Airbus Delivery Slowdown: Supply Chain Struggles And Order Analysis Wirestock

Earlier this year, Airbus (OTCPK:EADSF) announced that it would be lowering its delivery target for 2024 from 800 to 770 airplanes. While I already saw the strain in the delivery flow, the alert from Airbus caught me off guard as we still have months in deliveries to go. The downward revision on the delivery target was a very clear sign that while jet makers are looking to increase production there still are significant bottlenecks in the supply chain. Generally, what we have been hearing is that aerospace supply chain issues are easing but it seems that driven by bottlenecks for the engine supply chain, jet makers are still seeing significant delays to their production plans.

That makes it even more important to follow the orders and deliveries that are announced monthly. In this report, I will be discussing the Airbus airplane orders and deliveries in August.

Airbus Books Orders For All Commercial Airplane Programs

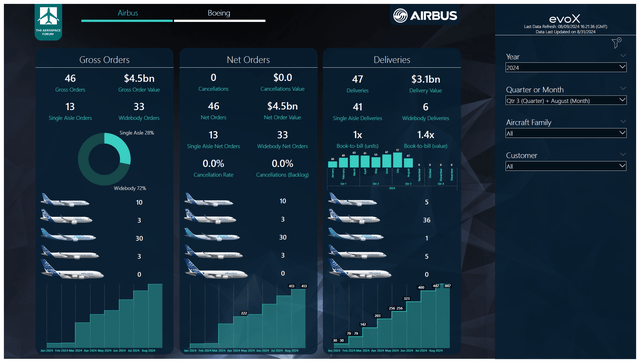

In August, Airbus booked 46 orders valued at $4.5 billion. The mix consisted of 33 widebody airplanes 13 single-aisle jets:

- Cathay Pacific (OTCPK:CPCAF) ordered 30 Airbus A330-900s.

- Private customers ordered three Airbus A320neo airplanes and three Airbus A350-900s.

- Air Baltic ordered 10 Airbus A220-300s.

During the month, the following order book changes and mutations took place:

- Air Lease Corporation transferred an order for one Airbus A330-900 to Virgin Atlantic Airways.

- British Airways took over a delivery slot for one Airbus A320neo from parent company IAG.

- China Express Airlines was identified as the customer for one Airbus A321neo, which was subsequently converted to an order for the Airbus A320neo.

- Flynas took over a delivery slot from CMB Financial Leasing for one Airbus A320neo.

- Indigo converted orders for 10 A320neo airplanes to the A321neo.

- Juneyao Air converted orders for a A320neo to an order for the A321neo.

- KLM Royal Dutch Airlines (OTCPK:AFRAF) was identified as the customer for one Airbus A321neo.

- Wizz Air (OTCPK:WZZAF) converted orders for 13 A320neos to 13 A321neos.

- Yemenia converted orders for 4 A320neos to 4 A321neos.

The most noteworthy order in August was the selection of 30 A330neos by Cathay Pacific. During the month, the European jet maker saw order inflow for all its commercial airplane platforms while there were no cancellations. Furthermore, we saw conversion activity where orders for the smaller A320neo were converted to orders for the A321neo. This likely reflects a combination of strong demand for the A321neo as well as conversion flexibility for airlines as Airbus is working through delivery delays and offers options for airlines to convert their orders to the A321neo to compensate for the delay.

In the same month last year, Airbus booked 117 orders and no cancellations, bringing net orders to 117 airplanes valued $8.7 billion, showing that year-on-year the order activity reduced. This in no way a concern as the backlogs are filled well and I view the reduction in orders as a result of the uncertainty in the delivery schedules. Year-to-date, Airbus booked 432 orders and 19 cancellations, bringing its net orders to 413 airplanes valued at $40.4 billion. A year ago, Airbus booked 1,257 gross orders and 39 cancellations, bringing the net order tally to 1,218 units valued at $82.1 billion. So, year-to-date we see a strong decline in order inflow but it should be noted that last year we saw big orders that only happen a couple of times each year. So, the year-to-date decline in order inflow is in no way a reason for concern.

Airbus Airplane Deliveries Decrease Year-on-Year

Airbus delivered a total of 47 airplanes in August, valued at $3.1 billion:

- Five Airbus A220-300 airplanes were delivered.

- A total of 36 Airbus A320neo airplanes were delivered, including 12 Airbus A320neo airplanes and 24 Airbus A321neo airplanes.

- Airbus delivered one Airbus A330-900neo.

- There were five Airbus A350 airplane deliveries, four for the -900 model and one for the -1000 model.

During the same month last year, Airbus delivered 52 airplanes valued at $3 billion. Year-over-year, we saw deliveries decrease by five units driven by lower single aisle deliveries, partially offset by higher A350 deliveries.

Year-to-date, Airbus has delivered 447 airplanes valued at $28.7 billion, compared to 433 deliveries valued at $27.7 billion a year ago. So, deliveries are higher year-on-year but not as much as one would have expected and for full year Airbus now expects deliveries to climb by 5% instead of 9%. The year-to-date numbers show a 3.2% increase in deliveries. August is always a seasonally weak month for deliveries, but I believe the year-on-year decline in delivery numbers also reflect the challenges faced in the aerospace supply chain.

The book-to-bill ratio was 1x in terms of units and 1.4x in terms of value. Year-to-date, the book-to-bill ratio in terms of units also were 1x and 1.4x in terms of value. While book-to-bill ratios above one tend to signal strong demand, for commercial aerospace they’re currently also driven by airplane production still being below undisturbed levels.

Conclusion: Airbus Delivery Growth Is Shrinking

On the order side, we see that demand is still strong and we see increasing order activity for the Airbus A330neo while more and more customers are converting orders to the bigger A321neo. The challenge that Airbus is facing is mostly on the delivery side of the business where continued part shortages including late deliveries of turbofans is putting pressure on the delivery targets. I believe that Airbus should still be able to meet its delivery target, but that requires 80 deliveries a month on average supported by timely delivery of engines. There is no certainty that Airbus will be meeting its delivery target as the company delivered 75 airplanes on average in the final four months of last year. So, we really need to see solid improvement in the delivery volumes in September. If that does not happen even the lowered target of 770 deliveries might become challenging to reach and the delivery target could slip closer to 750. I am maintaining my buy rating for Airbus as I believe the company has a strong commercial product portfolio and a backlog that supports significantly higher production rates in the years ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.