PM Images

The Virtus Diversified Income & Convertible Fund (NYSE:ACV) is a closed-end fund aka CEF that income-focused investors can purchase as a method of achieving their goals of receiving income from their portfolios to pay their expenses. As the name of this fund implies, the Virtus Diversified Income & Convertible Fund employs a somewhat different strategy to most income-focused funds, as it invests a significant proportion of its assets into convertible bonds. This is nice in some ways, as convertible bonds are a very reasonable way to obtain an attractive yield without the need to sacrifice the potential upside of an equity investment.

The reasonably attractive yields that can be obtained from these securities extend to this fund as well, as the Virtus Diversified Income & Convertible Fund pays a 9.83% yield at the current share price. This is a yield that will likely be very attractive to anyone who has had a bit of experience with the markets, as most things have had sub-5% yields over the past decade. It is now much easier to get yields that are close to double-digits than it used to be by investing in fixed-income securities, but convertible bond funds are one of the few ways to obtain such a yield and still have exposure to the potential for capital gains that accompanies an equity investment.

Here is how the current yield of the Virtus Diversified Income & Convertible Fund compares with that of several of its peers:

|

Fund Name |

Morningstar Classification |

Current Distribution Yield |

|

Virtus Diversified Income & Convertible Fund |

Hybrid-U.S. Allocation |

9.83% |

|

Calamos Strategic Total Return Fund (CSQ) |

Hybrid-U.S. Allocation |

7.90% |

|

Gabelli Convertible Income Securities Fund (GCV) |

Hybrid-U.S. Allocation |

13.64% |

|

RiverNorth Opportunities Fund (RIV) |

Hybrid-U.S. Allocation |

13.08% |

|

Source Capital (SOR) |

Hybrid-U.S. Allocation |

6.03% |

|

Virtus Equity & Convertible Income Fund (NIE) |

Hybrid-U.S. Allocation |

9.20% |

As we can see, the Virtus Diversified Income & Convertible Fund does not have the highest yield among its peers, but it is still higher than some of the other funds in this grouping. This might turn away some potential investors who wish to maximize the income that they receive from the assets in their portfolios. However, this should not be the case, as an outsized distribution yield can be a sign from the market that the fund will struggle to maintain its payout. In particular, a fund with an outsized distribution might be paying out money exceeding its investment income and destroying its net asset value in the process. The fact that the Virtus Diversified Income & Convertible Fund does not have an outsized yield relative to its peers suggests that it should not have that problem, but we should still examine this anyway.

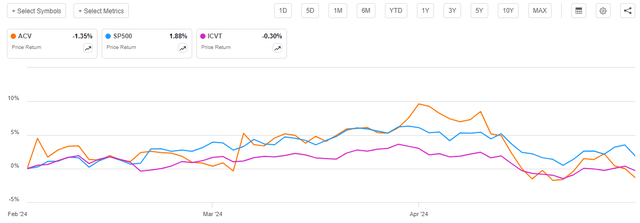

As regular readers may remember, we previously discussed the Virtus Diversified Income & Convertible Fund in early February 2024. The fund’s performance since that time has been rather disappointing. The shares have declined by 1.35%, which is worse than the 0.30% decline of the iShares Convertible Bond Index (ICVT) and the 1.88% gain of the S&P 500 Index (SP500):

At first glance, this will probably turn off many potential investors. After all, there is not typically a lot of sense in purchasing a convertible bond fund if it is simply going to underperform the index. However, as I pointed out in my last article on this fund:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund actually did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

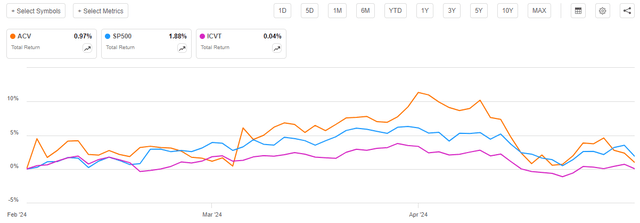

As of the time of writing, the iShares Convertible Bond Index has a 30-day SEC yield of 3.20% and a twelve-month trailing yield of 2.01% so obviously the Virtus Diversified Income & Convertible Fund manages to beat the index in terms of yield. Here is how the above performance chart changes when we include the distributions that this fund paid out during the intervening period:

As we can see, when we include the distributions paid by the fund, the Virtus Diversified Income & Convertible Fund outperforms the convertible bond fund over the past three months or so that have passed since we discussed this fund. It still fails to beat the S&P 500 Index, but that is not surprising given that convertible securities will rarely outperform common stocks. However, the Virtus Diversified Income & Convertible Fund does manage to outperform the S&P 500 Index over the trailing twelve-month period:

This is probably at least partly due to the incredibly low yield of the S&P 500 Index. Over time, the distributions paid out by this fund can add up to a lot of extra money. In addition, the recent performance of the S&P 500 Index has been heavily influenced by a handful of very long-duration and richly valued stocks that are highly sensitive to interest rate expectations. Over the past several months, investors have been interested in yield due to rising inflation and are less willing to hold richly valued stocks that will take many years to grow into their current valuations. The fact that this fund provides money now and has an attractive yield compared to most bonds has made it somewhat more appealing as a holding.

The fund recently released its annual report corresponding to the full-year period that ended on January 31, 2024. This should provide us with a great deal of insight about any recent changes this fund may have made, and, of course, how well it can sustain its distribution. Let us take a closer look at these changes and see if we need to adjust our thesis about this fund.

About The Fund

According to the fund’s website, the Virtus Diversified Income & Convertible Fund has the primary objective of providing its investors with a combination of current income and capital appreciation. The website describes how the fund intends to achieve this objective:

The Fund seeks to provide total return through a combination of current income and capital appreciation, while seeking to mitigate the risk of capital loss. The Fund strives to dynamically allocate across convertibles, equities, and income-producing securities.

The Fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in a diversified portfolio of convertible securities, income-producing equity securities and income-producing debt and other instruments of varying maturities, of which at least 50% of total managed assets are invested in convertibles. The Fund has the latitude to write covered call options on the stocks held in the equity portion.

The annual report provides the following asset allocation for this fund as of January 31, 2024:

|

Security Type |

% of Total Holdings |

|

Convertible Bonds and Notes |

82.8% |

|

Corporate Bonds and Notes |

18.5% |

|

Convertible Preferred Stock |

5.9% |

|

Preferred Stock |

0.0% |

|

Common Stock |

38.2% |

|

Warrants |

0.0% |

|

Money Market |

0.0% |

(Figures are a percentage of total assets as of January 31, 2024).

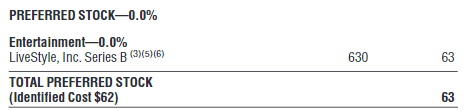

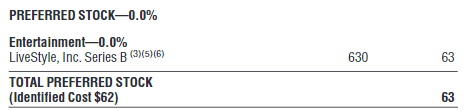

Please note that the assets that are given a 0.0% weighting in the chart above do not actually have zero representation in the portfolio. For example, the fund had 630 Class B preferred shares of LiveStyle, Inc. valued at $63,000 as of January 31:

Fund Annual Report

It is the same thing with both warrants and money market assets. The fund had 363,920 warrants for CCF Holdings (OTC:CCFLU) and $14,515 parked in a BlackRock Money Market Fund at the time of the report:

Fund Annual Report

The warrants expired on April 1, 2024, so it is probably a safe bet that it no longer has these. The annual report also does not provide a value for them, which reinforces the assumption that the fund almost certainly did not exercise the warrants. The exact amount of cash in the money market will almost certainly vary from day to day as the fund collects coupon payments from its bond positions and purchases new bonds.

In short, a 0.0% weighting does not mean that the fund has no assets of a given type. Rather, this fund had total assets of $314.301 million on January 31, 2024, so the 0.0% weighting just means that the fund’s position size rounds off to 0%.

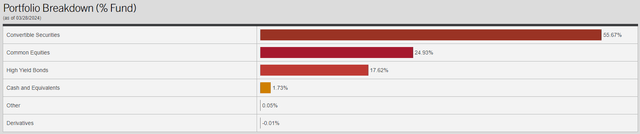

It appears that this fund has been reducing its weighting to convertible securities over the course of this year. Recall that back on December 29, 2023, the fund’s net assets consisted of 59.52% convertibles, 24.24% common equities, and 12.31% junk bonds. This is the asset allocation that was provided in my early February article on this fund.

Here is how the fund’s net assets looked on March 28, 2024 (the most recent data that is currently available):

This obviously represents a very significant reduction to convertible securities, along with a large increase in junk bonds. This change was probably not driven solely by relative performance, as convertible bonds outperformed junk bonds by quite a lot during the first quarter:

Thus, it appears that the Virtus Diversified Income & Convertible Fund has been making a conscious effort to increase its junk bond allocation at the expense of convertibles.

The fund therefore appears to be positioning itself to take advantage of a falling interest rate environment. This may not be a good idea right now. As I pointed out in a recent article, the inflation, and economic data that has been released year-to-date strongly suggest that reducing interest rates would be a very foolish decision. Calamos Investments states that convertibles may be better than junk bonds in a rising rate environment:

Convertible securities can enhance a fixed-income allocation by providing a hedge against a rising interest rate environment. Bonds tend to lose value in an environment of rising interest rates. However, convertible returns have tended to more closely reflect equity returns than bond returns when long-term interest rates rise.

However, over the full-year 2022 period, junk bonds outperformed convertibles:

Thus, this hedge is certainly not foolproof and probably depends more on market conditions being like they were in the 1990s. After all, during that decade, the stock market and the federal funds rate both moved up in lockstep. It is very different from what we have today, in which rising interest rates are bad for stocks. If we assume that the same thing that happened in 2022 will happen today if the Federal Reserve fails to cut interest rates, then the fund’s positioning away from convertibles and towards junk bonds makes sense.

We also should consider the possibility that the Federal Reserve ignores the rising inflation and cuts interest rates anyway. Simon White, Bloomberg’s macro strategist, outlined this in a recent note:

How the Treasury intends to meet its borrowing requirements – the mix between shorter-term bills and longer-term coupons – will strongly influence liquidity and thus the performance of risk assets.

In short, the U.S. Treasury’s demand for money to finance the deficit might force the Federal Reserve to pivot and cut rates, even though that would cause inflation to get much worse. In such an environment, a case could certainly be made for holding junk bonds as their price should rise in response to any rate cuts, which would provide capital gains for this fund. However, truthfully, I would rather be holding commodities and gold than any bonds if rate cuts are on the horizon. This fund can’t invest in those assets, though, so buying junk bonds could be a way to take advantage of impending rate cuts.

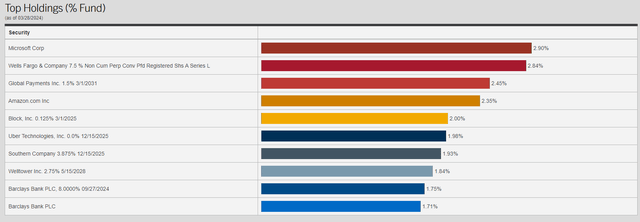

There have been quite a few changes to the fund’s largest positions since the last time that we discussed it as well. Here are the largest positions in the fund today:

Among the most significant changes that we see here are that Palo Alto Networks (PANW), Alphabet (GOOG) (GOOGL), Akamai Technologies (AKAM), and Affirm Holdings (AFRM) have all been removed from their previous positions among the fund’s largest holdings. The new additions are Global Payments (GPN), Uber Technologies (UBER), an 8% bond from Barclays (BCS), as well as Barclays common stock. The Barclays bond will almost certainly not be on this list for very long, though, given its September 2024 maturity date.

A look at the top-ten holdings list gives the assumption that this fund is reducing its allocation to information technology companies. After all, arguably all the removed companies are information technology (Affirm Holdings is a Fintech, so it is questionable whether it counts as technology or financial services), but the added ones are most certainly not.

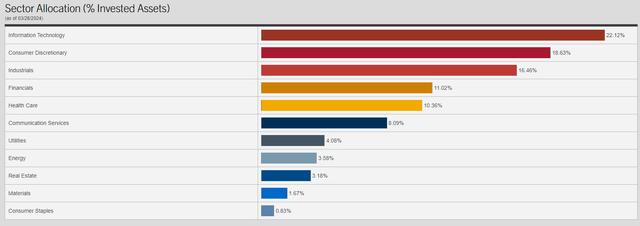

Here are the fund’s sector holdings as of March 28, 2024:

At the start of the year, the fund had 24.98% of its assets invested in the information technology sector. The annual report does not provide a sector allocation chart for some reason, but we can still see that the fund’s technology sector exposure declined to 22.12% on March 28, 2024. This is something that might be appealing to some investors, as many people who simply park their money in broad-market index funds or most domestic mutual funds have outsized exposure to that particular sector. As such, there can be a case to be made for putting money into a fund that has somewhat better diversification than the 29.17% weighting that the S&P 500 Index has to that particular sector.

Leverage

As is the case with most closed-end funds, the Virtus Diversified Income & Convertible Fund employs leverage as a method of boosting the effective yield that it earns from its assets. I explained how this works in my previous article on this fund:

Basically, the fund borrows money and then uses that borrowed money to purchase convertible securities, common stock, and other publicly traded securities. As long as the total return that the fund receives from the purchased assets is greater than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its total assets for this reason.

As of the time of writing, the Virtus Diversified Income & Convertible Fund has leveraged assets comprising 31.56% of its portfolio. This is a slight reduction from the 32.43% leverage that the fund had the last time that we discussed it, which is fairly nice to see.

Here is how the fund’s leverage compares to its peers:

|

Fund Name |

Leverage Ratio |

|

Virtus Diversified Income & Convertible Fund |

31.56% |

|

Calamos Strategic Total Return Fund |

30.56% |

|

Gabelli Convertible Income Securities Fund |

8.00% |

|

RiverNorth Opportunities Fund |

31.99% |

|

Source Capital |

0.00% |

|

Virtus Equity & Convertible Income Fund |

0.00% |

(All figures from CEF Data).

This is unfortunate, as we can clearly see that the Virtus Diversified Income & Convertible Fund is employing more leverage than its peers. This could suggest that the fund is using more leverage than is actually safe from a risk management perspective. However, it is not completely out of line with the Calamos Strategic Total Return Fund, which uses a very similar strategy. The fund’s leverage has also come down a bit over the past three months.

Overall, we probably do not need to worry too much about this fund’s leverage right now.

Distribution Analysis

As mentioned earlier in this article, the most recent financial report that is available for this fund corresponds to the full-year period that ended on January 31, 2024. This is a newer report than the one that was available to us the last time that we discussed it, so we should consult it to determine how well the fund is covering the attractive 9.83% yield that it currently pays out.

For the full-year period that ended on January 31, 2024, the Virtus Diversified Income & Convertible Fund received $6.125 million in interest along with $2.461 million in dividends from the assets in its portfolio. From this amount, we subtract the money that the fund had to pay in foreign withholding taxes. This gives the fund a total investment income of $8.584 million for the period. It paid its expenses out of this amount, which left it with $195,000 available for shareholders.

Obviously, $195,000 is nowhere near enough to fully cover the distributions that this fund paid out over the period. After all, the fund paid $22.389 million to its shareholders over the period.

The fund failed to offset the difference fully between its net investment income and distributions through capital gains. It reported net realized losses of $8.499 million that were offset by $26.908 million net unrealized gains. Overall, the fund’s net assets declined by $3.696 million after paying out the distribution.

The represents the second year in a row for which the fund failed to cover its distributions fully. On February 1, 2022, the fund had net assets of $282.348 million. This was down to $216.157 million as of January 31, 2024. This is a bad sign, which suggests that the fund will almost certainly need to cut the payout before it runs out of investible assets.

Valuation

The fund has traded at an average premium of 9.06% over the past month. This is an enormous premium for a fund that is failing to cover its distribution, and that could be problematic for anyone considering this fund.

Conclusion

In conclusion, the Virtus Diversified Income & Convertible Fund has a few things going for it. The fund appears to be improving its diversification by reducing its technology sector exposure in favor of other assets. It also appears to be betting on a cut in interest rates, which may not occur. Finally, the fund is trading at a premium valuation and is yet failing to cover its distributions. The market is obviously not pricing in a possible distribution cut, which makes this fund risky to buy right now.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.