Main currencies usually are not doing an excessive amount of to start out the day however the greenback stays weak amid the strikes thus far this week. EUR/USD rose greater after the ECB yesterday, with the pair as much as its highest in seven weeks close to 1.0950 now. There’s respiratory room till we get to 1.1000 however it is going to rely upon the US jobs report later right this moment.

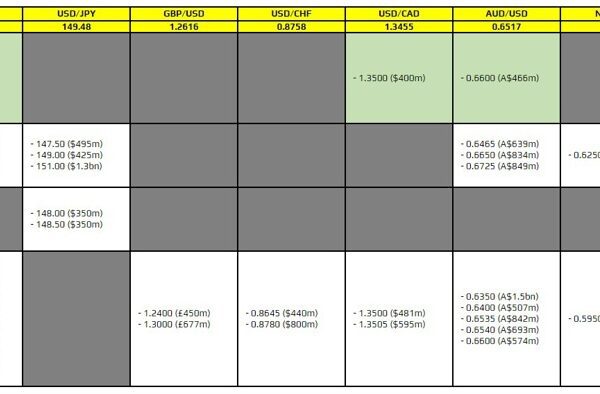

Apart from that, USD/JPY can be organising for one more potential technical break as outlined here. After which we’ve USD/CAD breaking again under its 200-day transferring common yesterday to 1.3445 now. In the meantime, AUD/USD can be as much as contemporary seven-week highs at 0.6630 as consumers look to come back up for air within the short-term.

The principle focus and a spotlight right this moment will probably be on the non-farm payrolls knowledge. The response to it’s what issues most however let’s take inventory of how markets are feeling in the mean time.

Contemplating broader sentiment, it appears to be like like merchants are wanting a launch that can validate the strikes this week i.e. softer greenback, stronger danger trades. Which means it’ll take fairly some convincing to show sentiment round as we glance in direction of the weekend. And barring any materials change to the Fed outlook on the hawkish facet, I reckon the play will probably be to fade any reverse response to the flows we’ve seen in the previous few days. However we’ll see.

As for European buying and selling right this moment, it is going to be a little bit of a dud till we get to the US jobs report.

0700 GMT – Germany January industrial output

0700 GMT – Germany January PPI figures

0745 GMT – France January commerce stability

1000 GMT – Eurozone This autumn closing GDP figures

That is all for the session forward. I want you all the very best of days to come back and good luck together with your buying and selling! Keep protected on the market.