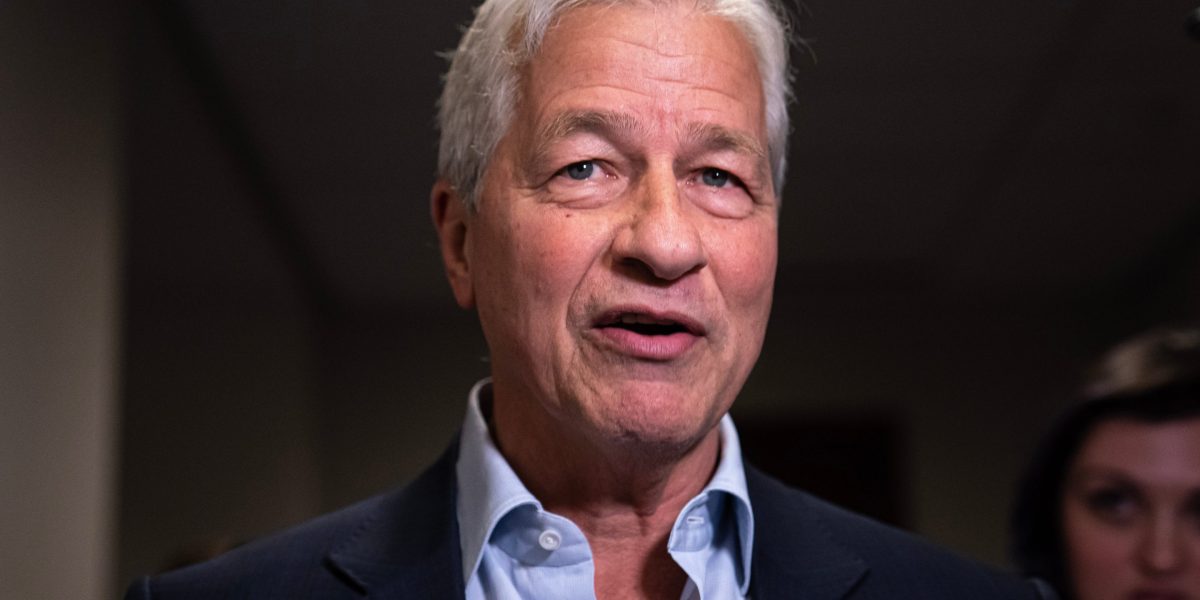

JPMorgan Chase & Co. Chief Government Officer Jamie Dimon and his household bought $150 million value of the financial institution’s inventory, following by means of on final 12 months’s announcement that he would start promoting shares for the primary time since taking the helm 18 years in the past.

Dimon and his household bought about 822,000 shares in a collection of transactions on Thursday, in response to a U.S. Securities and Alternate Fee filing. The inventory, which has outperformed the broader market and friends throughout his tenure, is buying and selling at a document excessive.

“Mr. Dimon continues to believe the company’s prospects are very strong and his stake in the company will remain very significant,” the corporate stated in an October submitting about his deliberate gross sales. A consultant for the agency declined additional touch upon Friday.

The October announcement stated Dimon deliberate to promote a million shares, topic to phrases of a stock-trading plan. Alongside along with his household, he continues to carry about 7.7 million shares after Thursday’s gross sales.

JPMorgan was a winner amongst banks final 12 months amid its deal for First Republic Bank, with its inventory rallying 27% and the New York-based firm posting record net interest income.

When he took over as CEO, the inventory was buying and selling for about $40. He bought the shares on Thursday for almost $183 a chunk, because the inventory had rallied roughly 30% for the reason that October announcement that he deliberate to dump shares. Shares gained 0.5% on Friday.

On Wall Road, analysts are decisively bullish on JPMorgan shares’ prospects. Two dozen maintain buy-equivalent suggestions, giving it the highest consensus rating amongst its handful of greatest banking friends. The return potential implied by their value targets is greater than 4% over the following twelve months.