VNV International, a Swedish funding agency that backs startups in mobility, well being and marketplaces, slashed the worth of its holding in Wasoko, an African B2B e-commerce startup, by 48%, in response to its annual report for 2023.

In its annual report, VNV set Wasoko’s honest worth at round $260 million as of December 2023, the month that Wasoko announced its planned merger with its Egyptian counterpart, MaxAB. The valuation is predicated on VNV’s 4.2% stake within the startup, which VNV values at $10.9 million.

This isn’t VNV’s first markdown for Wasoko. In This fall 2022, it valued Wasoko at $501 million, simply months after the eight-year-old startup closed a $125 million Series B investment co-led by Tiger International and Avenir at a $625 million valuation. That spherical was difficult for different causes, too: Wasoko disclosed to TechCrunch in December 2023 that it acquired solely $113 million of the overall funding raised in that spherical. VNV International invested $20 million in that funding spherical.

VNV International attributes its honest worth estimate to a valuation mannequin primarily based on buying and selling multiples of public friends quite than historic funding rounds.

“Wasoko is proud to have VNV Global as one of our major investors,” the Tiger-backed firm informed TechCrunch in response to the brand new improvement. “VNV has not reduced its shareholding in Wasoko whatsoever and continues to remain active and supportive of the company, including through our landmark merger with MaxAB. Wasoko is not involved in VNV’s internal reporting but sees VNV’s continued holdings of Wasoko as a clear signal of expected long-term value growth.”

The report from VNV International, which additionally backs Blablacar and Gett, preceded the MaxAB merger announcement. The funding agency — beforehand referred to as Vostok New Ventures, backing plenty of Russian startups (from which it has now divested) — stated it plans to carry on to its stake in Wasoko post-merger. “With VNVs permanent capital structure, we are typically very long-term investors (our best investments have all been 10+ years of holdings) and believe the combined company has the potential to become a very sizeable and valuable business over the coming years,” the agency’s spokesperson stated in an e mail to TechCrunch.

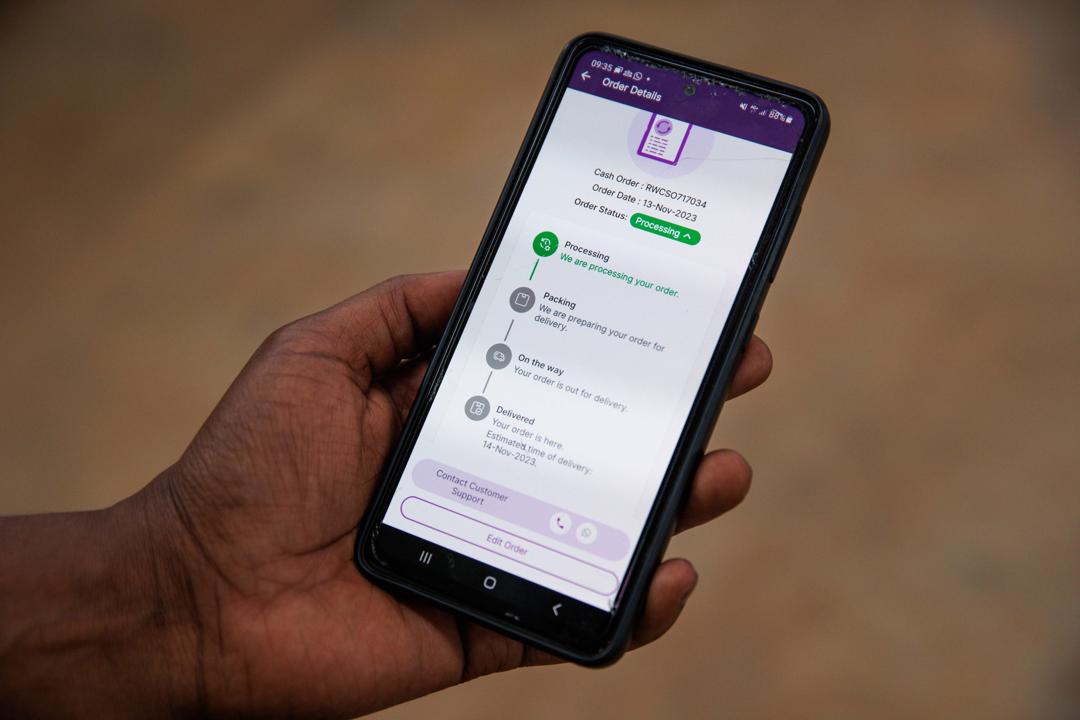

As one in every of Africa’s largest B2B grocery marketplaces, Nairobi-based Wasoko secures agreements with main suppliers like P&G and Unilever, bypassing intermediaries and providing items at aggressive costs. Based by Daniel Yu in 2014, the corporate skilled constant development, increasing from Kenya to 6 extra African markets by 2022. Throughout this era, Wasoko reported $300 million in Gross Merchandise Worth (GMV) on an annualized foundation. By 2023, it boasted a buyer base of over 200,000 small retailers utilizing its app to order groceries and home goods on-demand for his or her respective shops.

B2C e-commerce is a tiny proportion of retail throughout Africa, lower than 1% in response to this study from Mastercard. (Level of comparability: within the U.S. final quarter e-commerce was 15.6% of all retail gross sales, in response to the U.S. Census Bureau.) However bodily retailers must supply items, and e-commerce has confirmed to be a highly regarded channel for that. Funding and curiosity in B2B startups took off in the last decade and noticed a bump within the wake of COVID-19.

However extra just lately, B2B e-commerce startups’ enterprise fashions have come underneath strain: difficult unit economics and excessive prices have made revenue elusive; and funding has been particularly constrained in creating markets, shortening startups’ runways additional. African startups, together with B2B e-commerce platforms like Wasoko, have adopted the identical playbook as their counterparts additional afield: layoffs; value cuts; and closures should not unusual.

Wasoko was amongst these hit. In current occasions, it has pivoted its focus from aggressive growth to profitability, implementing cost-saving measures accordingly.

Within the lead-up to its merger with MaxAB, Wasoko shuttered hubs in Senegal and Ivory Coast and laid off workers in Kenya. Between December 2023, when the businesses introduced the merger and March of this 12 months, Wasoko parted methods with key executives to streamline overlap with MaxAB’s enterprise construction. Operations had been additionally quickly halted in Uganda and Zambia (through which Wasoko expanded in Q2 2023), native media TechCabal reported.

In the meantime, Wasoko additionally affords monetary companies to its retailers, and it continues to function in its three largest GMV markets — Kenya, Rwanda and Tanzania. It has stated that it expects to finalize its merger with Cairo-based MaxAB by the tip of this month.

For its half, MaxAB has additionally been on a bumpy street to consolidation. It operates a meals and grocery B2B e-commerce platform in Egypt and Morocco, increasing to the latter following its acquisition of YC-backed WaystoCap in 2021.

However regardless of elevating over $100 million from Silverlake, British Worldwide Funding, and others, MaxAB discovered itself in monetary peril final 12 months.

The construction of the brand new mixed entity nonetheless stays unclear, however MaxAB and Wasoko anticipate that collectively, they’ll be capable to supply a contemporary lifeline to their pursuit to steer the continent’s B2B e-commerce trade, profitably.