D-Keine

By Lily Dai & Lee Clements

The rapid growth of artificial intelligence (AI) has cast a shadow over the climate ambitions of leading tech companies. Emissions from their data centres are rising strongly, as a result of the power-hungry processing needed for AI computations.

This recent trend has been seen as a negative for efforts to slow and reverse global warming. But there is another side to the story: the AI revolution will spur tech firms to accelerate efforts to address their rising energy use, boosting investments in climate technologies, driving the next stage of growth within environmental markets and, ultimately, accelerating wider efficiencies in how the global economy uses energy.

Data centre energy use to double

The International Energy Agency has warned that energy consumption by data centres could double between 2022 and 2026. Its latest electricity market forecast estimates that power consumption by data centres (and cryptocurrencies) could reach 1,000 TWh by 2026, roughly equivalent to that of Japan. That’s up from 460 TWh in 2022.

The AI industry realises it has a problem. “An energy breakthrough is necessary for future artificial intelligence, which will consume vastly more power than people have expected,” Sam Altman, CEO of OpenAI, told the World Economic Forum meeting in January 2024.

Tech companies, many of which have set ambitious climate targets, are seeing those targets threatened by skyrocketing growth in AI.

But these companies are not passive actors in the face of rising energy use and emissions. They are already major investors in renewables, with Amazon (AMZN) the world’s largest purchaser of renewable energy for the fourth year in a row in 2023, followed by Meta (META) in second place and Google in fourth. In May, Microsoft (MSFT) was reported to have signed the world’s largest single contract for renewables, investing an estimated $10 billion with Brookfield (BAM) to develop more than 10.5 GW of wind and solar.

They have also helped drive the outperformance of companies working to improve the energy efficiency of the data centres they use. Big Tech has been quietly but effectively boosting data centre efficiency behind the scenes for many years, whether through chip design or cooling, building hyperscale data centres or the use of virtualisation technology.

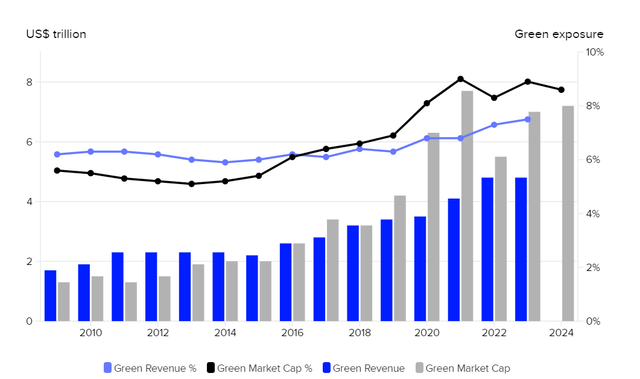

Behind the growth in energy efficiency

Our FTSE Environmental Opportunities All Share (EOAS) index tracks the performance of companies active in the green economy. They have been growing strongly, delivering a 13.8% compound average growth rate (CAGR) over the previous 10 years. If the green economy were considered as a standalone sector, it would be the second-best performing industry over the period, outpaced only by the Technology sector. From its inception in 2008 to the end of March 2024, the EOAS outperformed its benchmark by 82%.

Green economy 2009-2024

Source: LSEG Green Economy Report 2024

Energy Management and Efficiency has long been one of the largest sectors within the index: it currently accounts for 46% of the green economy by market capitalisation. It is also the second-best performing, with a five-year CAGR of 17% (after Transport Equipment, with a five-year CAGR of 24%, driven by electric vehicle, battery and railway equipment names).

Demand from tech firms has helped drive the growth in Energy Management and Efficiency. These firms have also contributed to a re-shaping of the theme, shifting its orientation from green buildings and industrial applications towards cloud computing (the largest sub-sector) and efficient IT equipment and electronics.

A performance step-up needed

However, the rapid progress the sector has made in improving the energy efficiency of IT has stalled.

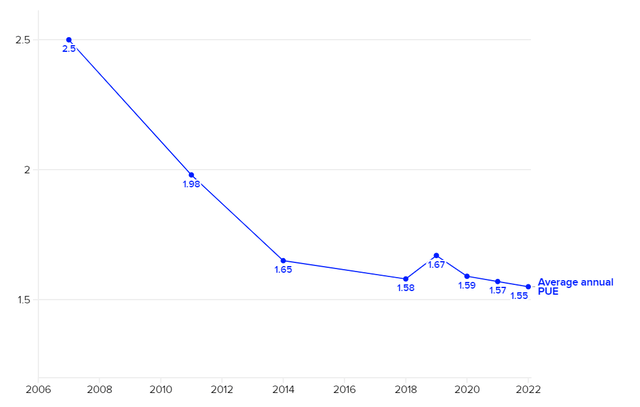

Power usage effectiveness (PUE) 2007-2022

The dramatic step-up in energy demand from AI will require a similar step-up in efficiency, particularly in the energy use of chips, if Big Tech is to meet its climate goals and rein in costs.

If the past is any guide, we can be reasonably confident that chip designers and manufacturers, data centre operators, and providers of related IT services will deliver such improved efficiency.

First, there is an obvious incentive to do so to cut costs associated with energy use. This incentive is reinforced by issues around energy security and geopolitics. There is a clear technological imperative: the more efficient that chips become (through reducing the heating effect from wasted energy) the more can be done with them in terms of capacity and power.

There are also regulatory tailwinds: in the EU, for example, revisions to the Energy Efficiency Directive will, from September 2024, require data centres to report key performance indicators. It introduces a sustainability rating scheme that will encourage improved performance.

The EU AI Act has also introduced energy-efficiency as a necessary priority for AI developers. As part of the EU AI Act implementation, the newly established EU AI Office and the Member States will facilitate the drawing up of codes of conduct. These will concern, among others, the voluntary application of specific standards assessing and minimising the impact of AI systems on environmental sustainability, including as regards energy-efficient programming and techniques for the efficient design, training and use of AI. Moreover, providers of general-purpose AI models will need to keep technical documentation, which now includes information about known or estimated energy consumption of the model.

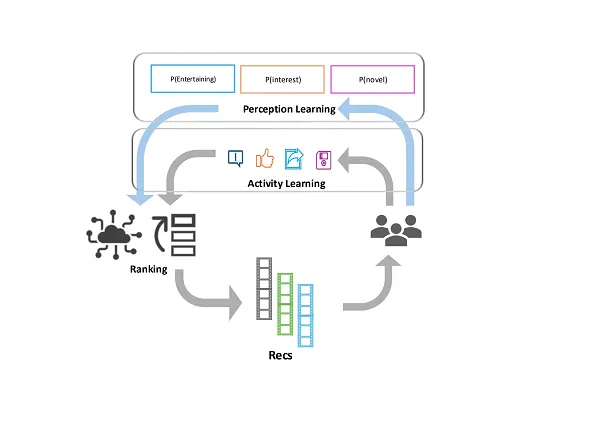

There is also a virtuous circle at work. Chip designers and manufacturers are applying AI to the challenges of chip production. AI is being increasingly applied to power management, improving the efficiency of manufacturing plants, data centres and power grids alike. AI can be applied to improve sustainability, which in turn can make AI more sustainable.

The growth in AI is also good news for another sub-sector within environmental markets. Renewable energy names have struggled since 2022, in the face of overcapacity, rising interest rates and collapsing equipment prices. However, they rallied in the second quarter of 2024, with the sub-sector climbing 20% during April and May, in anticipation of higher demand from AI.

Challenge and opportunity

Without question, the growth of AI represents a significant new source of power demand, adding to that created by the electrification of large swathes of the global economy. But, as we have seen many times over the relatively short history of the green economy, that demand will drive innovation, investment and, we believe, outperformance for long-term investors in environmental markets.

Legal Disclaimer

Republication or redistribution of LSE Group content is prohibited without our prior written consent.

The content of this publication is for informational purposes only and has no legal effect, does not form part of any contract, does not, and does not seek to constitute advice of any nature and no reliance should be placed upon statements contained herein. Whilst reasonable efforts have been taken to ensure that the contents of this publication are accurate and reliable, LSE Group does not guarantee that this document is free from errors or omissions; therefore, you may not rely upon the content of this document under any circumstances and you should seek your own independent legal, investment, tax and other advice. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon.

Copyright © 2024 London Stock Exchange Group. All rights reserved.

The content of this publication is provided by London Stock Exchange Group plc, its applicable group undertakings and/or its affiliates or licensors (the “LSE Group” or “We”) exclusively.

Neither We nor our affiliates guarantee the accuracy of or endorse the views or opinions given by any third party content provider, advertiser, sponsor or other user. We may link to, reference, or promote websites, applications and/or services from third parties. You agree that We are not responsible for, and do not control such non-LSE Group websites, applications or services.

The content of this publication is for informational purposes only. All information and data contained in this publication is obtained by LSE Group from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data are provided “as is” without warranty of any kind. You understand and agree that this publication does not, and does not seek to, constitute advice of any nature. You may not rely upon the content of this document under any circumstances and should seek your own independent legal, tax or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither We nor our affiliates shall be liable for any errors, inaccuracies or delays in the publication or any other content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the publication and its content is at your sole risk.

To the fullest extent permitted by applicable law, LSE Group, expressly disclaims any representation or warranties, express or implied, including, without limitation, any representations or warranties of performance, merchantability, fitness for a particular purpose, accuracy, completeness, reliability and non-infringement. LSE Group, its subsidiaries, its affiliates and their respective shareholders, directors, officers employees, agents, advertisers, content providers and licensors (collectively referred to as the “LSE Group Parties”) disclaim all responsibility for any loss, liability or damage of any kind resulting from or related to access, use or the unavailability of the publication (or any part of it); and none of the LSE Group Parties will be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, howsoever arising, even if any member of the LSE Group Parties are advised in advance of the possibility of such damages or could have foreseen any such damages arising or resulting from the use of, or inability to use, the information contained in the publication. For the avoidance of doubt, the LSE Group Parties shall have no liability for any losses, claims, demands, actions, proceedings, damages, costs or expenses arising out of, or in any way connected with, the information contained in this document.

LSE Group is the owner of various intellectual property rights (“IPR”), including but not limited to, numerous trademarks that are used to identify, advertise, and promote LSE Group products, services and activities. Nothing contained herein should be construed as granting any licence or right to use any of the trademarks or any other LSE Group IPR for any purpose whatsoever without the written permission or applicable licence terms.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.