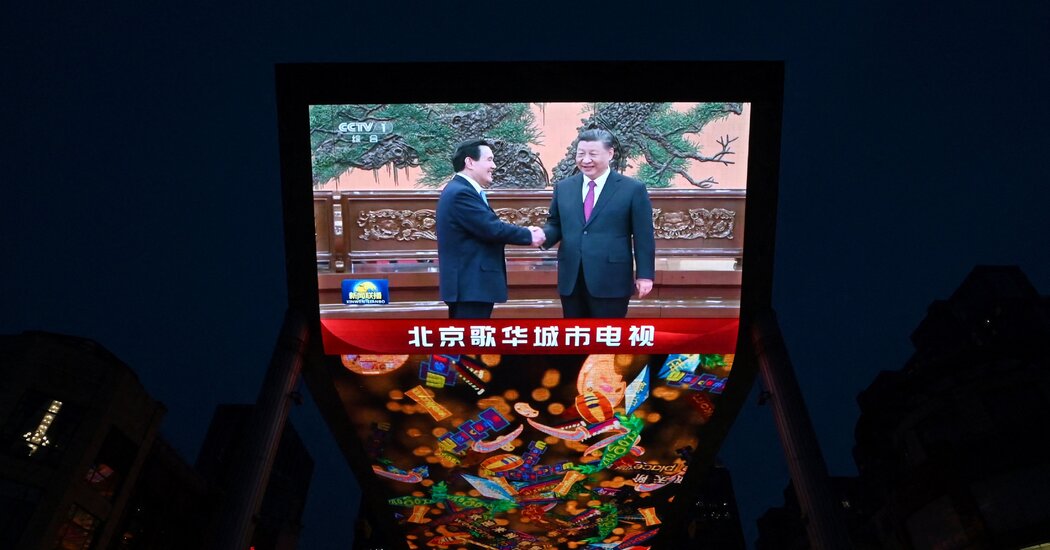

Take a look at the businesses making headlines in premarket buying and selling. Nvidia — Inventory within the chipmaker slipped lower than 1% earlier than the opening bell, however the synthetic intelligence play and “Magnificent Seven” chief formally entered correction territory on Tuesday. Shares have fallen 10% from an all-time closing excessive of $950 per share on March 25. Alibaba Group — The China-based e-commerce inventory rose practically 3% on media stories that co-founder Jack Ma touted the corporate’s administration in an inside memo to staff. Ma’s upbeat notice additionally talked in regards to the potential for AI. Albemarle — Shares gained about 2% after Financial institution of America upgraded the chemical substances manufacturing firm to purchase on the again of rising lithium costs, and raised its worth goal. GoodRx — Shares climbed practically 4% after KeyBanc upgraded the telemedicine inventory to obese on the heels of a robust subscriber progress forecast. Deckers Out of doors — Shares slipped greater than 2% after Truist downgraded the footwear inventory to carry over issues that demand for core merchandise together with Hoka is declining. Delta Air Strains – The air service gained 4% premarket after it posted adjusted earnings per share of 45 cents for the first-quarter, topping expectations by 9 cents, in keeping with LSEG. CEO Ed Bastian cited energy in each leisure and enterprise journey forward of the height journey season, chatting with CNBC Taiwan Semiconductor Manufacturing — Shares rose 2% after robust demand for synthetic intelligence-powering chips helped broaden the corporate’s month-to-month income 34.3% year-on-year in March. — CNBC’s Sarah Min and Tanaya Macheel contributed reporting

Subscribe to Updates

Get the latest tech, social media, politics, business, sports and many more news directly to your inbox.