Bitcoin on-chain information exhibits the so-called “accumulation addresses” have been shopping for massive quantities of the cryptocurrency this month.

Bitcoin Accumulation Addresses Have Seen Massive Inflows Just lately

As analyst Ali identified in a brand new post on X, Bitcoin accumulation addresses have been observing inflows not too long ago. The “accumulation addresses” right here check with the wallets of the cryptocurrency’s perennial HODLers.

Sure situations should be glad for an handle to be included on this cohort. Maybe probably the most attribute is that the pockets should not report outgoing transfers.

Which means accumulation addresses are those that have solely purchased tokens (that’s, obtained solely incoming transfers) and by no means participated in any selling.

Addresses are additionally solely thought of to be a part of this group as soon as they’ve obtained no less than two influx transactions and maintain better than 10 BTC of their stability.

Change and miner-associated wallets are excluded from this class of traders, as the provision held by these entities represents the sell-side of the market (as traders deposit to exchanges for promoting, whereas miners themselves are a relentless supply of promoting stress out there).

The provision held by the buildup addresses is taken into account to be locked tightly within the palms of those HODLers, so the obtainable provide successfully goes down when these traders purchase extra.

Wallets that final obtained an influx greater than seven years in the past are additionally excluded from this group since addresses so inactive are typically thought of misplaced resulting from being forgotten or having their keys misplaced. Such wallets would naturally not rely as “HODLers,” no less than not voluntary ones.

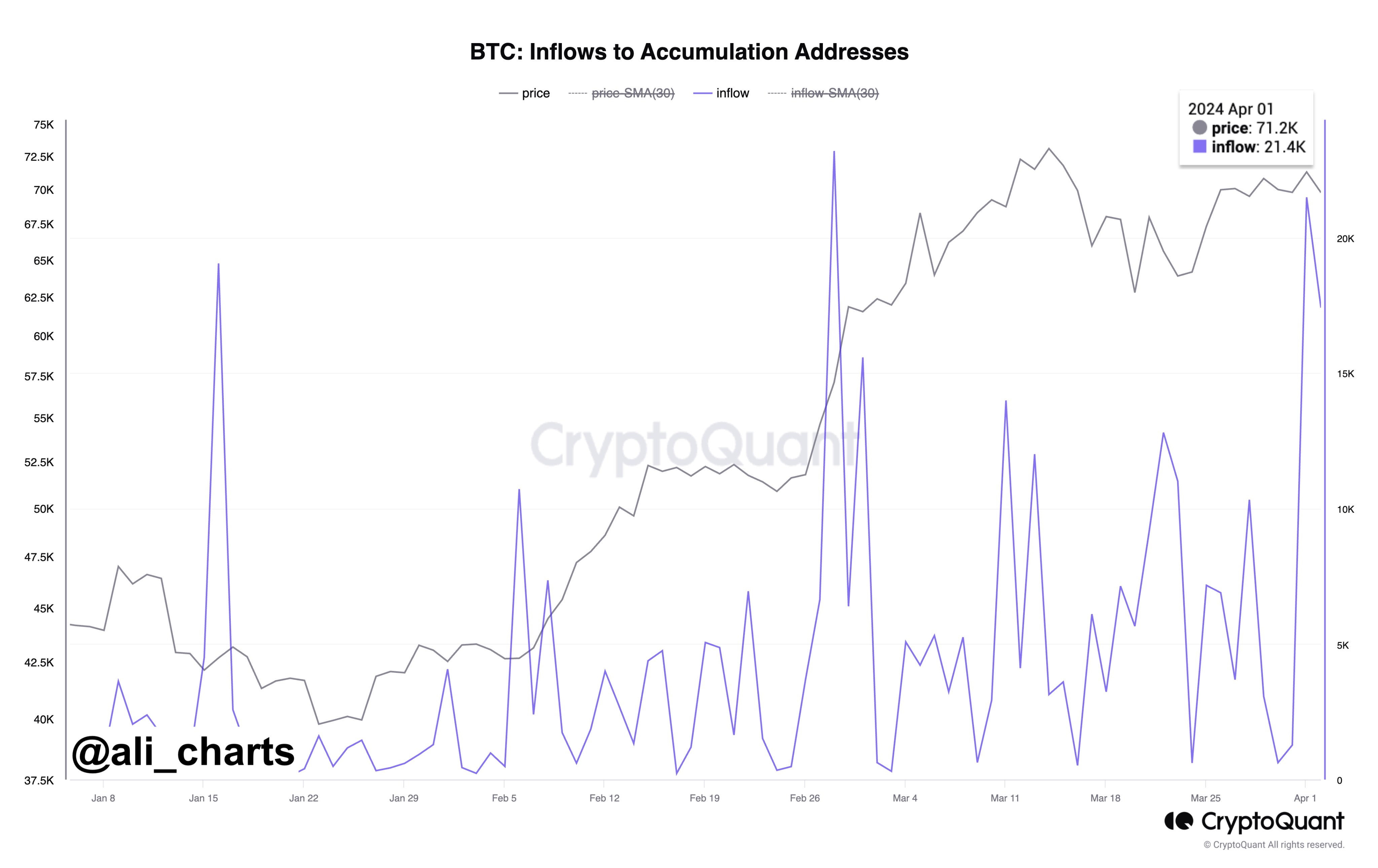

Now, right here is the CryptoQuant chart shared by Ali that exhibits the development within the Bitcoin inflows going in direction of these accumulation addresses because the begin of the 12 months:

Appears to be like like the worth of the metric has been fairly excessive in current days | Supply: @ali_charts on X

Because the above graph exhibits, the Bitcoin inflows to accumulation addresses have been excessive this month, suggesting that these traders have been repeatedly shopping for not too long ago.

On the primary date of the month, the metric even hit a price of 21,400 BTC. On the present alternate fee of the cryptocurrency, this stack is price greater than $1.4 billion.

This can be a important quantity and isn’t too removed from the 25,300 BTC all-time excessive (ATH) that the indicator achieved only a month and a half in the past.

Naturally, this newest shopping for from these traders could be a optimistic signal for the cryptocurrency. As if responding to it, BTC seems to have discovered its footing once more, because it has made some restoration over the previous day.

BTC Value

Following the soar of over 3% as we speak, Bitcoin has recovered above the $68,100 degree.

The worth of the asset seems to have been going up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, CryptoQuant.com, chart from TradingView.com