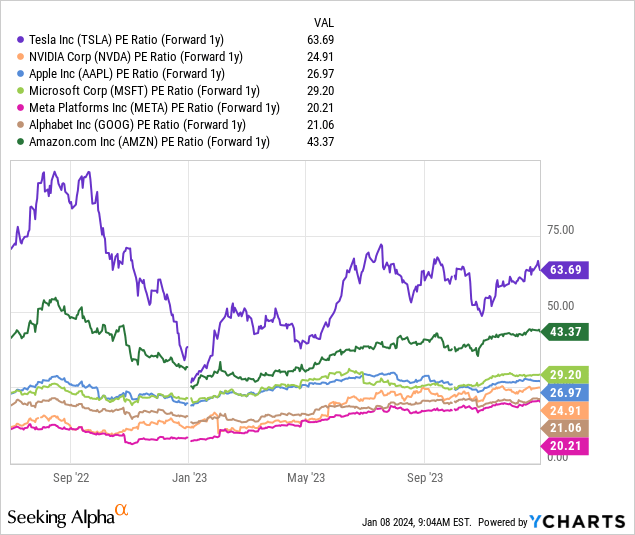

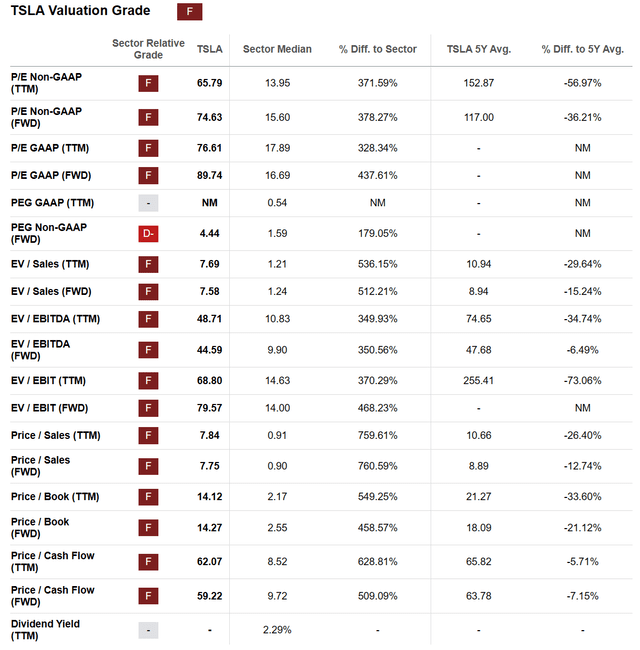

Should you consider the corporate suits higher as a Large Tech alternative (with a spread of merchandise below improvement, not simply autos), additionally it is clearly probably the most overvalued out of the Magnificent 7 enterprises as we speak, when taking a look at money move and earnings. The ahead 2024 outlook, utilizing the share value to underlying after-tax earnings estimate, is an incredible 63x vs. the median Largest Tech peer common of 27x.

YCharts – Tesla vs. Main World Automakers, Worth to Ahead Analyst Estimated Earnings, Since July 2022

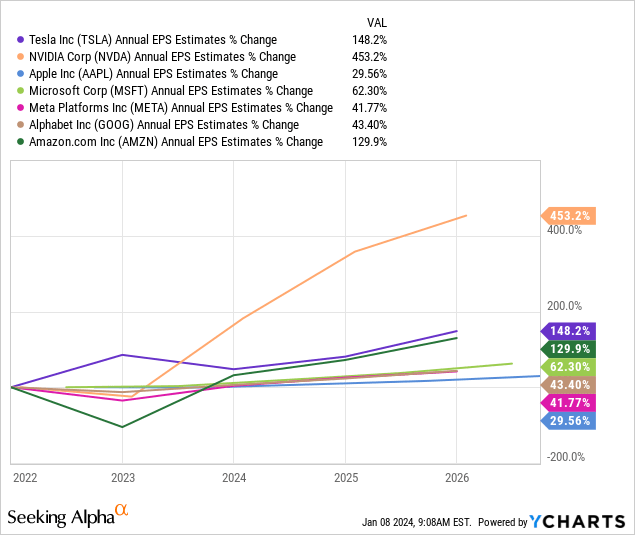

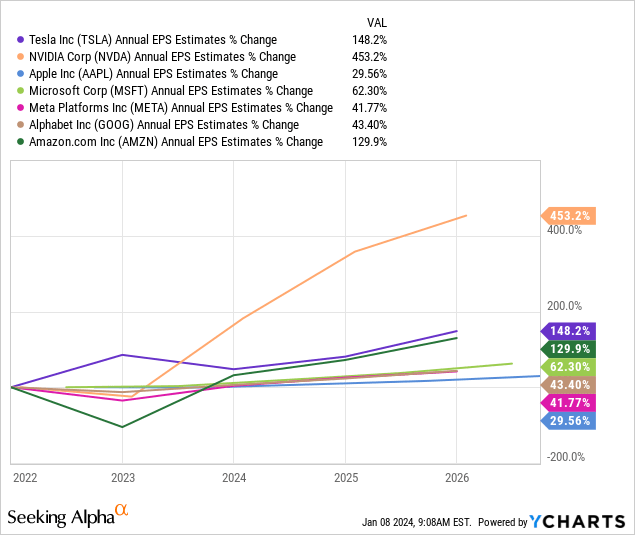

After all, Tesla’s anticipated progress charge in earnings per share from 2022 into 2026 is the best subsequent to Nvidia (NVDA). Nevertheless, even NVIDIA’s valuation on earnings and money move is dramatically decrease than Tesla.

YCharts – Magnificent 7, Analyst Estimated Earnings Development Charges into 2026, Made January seventh, 2024

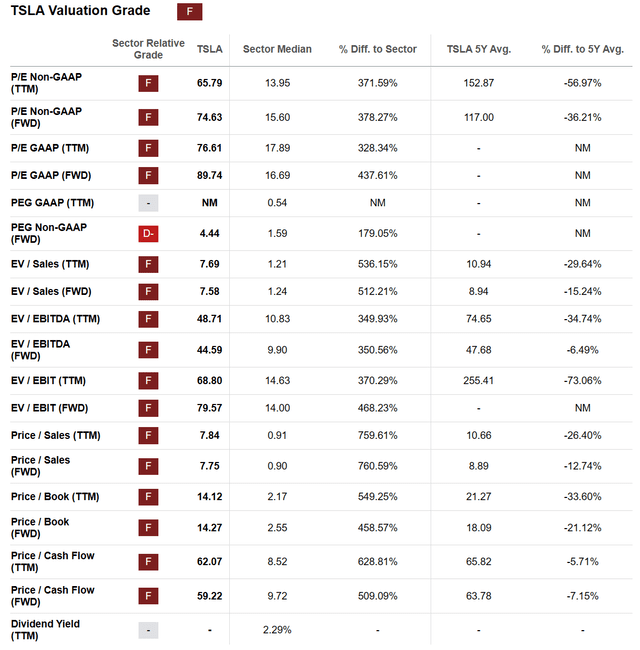

In search of Alpha’s Quant Valuation Grade remains to be an “F” rating. I personally would have given the inventory an F- nearer $300 in the summertime. Right now, I’d lean extra towards a D- after the inventory quote decline and one other six months of firm progress.

In search of Alpha Desk – Tesla, Quant Valuation Grade on January seventh, 2024

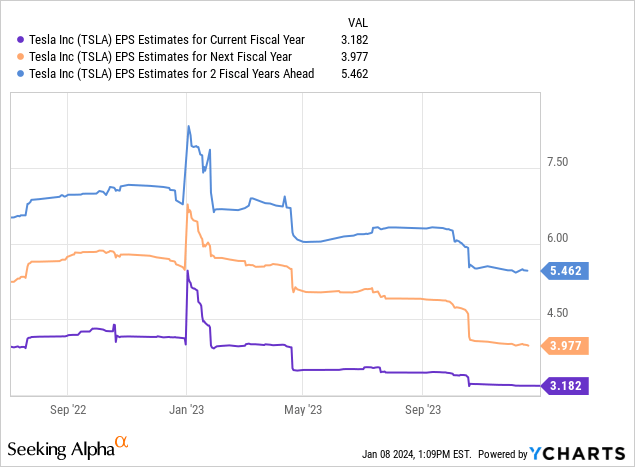

Early Recession Results

Even earlier than we’ve got formally entered a recession, Tesla’s earnings have been in downward revision territory since early 2023. The damaging results of rising competitors are the primary motive, which I screamed was the longer term in my September 2022 article here. A fast historical past: this effort changed into probably the most learn, debated, and commented article I’ve written in over 10 years on In search of Alpha. I put myself out on a limb and appropriately projected a Tesla value of $100 was approaching, when its quote was over $300.

YCharts – Tesla, Analyst EPS Revision Pattern for FY 2023-25, July 2022 to Current

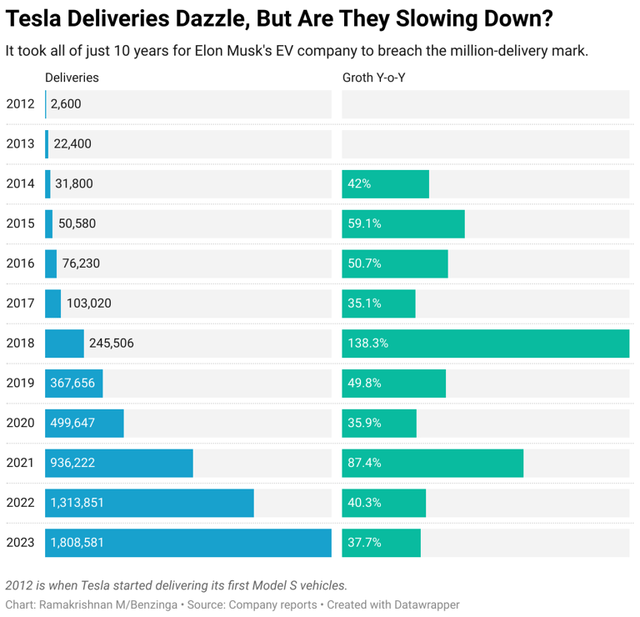

By way of getting actual for the bullish Tesla crowd, automotive/truck supply progress is now estimated to be under 25% YoY for calendar 2024, which might be the weakest displaying because the firm started deliveries in 2012. Plus, if a recession hits, I’d not be stunned by charges below 20% in 12 months. The tip conclusion is – gone are the times of booming enlargement.

Benzinga Telsa Article – Shanthi Rexaline, January 4th, 2024

Remaining Ideas

In abstract, Tesla seems to be absolutely valued to overvalued in my work at $240 per share in early January.

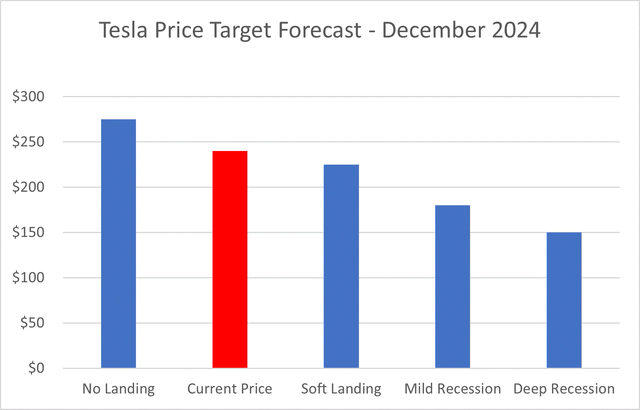

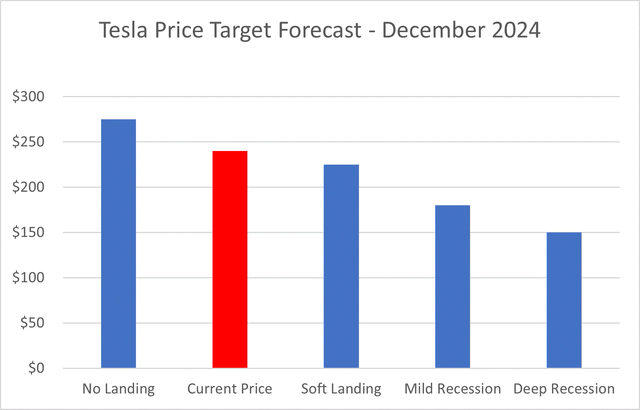

What are my value targets with rationale for the remainder of 2024? Let’s start with my most bullish situation, the place the economic system doesn’t decelerate and operations barely beat expectations. Retail buyers keep bullish en masse and sentiment helps a 55x P/E ratio on $5.00 for 2024 EPS. My math places value at $275 for an optimist. Such can be good for a optimistic +15% funding return from $240 now.

A soft-landing situation for each the U.S. and international economic system would possibly imply earnings keep round $4. Once more, if valuations begin transferring again to earth, an analogous 55x a number of will get you to $225 a share for a goal in 12 months (-5% loss for brand new buyers as we speak).

Then, we are able to visualize and put numbers on two recession outcomes. The primary projection (and highest chance for my part) is a light recession happens this yr. Beneath the average recession situation, Tesla may discover itself experiencing a double whammy of a discount in earnings on prime of higher promoting my buyers. Sustainable EPS of $3.50 (which could show overly rosy) creates a value goal of $175, on roughly 50x for Tesla’s P/E a number of (-25% loss from $240).

Lastly, a deep recession may drop EPS again to breakeven. Nevertheless, since Wall Road is a forward-looking machine, I consider value would expertise higher assist from establishments and hedge funds round $150 per share (-37% loss from $240). A rebound within the economic system with stronger demand for EVs after 2024 may simply generate earnings within the $5 to $6 vary. A P/E of 25x to 30x subsequent yr’s numbers (2025) would change into the brand new focus, and signify an affordable purchase degree.

Writer Estimates – Tesla, 12-Month Worth Targets Based mostly on Financial Outcomes

Bullish prospects for 2024 relate to investor sentiment, significantly a rerun of aggressive share shopping for and overconfidence within the firm’s future, regardless of the valuation logic. You possibly can name this potential final result both based mostly within the Greater Fool Theory, or backed by a Federal Reserve that eases financial coverage too quickly, or simply the reappearance of inventory market bubble-mania hypothesis. By way of an affordable outlook, whereas a bullish flip increased for a number of months stays doable, I don’t consider an prolonged run above $300 is within the playing cards this yr. I personally place the chances of such at lower than 10%.

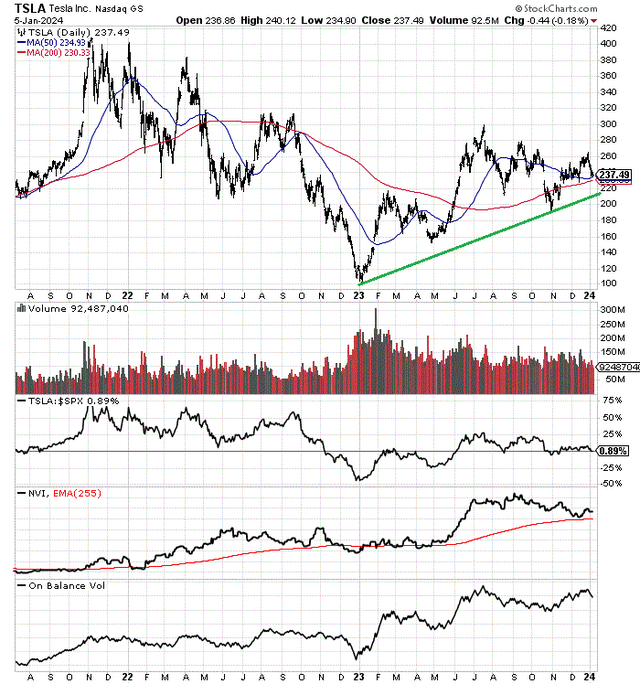

One other solution to view the Tesla buying and selling state of affairs is thru its day by day chart. Even given a severe recession, I’m not anticipating the January 2022 low of $101 to be violated on the draw back. But, merchants are watching the most recent sample of upper lows for hassle. Under, I’ve drawn a inexperienced trendline below the worth bottoms in January 2022 and October 2023. I’m assured a break beneath this line (round $210 as we speak) would trigger many bulls to surrender and various hedge funds to closely go quick. The web impact may very well be a fast pullback to $180 or decrease. At that time, if it occurs, I’ll once more contemplate when to go lengthy Tesla.

StockCharts.com – Tesla, Day by day Worth & Quantity Adjustments, Since July 2021

I’d additionally word, a lot of my technical momentum well being indicators just like the Unfavourable Quantity Index and On Steadiness Quantity stay in bullish uptrends. So, there’s ample cowl as we speak to no less than consider a growth-based backside will seem later within the yr.

On a pointy transfer below $200, I’m planning to improve my view to a Maintain if not Purchase score. If you wish to enter a Tesla place, I’d look ahead to a significant selloff to extend your odds of funding success. At this stage, with the information I’ve out there, a deep recession would possibly open up a Robust Purchase state of affairs below $160 for long-term buyers.

Nevertheless you slice it, I want to look elsewhere for getting alternatives with Tesla at $240. Right now’s value seems to be discounting a number of years of progress already. As an investor, you wish to purchase future progress when others are promoting and valuations are low. That’s undoubtedly not the basic definition GARP (progress at an affordable value) or PEG (low value to earnings to earnings progress charges) case for Tesla at the moment. Consequently, I proceed to charge Tesla a Promote for my 12-month outlook.

Thanks for studying. Please contemplate this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is really helpful earlier than making any commerce.