Alvin Man

In September 2023, I covered Air Canada with a buy rating, but the stock has not performed as expected, trading flat whereas the S&P 500 returned 18%. I believe it shows how challenging airline investments are and also reflects the challenges that airlines are currently facing on costs that are continuing to rise despite adding capacity, which should normally provide a strong base for fixed cost absorption. In this report, I will be discussing the most recent results, the outlook, debt profile and assess whether Air Canada stock is still worth its buy rating.

Air Canada Revenues and Earnings Grow Despite Cost Pressures

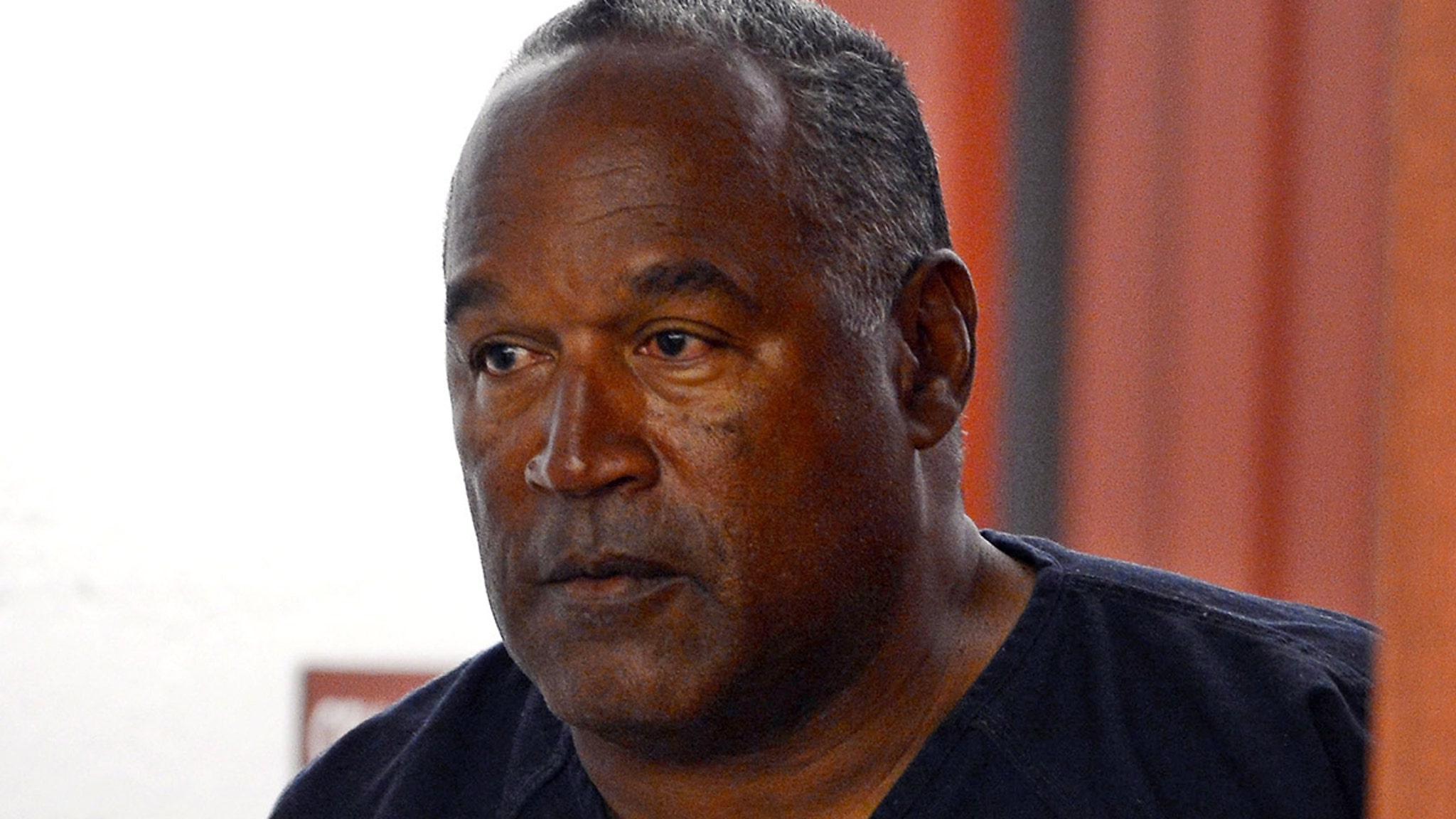

Air Canada

The slide above shows the key financial metrics for Air Canada. Total operating revenues climbed 7% where passenger traffic revenues were up 9%, but overall revenue growth saw some pressure as cargo revenues declined 9% and other revenues increased only 1%. Passenger unit revenues declined 2.2% driven by a 0.5% decrease in load factors and a reduction in yield primarily on the Atlantic market.

The strongest revenue growth was observed in the Pacific market and that was driven by some Atlantic capacity being deployed to the Pacific market, where there is still space for Canada to capitalize on pent-up demand. That is also why Pacific capacity expanded 38.3% year-on-year. The Atlantic market saw a 5.2% decline in yield (a measure of the revenue divided by the number of occupied seats). So, that pivot does make a lot of sense. Domestic services saw a 2.5% increase in capacity and a 3.5% increase in yield for a 2.8% increase in unit revenues, while capacity on US transborder operations increased 6.4% leading to a 7.5% growth in revenues. So overall, we see conscious capacity deployment. The art of capacity deployment is increasingly focusing on where to deploy the capacity, and I believe that Air Canada’s first quarter capacity deployment was prudent.

Total operating expenses increased by 6.3% to C$5.215 billion, resulting in operating income of C$11 million compared to a C$17 million loss in the same quarter last year. So, what we are mostly seeing is a positive near-break-even margins during the quarter compared to negative near break-even margins last year. Given that Q1 tends to be the weakest quarter, this is a positive.

However, it should be noted that costs excluding fuel were up 12.2% which is in excess of the 11.1% growth in capacity. Consequently, this means that the CASM-ex was slightly higher year-on-year. Not adding the capacity would provide an even worse unit cost figure, but it should also be noted that the capacity growth is still not offsetting the growth in costs excluding fuel. The higher costs were driven by a combination of higher flight activity, higher profit sharing and wages, digital transformation initiatives and inflation on food and services. So, not all cost increases are driven by inflation, but we do see that overall the cost basis is on an elevated level. It should be noted that higher planned capacities are also driving cost items such as maintenance and salaries. So, some of the unfavorable costs seen during the quarter will be to execute capacity plans during the summer.

Air Canada Guides For A Flat Earnings Year

Air Canada

For 2024, Air Canada expects capacity increases to be up 6 to 8 percent with adjusted EBITDA between C$3.7 billion and C$4.2 billion or C$3.95 billion at the midpoint. Last year, adjusted EBITDA came in at nearly C$4 billion so, we do see that there is some pressure on translating higher capacity to higher adjusted EBITDA, which I believe is driven by higher non-fuel costs as well as higher fuel costs. The adjusted CASM figures are expected to be up 2.5% to 4.5% year-on-year and that is mostly driven by lower capacity additions year-on-year compared to last year while the cost basis is continuing to rise. So overall, Air Canada is targeting for earnings growth to be flat year-on-year.

Air Canada Reduces Debt Even Further

Air Canada

While the guidance for 2024 might seem somewhat uninspiring, but fully reflective of the industry realities, I believe there certainly is significant progress in other areas. We see that the company started deleveraging last year, with net debt reducing by nearly C$3 billion and in Q1 2024 net debt reduced by another C$786 million bringing the leverage ratio to 0.9x compared to the 0.8x pre-pandemic. So, we do see very strong progress there.

Is Air Canada Stock A Buy Or Hold?

The Aerospace Forum

After implementing the forward projections and balance sheet data for Air Canada, I believe that the stock is a buy. The company is managing its deleveraging path quite well, and the only pressure points I am seeing currently is that its free cash flow is expected to decline and will even be negative by 2026 due to the capital expenditures planned for 2026. However, given the uncertainties regarding aircraft productions, we have yet to see whether the current expected CapEx profile is anywhere near accurate and whether planned deliveries for 2026 will occur as planned. Either way, with Air Canada stock trading at a significant discount to its peers as well as its own median valuation, I believe the stock is a buy with 45% upside. It should be noted that despite the fundamentally driven upside I am seeing, airline stocks tend to be volatile and that might lead to airline stocks such as Air Canada not being fully valued even though there is upside from a fundamental perspective.

Conclusion: Air Canada Stock Remains A Buy

Air Canada stock has not performed as expected since my last coverage, and I am not one to maintain a buy rating until one day I am right, but I pushed the most recent figures in my valuation model and those show that there should be significant upside, and we also see that Wall Street analysts project significant upside for Air Canada stock. Looking at the strategic pivot this quarter from Atlantic to Pacific markets, the decision to not add to the Boeing 767 freighter fleet and the successful deleveraging as well as the undervaluation compared to the company’s own median valuation and its peers group, I am maintaining my buy rating for the stock but reduce the target from $20.20 to $19.83 (US Dollars).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.