Traders on the lookout for a novel method into the inventory market’s synthetic intelligence increase are discovering an intriguing financial institution shot in what’s historically probably the most boring nook of the equities universe: utilities.

AI is the buzzword today, with everybody from chipmakers to laptop gear producers to automotive corporations making an attempt to color themselves in its hopeful colours. It’s additionally driving the most recent inventory market rally, as traders noticed this previous week.

On Thursday, Meta Platforms Inc. shares had their worst efficiency since October 2022 after the corporate mentioned it might spend excess of anticipated on developing AI. Then on Friday, Google dad or mum Alphabet Inc. soared previous $2 trillion in market valuation whereas Microsoft Corp.’s inventory additionally gained after the companies showed progress on AI of their quarterly outcomes.

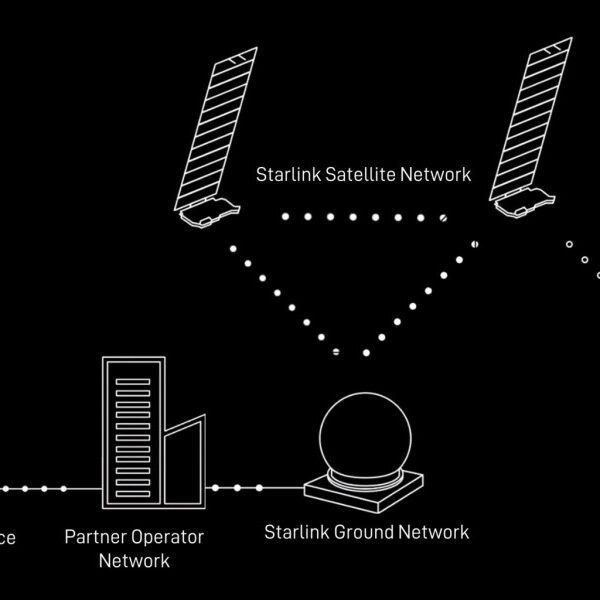

However right here’s the factor about AI expertise: It requires an unlimited quantity of power to develop and run. And that’s the place utilities are available.

“Power demand from data centers has already been humongous, then came the AI hype and the need for power skyrocketed,” mentioned Manju Naglapur, senior vp and normal supervisor for cloud, functions and infrastructure options at Unisys Corp. “With all the money spent on data centers, the power consumption will increase massively.”

The S&P 500 Index’s utilities sector fell 10% in 2023, its worst 12 months since 2008, making it the weakest group within the equities benchmark, which soared 24% total. That wasn’t precisely a shock contemplating the businesses are likely to do poorly in periods of persistently excessive rates of interest.

The shares have recovered considerably in 2024, rising 4.4% as price controls offset increased refinancing bills and document capital spending. However the largest change in sentiment for utilities is the hope for surging demand from the brand new power-sucking knowledge facilities required for AI’s enlargement.

Largest Driver

“The AI narrative is capturing the biggest amount of investor interest,” mentioned Ryan Levine, who heads utilities protection at Citigroup Inc. “It has the potential to be the biggest driver of the industry.”

Throughout the US, utilities are making ready for historic will increase in electrical energy demand led by knowledge facilities and AI. Even outdoors Information Heart Alley in Northern Virginia, the place Dominion Energy Inc. briefly paused new knowledge middle connections in 2022 as a consequence of grid constraints, the businesses are planning new energy crops and transmission strains.

Synthetic intelligence is poised to assist drive a 900% jump in power demand from knowledge facilities within the Chicago space, which is able to probably require as a lot electrical energy as round 4 nuclear energy crops can produce, Exelon Corp. Chief Government Officer Calvin Butler mentioned not too long ago. Southern Co. predicts its electrical energy gross sales will rise to six% annual development with about 80% coming from knowledge facilities.

This explains why Goldman Sachs Group Inc. arrange two funding baskets — Energy Up America and Information Heart Gear — for purchasers searching for alternative routes to play the approaching AI explosion. Whereas the financial institution doesn’t disclose the shares in its baskets, it’s selecting corporations primarily based on 4 classes: unregulated and controlled utilities, smart-grid infrastructure and power-generating uncooked supplies.

“We consider these themes, along with Goldman’s Broad AI basket, to be the most popular in the next few years,” Faris Mourad, the agency’s vp of US customized baskets, mentioned in a telephone interview.

To date this 12 months, the Energy Up basket has soared virtually 28% and the Information Heart Gear basket is up greater than 18%. These are some lofty numbers contemplating the normally high-flying S&P 500 tech sector has gained simply 8.3% in 2024, and communication providers, which incorporates social media companies, is the very best performing group within the index with a 17% rise.

In the meantime, Mourad expects Energy Up America basket’s 2024 year-end earnings to be 21% increased than what was initially forecast in January 2023. And he sees extra positive aspects forward.

Increasing Sources

Vitality availability is a key consideration when knowledge middle operators resolve the place to construct. Sometimes, they go to an area utility to debate how a lot energy they want, after which the utility seeks approval to construct a brand new plant or purchase electrical energy from third events. For instance, Georgia Energy, the biggest subsidiary of utility holding firm Southern, not too long ago gained approval from the Georgia Public Service Fee to develop its capability by 1.4 gigawatts to satisfy demand from knowledge facilities and different companies.

“We’re recommending buying Southern Co. on this thesis,” Citigroup’s Levine mentioned.

Entry to renewable energy sources additionally is a bonus. Aaron Dunn, co-head of worth fairness and portfolio supervisor at Morgan Stanley Funding Administration, likes NextEra Energy Inc. as a result of it builds renewable technology for its personal utility unit and develops renewables for others.

“We believe renewables and storage are a key enabler to help meet this increased demand” NextEra CEO John Ketchum mentioned in the course of the firm’s first-quarter earnings name on Tuesday. “The U.S. renewables and storage market opportunity has the potential to be 3x bigger over the next seven years compared to the last seven.”

With knowledge middle builders on the lookout for cheap areas, Dunn expects the Midwest to turn into a hub of exercise since land is cheaper than in different elements of the nation. “That also benefits a company like CMS Energy Corp., which operates out of Michigan,” he mentioned.

Certainly, CMS mentioned on its earnings name Thursday that it signed a contract for a brand new 230-megawatt knowledge middle and has different corporations trying to construct in Michigan.

After all, all of this demand can solely profit utilities if they’ll produce the electrical energy to satisfy it. Many power specialists are involved that the US energy grid isn’t ready to deal with the wave coming its method. And that has some traders turning to the businesses that can be introduced in to strengthen the grid so utilities can adapt to the brand new high-energy surroundings.

“This is going to be a real challenge for traditional utilities,” mentioned Walter Todd, chief funding officer at Greenwood Capital Associates, which owns shares like Eaton Corp. and Hubbell Inc. “The real beneficiaries of this data center electricity usage are those that will benefit from money spent to upgrade the grid.”