Artur

In a normal CEF world, trying to raise your fund’s distributions by 70%-plus would mean that your fund’s NAV performances would be outstanding, and the increase would be justified.

But all you have to do is look the latest Equity CEF Performance sheets (see below) and see that the abrdn Total Dynamic Dividend fund (AOD), $8.57 closing market price, is up only 4.8% year-to-date at NAV while the abrdn Global Dynamic Dividend fund (NYSE:AGD), $9.89 closing market price, is seeing its NAV performing even worse, up only +4.7% year-to-date.

That puts both funds in the bottom one third of NAV performers I follow:

Capital Income Management, LLC

Note: This screenshot shows the bottom one-third of the roughly 100 equity CEFs I follow, sorted by NAV performance year-to-date through Aug. 9.

And yet, abrdn announced last Thursday, Aug. 8 that both funds will be adopting +12% NAV distribution policies, which means AOD’s distribution is going from $0.0575/share per month to $0.10/share per month, or a 73.9%, while AGD’s distribution is going from $0.065/share per month to $0.11/share per month, or a 70%-plus increase.

So that gets both fund’s NAV yields up to about their 12% targets (reflected above) from the prior roughly 7% NAV yields. The only problem is that AGD and AOD were struggling to cover their previous NAV yields, so trying to set an even higher NAV yield means something is going to have to change.

Now those +12% NAV yields are not impossible to cover, but clearly, AOD’s and AGD’s dividend and value stock investment approach is going to have to pick up the pace if the funds are going to be in a position to cover those dramatically higher distributions. Because if they don’t, then they will just see accelerated NAV erosion, which means that they will be even less likely to cover future distributions.

Keep in mind that when a fund, whether it be a CEF, ETF or mutual fund, goes ex-dividend, the market price (and the NAV in the case of CEFs) are deducted by the distribution amount. So until the fund makes up the distribution and replenishes the NAV amount in whole, the yield has not been earned, and the fund has only succeeded in giving you back your own money. Better known as the destructive return of capital.

So it appears that AGD and AOD are, in fact, positioning their portfolios toward more growth-oriented stocks rather than dividend yielding value stocks to try and capture more upside performance. Because from what I see, AGD and AOD don’t really use leverage and don’t use options that most other CEFs use to help supplement the income necessary to cover those enhanced yields.

Will it work? Maybe, but without the use of leverage or options, it seems to me that abrdn is taking a big risk by positioning its funds in growth stocks rather late in the game.

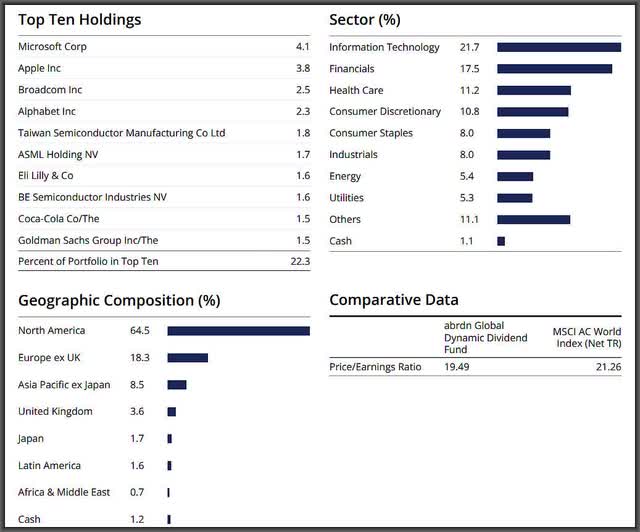

Here is AGD’s current portfolio as of 6/30/2024:

So yes, AGD shows a 21.7% weighting in the Information Technology sector as of the second quarter of 2024, which is up from 18.4% as of the Oct. 31 annual report.

Is it enough? I have my doubts. Historically, AGD and AOD have been very poor performers, a lot of which was due to a Dividend Harvest income strategy the two funds used for years when the funds were managed by Alpine Investments.

I pointed out as far back as 2012 in this article, Alpine Global Dynamic Dividend fund: CEF That Least Deserves To Be Trading At A Premium that the Dividend Harvest strategy was an NAV destroyer and Alpine eventually discarded the approach after losing a ton of NAV.

Conclusion

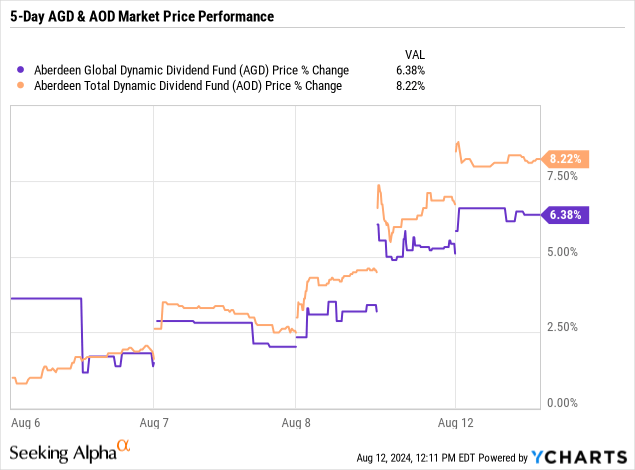

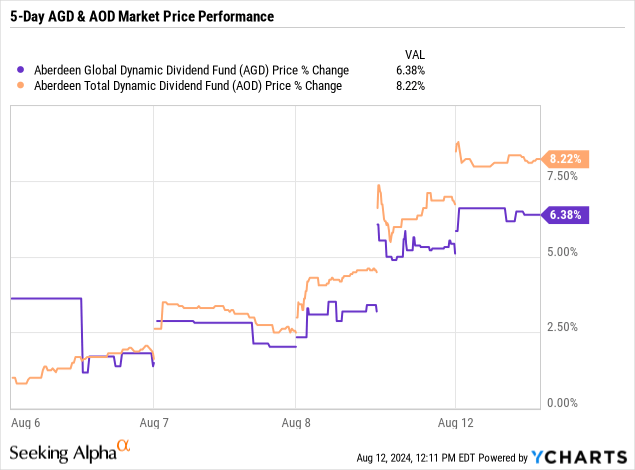

So far, the reaction to the distribution increases reflecting the new 12% annualized NAV yields has been positive for both AGD and AOD.

In fact, both fund’s market prices were moving up even before the Press Release from last Friday, Aug. 9:

But will these latest changes to AGD and AOD prove to be more of a burden to the NAV than a benefit to shareholders, just like what the fund’s Dividend Harvest strategy resulted in?

Ironically, back in 2012, both AGD and AOD were trying to cover +12.5% NAV yields with their Dividend Harvest strategy and were also offering a +13.6% market yield for AOD and an +11.5% market yield for AGD.

Not that much different than what these latest distribution changes have resulted in. So, will abrdn succeed where others have failed? Time will tell, but I would question the motivation behind any fund sponsor raising the distributions on their funds by that much, especially when it’s clear that it has nothing to do with NAV growth or NAV performance.