miniseries

The fourth quarter supplied a definite ultimate chapter to the shifting quarterly narratives of 2023. The “higher for longer” rate of interest issues of the third quarter gave technique to optimism that the Federal Reserve is completed elevating rates of interest and that the economic system, having skirted the much- anticipated recession to date, was extra prone to obtain the dream state of affairs of a “soft landing.” Mix that with the Federal Reserve’s signaling of potential rate of interest decreases within the again half of 2024, and it made for a heady vacation season. The S&P 500 completed the yr with 9 consecutive weeks of good points. Our Fund’s efficiency through the quarter proved even stronger, lifting efficiency for the yr forward of the S&P 500, regardless of not proudly owning any of the “Magnificent 7” names so disproportionately answerable for the S&P 500’s advance.

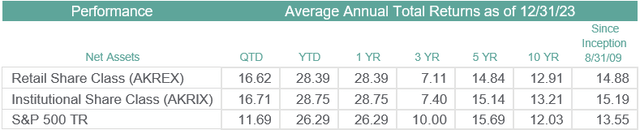

The Akre Focus Fund’s fourth quarter 2023 efficiency for the Institutional share class was 16.71% in contrast with S&P 500 Complete Return at 11.69%. Efficiency for the trailing 12-month interval ending December 31, 2023 for the Institutional share class was 28.75% in contrast with S&P 500 Complete Return at 26.29%.

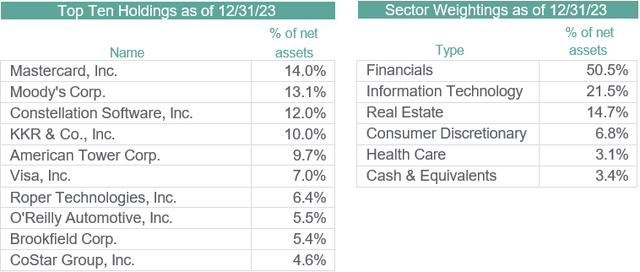

The highest 5 constructive contributors to efficiency through the quarter had been Moody’s (MCO), KKR (KKR), American Tower (AMT), Constellation Software program (OTCPK:CNSWF) and Mastercard (MA). Nothing notable to name out.

The one two destructive detractors from efficiency this quarter had been Lumine Group (OTCPK:LMGIF) and Veralto Group (VLTO). Veralto, a by-product from Danaher (DHR), was bought in mid-October.

Money and equivalents stood at 3.4% of the Fund’s web property as of December 31 in contrast with 6.1% on the finish of the third quarter.

Efficiency information quoted represents previous efficiency and does not assure future outcomes. The funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when redeemed, could also be price kind of than their unique price. Fund efficiency present to the latest month-end could also be decrease or increased than the efficiency quoted, and might be obtained by calling 1-877-862-9556. The Fund’s annual working expense (gross) for the Retail Class shares is 1.31% and 1.04% for the Institutional Class shares. The Fund imposes a 1.00% redemption payment on shares held lower than 30 days. Efficiency information doesn’t mirror the redemption payment, and if mirrored, complete returns can be lowered.

Mutual fund investing entails danger. Principal loss is feasible. The Fund is non-diversified, that means it could focus its property in fewer particular person holdings than a diversified fund. Subsequently, the Fund is extra uncovered to particular person inventory volatility than a diversified fund. Along with large- capitalization corporations, the Fund invests in small- and medium- capitalization corporations, which contain extra dangers reminiscent of restricted liquidity and better volatility than bigger capitalization corporations.

Regardless of the constructive outcomes for the yr on an absolute and relative foundation, our objective as traders is to carry out effectively over time—not all the time. The excellence is a crucial one as a result of it speaks to what our traders ought to anticipate: (1) We might be periodically out of step with prevailing market fashions; (2) We are going to keep on with our high quality requirements and valuation self-discipline even when confronted with compelling new themes that seize the creativeness of traders; and (3) We are going to proceed to personal what we imagine are nice companies by means of inevitable intervals wherein their share costs drag on the Fund’s efficiency. Briefly, we won’t abandon what works over time to chase what’s working on the time. That has, and can, result in intervals the place our outcomes path these of the broader market. In our view and expertise, it is a obligatory ingredient to attaining above-average charges of compounding over the long run.

As we glance to 2024, we stay agnostic as ever about market path. Think about that only a yr in the past, the consensus market outlook for 2023 known as for recession and a commensurately gloomy outlook for shares as the required and logical end result of rate of interest tightening by the Federal Reserve. Clearly, the market had different concepts!

As we hope you will have come to grasp and anticipate, we don’t make investments on the premise of headlines, market prognostications, or geopolitics. As fascinating as these might be, they’re awful guides with regards to compounding capital. We focus as an alternative on high quality and worth as the first drivers of funding selections. No matter the brand new yr has in retailer, enterprise high quality and worth will stay our touchstones.

We want you an exquisite winter, and thanks on your continued assist.

The composition of the sector weightings and fund holdings are topic to vary and will not be suggestions to purchase or promote any securities. Money and Equivalents embody asset backed bonds, company bonds, municipal bonds, funding bought with money proceeds for securities lending, and different property in extra of liabilities.

The S&P 500 TR is a broad-based unmanaged index of 500 shares, which is widely known as consultant of the fairness market on the whole. It isn’t attainable to speculate straight in an index.

The Fund’s funding aims, dangers, costs, and bills should be thought-about fastidiously earlier than investing. The abstract and statutory prospectus incorporates this and different essential details about the funding firm, and it could be obtained by calling (877) 862-9556 or visiting www.akrefund.com. Learn it fastidiously earlier than investing.

The Akre Focus Fund is distributed by Quasar Distributors, LLC.

Editor’s Notice: The abstract bullets for this text had been chosen by Looking for Alpha editors.