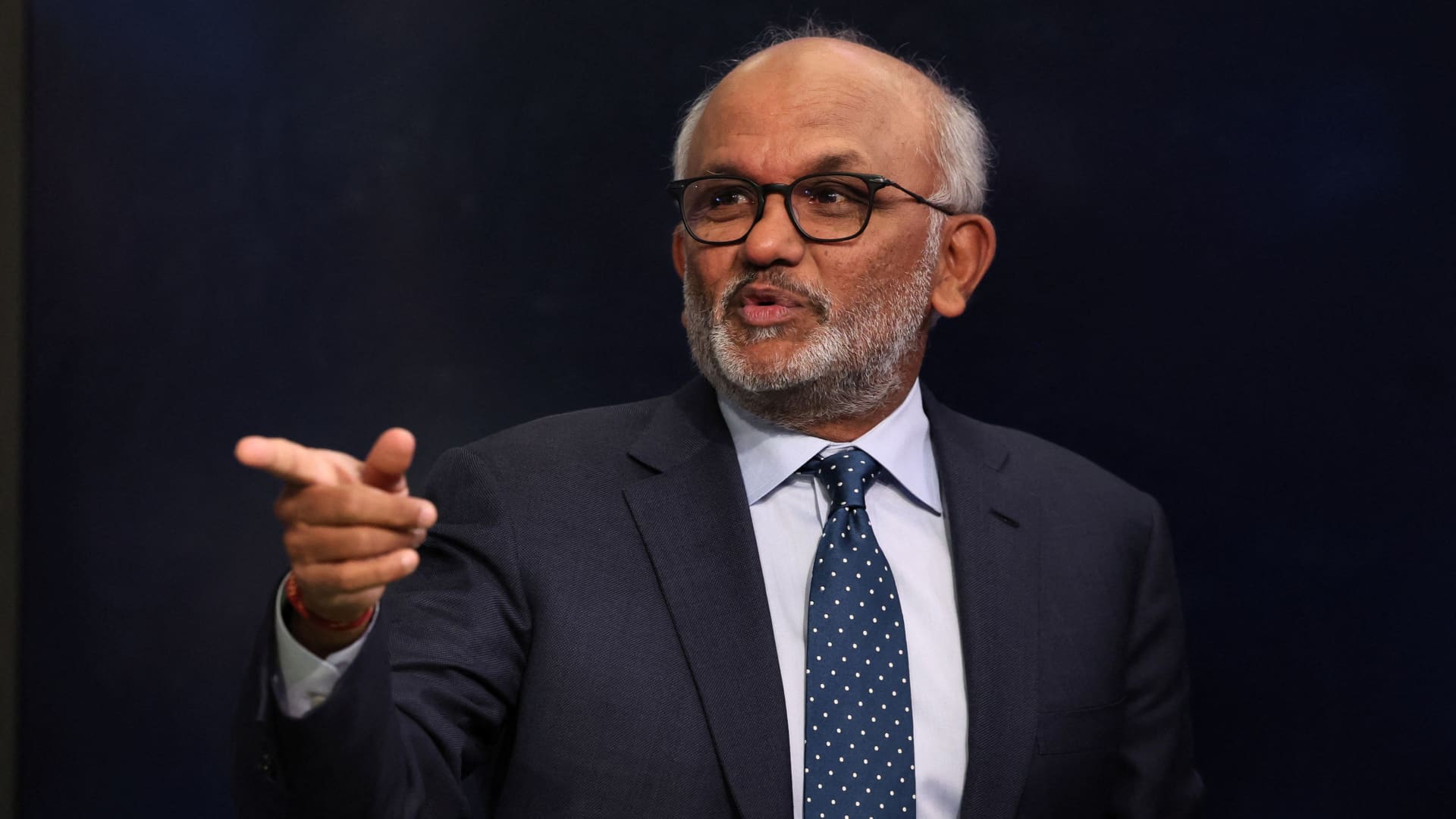

Adobe CEO Shantanu Narayen speaks throughout an interview with CNBC on the ground on the New York Inventory Change (NYSE) in New York Metropolis, U.S., February 20, 2024.

Brendan Mcdermid | Reuters

Adobe shares fell 13% on Friday morning after the corporate reported first-quarter results that beat estimates however delivered a light-weight quarterly income forecast.

The design software program firm posted adjusted earnings per share of $4.48, above the $4.38 analysts had been anticipating, based on LSEG, previously referred to as Refinitiv. Its income of $5.18 billion exceeded the $5.14 billion analysts estimated.

For the present quarter, Adobe expects adjusted earnings per share of $4.35 to $4.40, whereas analysts had been anticipating $4.38. It mentioned income will complete $5.25 billion to $5.30 billion, barely beneath the $5.31 billion estimated. The corporate additionally introduced a $25 billion share buyback.

Adobe additionally just lately launched a new artificial intelligence assistant for its Reader and Acrobat purposes that may assist customers digest info from lengthy PDF paperwork.

Financial institution of America analysts, reiterating their purchase ranking of Adobe shares, lowered their worth goal for the inventory to $640 from $700, expressing optimism about Firefly, the corporate’s generative AI picture creation device.

“No change to our view that Adobe is a major AI beneficiary,” the analysts wrote in a Thursday investor be aware. “While the monetization ramp is slower than anticipated, Firefly is one of the [most] widely used generative AI offerings, with potential for multiple paths to monetization.”

Barclays dropped its worth goal for shares of Adobe to $630 from $700 whereas sustaining an obese ranking for the inventory. Its analysts wrote on Friday that they anticipate the inventory to get better and “would be buying this dip because pricing is masking the underlying strength in Creative Cloud.”

Analysts at Morgan Stanley saved their obese ranking of and $660 worth goal for Adobe inventory, writing on Friday that “more patience is likely warranted.”

“A smaller than expected beat in Digital Media Net New ARR likely increases investor concerns around competitive pressures,” the analysts wrote. “However a growing number of vectors for monetizing GenAI and new monetizable solutions coming online in 2H24 should help improve the narrative going forward.”