tupungato

August 28th was not a very pleasant day for shareholders of clothing company Abercrombie & Fitch (NYSE:ANF). Shares closed down 17% after management announced financial results covering the second quarter of the company’s 2024 fiscal year. At first glance, this is surprising. I say this because management reported revenue and earnings per share that came in above what analysts anticipated. However, the market has gotten overly picky with this name, punishing the stock because margins did not come in at or above where analysts had hoped. It’s also likely that some of the downside was driven by rhetoric coming from management that the environment in which the company operates is becoming ‘increasingly uncertain.’

Ultimately, I believe that this was an overreaction. Starting in 2023, Abercrombie & Fitch has achieved some very impressive results because of price increases that customers have accepted and declining costs. Having said that, I do think that management is on to something about the uncertainty of current conditions. On an absolute basis, shares of the company do look attractively priced to me. But relative to similar firms, shares are more or less fairly valued. Add on top of this the extreme volatility that the company has exhibited from a fundamental perspective over the past few years now, and I would say that taking a more cautious approach and rating the company a ‘hold’ would not be a bad idea.

An interesting quarter

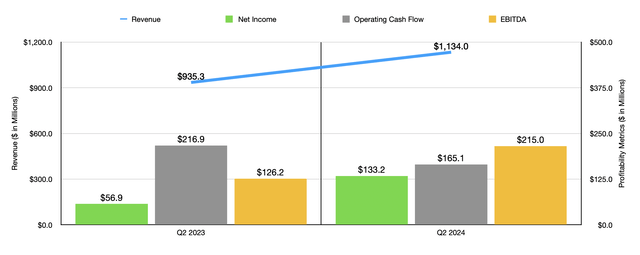

Objectively speaking, the second quarter of the 2024 fiscal year was a great time for Abercrombie & Fitch. For starters, revenue at the company came in strong at $1.13 billion. That’s an increase of 21.2% compared to the $935.3 million the company generated one year earlier. It’s also a whopping $40 million above what analysts had anticipated for the quarter. This increase in sales was driven by a surge in comparable sales. For the quarter on its own, comparable sales were up 18% year over year. This was driven mostly by a 21% shot higher achieved by the company’s Abercrombie brand that pushed revenue up 25.9% from $462.7 million to $582.4 million. Having said that, the Hollister brand also performed well, with comparable sales growth of 15% pushing revenue up 16.7% year over year from $472.6 million to $551.6 million.

On the bottom line, the business also exceeded forecasts. Earnings per share came in at $2.50. That’s more than double the $1.10 per share reported the same time last year. It also happens to be $0.37 per share greater than what analysts were expecting for the quarter. Put another way, the company went from generating net profits of $56.9 million in the second quarter of 2023 to generating profits of $133.2 million the same time this year. Other profitability metrics were mixed. Operating cash flow dropped from $216.9 million to $165.1 million. Normally, I like to also provide an adjusted figure for this that strips out changes in working capital. And I suspect that if I did, that there would be a substantial year-over-year improvement as well. But management has not released those figures as of this writing. Meanwhile, EBITDA for the company expanded from $126.2 million to $215 million.

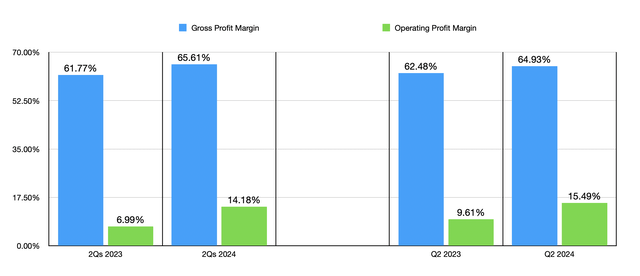

The improvements that the company has seen on the top line have come about in part from higher prices that the company charges its customers for its goods. Usually, when prices increase, the end result is also growth on the bottom line. However, the company has also benefited from lower cotton prices that more than offset higher freight costs. To see just how drastic this combination of factors is, we need only look at margins for the most recent quarter. During the second quarter, on its own, the company achieved a gross profit margin of 64.93%. That’s an improvement over the 62.48% achieved one year earlier. At first glance, this may not seem like much, but the difference, when applied to the revenue generated in the quarter alone, should be about $27.8 million in additional profits for the company on a pre-tax basis.

By the time we get to operating income, the disparity is even larger. Management achieved an operating profit margin of 15.49% in the second quarter of 2024. That is massively higher than the 9.61% achieved one year earlier. When applied to the revenue generated in the second quarter, this would be an extra $66.7 million in pre-tax profits. It is worth noting that this is not a one-time event. For the first half of this year as a whole, margins came in stronger than they did the prior year.

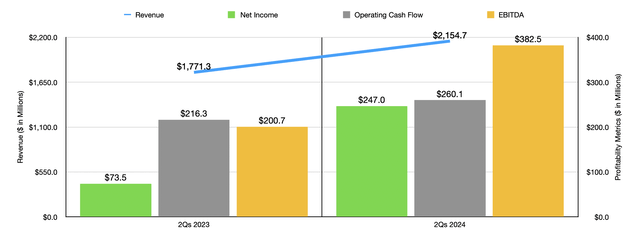

In the chart above, you can see results for the first half of 2024 compared to the same time of 2023. As was the case in the second quarter on its own, the company benefited from a surge in comparable sales for the same reasons I mentioned already. This combination of factors looks set to significantly impact this year’s results compared to what the company had seen in prior years. In the chart below, for instance, you can see revenue, profits, and cash flows, all covering for the 2021 through 2023 fiscal years.

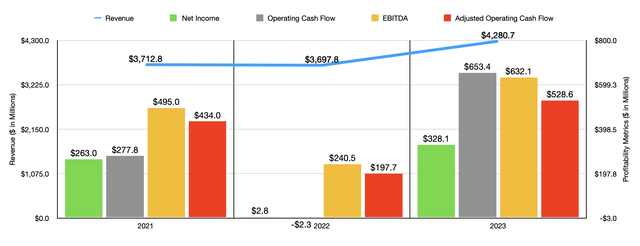

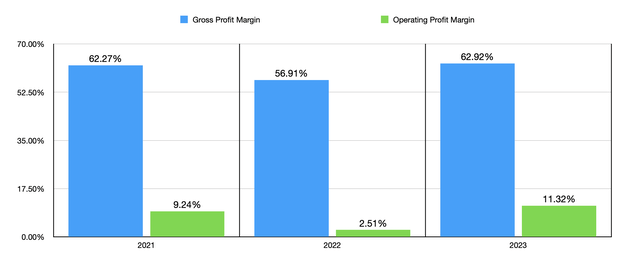

I do think it’s important to note that management has even acknowledged extreme volatility in the company’s results in prior years. For instance, a lot of the improvement from 2022 to 2023 that allowed Abercrombie & Fitch to grow its net income from only $2.8 million to $328.1 million was driven not only by price increases, but by lower freight costs that more than offset higher raw material expenses. This is the exact opposite of what has been occurring this year. The resulting change in margins, meanwhile, as illustrated below, is quite significant.

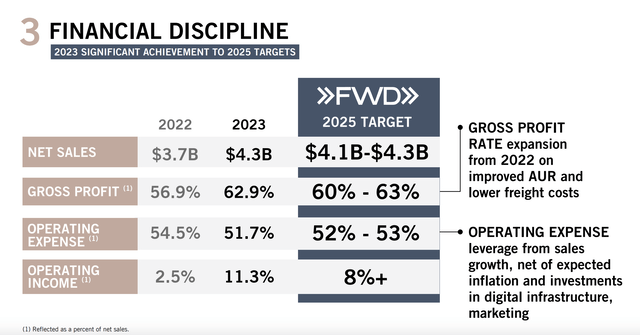

Despite this tremendous volatility, management does seem confident about the longer-term picture. Back in 2022, the company set an ambitious target to grow sales from $3.7 billion at year to between $4.1 billion and $4.3 billion by 2025. Management is well on the way toward achieving that. In fact, in 2023, the $4.28 billion the company generated already put it near the high end of the 2025 target. This year, if management is right, results should be even more impressive. This is because management is anticipating revenue growth of between 12% and 13%. At the midpoint, that would translate to sales of $4.82 billion. This anticipated year over year improvement actually represents an upgrade compared to the 10% or more revenue growth that management had been previously anticipating.

Even though this is good news, the market seems to be a bit picky. You see, analysts were anticipating a gross profit margin for the company for the most recent quarter of 65.4%. The actual gross profit margin, as I detailed already, was lower at 64.93%. For this year as a whole, management is expecting operating margin to be between 14% and 15%. This is more or less in line with the 14% or more than analysts had been anticipating. However, there is some concern that operating margin expected for the third quarter would be a bit lower, at between 13% and 14%. The concern from analysts, most likely, is that this could be an easy way for management to eventually downgrade their own guidance for the rest of the year.

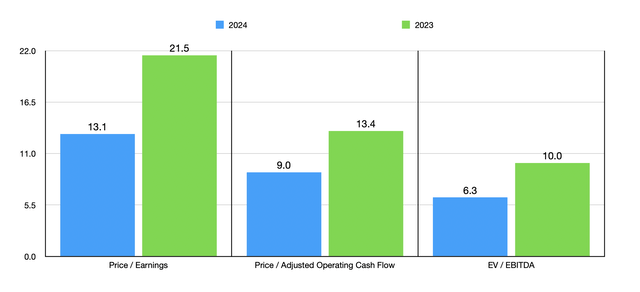

If we take management’s forecasts for the rest of this year as being an accurate predictor of what will actually occur, and if we annualize both interest expense and interest income to get to net profits, then, at the midpoint, net income for this year should be around $539.3 million. If we then annualize results seen for the other metrics, then we would get adjusted operating cash flow of $785.7 million and EBITDA of $1.01 billion. With these figures, we can see in the chart above how shares are valued on a forward basis and how they are valued using results from last year. On a forward basis, I would say that the stock looks a bit undervalued. However, using the 2023 figures, I would say that the company is much more solidly fairly valued.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Abercrombie & Fitch – 2024 | 13.1 | 9.0 | 6.3 |

| Abercrombie & Fitch – 2023 | 21.5 | 13.4 | 10.0 |

| Gap, Inc. (GAP) | 12.5 | 5.5 | 6.1 |

| American Eagle Outfitters (AEO) | 19.6 | 7.8 | 6.6 |

| Urban Outfitters (URBN) | 11.2 | 7.5 | 5.5 |

| Burlington Stores (BURL) | 45.7 | 17.7 | 19.9 |

| Victoria’s Secret (VSCO) | 19.2 | 5.1 | 5.7 |

Relative to similar firms, however, even using the 2024 estimates, shares look fairly priced. In the table above, you can see what I mean. On a price to earnings basis, two of the five firms I compared Abercrombie & Fitch to ended up being cheaper than that. This number increases to three to the five on an EV to EBITDA basis, and it grows further to four of the five on a price to operating cash flow basis. If, however, we assume an eventual return to the levels of profitability achieved last year, then across the board, four of the five companies end up being cheaper than our candidate.

Takeaway

All things considered, Abercrombie & Fitch is an interesting business. Regarding this particular quarter, I believe that the market was overreactive. Given how things had gone, I would have anticipated a nice increase in share price as opposed to a decline. But it is clear that the market is being incredibly cautious considering the uncertainty that management has cited. As a value investor, my objective is always to err on the side of caution. And when I look at the totality of the picture, particularly how volatile results have been, I think that adopting a more neutral approach with a ‘hold’ rating makes sense at this point in time.