Aave, a decentralized finance (DeFi) platform, has revealed a governance proposal to combine Chainlink’s Cross-Chain Interoperability Protocol (CCIP) for safe cross-chain transfers of its GHO stablecoin.

Aave Desires To Combine Chainlink’s CCIP For Cross-Chain GHO Transfers

The suggestion, floated by Aave Labs, the lending and borrowing protocol’s developer, says the CCIP integration addresses the present limitations of its algorithmic stablecoin, GHO, if authorised by the neighborhood. As it’s at the moment constituted, the stablecoin is primarily accessible solely through minting on Ethereum or by means of secondary markets.

In accordance with CoinMarketCap data, GHO recorded a buying and selling quantity of round $1.6 million prior to now 24 hours. On the identical time, GHO is obtainable in a number of secondary markets, together with Uniswap v3 and Balancer v2 on Ethereum.

Nevertheless, contemplating its function in DeFi and Aave, this quantity is comparatively decrease. DAI, the algorithmic stablecoin managed by MakerDAO, already boasts a market cap of over $5.3 billion, with buying and selling quantity prior to now 24 hours exceeding $124 million.

Technically, Chainlink’s CCIP provides a framework enabling safe cross-chain communication between a number of blockchains. By way of this answer, incorporating protocols can switch property and information throughout completely different protocols. On this manner, CCIP appears to be a safe various to bridges that act as channels for shifting property throughout blockchains however have been focused on a number of events, resulting in lack of person funds.

By implementing CCIP, Aave goals to rework GHO right into a multichain asset, enabling stablecoin customers to work together with it throughout varied blockchain networks. On this evaluation, this integration will considerably improve GHO’s liquidity, accessibility, and interoperability. All this may probably elevate GHO the stablecoin and liquidity rating, additional boosting Aave’s complete worth locked (TVL).

In accordance with DeFiLlama data on January 18, Aave manages over $7.3 billion of property and deploys them in 10 chains, together with Polygon, Avalanche, and several other Ethereum layer-2 choices like Optimism and Arbitrum.

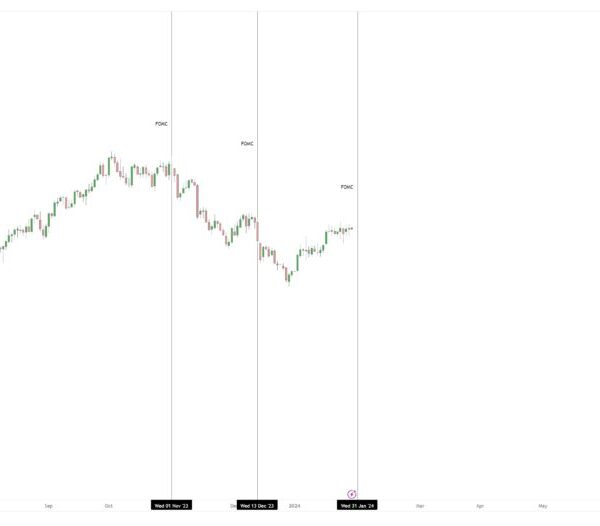

Will LINK Break Above $17?

The combination of CCIP will likely be an important improvement within the Aave and Chainlink ecosystems. Although the transfer might enhance GHO liquidity and enhance entry, LINK and AAVE may profit.

Associated Studying: Bitcoin ETFs Face Regulatory Roadblock In Singapore – Here’s Why

CCIP is designed to incentivize integrating protocols, reminiscent of Aave, to pay charges utilizing LINK, the native token of Chainlink. Utilizing this token means they aren’t surcharged. In the event that they select to pay utilizing AAVE, Aave’s native governance token, they are going to be topic to a ten% surcharge payment.

LINK is agency and buying and selling at close to December 2023 highs. So far, the token is up 170% from September 2023 lows. A break above $17 might push the token to contemporary highs to proceed the strong march up from H2 2023.

Characteristic picture from Canva, chart from TradingView