For the final a number of quarters we’ve seen a lull within the growth of the cloud infrastructure market, with decrease development numbers than we’ve been accustomed to seeing prior to now. That modified this quarter thanks largely to curiosity in generative AI. The brand new income wave started simply final 12 months pushed the by the ChatGPT hype cycle, however has already pushed cloud infra income within the fourth quarter of 2023 to $74 billion, up $12 billion over final 12 months presently and $5.6 billion over Q3, the biggest quarter-over-quarter improve the cloud market has skilled, per Synergy Research.

The cloud infrastructure marketplace for for your entire 12 months grew to an eye fixed popping $270 billion, up from $212 billion in 2022. Synergy’s John Dinsdale predicts that the expansion we noticed within the final 12 months is right here to remain, even because the market continues to mature and the legislation of enormous numbers takes growing impact. “Cloud is now a massive market and it takes a lot to move the needle, but AI has done just that. Looking ahead, the law of large numbers means that the cloud market will never return to the growth rates seen prior to 2022, but Synergy does forecast that growth rates will now stabilize, resulting in huge ongoing annual increases in cloud spending,” he mentioned in a press release.

Jamin Ball, a associate at Altimeter Capital, writing in his wonderful Clouded Judgement newsletter, sees a equally brilliant future for these distributors.

“The hyperscalers are really starting to see the tailwind of new workload growth overtake the headwind of optimizations. Sometimes new workloads are AI related. Sometimes they’re classic cloud migrations. The hyperscalers benefit from massive scale, distribution, trust and depth of customer relationships in ways no other software companies do. They also are seeing AI revenue (largely compute) show up sooner than anyone else,” he wrote in his newest cloud missive.

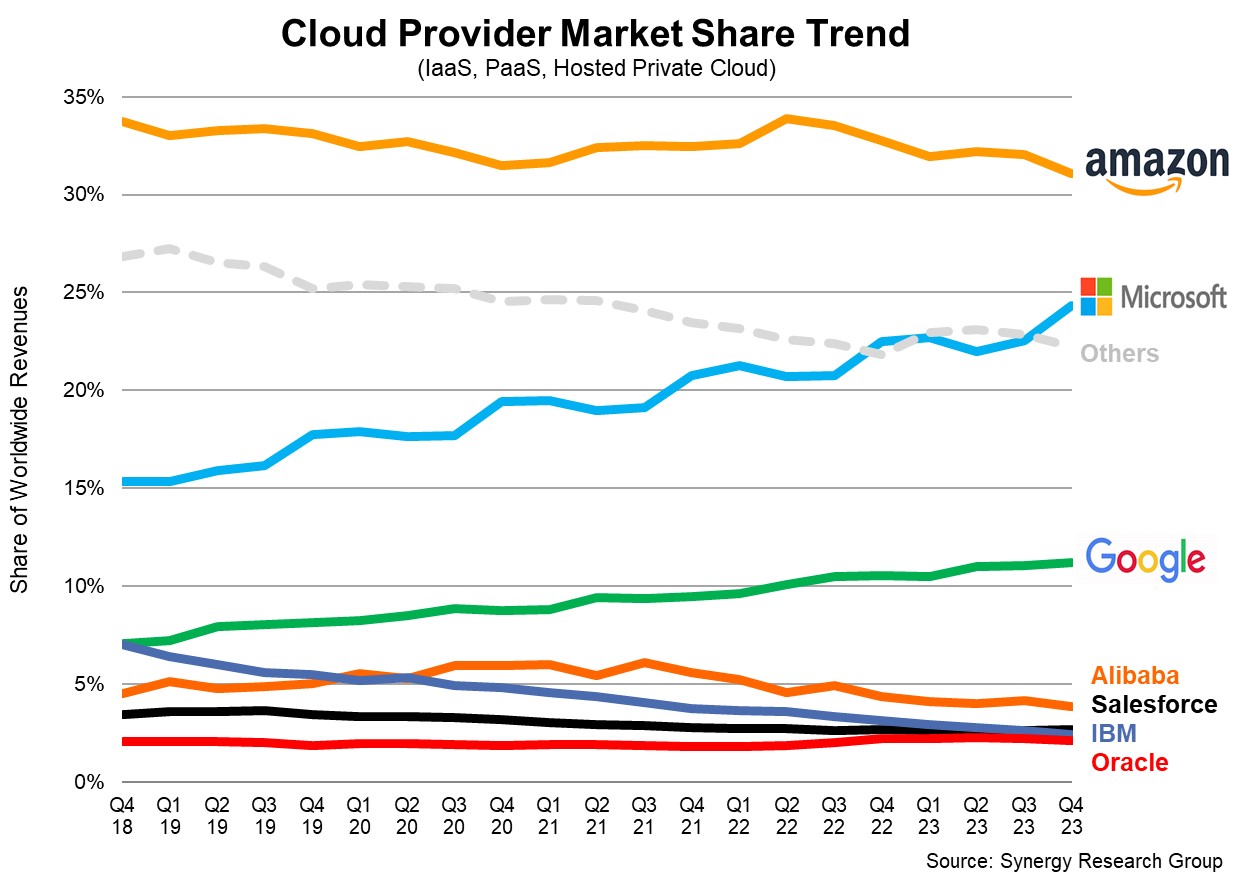

Ball’s information helps Dinsdale’s claims round diminishing development charges, however in a market so massive, development for development’s sake turns into a far much less necessary metric:

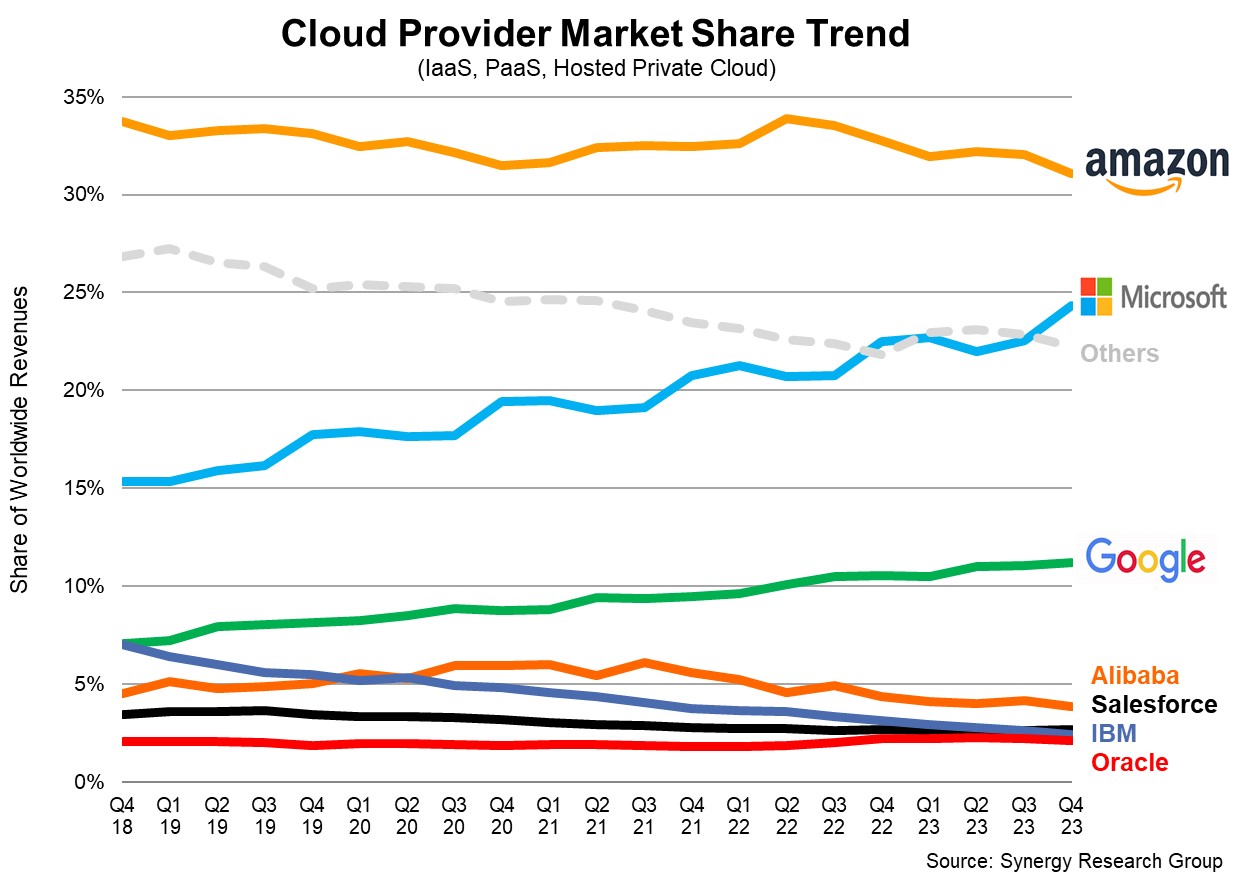

Picture Credit: Jamin Ball, Clouded Judgement Altimeter Capital

For now, it seems that Microsoft’s profitable investment/partnership with OpenAI is giving it an edge out there as we noticed the corporate’s market share develop two full share factors to 25% within the fourth quarter, a exceptional one quarter improve. Amazon continues to be king of the mountain with 31% share, albeit down two factors from final quarter. It could be simple to say Amazon’s loss was Microsoft’s acquire, though it’s in all probability not fairly that straightforward and there are in all probability extra nuanced impacts throughout the market. In the meantime Google held regular at round 11% share.

Synergy stories that the large 3 represent 67% of total market share, or roughly $50 billion in complete cloud income coming from the the three largest firms for a single quarter.

From a {dollars} perspective, the numbers are, per normal, a bit thoughts boggling with Amazon coming in at $23 billion, Microsoft at $18.5 billion and Google with round $8 billion. If these numbers don’t match the reported numbers precisely, that’s as a result of these firms usually mix several types of cloud income to reach on the reported figures. Synergy appears to be like at IaaS, PaaS and hosted non-public cloud companies, and the businesses reported cloud numbers might embody SaaS and different income that Synergy doesn’t rely.

Picture Credit: Synergy Analysis

When it comes to quarterly share development, holding in thoughts these caveats about how the businesses measure income, AWS was up 13%, Azure was up 30% and Google Cloud was up round 25% (though they don’t separate out SaaS income in that quantity).

One factor was clear final 12 months, Microsoft was placing the warmth on Amazon and left the company on its heels, maybe for the primary time, with its aggressive deal making with OpenAI.

Scott Raney, a associate at Redpoint told TechCrunch at re:Invent in December that Amazon was clearly taking part in catch up when it got here to AI, and it was an uncommon place for the corporate to seek out itself. “This might be the first time where people looked and said that Amazon isn’t in the pole position to capitalize on this massive opportunity. What Microsoft’s done around Copilot and the fact Q comes out [this week] means that in reality, they’re absolutely 100% playing catch-up,” Raney mentioned on the time.

Whereas generative AI represents a large alternative for all of the cloud distributors, it’s nonetheless very a lot early days. We at all times prefer to say that first to market is a large benefit and it definitely has been for Amazon all these 12 months. Whether or not Microsoft’s aggressive method to AI represents an identical benefit isn’t clear but, nevertheless it’s laborious to disregard a two share level market share improve in a single quarter. For now it appears like Microsoft has taken the lead relating to AI within the enterprise, however Google and Amazon nonetheless have loads of time left on the clock to determine it out.