Dragon Claws

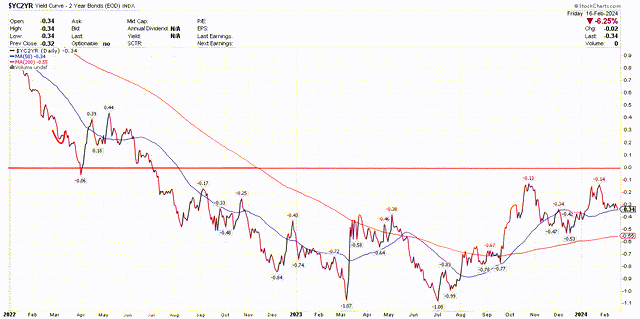

There have been quite a few forecasts for a recession over the previous two years from Wall Road strategists and market pundits, however one has but to materialize. Some of the vital developments used to assist their argument has been the inverted yield curve, which has traditionally been an especially dependable main indicator of impending financial contractions. The yield on the 10-year Treasury fell under that of the 2-year Treasury in July 2022 to begin the inversion, however the economic system continues to increase. The recession crowd insists that this indicator remains to be on monitor, because it operates with a lead time that may be so long as 24 months.

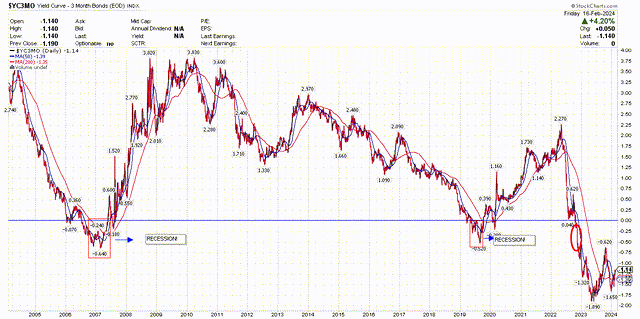

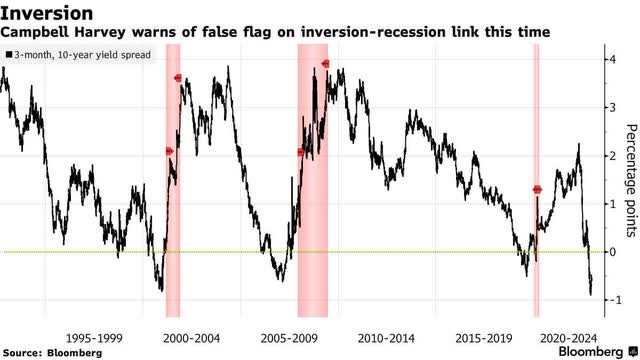

We should credit score Campbell Harvey, who’s now a finance professor at Duke College, with growing this helpful yield-curve indicator that so many have relied on to this present day. We can have a look at quite a lot of totally different short- and long-term charges to see if they’re inverted, however right this moment any mixture will produce the inversions that Harvey warns us about. Notice the timeliness of the inversion warnings under between 3-month and 10-year yields in 2007 and 2019.

The most recent inversion has lasted an especially very long time with out producing a recession. I’ve ignored it over the previous two years, believing that this time it’s giving us a false sign. In actual fact, Harvey acknowledged that it might be inaccurate this time round as early as January 2023, as a result of his mannequin was linked to inflation-adjusted yields, which haven’t been inverted. It appears like his evaluation has been spot on.

Mr. Harvey ought to have an amazing quantity of credibility as an economist, particularly with those that are involved about recession. Subsequently, his views on inflation, as an especially astute economist, must be valued no much less. That’s my perspective.

Lots of those self same strategists and pundits, who’ve been utilizing his indicator to foretell a recession, are calling for inflation to stay sticky and properly above the Fed’s goal of two%. They could wish to take note of what Mr. Harvey lately stated about this topic.

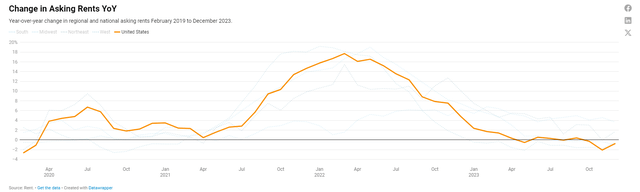

He asserts that “inflation is already within the 2% preferred range,” and that the Fed shouldn’t be counting on the incorrect image that the Client Worth Index presents to find out financial coverage. Therefore, his suggestion that “the Fed should cut sooner than later.” Harvey states that the inflation information collected to compute the Client Worth Index (CPI) is “stale,” with a selected give attention to shelter information, which the CPI suggests is up 6% year-over-year. That accounts for 40% of the inflation gauge. In line with Harvey, “the real-time data is what we should be basing our decisions on. Shelter inflation is not 6%. I don’t know anybody that would believe that it is 6%.”

To that time, private-sector information signifies a a lot totally different state of affairs for shelter prices. For instance, Rental.com has seen its measurement of asking rents fall for eight months in a row. In its most up-to-date nationwide Hire Report, Rental.com indicated that yearly declines in hire costs nationally continued in December, falling by lower than 1% on a year-over-year foundation. That’s a far cry from a 6% improve.

As we work off the annualized hire will increase from a 12 months in the past and exchange them with the hire decreases we’re realizing right this moment, the shelter value calculation within the CPI will fall dramatically. This isn’t hypothesis, because the numbers will be seen within the chart above.

I used to be emboldened to keep up my outlook for comfortable touchdown greater than a 12 months in the past when Campbell Harvey acknowledged that his recession indicator was seemingly giving a false sign in July 2022. He’s lots smarter than me. Why would I not hearken to him in the identical manner in terms of the speed of inflation. I agree with Harvey that the conflict on inflation is over, however it isn’t displaying up within the stale method used to calculate it.

Editor’s Notice: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.