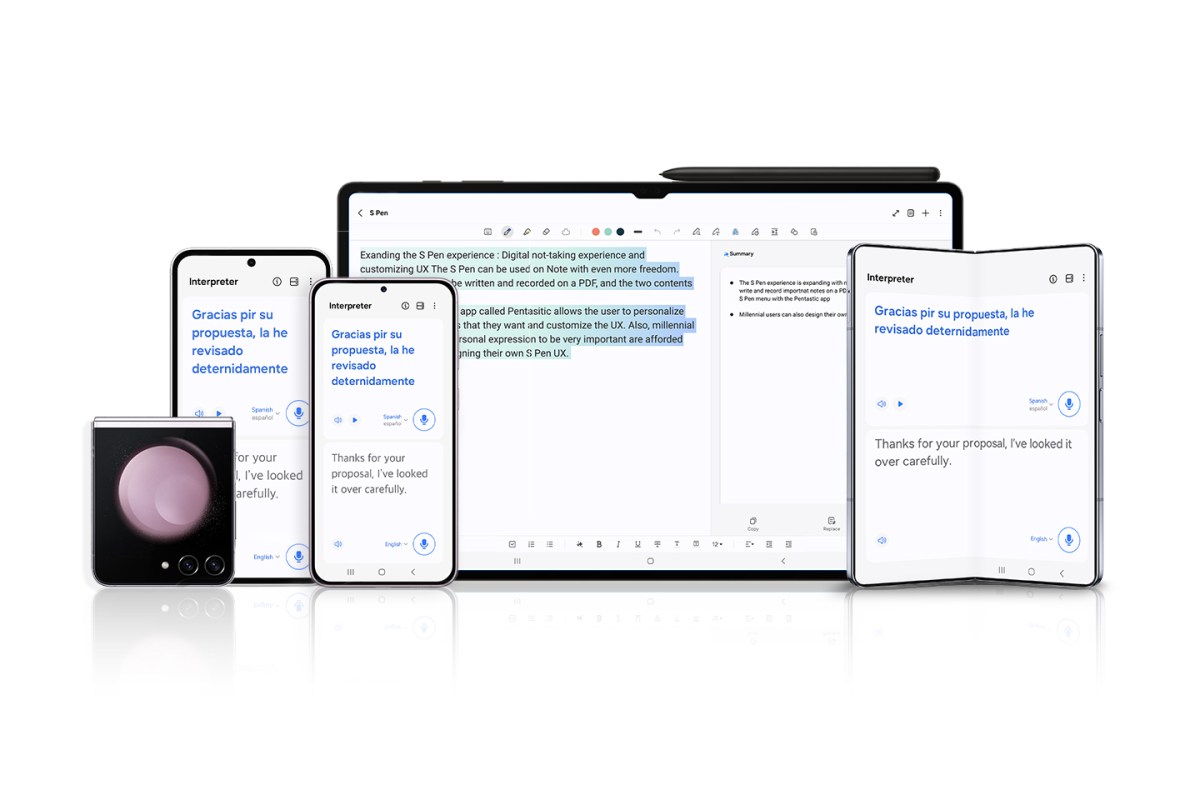

A microchip and the Nvidia brand displayed on a cellphone display screen are seen on this photograph taken in Krakow, Poland, on April 10, 2023.

Nurphoto | Getty Pictures

Synthetic intelligence and semiconductor chip shares rallied after U.S. chip design agency Nvidia beat Wall Street’s expectations for fourth-quarter earnings and income on Wednesday and projected “continued growth” in 2025 and past.

Nvidia provider Taiwan Semiconductor Manufacturing Company jumped as a lot as 2.05% in Thursday morning commerce. TSMC is the world’s largest contract chip maker and produces superior processors for firms like Nvidia and iPhone maker Apple.

Shares of server part provider Super Micro Computer rose 11.42% in Wednesday’s after-hours buying and selling. Dutch chip tools producer ASML, which provides TSMC lithography machines crucial to chip making, jumped 2.7% within the U.S. throughout after hours buying and selling.

Following Nvidia’s earnings report, rivals Advanced Micro Devices and SoftBank-backed U.Okay. chip designer Arm Holdings surged 4.08% and seven.87%, respectively, in after hours buying and selling.

Nvidia, which customized designs AI chips for the likes of Amazon, Microsoft and Google, noticed skyrocketing demand for its graphics processing models due to the AI growth.

OpenAI’s ChatGPT, which gained large reputation worldwide in November 2022 for its means to generate human-like responses to person prompts, is educated and run on hundreds of Nvidia’s GPUs. Nvidia shares rose 9% in prolonged buying and selling.

South Korea’s reminiscence chipmakers Samsung Electronics and SK Hynix gained 0.41% and three.22% respectively on Thursday. Giant language fashions similar to ChatGPT depend on high-performance reminiscence chips to recollect particulars from previous conversations and person preferences to be able to generate humanlike responses.

Different Taiwanese semiconductor corporations Orient Semiconductor Electronics and MediaTek rose 2.94% and 1.53% respectively on Thursday.

Intel, Broadcom and Qualcomm, three U.S. chip makers, noticed will increase in share costs in extending buying and selling Wednesday, surging 1.38%, 2.79% and 1.80% respectively.

“Fundamentally, the conditions are excellent for continued growth” in 2025 and past, Nvidia CEO Jensen Huang instructed analysts on Wednesday in an earnings name. He added that demand for Nvidia GPUs will stay excessive as a consequence of generative AI and an industry-wide shift away from central processors to the accelerators that Nvidia makes.

“If I was going to just kind of put a stake in the ground relative to the conversation, whether it’s related to market share or to their margins, I think they’re going to surprise people,” Gene Munster, managing companion of Deepwater Asset Administration, instructed CNBC’s “Street Signs Asia” on Thursday.