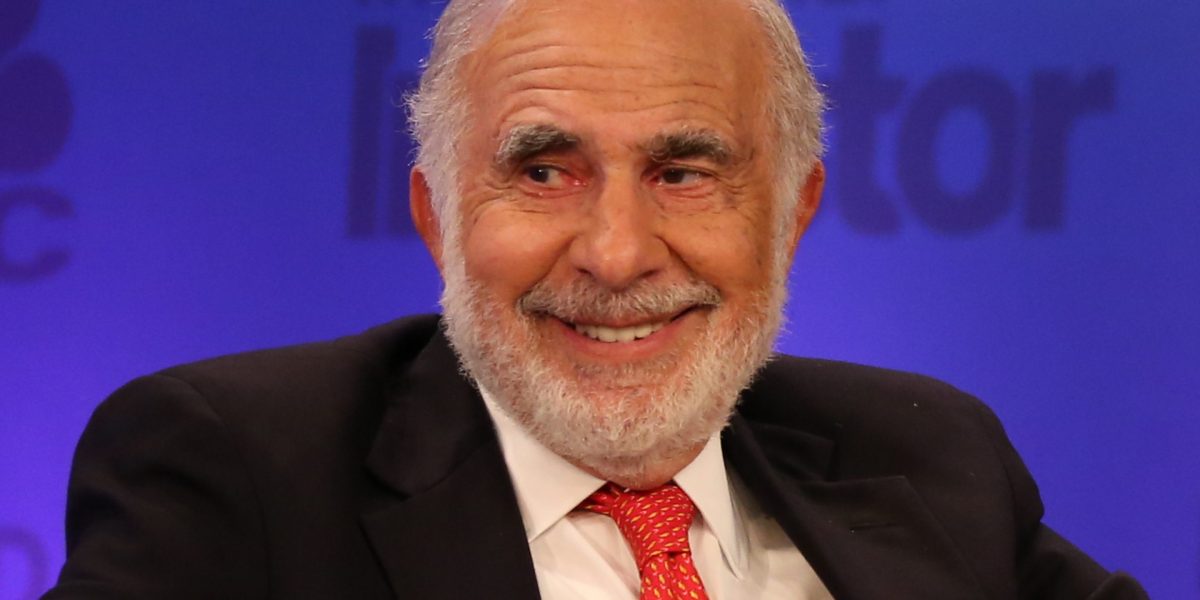

The company raider Carl Icahn is likely to be on a brand new streak as of right this moment, his 88th birthday. JetBlue Airways introduced on Friday that it had struck a deal to grant seats on the corporate’s board of administrators to 2 representatives from Icahn’s firms. The lightning-fast JetBlue settlement got here simply days after utility firm American Electric Power mentioned it had reached an settlement with Icahn to seat two of his representatives on the board.

At JetBlue, Icahn disclosed his 9.9% possession stake on Monday, the identical day that new CEO Joanna Geraghty took over the job. It was additionally the identical day that AEP introduced its personal cope with Icahn. His stakes within the two firms—and the wins—marked a public return to his well-worn activist-investing background after he weathered criticism from short-seller Hindenburg Analysis last year and pledged to traders that he would stick to what he does best: agitating for change on a board or within the CEO position and unlocking worth for shareholders.

Within the joint assertion, Geraghty mentioned the corporate was working to revive its incomes energy. The airline has been reeling since a federal decide quashed a merger between JetBlue and Spirit Airlines a month in the past.

JetBlue shares rose 16% when Icahn disclosed his stake this week and 5.9% in after-hours buying and selling following the announcement, reported Bloomberg.

“We are executing more than $300 million of revenue initiatives this year, and are on track to deliver significant cost savings from our structural cost program, fleet modernization, and fixed cost base reductions,” mentioned Geraghty, including that JetBlue welcomes “the contributions of our new board members as we move forward with that common goal.”

Icahn mentioned he appreciated the “constructive engagement” with JetBlue’s board and C-suite.

“We very much look forward to working with them in the future,” he mentioned.

JetBlue appointed Icahn Enterprises basic counsel Jesse Lynn and Icahn Capital portfolio supervisor Steven Miller, the corporate mentioned in a filing with the SEC. Lynn has served on boards together with Crown Holdings, FirstEnergy and Xerox. Miller is a board member at Dana Incorporated, Bausch Well being Firms and beforehand served on the Xerox board.

JetBlue chairman Peter Boneparth mentioned Lynn and Miller would add “useful insights” to the board as the corporate charts a path to development. The 2 new board members will probably be non-voting observers after they be part of the board on Feb. 26, and gained’t have voting energy till after the annual shareholder assembly this 12 months.

In the meantime, Icahn’s $120 million stake in AEP yielded board seats for Icahn Enterprises senior managing director Hunter Gary, who joined the AEP board together with Henry Linginfelter, former govt vice chairman of Southern Firm Fuel.